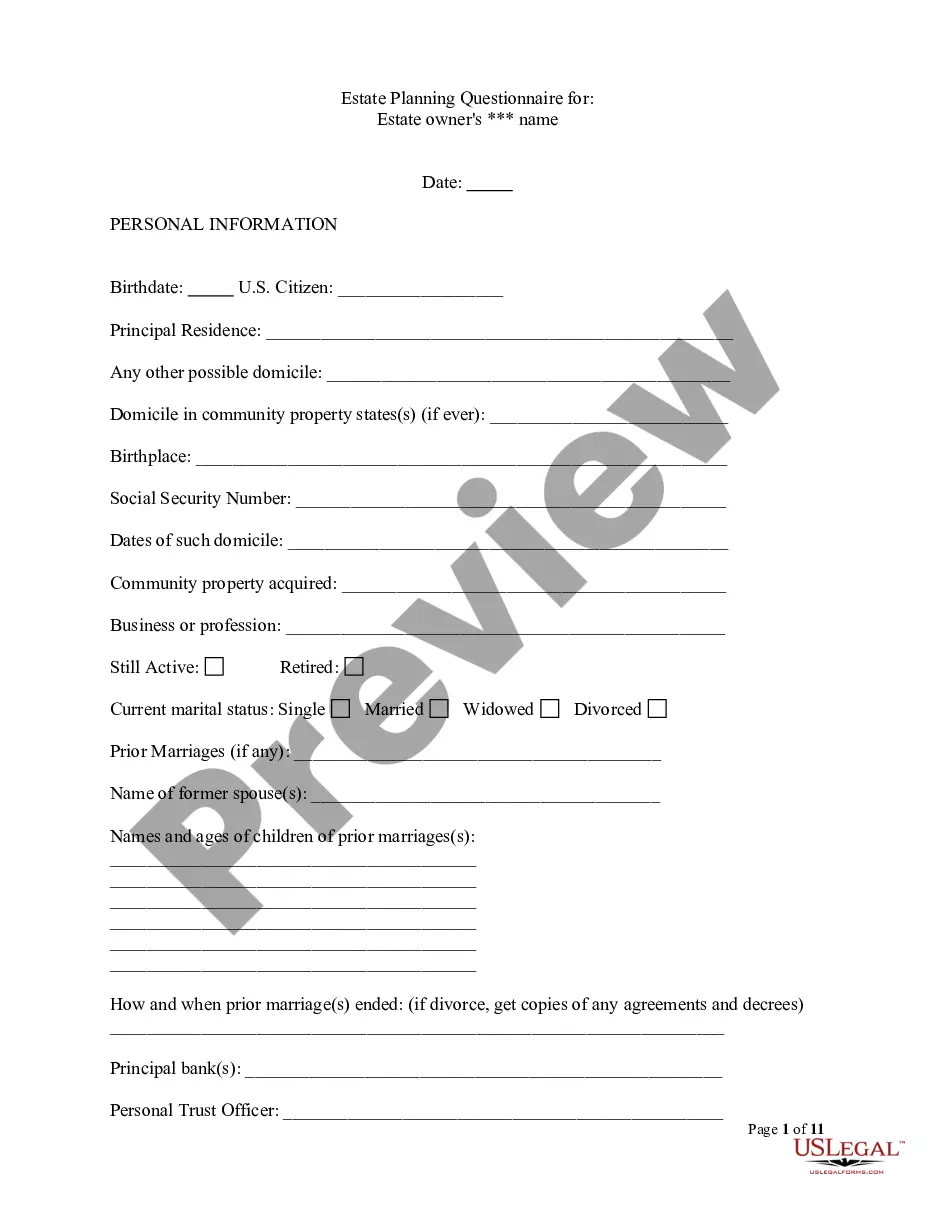

Mississippi Estate Planning Questionnaire

Description

How to fill out Mississippi Estate Planning Questionnaire?

