Mississippi Application for Exemption from Ad Valorem Taxes for Certain Manufactured Products Held for Sale or Shipment to Other than Final Consumer for a Period of 10 Years

Description Valorem Taxes Agreement

How to fill out Mississippi Exempt Code?

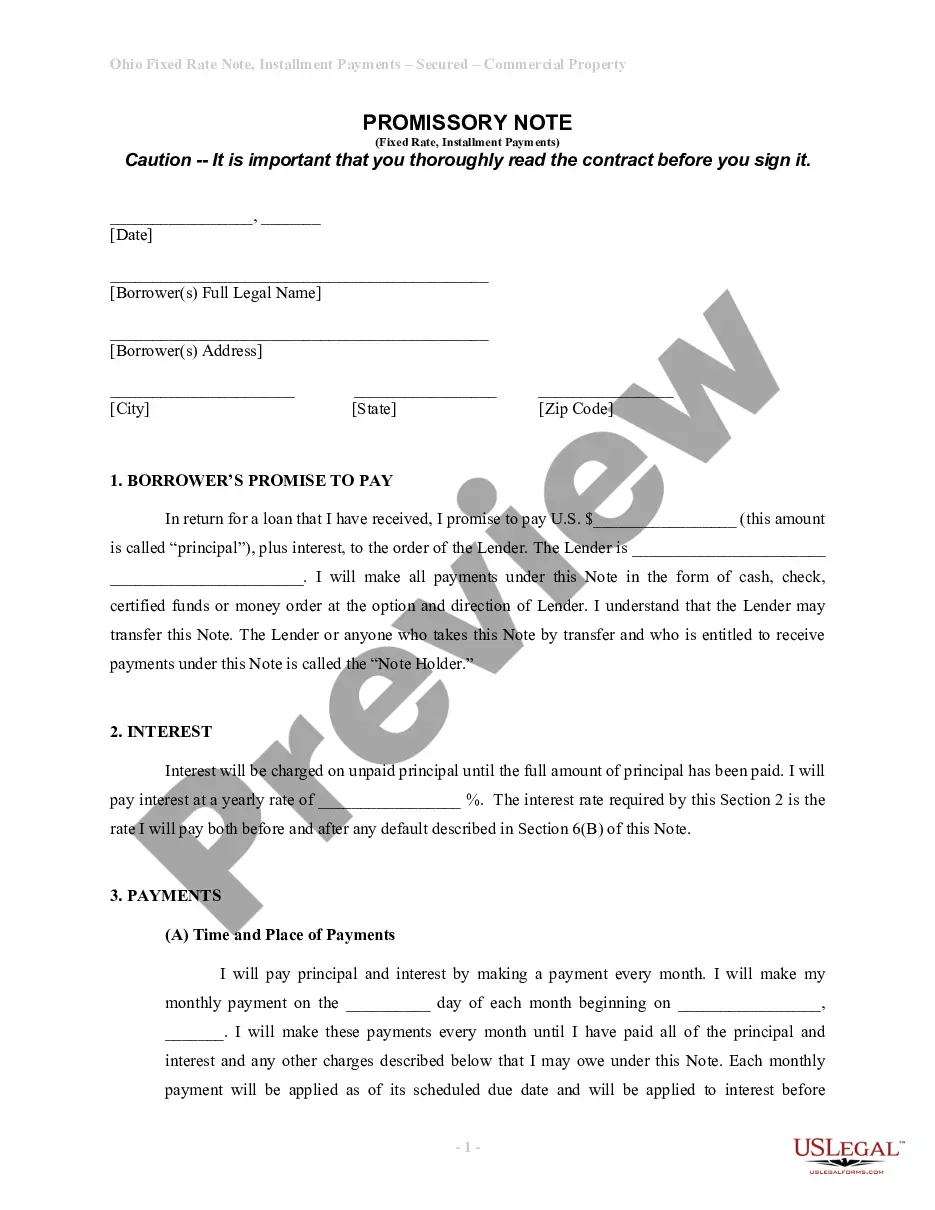

Obtain a printable Mississippi Application for Exemption from Ad Valorem Taxes for Certain Manufactured Products Held for Sale or Shipment to Other than Final Consumer for a Period of 10 Years within just several clicks from the most comprehensive library of legal e-files. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the #1 provider of affordable legal and tax forms for US citizens and residents online starting from 1997.

Customers who have a subscription, need to log in straight into their US Legal Forms account, get the Mississippi Application for Exemption from Ad Valorem Taxes for Certain Manufactured Products Held for Sale or Shipment to Other than Final Consumer for a Period of 10 Years and find it saved in the My Forms tab. Customers who don’t have a subscription must follow the steps listed below:

- Make sure your template meets your state’s requirements.

- If provided, look through form’s description to learn more.

- If offered, review the shape to see more content.

- As soon as you’re sure the template fits your needs, simply click Buy Now.

- Create a personal account.

- Choose a plan.

- Pay out via PayPal or bank card.

- Download the template in Word or PDF format.

