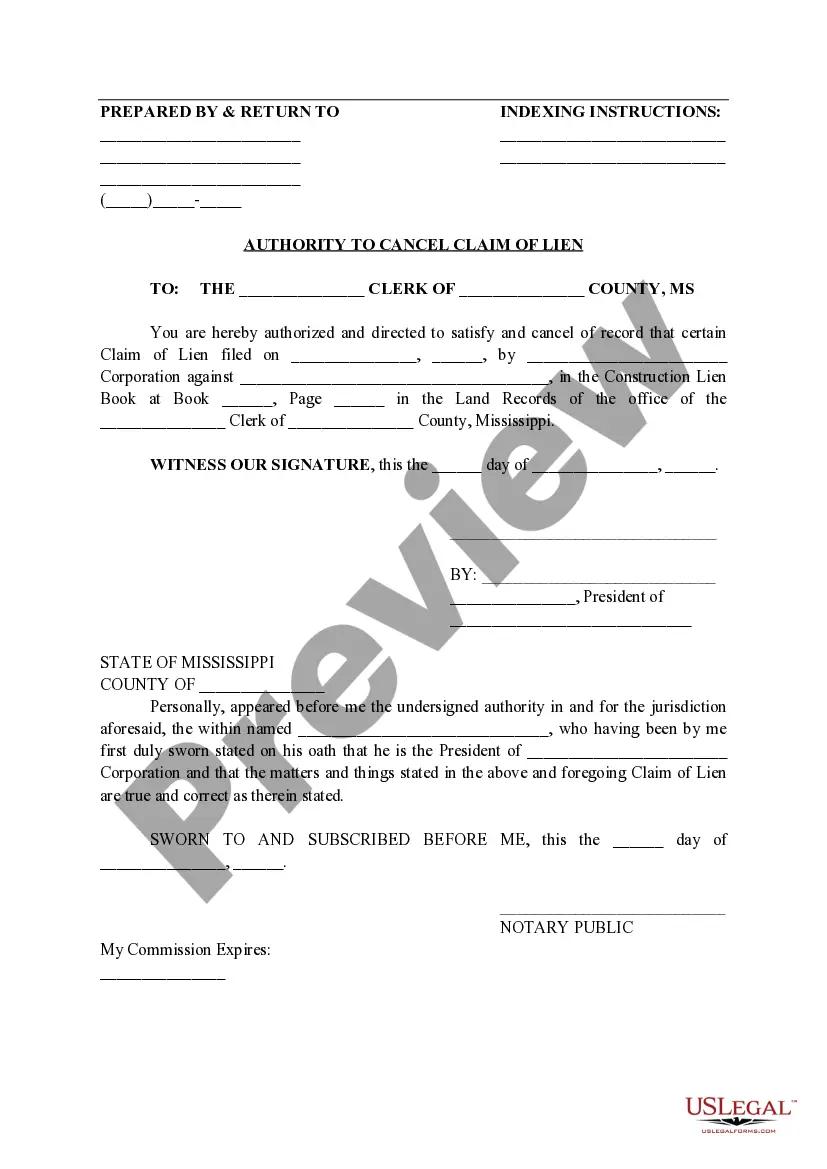

Mississippi Authority to Cancel Claim of Lien

Description Mississippi Cancel Purchase

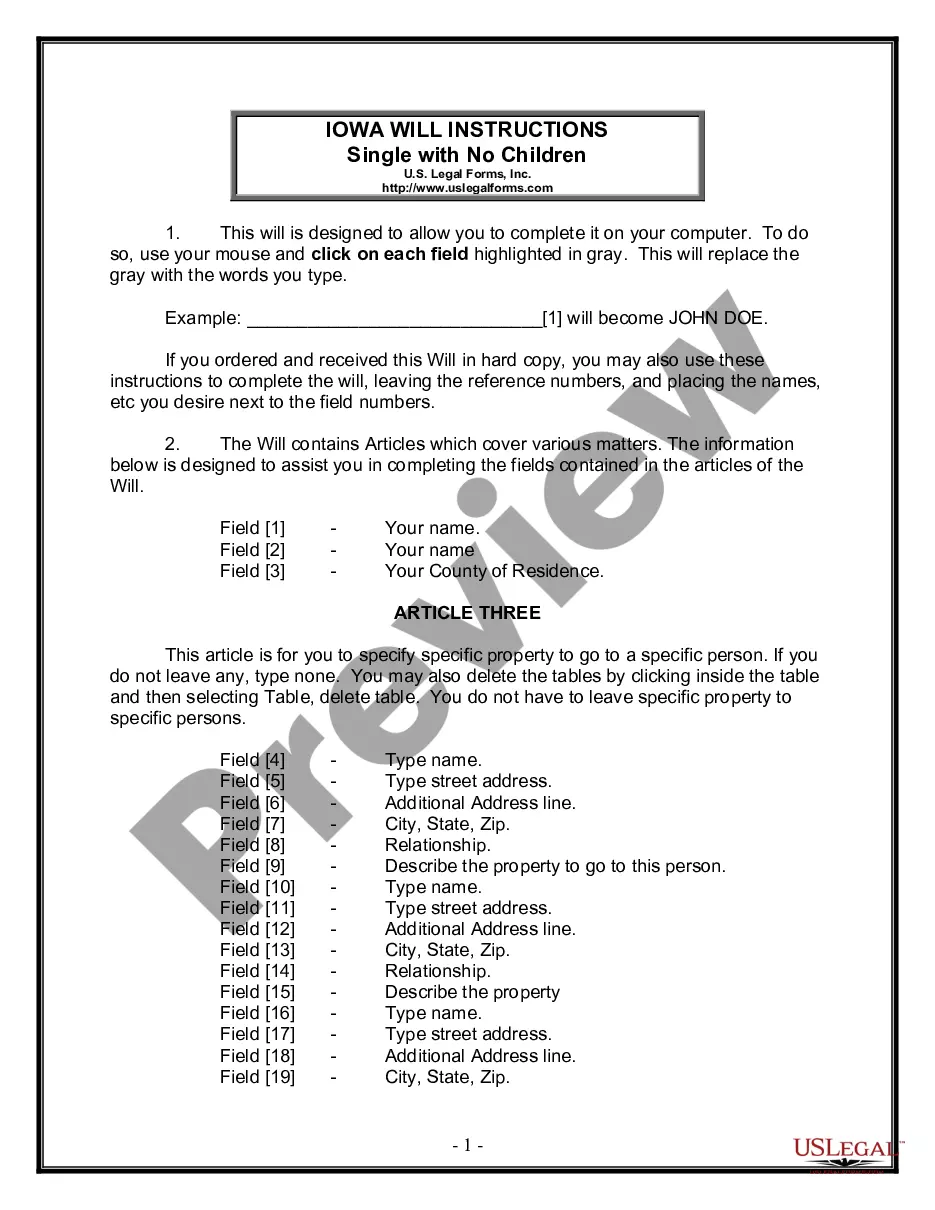

How to fill out Mississippi Authority To Cancel Claim Of Lien?

Obtain a printable Mississippi Authority to Cancel Claim of Lien within several mouse clicks in the most complete library of legal e-documents. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the Top supplier of reasonably priced legal and tax forms for US citizens and residents on-line starting from 1997.

Users who have already a subscription, need to log in straight into their US Legal Forms account, get the Mississippi Authority to Cancel Claim of Lien and find it stored in the My Forms tab. Users who do not have a subscription are required to follow the steps listed below:

- Make sure your form meets your state’s requirements.

- If provided, look through form’s description to learn more.

- If available, review the shape to find out more content.

- Once you’re confident the form is right for you, click Buy Now.

- Create a personal account.

- Pick a plan.

- Pay out through PayPal or visa or mastercard.

- Download the template in Word or PDF format.

When you’ve downloaded your Mississippi Authority to Cancel Claim of Lien, you can fill it out in any online editor or print it out and complete it by hand. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

Formalize a defense for disputing the amount of the lien. Gather supporting documentation for your rebuttal, depending on the type of lien. Contact the agent representing the creditor to dispute the amount of the claim. Negotiate a payment settlement with the creditor if you cannot pay the amount you owe in full.

If a creditor puts a lien on your property, you may make an offer to settle the amount for less than you owe. As part of the negotiations, get the creditor to agree to release the lien. If you need help in the negotiations, consider hiring a debt settlement lawyer to help you.