Get a printable Mississippi Estate Planning Questionnaire within just several mouse clicks from the most extensive catalogue of legal e-files. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the Top supplier of affordable legal and tax forms for US citizens and residents online starting from 1997.

Users who have a subscription, need to log in directly into their US Legal Forms account, get the Mississippi Estate Planning Questionnaire and find it stored in the My Forms tab. Users who never have a subscription must follow the tips listed below:

- Make certain your form meets your state’s requirements.

- If available, read the form’s description to find out more.

- If accessible, review the shape to see more content.

- As soon as you’re sure the form meets your requirements, click Buy Now.

- Create a personal account.

- Pick a plan.

- via PayPal or visa or mastercard.

- Download the form in Word or PDF format.

Once you’ve downloaded your Mississippi Estate Planning Questionnaire, it is possible to fill it out in any web-based editor or print it out and complete it manually. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

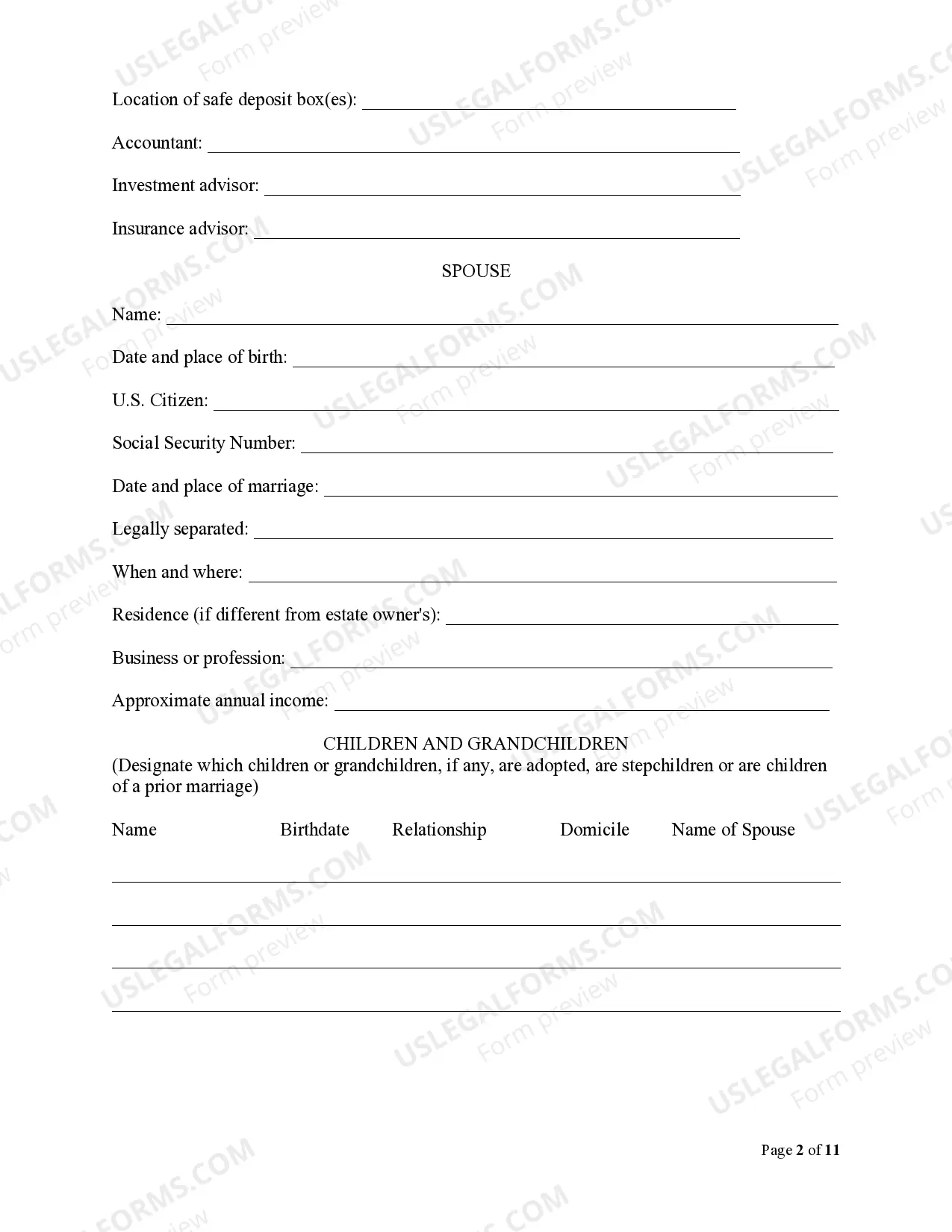

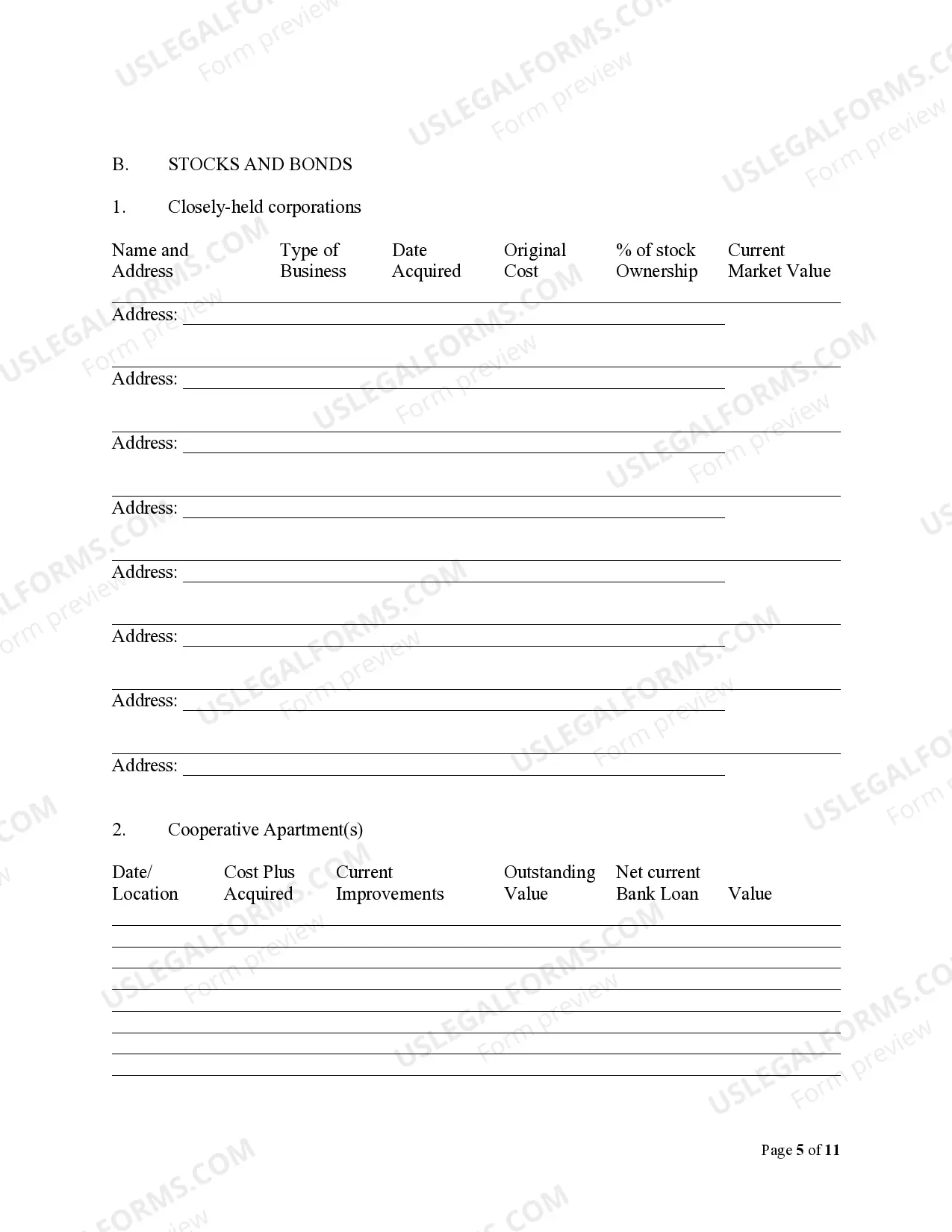

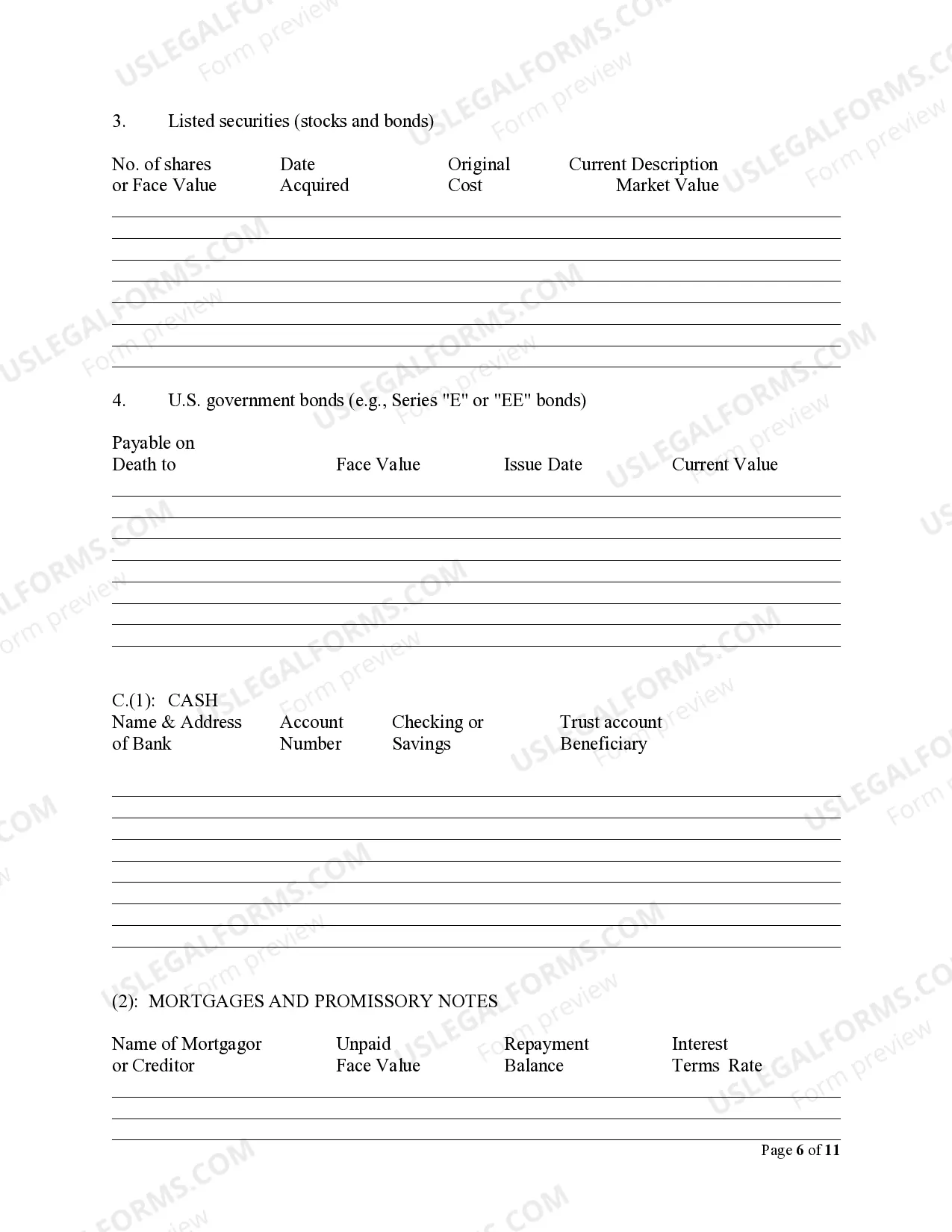

