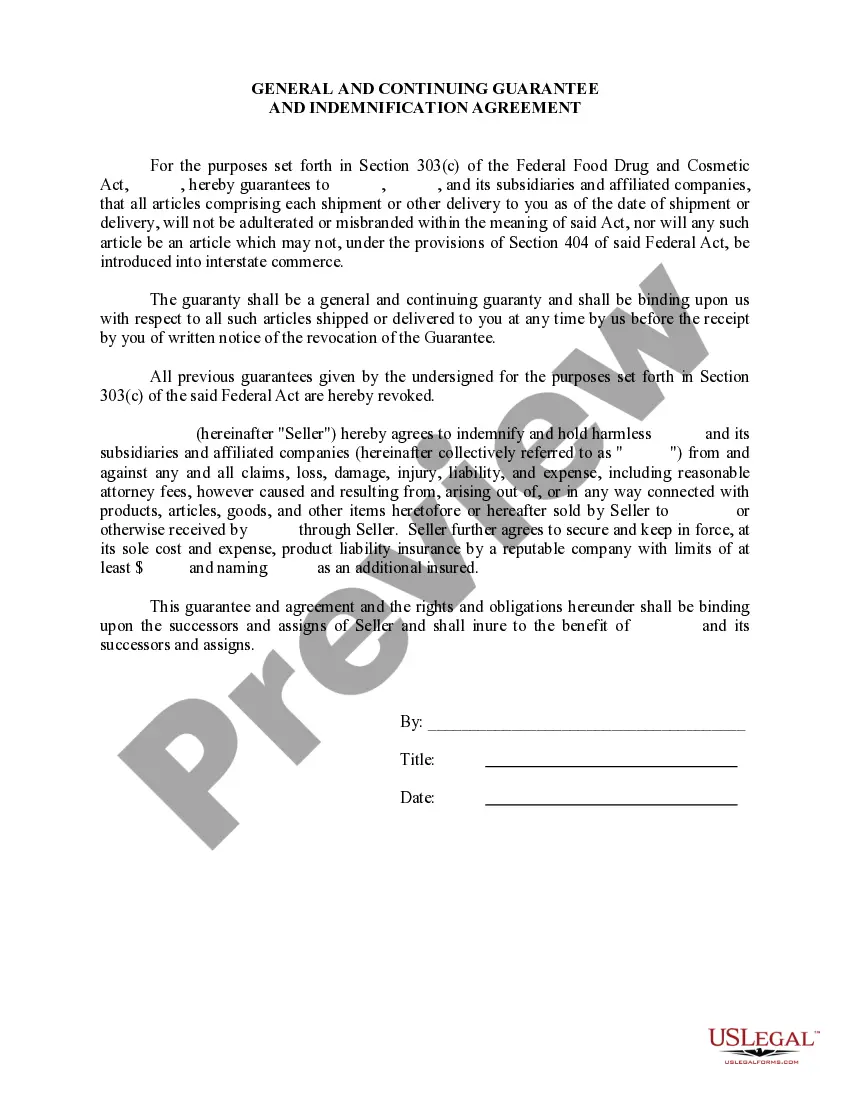

Mississippi General and Continuing Guarantee and Indemnification Agreement

Description

How to fill out Mississippi General And Continuing Guarantee And Indemnification Agreement?

Get a printable Mississippi General and Continuing Guarantee and Indemnification Agreement in just several mouse clicks in the most comprehensive catalogue of legal e-forms. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the Top supplier of affordable legal and tax forms for US citizens and residents online since 1997.

Users who have a subscription, must log in directly into their US Legal Forms account, download the Mississippi General and Continuing Guarantee and Indemnification Agreement and find it stored in the My Forms tab. Users who do not have a subscription must follow the steps listed below:

- Ensure your form meets your state’s requirements.

- If available, read the form’s description to learn more.

- If readily available, review the form to discover more content.

- As soon as you are confident the template suits you, click Buy Now.

- Create a personal account.

- Select a plan.

- Pay out through PayPal or visa or mastercard.

- Download the form in Word or PDF format.

Once you have downloaded your Mississippi General and Continuing Guarantee and Indemnification Agreement, you are able to fill it out in any web-based editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific forms.

Form popularity

FAQ

There are two types of Guarantee i.e. Specific Guarantee which is for a specific transaction and Continuing Guarantee which is for a series of transactions. Specific Guarantee: A guarantee which is given for only one transaction or debt, the guarantee is known as a Specific Guarantee.

Bid/Tender Guarantee. Issued in support of an exporter's bid to supply goods or services and, if successful, ensures compensation in the event that the contract is not signed. Performance Guarantee. Advance Payment Guarantee. Warranty Guarantee. Retention Guarantee.

By death of surety: A continuing guarantee is automatically revoked as regards future transactions on surety's death and no notice of death is required to be given to the creditor. But for the transactions already entered into, the estate of the surety is liable Section 131.

A continuing guaranty is an agreement by the guarantor to be liable for the obligations of someone else to the lender, even if there are several different obligations that are made, renewed or repaid over time. In contrast, a specific guaranty is limited only to one individual transaction.

Bid/Tender Guarantee. Issued in support of an exporter's bid to supply goods or services and, if successful, ensures compensation in the event that the contract is not signed. Performance Guarantee. Advance Payment Guarantee. Warranty Guarantee. Retention Guarantee.

A continuing guarantee is said to be revoked as regards to the future transactions to be entered between the debtor and the creditor, in the following ways: By notice of revocation by the surety (Section 130) By death of the surety (Section 131)

Continuing guaranty refers to a guaranty in which the guarantor will not be liable unless a specified event occurs.A continuing guaranty may be revoked at any time by the guarantor in respect to future transactions, unless there is a continuing consideration as to the transactions that the guarantor does not give up.

There are two types of Guarantee i.e. Specific Guarantee which is for a specific transaction and Continuing Guarantee which is for a series of transactions. Specific Guarantee: A guarantee which is given for only one transaction or debt, the guarantee is known as a Specific Guarantee.

Specific Guarantee: A specific guarantee is for a single debt or any specified transaction. It comes to an end when such debt has been paid.A continuing guarantee applies to all the transactions entered into by the principal debtor until it is revoked by the surety.