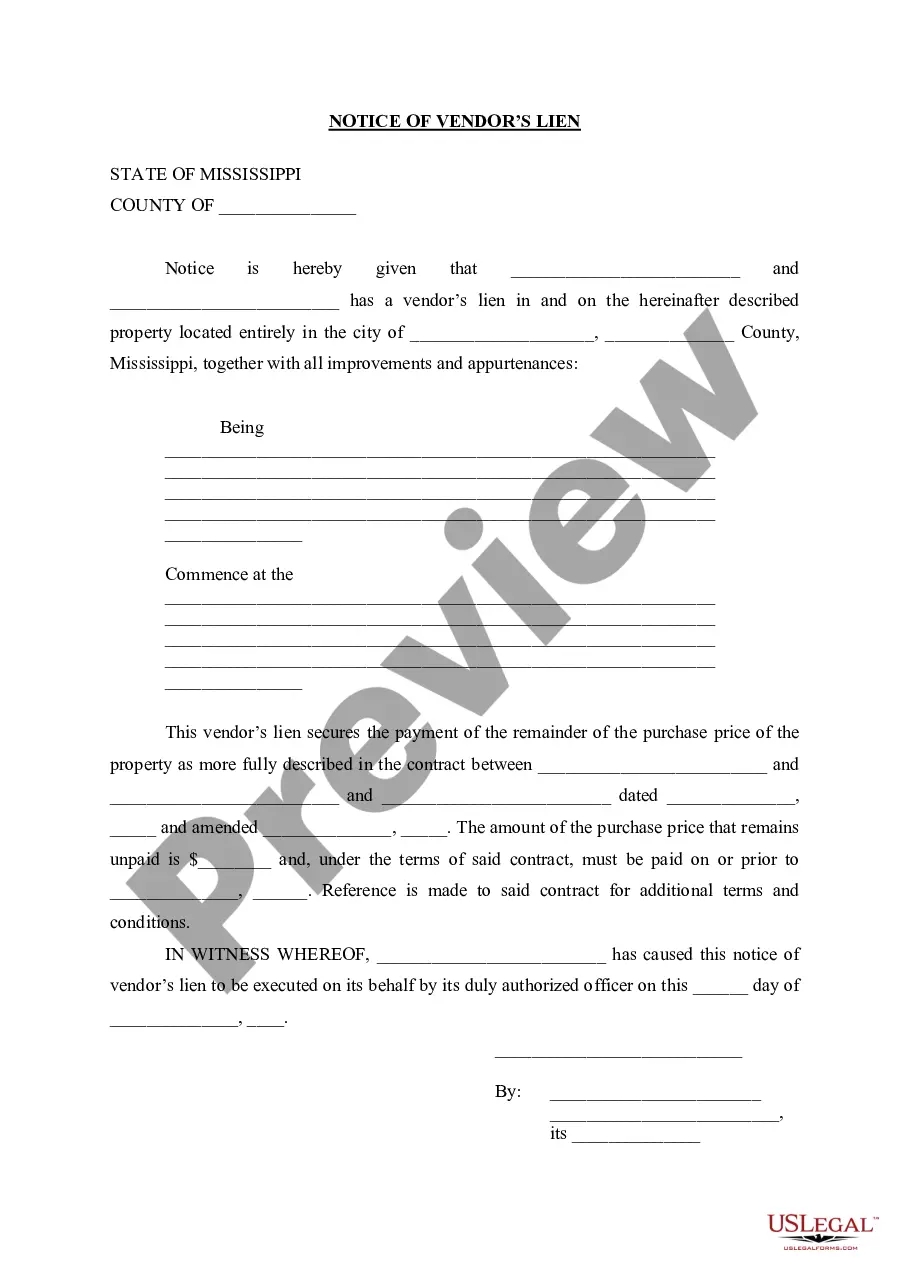

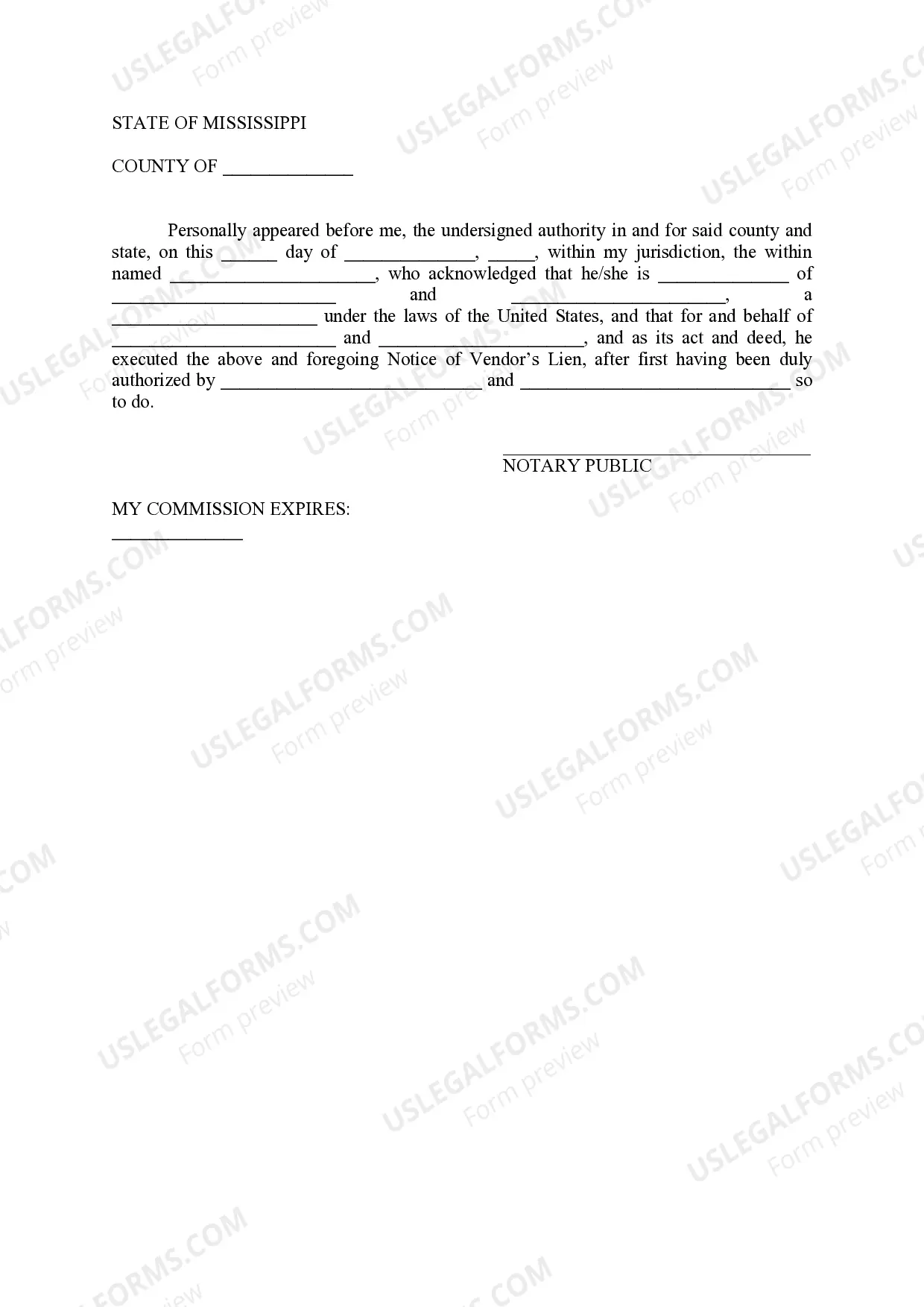

Mississippi Notice of Vendor's Lien

Description Specific Lien

How to fill out Mississippi Notice Of Vendor's Lien?

Obtain a printable Mississippi Notice of Vendor's Lien within several mouse clicks in the most complete library of legal e-forms. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the Top supplier of affordable legal and tax templates for US citizens and residents on-line starting from 1997.

Users who have already a subscription, need to log in directly into their US Legal Forms account, get the Mississippi Notice of Vendor's Lien and find it saved in the My Forms tab. Users who do not have a subscription must follow the steps below:

- Make certain your form meets your state’s requirements.

- If provided, look through form’s description to learn more.

- If offered, preview the shape to discover more content.

- Once you’re sure the form meets your requirements, just click Buy Now.

- Create a personal account.

- Choose a plan.

- via PayPal or visa or mastercard.

- Download the template in Word or PDF format.

When you have downloaded your Mississippi Notice of Vendor's Lien, you can fill it out in any online editor or print it out and complete it by hand. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific files.

Ms Lien Form popularity

FAQ

To place a lien, you must first demonstrate that you have a valid debt that has not been paid by the property holder for example if you performed construction work as a contractor or subcontractor at company headquarters and the business did not pay your bill.

A Lien Demand Letter or Notice of Intent to Lien is a formal demand for payment.A lien demand letter puts a debtor on notice of your intent to lien the job site property by a specific date deadline. Increase your odds of getting paid with a lien demand letter.