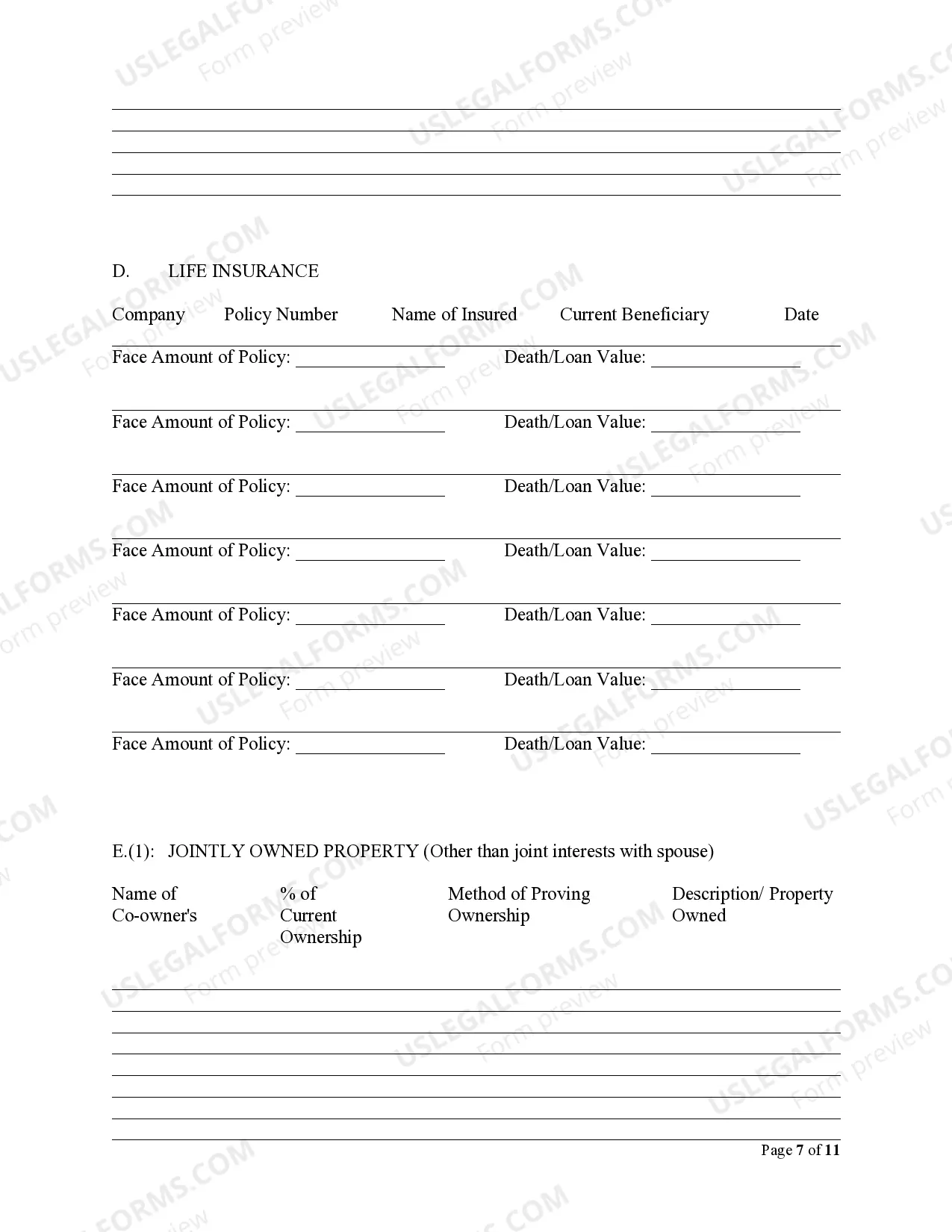

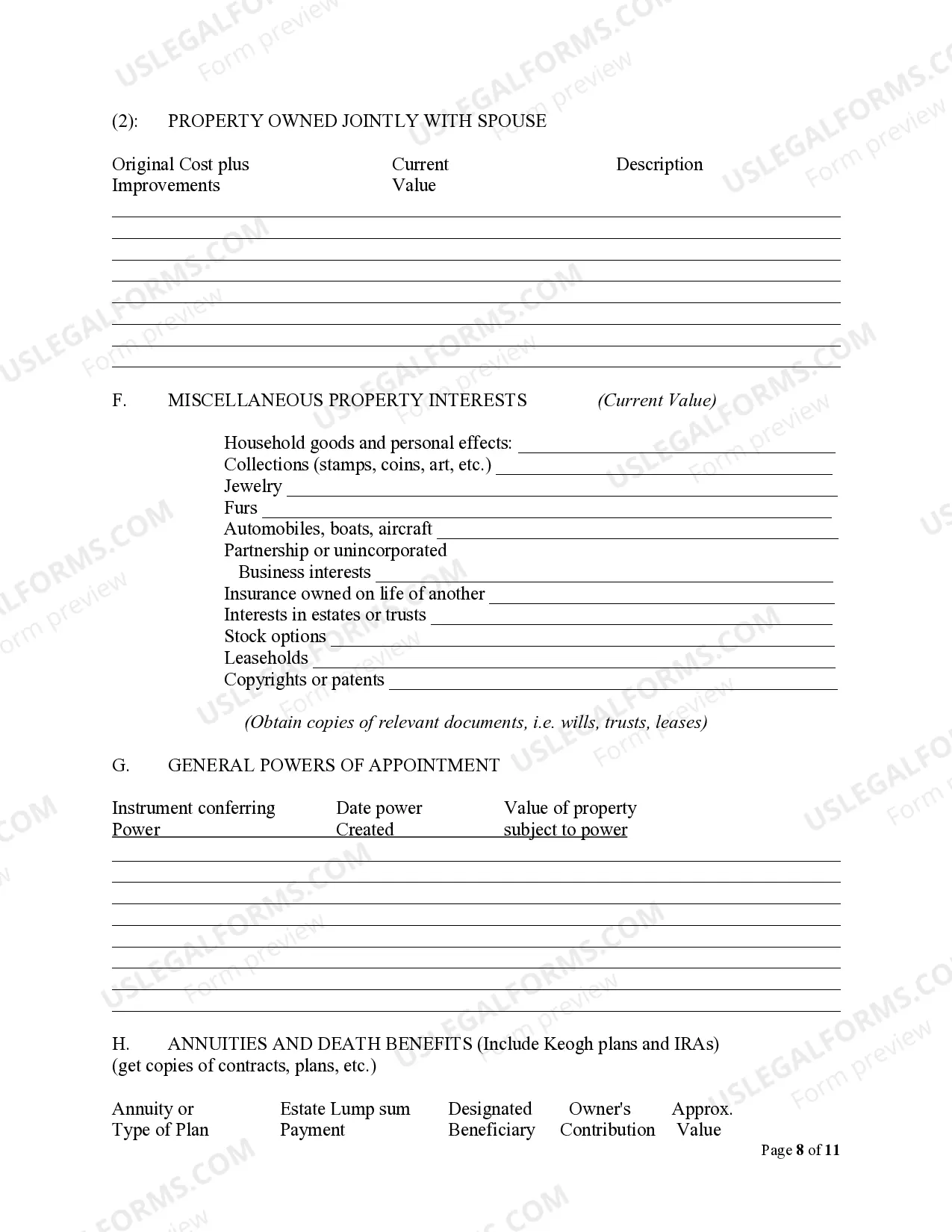

Fill out your attorney's intake questionnaire. Gather your financial documents. Bring copies of your current estate plan documents. Divorce agreements, premarital agreements, and other relevant contracts. Choose your executors and health care agents.

