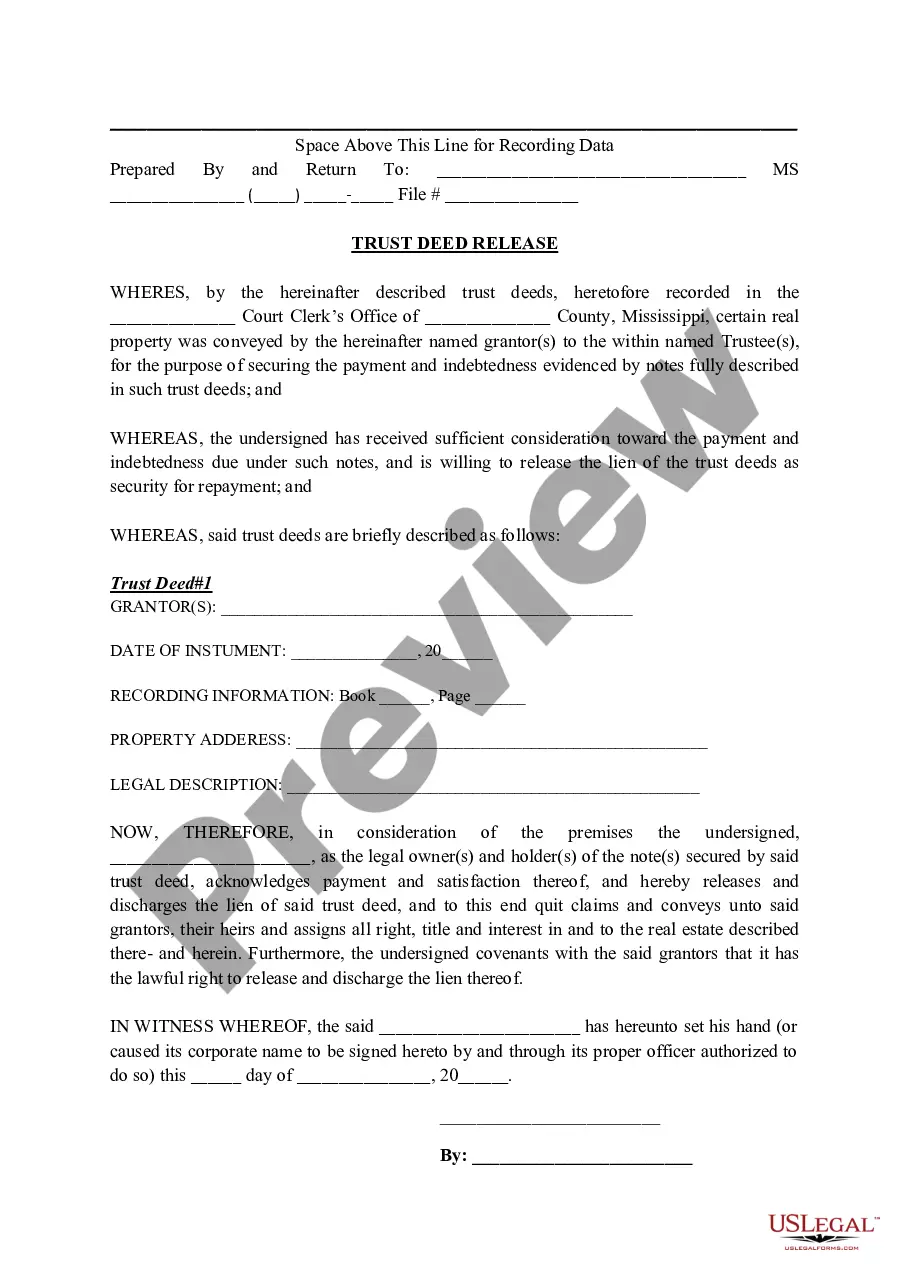

Mississippi Trust Deed Release

Description Mississippi Trust Release

How to fill out Mississippi Trust Deed Release?

Obtain a printable Mississippi Trust Deed Release in only several clicks in the most extensive library of legal e-files. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the Top provider of reasonably priced legal and tax forms for US citizens and residents online starting from 1997.

Customers who have already a subscription, must log in in to their US Legal Forms account, down load the Mississippi Trust Deed Release see it stored in the My Forms tab. Users who do not have a subscription are required to follow the tips listed below:

- Make sure your form meets your state’s requirements.

- If provided, look through form’s description to find out more.

- If offered, review the form to view more content.

- Once you are sure the template meets your requirements, just click Buy Now.

- Create a personal account.

- Select a plan.

- via PayPal or credit card.

- Download the template in Word or PDF format.

Once you have downloaded your Mississippi Trust Deed Release, you may fill it out in any web-based editor or print it out and complete it by hand. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific files.

Ms Deed Release Form popularity

Ms Trust Deed Other Form Names

FAQ

A deed of release or release deed is a legal document that removes the claim of a person from an immovable property and transfers his/her share to the co-owner. The release deed procedure is executed in the sub-registrars office and both the parties are required to be present for signing it.

The deed can be re-written to reflect changes, but it needs the consent of both parties. If you want to make substantial changes to the deed, it's typically best to get a new one written. If changes are only minor, you can enter a deed of variation.

A deed of release literally releases the parties to a deal from previous obligations, such as payments under the term of a mortgage because the loan has been paid off. The lender holds the title to real property until the mortgage's terms have been satisfied when a deed of release is commonly entered into.

Parties need a deed of release to bring a dispute or agreement to an end.Alternatively, if you are an employer, you may want a departing employee to sign a deed of release to agree that they won't make any employment claims against you once they have gone.

A Deed of Trustis a document where a borrower transfers the legal title for its property to a trustee who holds the property in trust as security for the payment of the debt to the lender. If the borrower pays the debt as agreed, the deed of trust becomes void and the lender executes a Deed of Reconveyance.

Yes, you can challenge the release deed/ relinquishment deed after the death of the person. but to challenge it you need to have solid grounds and proof stating that the deed was made fraudulently. if you dont have any proof then their is no point challenging it as the case may not sustain merit in the court.

The property's title remains in the trust until the loan is paid off, or satisfied, then it is released from the trust. To complete the release, the lender prepares a deed of reconveyance. This document states that the conditions of the loan have been met and you have no further financial obligations to the lender.

In order to clear the Deed of Trust from the title to the property, a Deed of Reconveyance must be recorded with the Country Recorder or Recorder of Deeds. If the Trustee/Beneficiary fails to record a satisfaction within the set time limits, the Trustee/Beneficiary may be responsible for damages as set out by statute.

Giving the wrong legal address for the property or the wrong amount of the debt can render the deed unenforceable. In some cases, the error is easy to fix, and the court will rule the deed is enforceable.