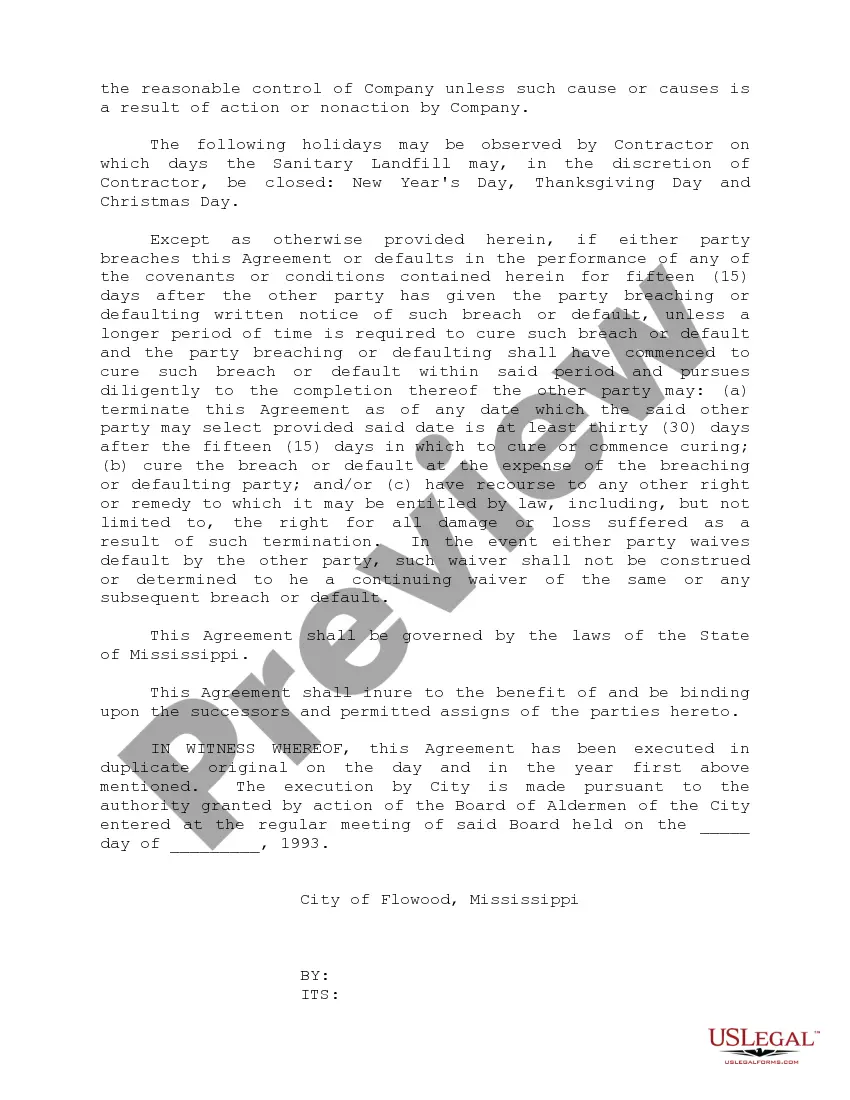

Mississippi Collection Contract

Description

How to fill out Mississippi Collection Contract?

Get a printable Mississippi Collection Contract in just several clicks in the most extensive library of legal e-forms. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the #1 supplier of affordable legal and tax forms for US citizens and residents online since 1997.

Customers who already have a subscription, must log in straight into their US Legal Forms account, get the Mississippi Collection Contract see it stored in the My Forms tab. Users who do not have a subscription are required to follow the tips listed below:

- Make sure your template meets your state’s requirements.

- If provided, look through form’s description to find out more.

- If readily available, review the form to view more content.

- As soon as you’re sure the template fits your needs, just click Buy Now.

- Create a personal account.

- Choose a plan.

- Pay through PayPal or credit card.

- Download the form in Word or PDF format.

As soon as you’ve downloaded your Mississippi Collection Contract, you are able to fill it out in any online editor or print it out and complete it by hand. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

Mississippi law limits the amount of money that your creditors can garnish (take) from your wages to repay your debts.Most creditors with judgments can take only 25% of your wages, but some types of creditors are permitted to take more. Read on to learn about wage garnishment law in Mississippi.

In California, there is generally a four-year limit for filing a lawsuit to collect a debt based on a written agreement.

Credit card companies sue for non-payment in about 15% of collection cases. Usually debt holders only have to worry about lawsuits if their accounts become 180-days past due and charge off, or default. That's when a credit card company writes off a debt, counting it as a loss for accounting purposes.

Don't ignore them. Debt collectors will continue to contact you until a debt is paid. Find out debt information. Find out who the original creditor was, as well as the original amount. Get it in writing. Don't give personal details over the phone. Try settling or negotiating.

A statute of limitations is a law that tells you how long someone has to sue you. In California, most credit card companies and their debt collectors have only four years to do so. Once that period elapses, the credit card company or collector loses its right to file a lawsuit against you.

A statute of limitations is a law that tells you how long someone has to sue you. In California, most credit card companies and their debt collectors have only four years to do so. Once that period elapses, the credit card company or collector loses its right to file a lawsuit against you.

However there are times when you should not pay a collection agency: If you pay the collection agency directly, the debt is removed from your credit report in six years from the date of payment. If you don't pay, it purges six years from the last activity date, but you may be at risk for wage garnishment.

Debt collectors report accounts to the credit bureaus, a move that can impact your credit score for several months, if not years.The late payments and subsequent charge-off that typically precede a collection account already will have damaged your credit score by the time the collection happens.

If you pay the collection agency directly, the debt is removed from your credit report in six years from the date of payment. If you don't pay, it purges six years from the last activity date, but you may be at risk for wage garnishment.