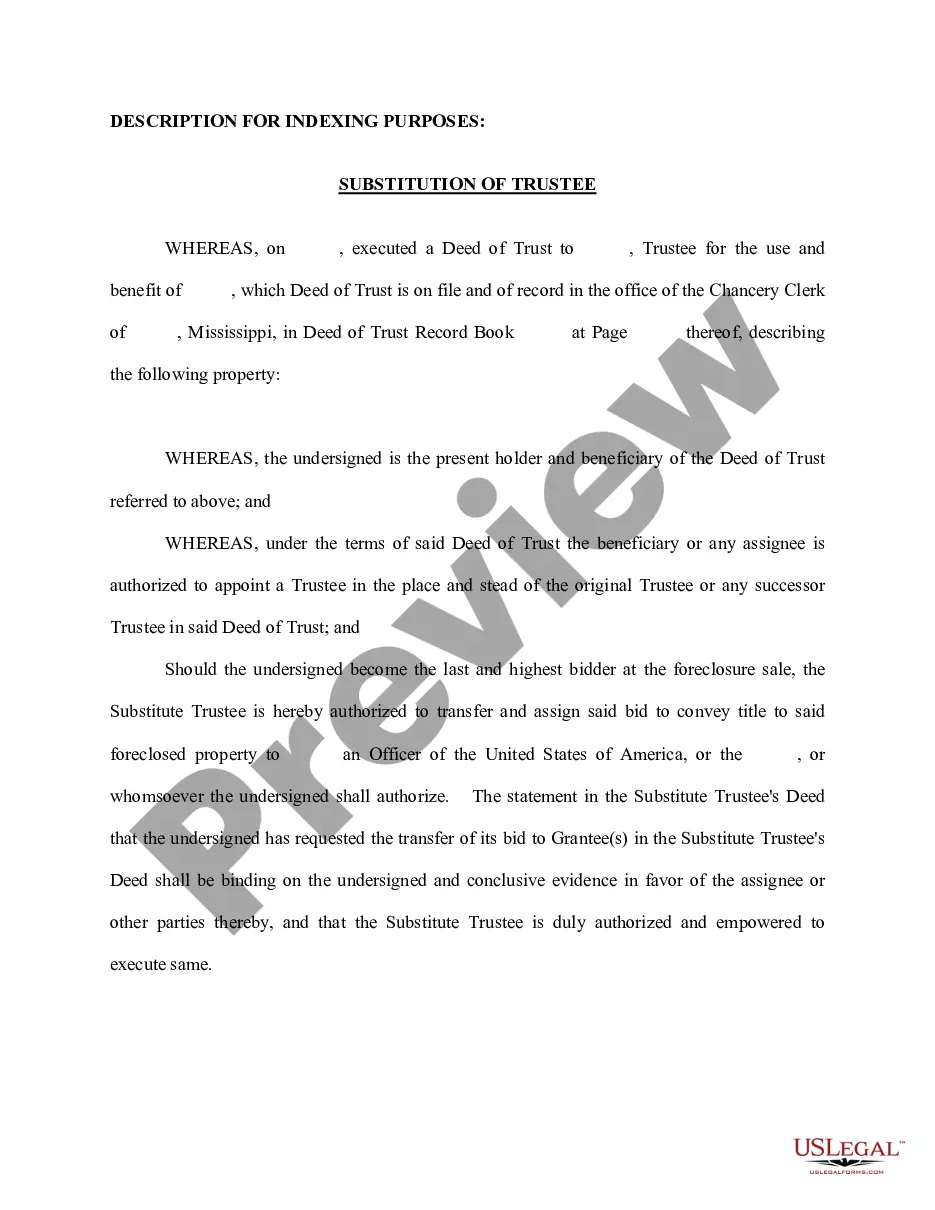

Mississippi Substitution of Trustee

Description What Is A Substitute Trustee

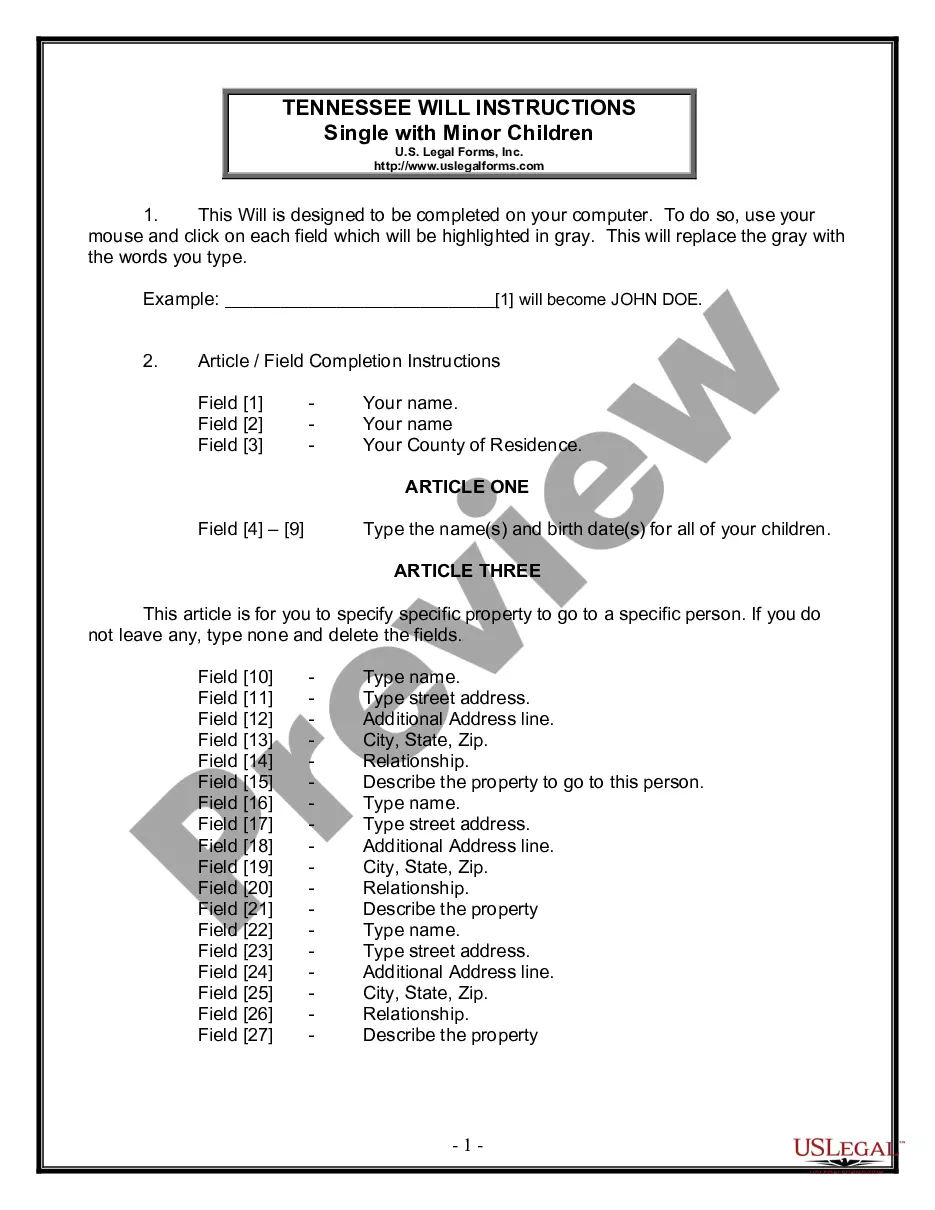

How to fill out Mississippi Substitution Of Trustee?

Obtain a printable Mississippi Substitution of Trustee in only several clicks from the most complete catalogue of legal e-forms. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the Top supplier of reasonably priced legal and tax templates for US citizens and residents on-line since 1997.

Customers who already have a subscription, need to log in into their US Legal Forms account, download the Mississippi Substitution of Trustee see it saved in the My Forms tab. Users who never have a subscription must follow the steps below:

- Make certain your template meets your state’s requirements.

- If available, read the form’s description to learn more.

- If accessible, preview the form to find out more content.

- Once you are sure the template suits you, simply click Buy Now.

- Create a personal account.

- Choose a plan.

- via PayPal or credit card.

- Download the form in Word or PDF format.

When you’ve downloaded your Mississippi Substitution of Trustee, it is possible to fill it out in any web-based editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

A document known as a substitution of trustee and full reconveyance identifies the person who has the authority to reconvey the property and remove the lien.Once the document is registered, it establishes the borrower as the sole owner of the property, which is now free and clear of the previous mortgage.

Can trustees be held personally liable:Trustees must be aware that they can be held personally liable, even if only one trustee has signing power on behalf of the trust and that person makes a poor decision that finds all the trustees liable for his/her negligence. This is, in itself, an onerous provision.

