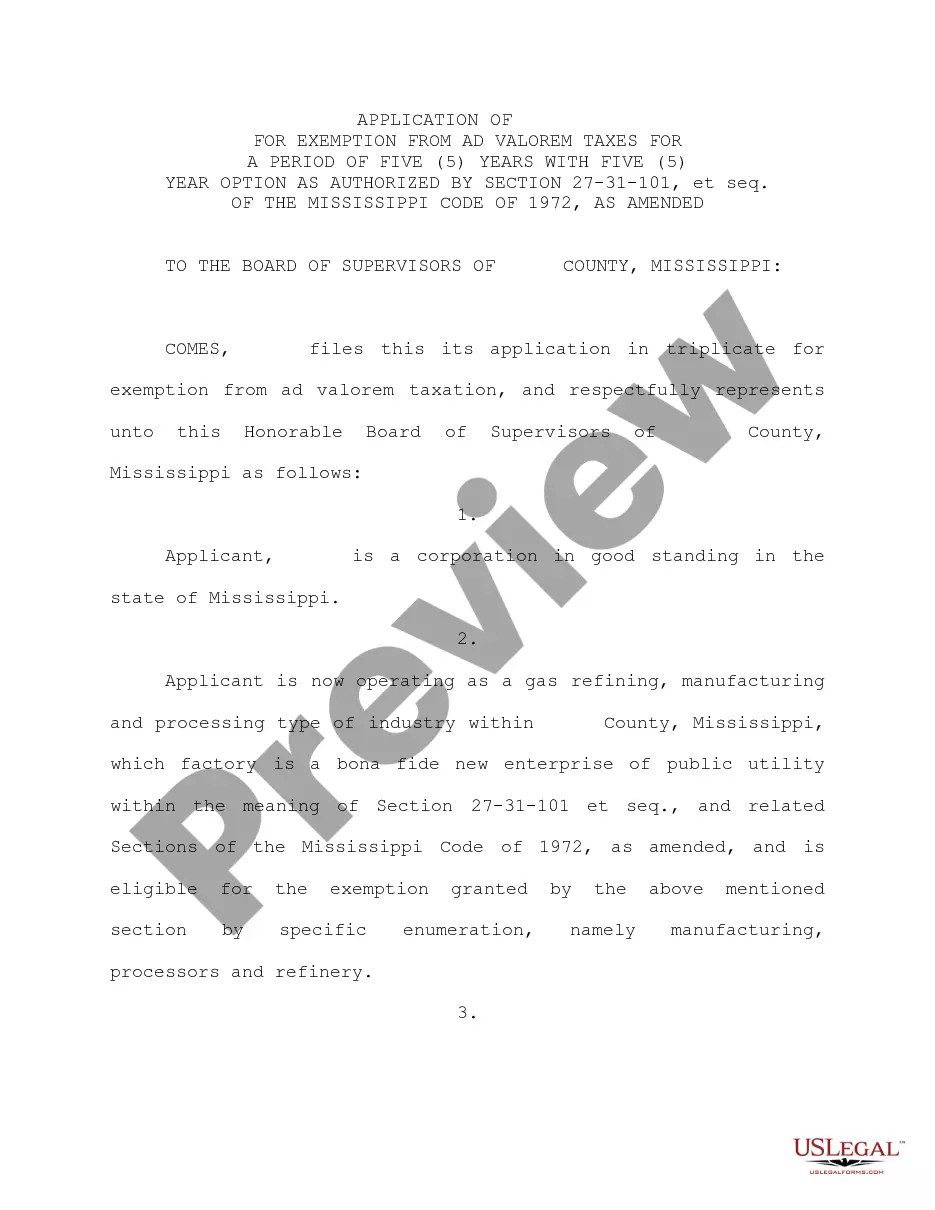

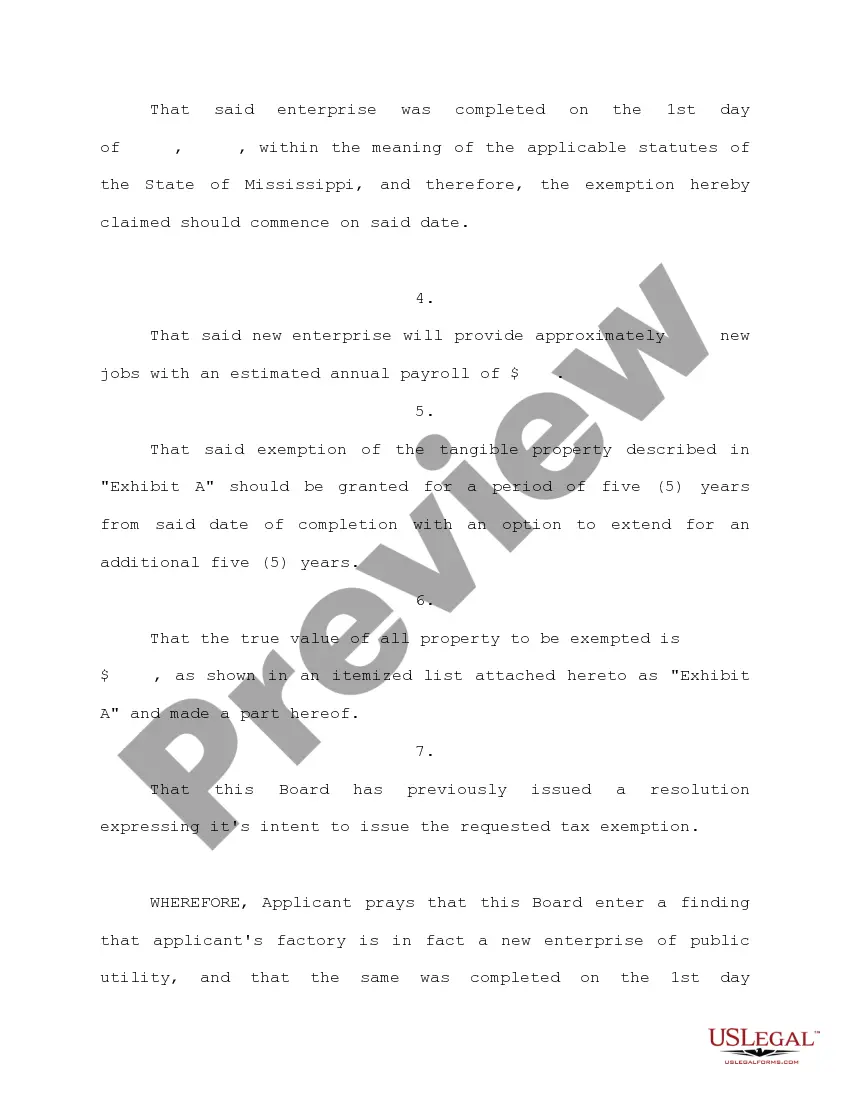

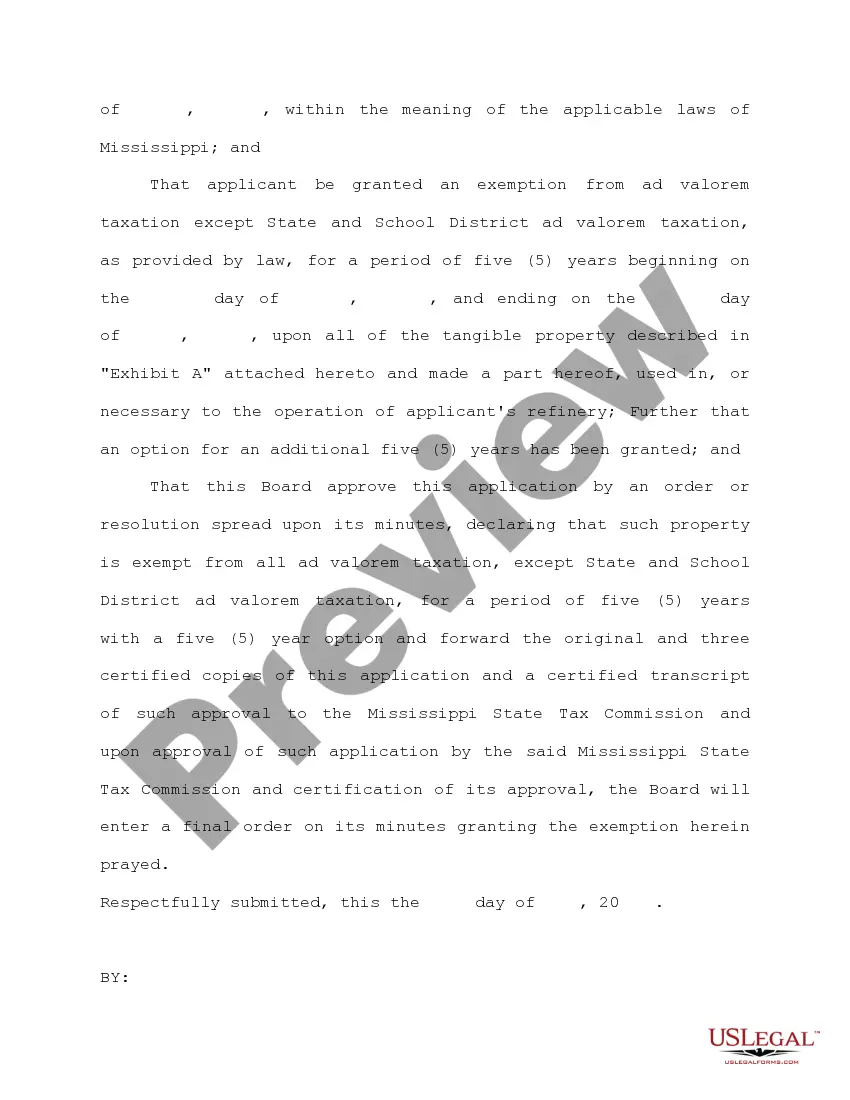

Mississippi Application for Exemption from Ad Valorem Taxes for Period of 5 Years with 5 Year Option

Description

How to fill out Mississippi Application For Exemption From Ad Valorem Taxes For Period Of 5 Years With 5 Year Option?

Obtain a printable Mississippi Application for Exemption from Ad Valorem Taxes for Period of 5 Years with 5 Year Option within just several clicks in the most complete library of legal e-files. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the Top supplier of affordable legal and tax templates for US citizens and residents online starting from 1997.

Customers who already have a subscription, must log in in to their US Legal Forms account, download the Mississippi Application for Exemption from Ad Valorem Taxes for Period of 5 Years with 5 Year Option see it stored in the My Forms tab. Users who never have a subscription are required to follow the steps listed below:

- Make sure your template meets your state’s requirements.

- If provided, read the form’s description to find out more.

- If available, preview the shape to discover more content.

- Once you’re confident the template fits your needs, click on Buy Now.

- Create a personal account.

- Select a plan.

- through PayPal or bank card.

