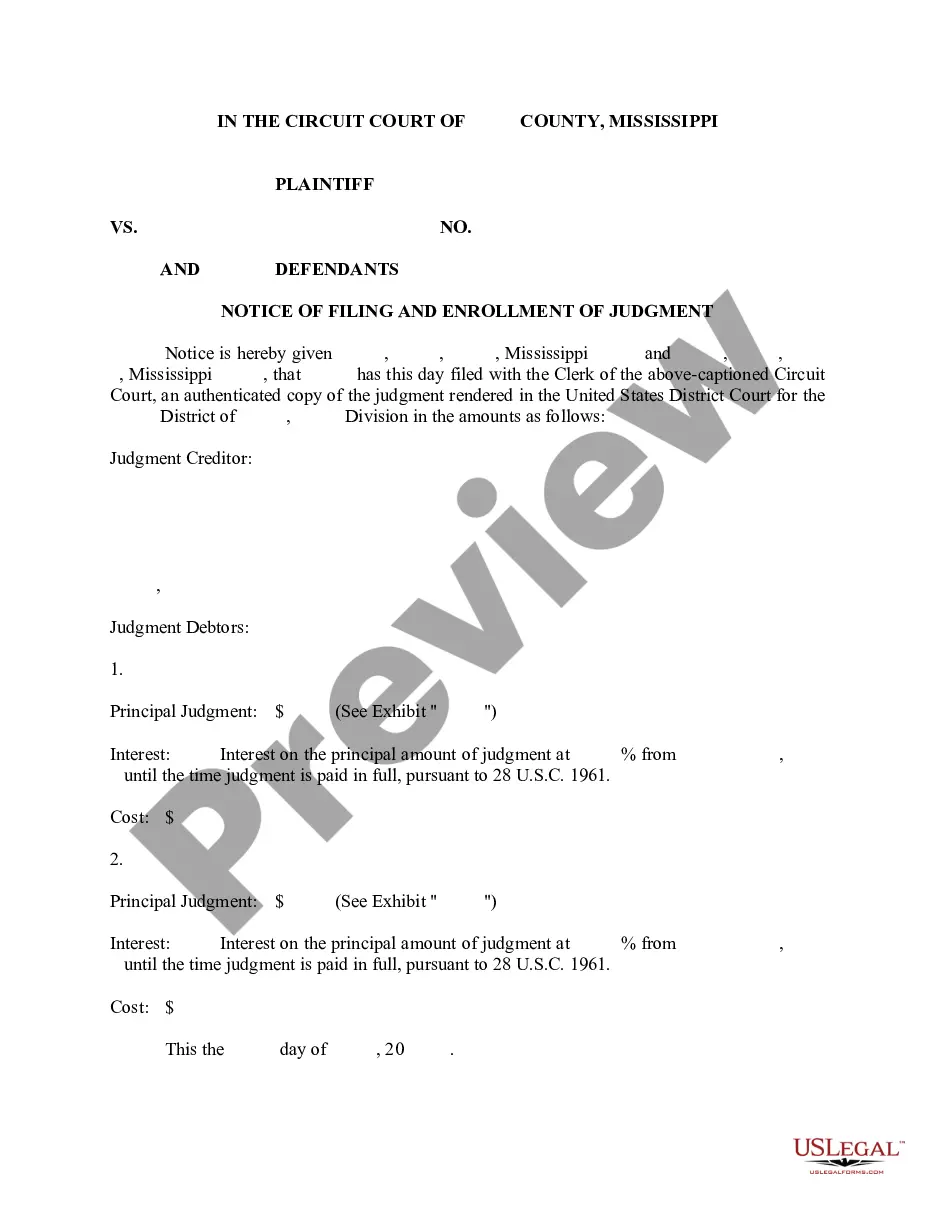

Mississippi Notice Of Filing And Enrollment Of Judgment

Description Mississippi Filing Statement

How to fill out Notice Judgment?

Get a printable Mississippi Notice Of Filing And Enrollment Of Judgment in only several clicks from the most comprehensive catalogue of legal e-files. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the #1 supplier of reasonably priced legal and tax templates for US citizens and residents online starting from 1997.

Customers who have a subscription, must log in into their US Legal Forms account, download the Mississippi Notice Of Filing And Enrollment Of Judgment see it stored in the My Forms tab. Customers who do not have a subscription are required to follow the steps below:

- Make certain your template meets your state’s requirements.

- If available, read the form’s description to learn more.

- If readily available, review the shape to view more content.

- As soon as you are sure the template fits your needs, just click Buy Now.

- Create a personal account.

- Select a plan.

- Pay out through PayPal or visa or mastercard.

- Download the template in Word or PDF format.

When you have downloaded your Mississippi Notice Of Filing And Enrollment Of Judgment, you can fill it out in any online editor or print it out and complete it by hand. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific forms.

Ms Filing Judgment Form popularity

Mississippi Judgment Form Other Form Names

Mississippi Filing FAQ

Due to a recent policy change by tax authorities (not eFile.com and other online tax websites), you can only efile a state tax return with your federal tax return. If you have already e-filed or filed your federal return, you can still prepare your state return on eFile.com.

The 2020 Mississippi State Income Tax Return forms for Tax Year 2020 (Jan. 1 - Dec. 31, 2020) can be e-Filed together with the IRS Income Tax Return by the April 15, 2020 May 17, 2021 due date. If you file a tax extension you can e-File your Taxes until October 15, 2021 without a late filing penalty.

Tax Day has come and gone, but it's not too late to file your 2018 state income tax return.April 15 was the deadline for taxpayers who owed tax. But if you didn't get around to filing, remember that everyone gets an automatic, six-month filing extension to file until Oct. 15.

Mississippi will follow the federal extension to file the 2020 individual income tax returns from April 15, 2021 to May 17, 2021. This extension only applies to the filing of the individual income tax return and payment of tax due.Beginning January 1, 2021, Miss.

If you are receiving a refund. P.O. Box 23058. Jackson, MS 39225-3058. All other income tax returns. P. O. Box 23050. Jackson, MS 39225-3050.

How you can file your return electronically. Use a tax preparer that is approved in the Mississippi e-file Program. (Make sure your tax preparer is approved by the IRS for e-file and signs your Form MS 8453, Mississippi State Declaration for Electronic Filing.)

Mississippi Residents As a resident you are required to file a state income tax return if you had any income withheld for tax purposes, earned more than $8,300 (single; add $1,500 per dependent) or earned more than $16,600 (married; add $1,500 per dependent).