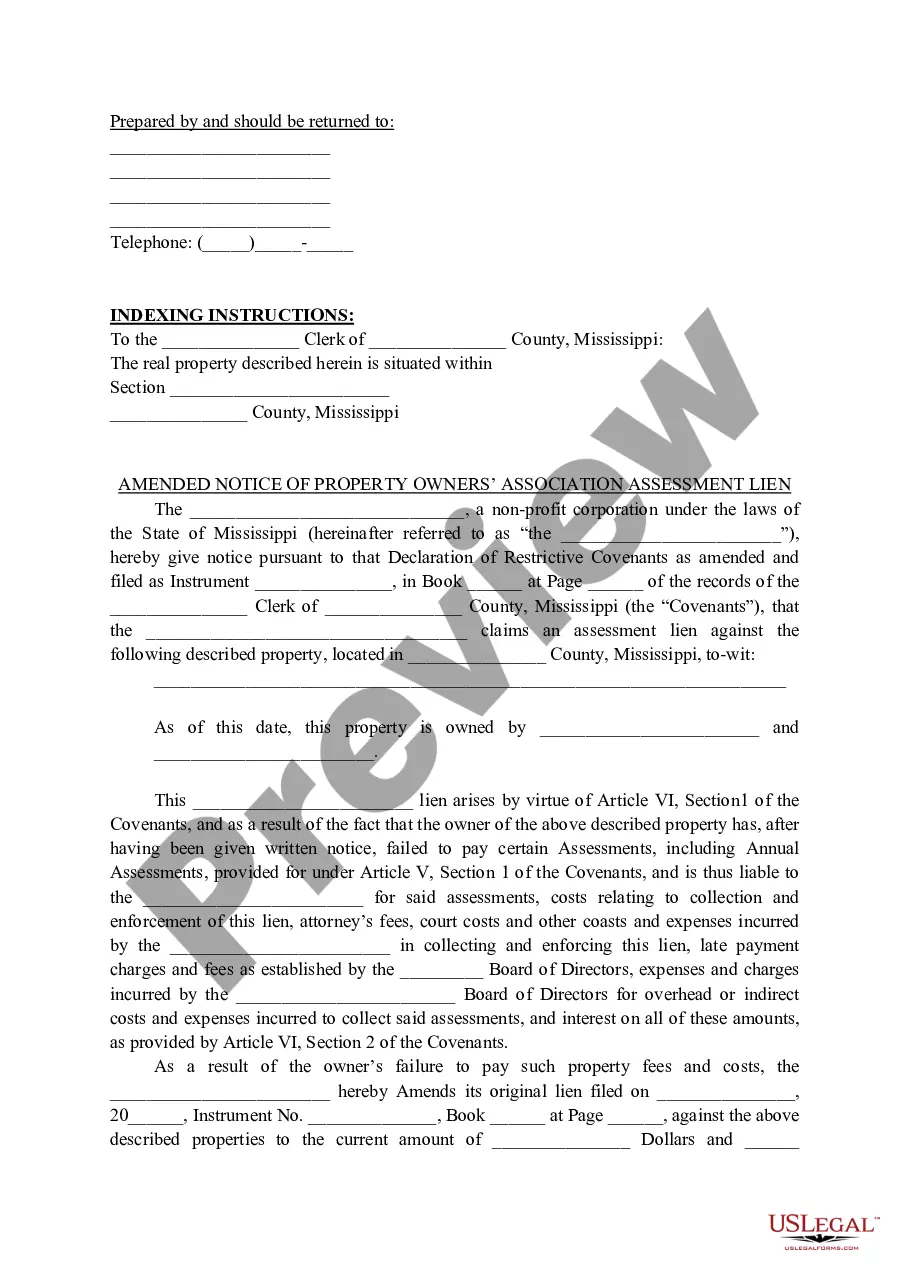

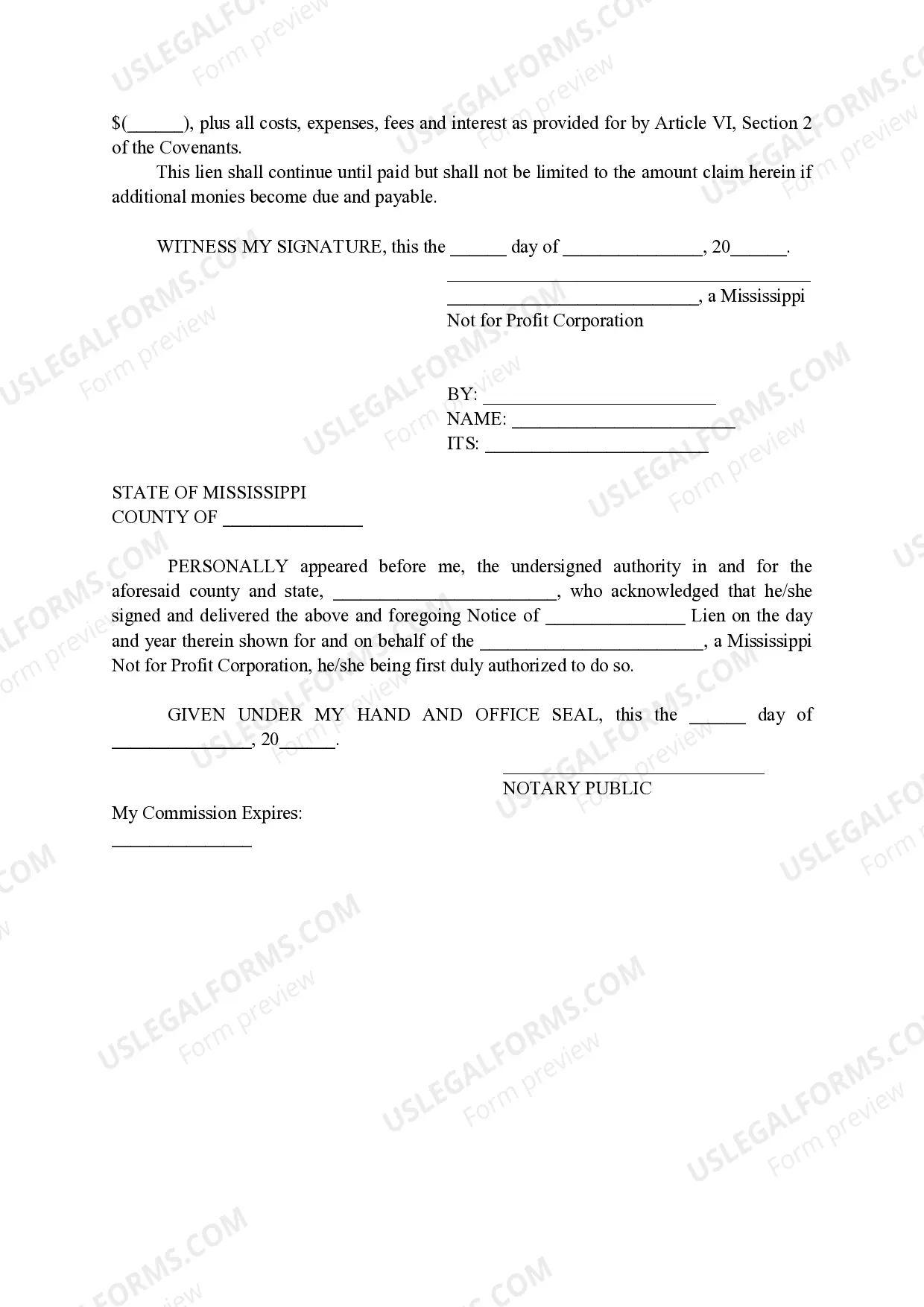

Mississippi Amended Notice of Property Owner's Association Assessment Lien

Description Sample Response Letter To Hoa Violation Notice

How to fill out Mississippi Amended Notice Of Property Owner's Association Assessment Lien?

Get a printable Mississippi Amended Notice of Property Owner's Association Assessment Lien in only several mouse clicks in the most complete catalogue of legal e-files. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the #1 provider of reasonably priced legal and tax forms for US citizens and residents on-line since 1997.

Customers who have a subscription, must log in directly into their US Legal Forms account, get the Mississippi Amended Notice of Property Owner's Association Assessment Lien and find it stored in the My Forms tab. Customers who do not have a subscription must follow the tips below:

- Make sure your template meets your state’s requirements.

- If provided, look through form’s description to find out more.

- If available, preview the form to view more content.

- When you’re sure the template is right for you, just click Buy Now.

- Create a personal account.

- Pick a plan.

- Pay out through PayPal or visa or mastercard.

- Download the template in Word or PDF format.

As soon as you have downloaded your Mississippi Amended Notice of Property Owner's Association Assessment Lien, you may fill it out in any web-based editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific files.

Toll Violation Dispute Letter Sample Ny Form popularity

Hoa Violation Letter Other Form Names

Hoa Letter Template Violation FAQ

There should be a single line of space between the recipient's address and this greeting. Compose the first paragraph in the body of the letter by briefly introducing yourself. Even if you have cooperated with the HOA before, state your full name, your address and how long you have lived in the community.

