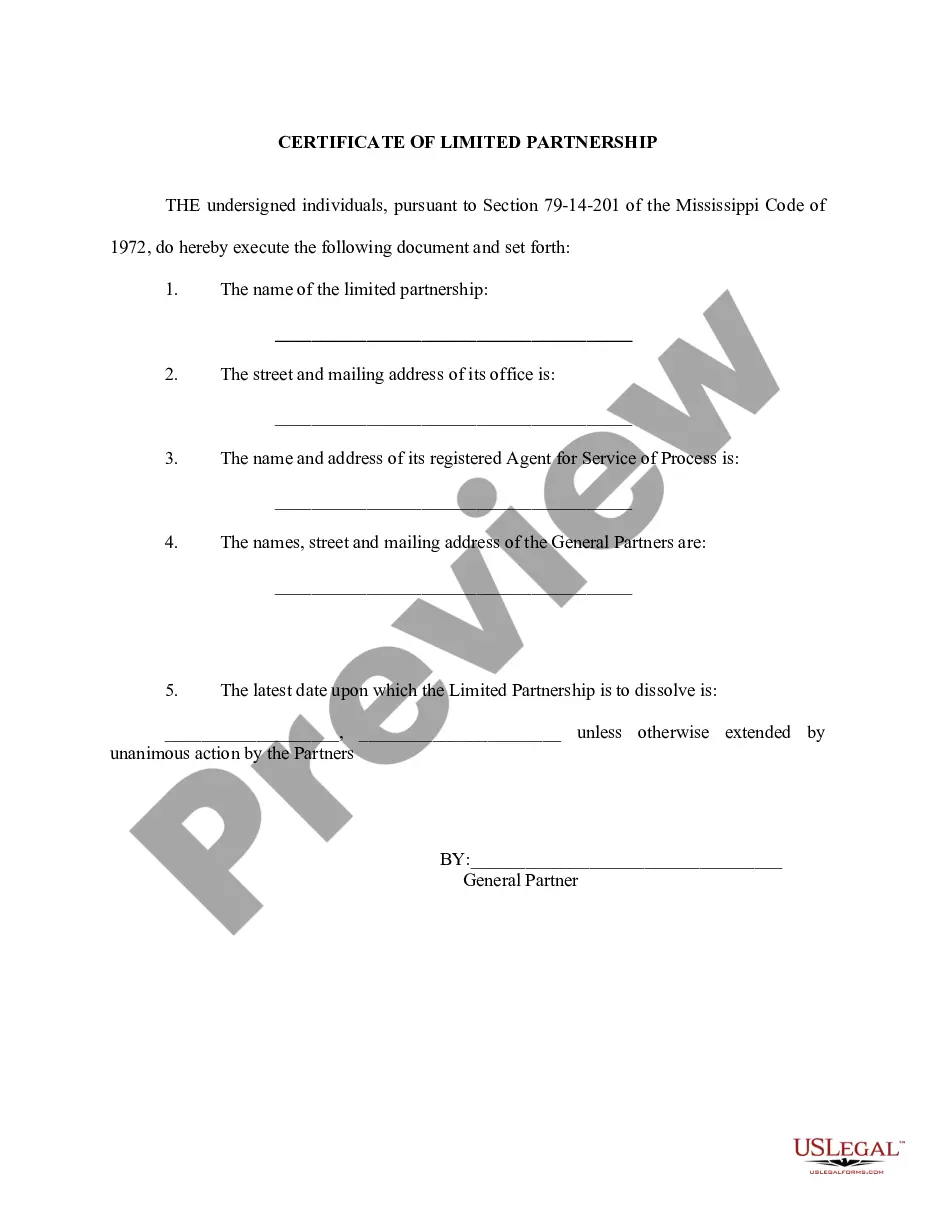

Mississippi Limited Partnership Agreement and Certificate

Description

How to fill out Mississippi Limited Partnership Agreement And Certificate?

Obtain a printable Mississippi Limited Partnership Agreement and Certificate within several clicks from the most extensive catalogue of legal e-files. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the Top supplier of reasonably priced legal and tax forms for US citizens and residents on-line starting from 1997.

Users who have a subscription, must log in into their US Legal Forms account, get the Mississippi Limited Partnership Agreement and Certificate and find it saved in the My Forms tab. Users who don’t have a subscription are required to follow the steps below:

- Make certain your template meets your state’s requirements.

- If provided, read the form’s description to find out more.

- If readily available, review the shape to view more content.

- When you’re sure the form meets your requirements, click Buy Now.

- Create a personal account.

- Select a plan.

- Pay out through PayPal or visa or mastercard.

- Download the form in Word or PDF format.