A lien is a legal claim against your property to secure payment of your tax debt, while a levy actually takes the property to satisfy the tax debt.When filed, the Notice of Federal Tax Lien is a public document that alerts other creditors that the IRS is asserting a secured claim against your assets.

Where and how should you file the mechanics lien in Mississippi? The mechanics lien must be filed the chancery court where the project is located. You may have the mechanics lien recorded in the court by sending it via email together with the required lien fees, or you may also walk in and personally file it.

If you're claiming a lien on real property, it must be filed in the recorder's office of the county where the property is located. Expect to pay a filing fee between $25 and $50 depending on the location where you file.

The Tax-Forfeited Inventory200b link provides access to the properties available for sale or you may contact the Public Lands Division in the Secretary of State's Office at 601-359-5156 or toll free (in-state) at 1-866-TFLANDS(835-2637). Approximately how long does the process take?

A lien secures the government's interest in your property when you don't pay your tax debt. A levy actually takes the property to pay the tax debt. If you don't pay or make arrangements to settle your tax debt, the IRS can levy, seize and sell any type of real or personal property that you own or have an interest in.

The answer is simple no. In Mississippi, paying the property taxes on someone else's land does not affect ownership in any manner. You simply cannot obtain title to someone's land by paying their taxes for them.

Prepare the lien document, taking care to include all the necessary information set forth above including the required statements. Sign the document. Deliver the lien must the office of the clerk of the chancery court of the county where the property is located.