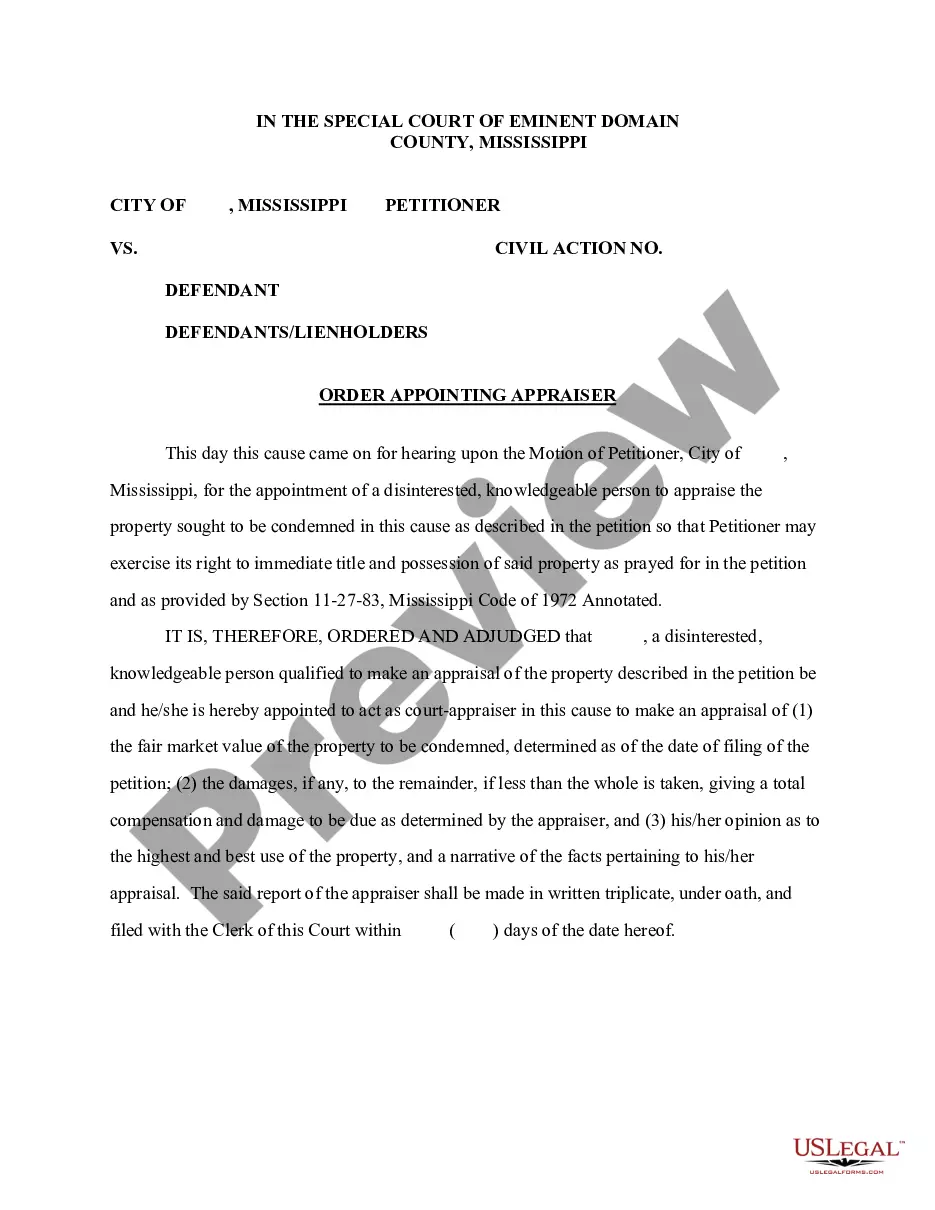

Mississippi Order Appointing Appraiser

Description

How to fill out Mississippi Order Appointing Appraiser?

Get a printable Mississippi Order Appointing Appraiser in only several mouse clicks in the most comprehensive catalogue of legal e-forms. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the #1 provider of affordable legal and tax templates for US citizens and residents online since 1997.

Customers who already have a subscription, need to log in into their US Legal Forms account, get the Mississippi Order Appointing Appraiser and find it saved in the My Forms tab. Users who don’t have a subscription are required to follow the steps below:

- Make certain your form meets your state’s requirements.

- If available, look through form’s description to learn more.

- If offered, review the shape to find out more content.

- Once you’re confident the form meets your requirements, click on Buy Now.

- Create a personal account.

- Choose a plan.

- Pay through PayPal or visa or mastercard.

- Download the template in Word or PDF format.

Once you have downloaded your Mississippi Order Appointing Appraiser, you may fill it out in any web-based editor or print it out and complete it by hand. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific files.

Form popularity

FAQ

Job Outlook Employment of property appraisers and assessors is projected to grow 3 percent from 2019 to 2029, about as fast as the average for all occupations. Employment growth will be driven by economic expansion and population increases.

Unless you're paying cash for your home (and thus not taking a loan), you'll have to go through the appraisal process. While the appraisal fee is typically paid by the buyer, the lender chooses the home appraiser to be sure it won't be biased in the buyer's favor. Appraisers must be a neutral party.

Unless you're paying cash for your home (and thus not taking a loan), you'll have to go through the appraisal process. While the appraisal fee is typically paid by the buyer, the lender chooses the home appraiser to be sure it won't be biased in the buyer's favor. Appraisers must be a neutral party.

The average income for home appraisers is $60,040 as of 2020, according to PayScale, although a certified residential real estate appraiser may earn $100,000 or more, as they become more experienced.

In most residential property transactions you are able to choose your real estate agent and your lender, but you cannot choose your appraiser. Instead the appraiser must be chosen by your lender to provide a level of independence from the buyer and seller.

Step 1: Meet the Basic Requirement: Step 2: Complete the Required Hours of Working Experience. Step 3: Fulfill the Education Requirement. Step 4: Submit Application to the Mississippi Appraisal Board. Step 5: Pass the Certified General Appraiser Exam.

Step 1: Meet the Basic Requirement: Step 2: Complete the Required Hours of Working Experience. Step 3: Fulfill the Education Requirement. Step 4: Submit Application to the Mississippi Appraisal Board. Step 5: Pass the Certified General Appraiser Exam.

For all practical purposes, the appraisal belongs to that lender because the borrower cannot use it with another lender. While nothing prevents borrowers from purchasing appraisals on their own, lenders will not accept them, which means that they will have to pay for a second appraisal when they apply.

To become a real estate appraiser, it indeed requires lots of hard work and persistence. Not only you would need to finish all the required course works, but you must obtain the necessary work experience. Therefore, many people would like more reassurance before they start investing in this career.