When you’ve downloaded your Mississippi Limited Partnership Agreement and Certificate, it is possible to fill it out in any online editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

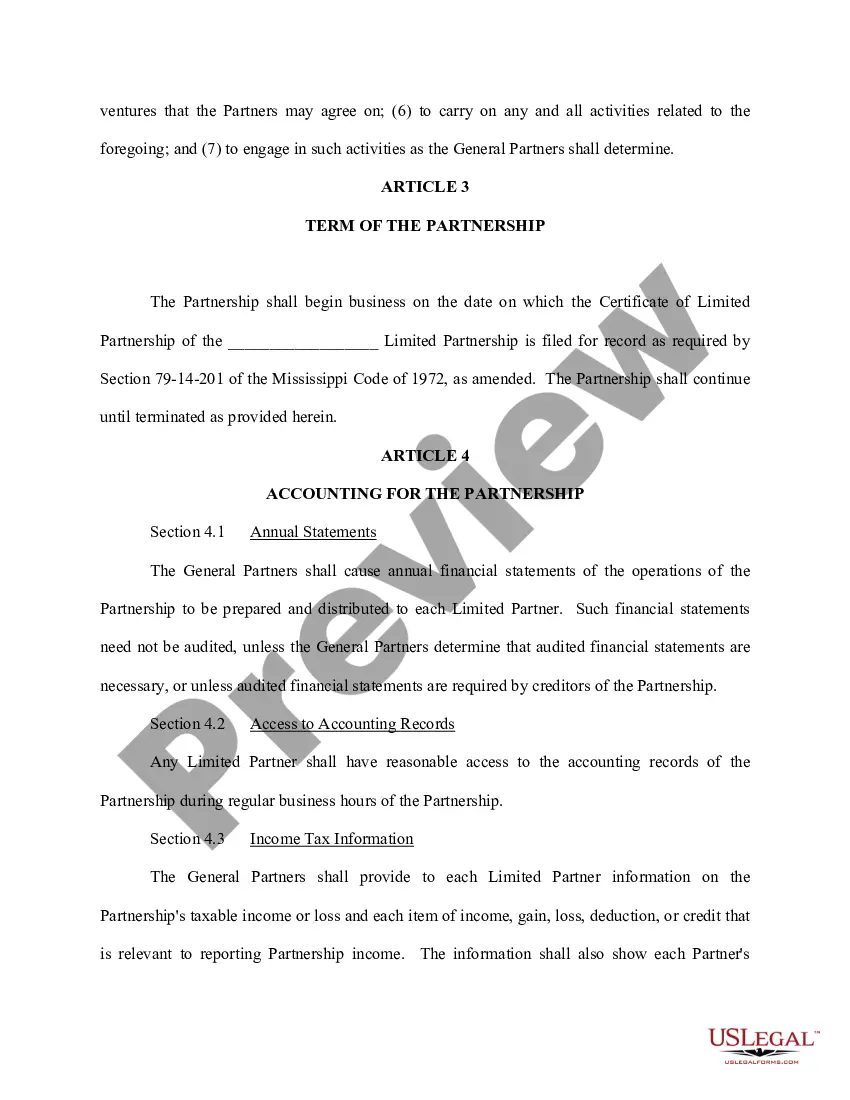

A partnership is not a corporate or separate entity; rather it is viewed as an extension of its owners for legal and tax purposes, although a partnership may own property as a legal entity.Limited Partnerships In a limited partnership, one or more partners are general partners, and one or more are limited partners.

A limited partnership is different from a general partnership in that it requires a partnership agreement.A limited partner is one who does not have total responsibility for the debts of the partnership. The most a limited partner can lose is his investment in the business.

A limited partnership (LP) is a type of business that's owned by two types of partners: general partners and limited partners. The general partners in an LP make business decisions and take on full liability for the company.

A limited partnership is considered to be a separate legal entity, and as such can sue, be sued, and own property.Asset protection; when a limited partner is sued, the assets inside of the LP are protected from seizure. Limited Partners are protected from liability in a business lawsuit.

A limited partnership, formed under the Limited Partnerships Act 1907, is a business association of one or more 'general partners' alongside one or more 'limited partners'.A limited partnership must have at least one 'general partner' and also at least one 'limited partner'.

While partnerships can be registered, a partnership is not a separate legal person and cannot enter into agreements on its own the way corporations can; one or more of the partners in the partnership must enter into agreements on behalf of the partnership, similar to the way an individual enters into agreements on

Two popular forms of company structures are the Limited Partnership (LP) and the Limited Liability Company (LLC). All members of an LLC receive limited liability and the company can be exempt from double taxation.A growing trend in company structure is the LP/LLC hybrid company.

A limited partnership (LP)not to be confused with a limited liability partnership (LLP)is a partnership made up of two or more partners. The general partner oversees and runs the business while limited partners do not partake in managing the business.

An LP, also referred to as a limited partnership, consists of limited partners, which is unlike the general partnership that consists of general partners. An LLC, or limited liability company, consists of members (owners).