Mississippi Agreement for Donation of Land to City

Description Agreement Donation

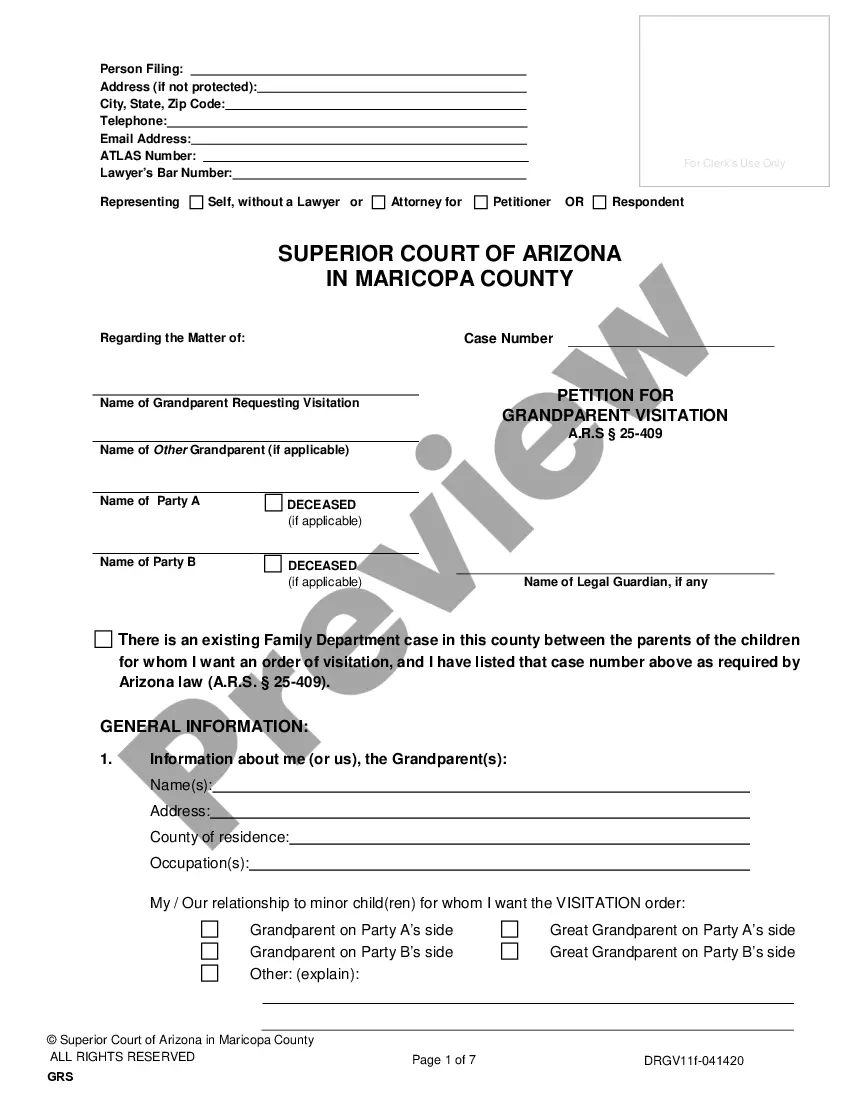

How to fill out Mississippi Agreement For Donation Of Land To City?