All negative information, including the HOA lien, affects your credit score. The HOA lien stays on your credit report for seven years.If your HOA pursues foreclosure after placing the lien, it would force your first mortgage holder to also file foreclosure.

The main way to secure the release of an HOA lien is to pay the association the full amount that it is due. This includes the delinquent assessment fees, late fees, interest, collection costs, and attorney fees, if applicable.

HOA Liens. A lien is a legal claim or hold on a piece of property.In essence, a HOA will go to court over a homeowner member's delinquent dues and attempt to convince the court to issue a judgment. HOAs can record judgments that they obtain against homeowner members against those members' homes.

Tip 1: Understand why the rules exist in the first place. Tip 2: Ask why you received the notice. Tip 3: Remember that notices are not an attack on your character. Tip 4: Understand that it is a progressive process. Tip 5: If there are extenuating circumstances, let the board know.

HOA Super Liens, Though, Are Senior to First Mortgages If an HOA forecloses a super lien, it can potentially eliminate the first mortgage and any other junior mortgages on the property. Keep in mind, though, that even if a mortgage lien is eliminated, you're not off the hook for the debt.

If an HOA has a lien on a homeowner's property, it may forecloseeven if the home already has a mortgage on itas permitted by the CC&Rs and state law. The HOA can foreclose either through judicial foreclosure or a nonjudicial foreclosure, depending on state law and the terms in the CC&Rs.

In your letter, include statements describing the steps taken to correct each violation and prevent it's recurrence, and list the date compliance was achieved. Respond to each violation individually. When in doubt, call the technical reviewer listed on the notice. Do not return the notice of violation.