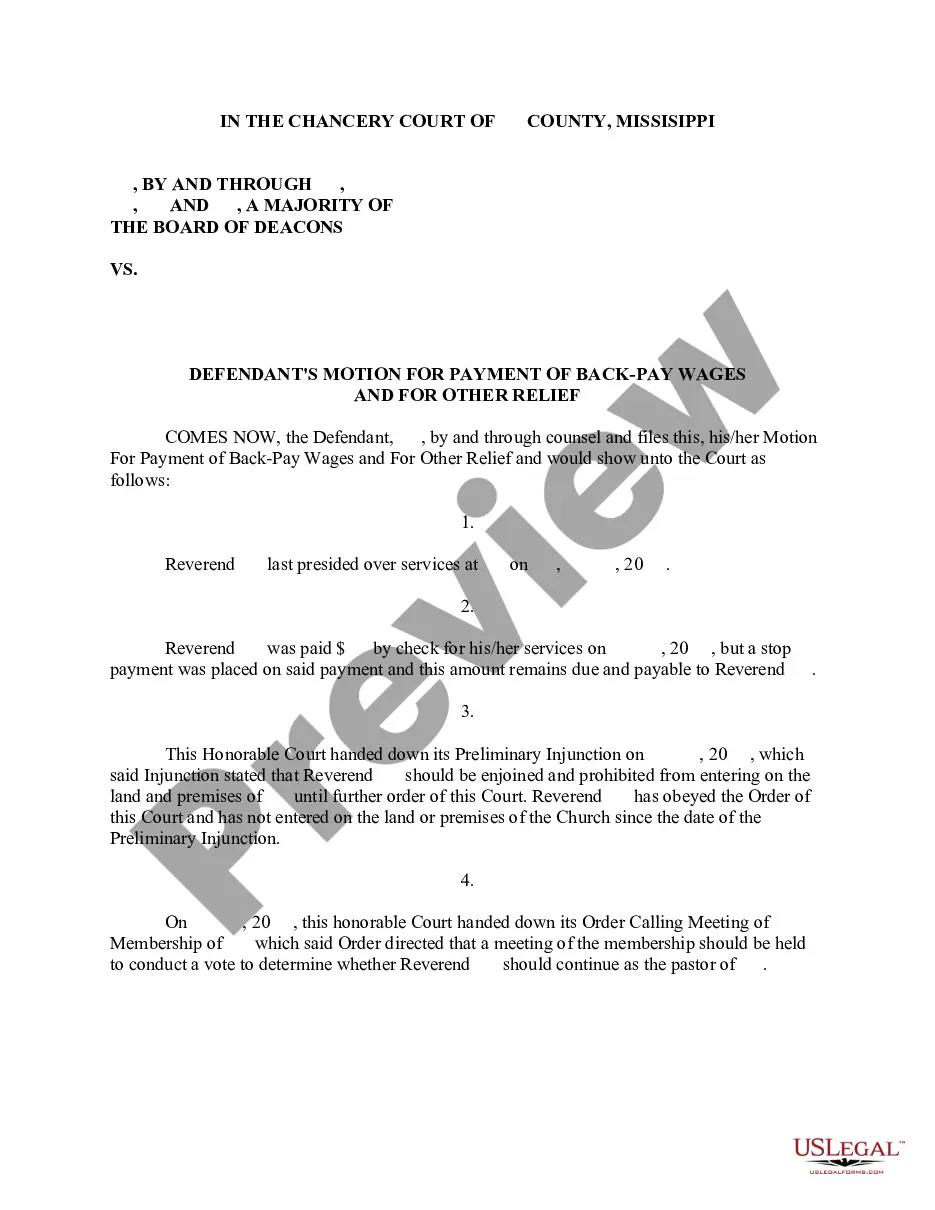

Mississippi Defendant's Motion for Payment of Back Pay Wages and for other Relief

Description Court Pay Would

How to fill out Mississippi Defendant's Motion For Payment Of Back Pay Wages And For Other Relief?

Obtain a printable Mississippi Defendant's Motion for Payment of Back Pay Wages and for other Relief within several clicks from the most extensive library of legal e-documents. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the #1 provider of affordable legal and tax templates for US citizens and residents on-line since 1997.

Customers who have a subscription, must log in into their US Legal Forms account, get the Mississippi Defendant's Motion for Payment of Back Pay Wages and for other Relief and find it stored in the My Forms tab. Customers who never have a subscription must follow the tips below:

- Make sure your template meets your state’s requirements.

- If available, look through form’s description to find out more.

- If offered, review the form to view more content.

- When you are confident the form suits you, simply click Buy Now.

- Create a personal account.

- Choose a plan.

- Pay out via PayPal or bank card.

- Download the form in Word or PDF format.

Once you have downloaded your Mississippi Defendant's Motion for Payment of Back Pay Wages and for other Relief, it is possible to fill it out in any online editor or print it out and complete it by hand. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific documents.

Mississippi Payment Back Form popularity

Back Pay Statement Other Form Names

Back Wages Contract FAQ

If you are owed back pay or unpaid wages in California, you can file a lawsuit to recover the amount owed, including interest and any penalties. Talk to your California wage and hour law lawyer about your case and how to make your employer pay for the work you were never compensated for.

Employees in California may be entitled to back pay anytime their wages and benefits are lost due to wrongful practices by their employer. Most employees receive back pay awards as a result of wrongful termination caused by workplace harassment or hostile work environment.

Retroactive, or retro, pay is money due to an employee for work already performed but paid at a lower rate. Most commonly, it is linked to late performance appraisals, in which the employee received a pay increase that took effect in a prior pay period.

Retro pay, or retroactive pay, is compensation you owe an employee for work performed during a previous pay period. Retro pay differs from back pay.Back pay is when you owe employee wages that you didn't pay at all, whereas retro pay is when you paid an employee less than what you should have.

There is an important time limit for court claims: you only have 6 years from the date that the amount became due and payable to you to claim in a court for unpaid entitlements. If you do not take action in a court to recover the unpaid wages or entitlements during that time, you will lose the right to claim entirely.

Back pay is a payment for work that an employee previously completed but never received payment for at all. One more thing to note: Retroactive pay can be mandated. Courts can order a business to issue retroactive pay in the event of things like: Discrimination.

Usually, a claimant will receive their backpay (or the first installment of their backpay) within 60 days of being approved. But it doesn't always work out that way. Sometimes the backpay comes very quickly. In fact, backpay is sometimes deposited to a bank account before an award notice is even sent.

If you are owed back pay or unpaid wages in California, you can file a lawsuit to recover the amount owed, including interest and any penalties. Talk to your California wage and hour law lawyer about your case and how to make your employer pay for the work you were never compensated for.

What are the Federal Regulations Regarding Retroactive Pay? According to the Department of Labor Wage and Hour Division, employees must be paid each pay period and no later than 12 days from the end of the pay period.