- Download the template in Word or PDF format.

Once you’ve downloaded your Mississippi Application for Exemption from Ad Valorem Taxes for Period of 5 Years with 5 Year Option, you can fill it out in any web-based editor or print it out and complete it by hand. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific files.

Form popularity

FAQ

Mississippi requires employers to withhold income taxes from employee paychecks in addition to employer paid unemployment taxes. You can find Mississippi's tax rates here. Employees fill out Form 89-350 Mississippi Employee's Withholding Exemption Certificate, to be used when calculating withholdings.

Mississippi Form 89-350, Employee's Withholding Exemption Certificate. The Mississippi Form 89-350, Employee's Withholding Exemption Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages.

Note: Prior to 2020, Single and Head of Household will all be coded as filing status MS. Married will be coded as filing status MJ. The Standard tax tables are used to calculate tax based on the employee's marital status. The exemption amount per withholding allowance claimed has changed from $4,200 to $4,300.

Withholding allowance refers to an exemption that reduces how much income tax an employer deducts from an employee's paycheck. In practice, employees in the United States use Internal Revenue Service (IRS) Form W-4, Employee's Withholding Certificate to calculate and claim their withholding allowance.

Sales of property, labor or services sold to, billed directly to, and payment is made directly by the United States Government, the state of Mississippi and its departments, institutions, counties and municipalities or departments or school districts of its counties and municipalities are exempt from sales tax.

One may claim exempt from 2020 federal tax withholding if they BOTH: had no federal income tax liability in 2019 and you expect to have no federal income tax liability in 2020. If you claim exempt, no federal income tax is withheld from your paycheck; you may owe taxes and penalties when you file your 2020 tax return.

The state of Mississippi issues just one exemption form, to be utilized when purchasing exempt items such as items intended for resale. The state is one of the few states to only offer one exemption form.

You may claim exemption from withholding for 2019 if both of the following apply. For 2019 you expect a refund of all federal income tax withheld because you expect to have no tax liability. If you're exempt, complete only lines 1, 2, 3, 4, and 7 and sign the form to validate it.

There is no tax schedule for Mississippi income taxes. Mississippi has a graduated tax rate. These rates are the same for individuals and businesses. There is no tax schedule for Mississippi income taxes.