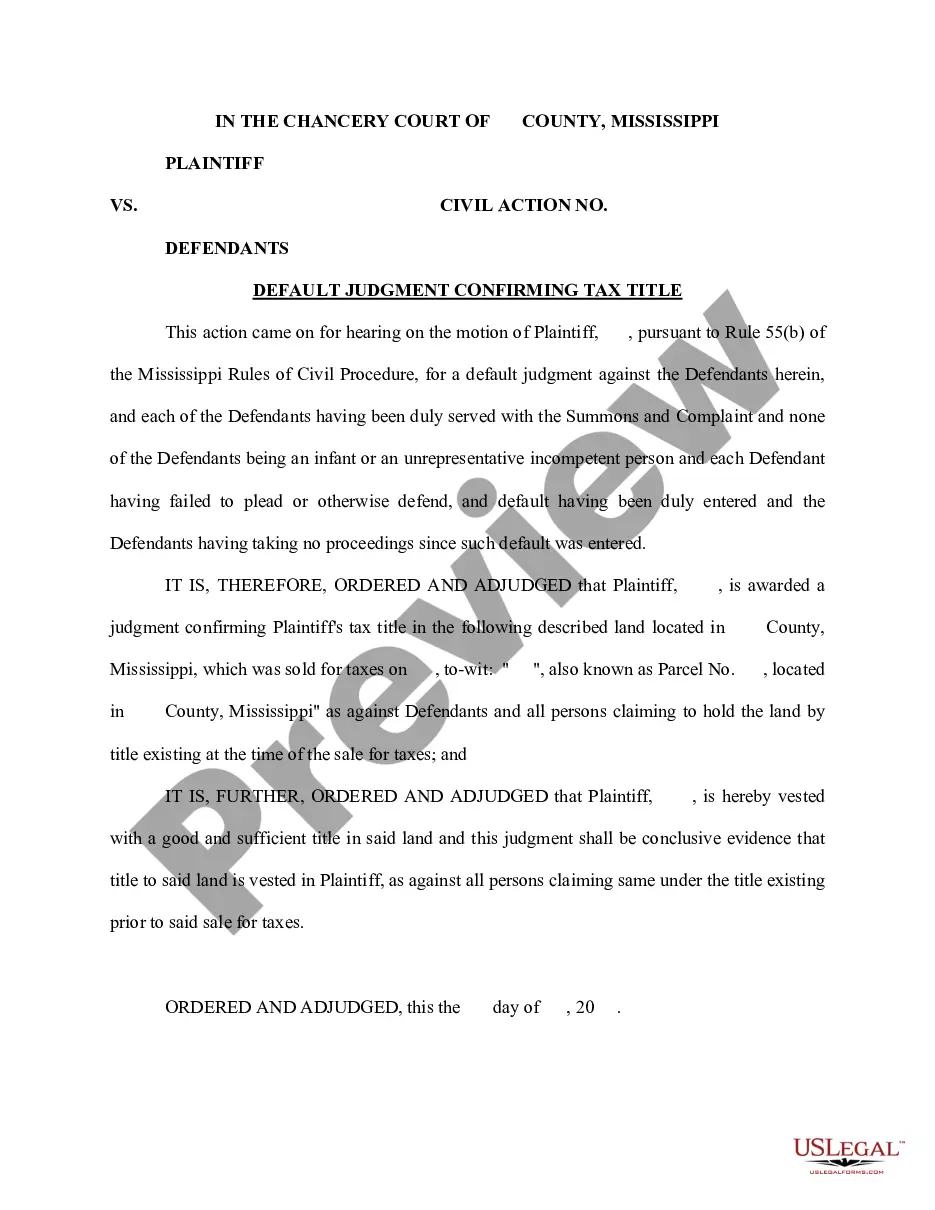

Mississippi Default Judgment Confirming Tax Title

Description

How to fill out Mississippi Default Judgment Confirming Tax Title?

Get a printable Mississippi Default Judgment Confirming Tax Title within just several mouse clicks in the most complete library of legal e-files. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the Top provider of affordable legal and tax forms for US citizens and residents online starting from 1997.

Users who have already a subscription, must log in into their US Legal Forms account, get the Mississippi Default Judgment Confirming Tax Title and find it saved in the My Forms tab. Customers who do not have a subscription must follow the tips below:

- Ensure your form meets your state’s requirements.

- If provided, look through form’s description to learn more.

- If available, review the shape to view more content.

- As soon as you are sure the template meets your requirements, click on Buy Now.

- Create a personal account.

- Pick a plan.

- via PayPal or visa or mastercard.

- Download the template in Word or PDF format.

As soon as you have downloaded your Mississippi Default Judgment Confirming Tax Title, you can fill it out in any web-based editor or print it out and complete it manually. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific forms.

Form popularity

FAQ

The IRS allows you to check the status of your payment by using its online Get My Payment tool. For eligible stimulus payment recipients, it will show how much you're getting, how you're getting it (mail or direct deposit) and when it was sent to you.

Using the IRS Where's My Refund tool. Calling the IRS at 1-800-829-1040 (Wait times to speak to a representative may be long.) Viewing your IRS account information. Looking for emails or status updates from your e-filing website or software.

If you did use a tracking service from the post office when you mailed the federal tax return, there is no way to verify that the return was received by the IRS. There is no IRS phone to call to verify that the return was received.

An acknowledgement can either be an acceptance or rejection of the return. The taxpayer then receives an email stating the status of the return - accepted or rejected.When the state sends the ACK, we e-mail the taxpayer whether the return has been accepted or rejected.