The trustee acts as the legal owner of trust assets, and is responsible for handling any of the assets held in trust, tax filings for the trust, and distributing the assets according to the terms of the trust. Both roles involve duties that are legally required.

A trustee cannot comingle trust assets with any other assets.If the trustee is not the grantor or a beneficiary, the trustee is not permitted to use the trust property for his or her own benefit. Of course the trustee should not steal trust assets, but this responsibility also encompasses misappropriation of assets.

A trustee is a person or firm that holds and administers property or assets for the benefit of a third party.Trustees are trusted to make decisions in the beneficiary's best interests and often have a fiduciary responsibility, meaning they act in the best interests of the trust beneficiaries to manage their assets.

Every trust must have at least one trustee who holds the trust property for the benefit of the beneficiaries. In a financial context, investments and insurance policies are often written in trust and, as such, also require trustees.

The trustee is under a duty to the beneficiaries to invest and mange the funds of the trust as a prudent investor would, in light of the purposes, terms, distribution requirements, and other circumstances of the trust.(5) Trustees may have a duty as well as having the authority to delegate as prudent investors would.

In a nutshell, the Substitution of Trustee and Deed of Reconveyance is a legal document that evidences security interest is being release by a lender.If the bank chooses to appoint a new trustee at the time the loan is paid and/or the obligation is satisfied, they will substitute a new trustee.

The trustee holds legal title to the property and the beneficiaries hold equitable title. Because the trustee holds legal title to the property, that property must be held in the trustee's name.