As soon as you’ve downloaded your Mississippi Application for Exemption from Ad Valorem Taxes for Certain Manufactured Products Held for Sale or Shipment to Other than Final Consumer for a Period of 10 Years, you are able to fill it out in any web-based editor or print it out and complete it by hand. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific forms.

Valorem Taxes Form popularity

Mississippi Exemption Ad Other Form Names

Application 10 Download FAQ

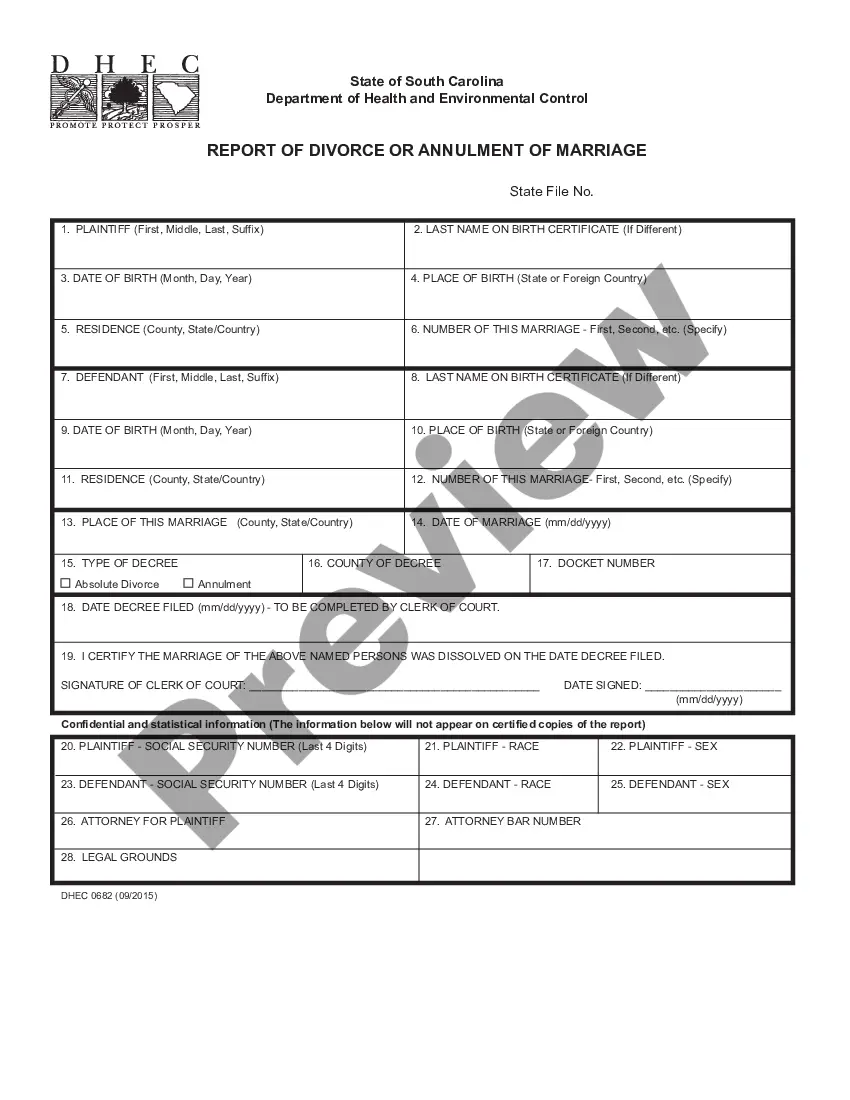

How do you register for a sales tax permit in Mississippi? Business owners can register online at Mississippi's TAP website. Mississippi encourages online sellers to register and file sales tax online.

Persons who are 65 years of age and older or who are disabled, upon application and proof of eligibility, are exempt from all ad valorem taxes up to $7,500.00 of assessed value.

Application Requirements A copy of your recorded Warranty Deed. Your Mississippi car and/or truck tag numbers. Social Security Numbers for You and Your Spouse if You Are Married. Birth dates for you and your spouse or all parties applying for homestead.

Since the Mississippi Department of Revenue doesn't provide resale certificates, a vendor who regularly works with resellers might put together a form that serves the same purposes. Essentially, you'll have a form to collect the buyer's name, address, and permit number.

Under Mississippi law, families have the right to keep a certain portion of their homestead exempt from creditors. Specifically, the law exempts 160 acres or $75,000 in equity, whichever is lower, from the reach of creditors.The homestead law's intent is to keep families on their property.

Persons who are 65 years of age and older or who are disabled, upon application and proof of eligibility, are exempt from all ad valorem taxes up to $7,500.00 of assessed value.

Sales of property, labor or services sold to, billed directly to, and payment is made directly by the United States Government, the state of Mississippi and its departments, institutions, counties and municipalities or departments or school districts of its counties and municipalities are exempt from sales tax.

A valid Florida driver's license. Either a valid voter's registration or a Declaration of Domicile, reflecting the homeowner's Florida address. At least one of your automobiles must be registered in Florida.

The state of Mississippi issues just one exemption form, to be utilized when purchasing exempt items such as items intended for resale. The state is one of the few states to only offer one exemption form.