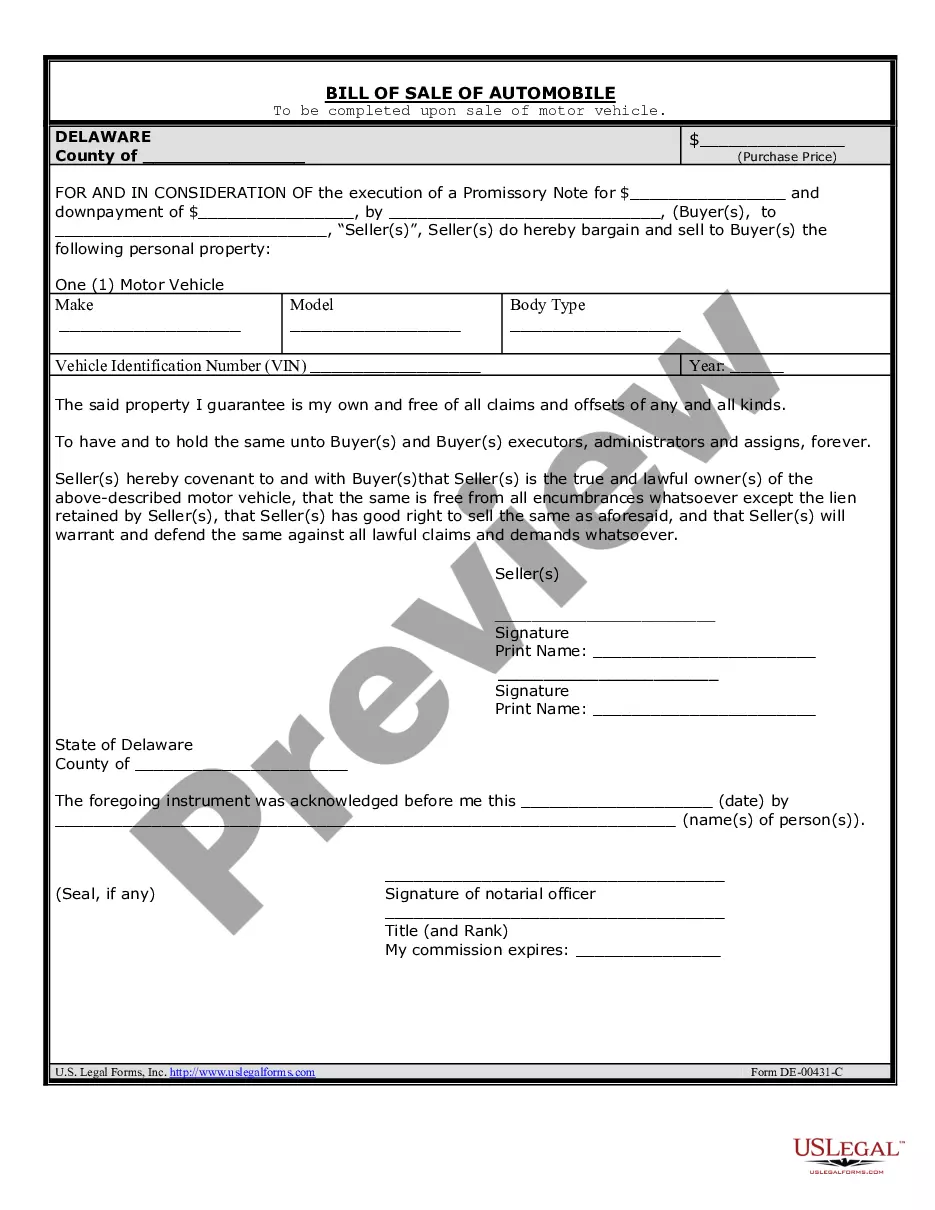

Obtain a printable Mississippi Agreement for Donation of Land to City in only several clicks from the most comprehensive library of legal e-forms. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the #1 supplier of reasonably priced legal and tax forms for US citizens and residents online since 1997.

Customers who have a subscription, must log in straight into their US Legal Forms account, get the Mississippi Agreement for Donation of Land to City and find it saved in the My Forms tab. Users who don’t have a subscription must follow the tips listed below:

- Make sure your form meets your state’s requirements.

- If available, read the form’s description to find out more.

- If offered, review the shape to see more content.

- Once you are confident the template meets your requirements, click Buy Now.

- Create a personal account.

- Choose a plan.

- through PayPal or credit card.

- Download the form in Word or PDF format.

As soon as you have downloaded your Mississippi Agreement for Donation of Land to City, you may fill it out in any web-based editor or print it out and complete it manually. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific documents.

Donation Land Form Form popularity

Land Donation Agreement Other Form Names

FAQ

In the United States, a conservation easement (also called conservation covenant, conservation restriction or conservation servitude) is a power invested in a qualified private land conservation organization (often called a "land trust") or government (municipal, county, state or federal) to constrain, as to a

For individual non-cash gifts of $250 to $500, that proof must include written confirmation. For a non-cash gift between $500 and $5,000, on top of written acknowledgment from the benefiting organization, you need to document your ownership and cost and file Form 8283.

5. Can I donate to my own 501c3? Yes, you can donate to your own 501(c)(3) organization. You can make a tax-deductible donation to any 501(c)(3) charity, regardless of your affiliation with it.

Draft a letter requesting the donation of a building. Ask philanthropic building owners to donate a building for your nonprofit to use. State in the letter you are requesting a gift in the form of a building being signed over to the nonprofit.

Time is money and some charities need manpower more than money. Donate your credit card points. Set up a Facebook fundraiser. Give blood it's always in need. Create a bake sale fundraiser in your kitchen. Donate toys, furniture and winter wear.

Income tax relief is available to individual donors giving property to a charity. As well as being able to claim a deduction from your income tax bill, there is also an exemption from having to pay any capital gains tax that would have otherwise arisen on the disposal of the property.

You deed your property (such as a home, vacation home, commercial building or investment property) to TNC. The Conservancy will sell the property and use the proceeds to support vital programs. In very limited cases we may use the property for our own purposes.

Conservation easements are a great idea, in theory. Here's the way they work. Basically, if you are willing to donate your property for the public good, and that donation reduces the value of your property, you get to take a tax deduction equal to the reduction in the value of your property.

Outside the U.S., the Conservancy does not generally acquire land for its own protection but instead works with local communities and national governments to encourage the protection of ecologically-sensitive land.