A tax lien recorded on the State Tax Lien Registry covers all property in Mississippi. To avoid having a tax lien filed against your property, send the Department of Revenue full payment before the due date as set forth in your Assessment Notice.

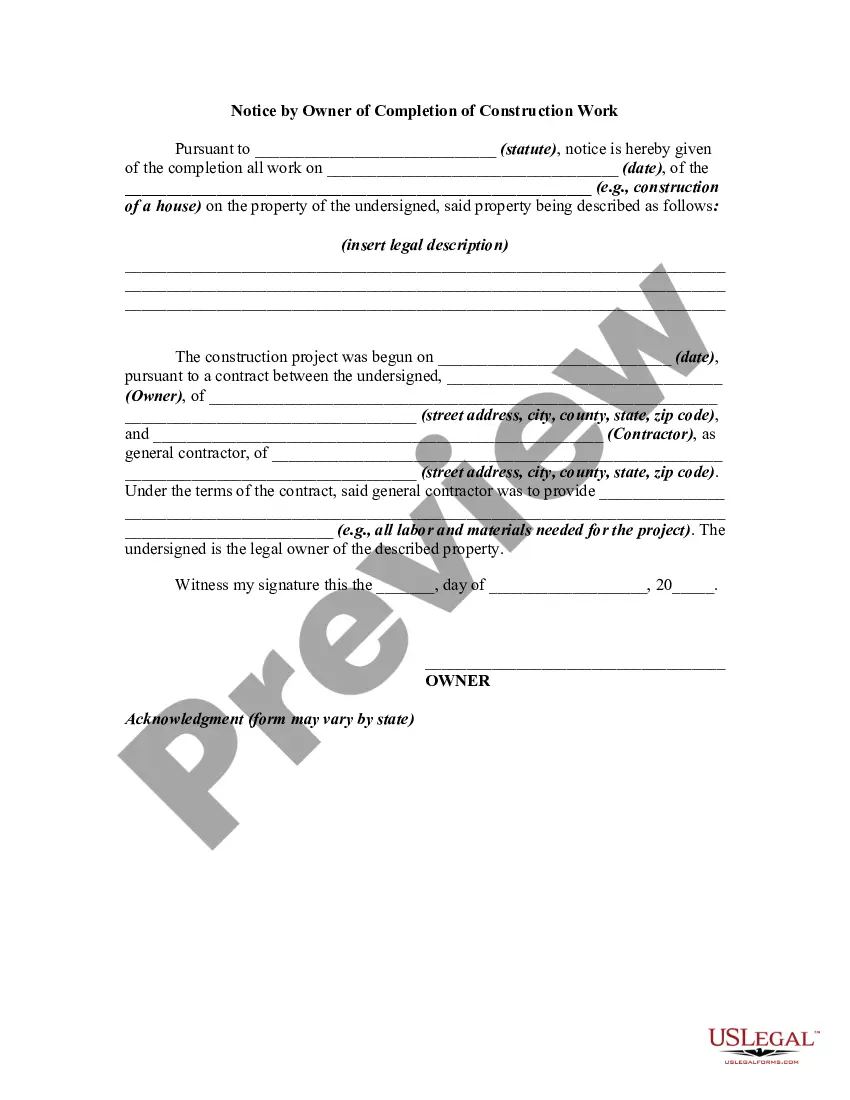

The simplest way to prevent liens and ensure that subcontractors and suppliers are paid is to pay with joint checks. This is when both parties endorse the check. Compare the contractor's materials or labor bill to the schedule of payments in your contract and the Preliminary Notices.

The answer is simple no. In Mississippi, paying the property taxes on someone else's land does not affect ownership in any manner. You simply cannot obtain title to someone's land by paying their taxes for them.

If a creditor gets a judgment against you, it can then place a lien on your property. The lien gives the creditor an interest in your property so that it can get paid for the debt you owe.And in some cases, the lien gives the creditor the right to force a sale of your property in order to get paid.

What Is a Fraudulent Lien?the claimant is owed money on another job by the same general contractor or property owner, but didn't file a lien on that project before time expired; or. the claimant wants to file a lien because of personal reasons generally related to the identity of the property owner.

Invalid Liens A lien stays in the county records and on your property title until you take action to remove it.If the contractor, subcontractor, laborer, or material supplier fails to follow any of the specific time frames, you can petition the court to remove the lien.