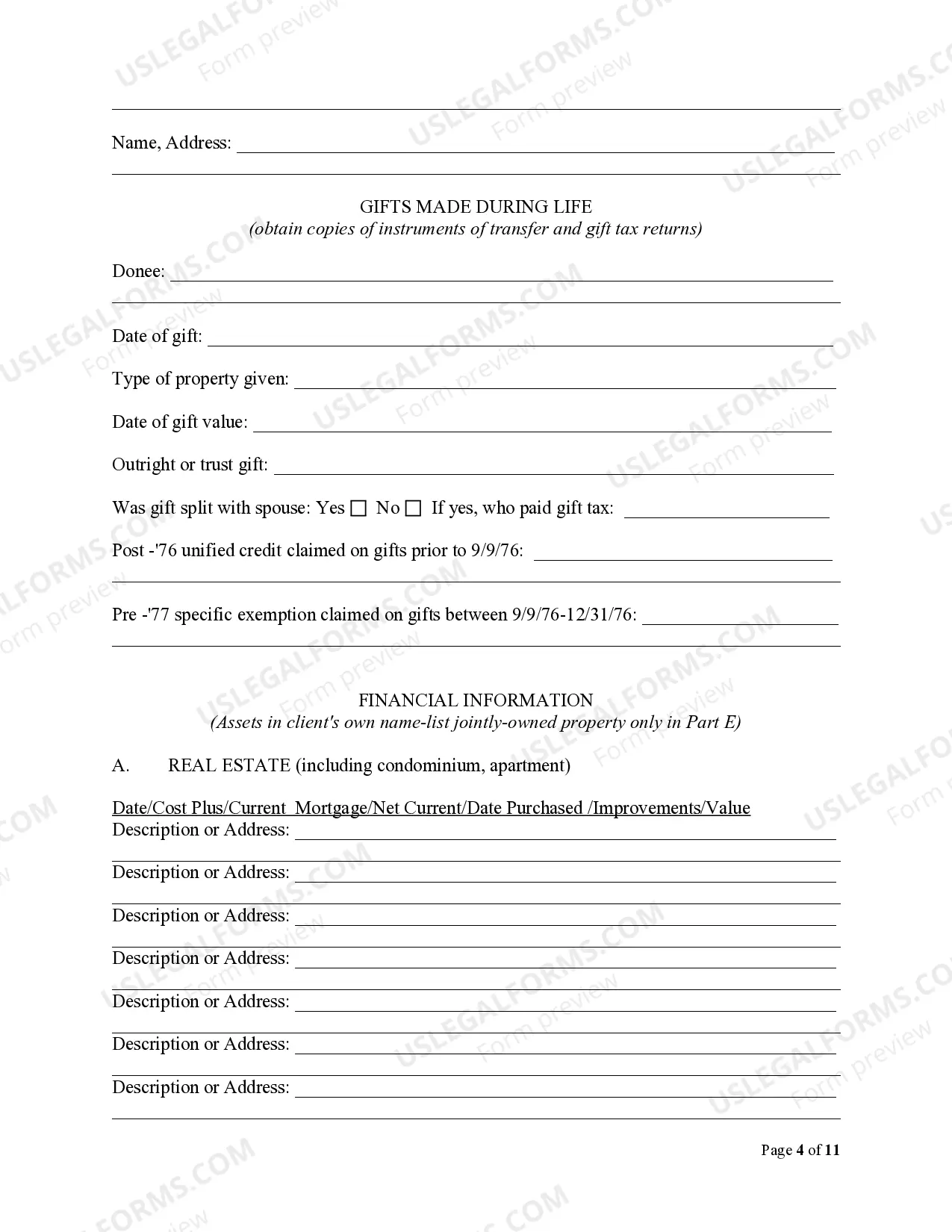

More Than a Last Will. Itemize Your Inventory. Follow with Non-Physical Assets. Assemble a List of Debts. Make a Memberships List. Make Copies of Your Lists. Review Your Retirement Account. Update Your Insurance.

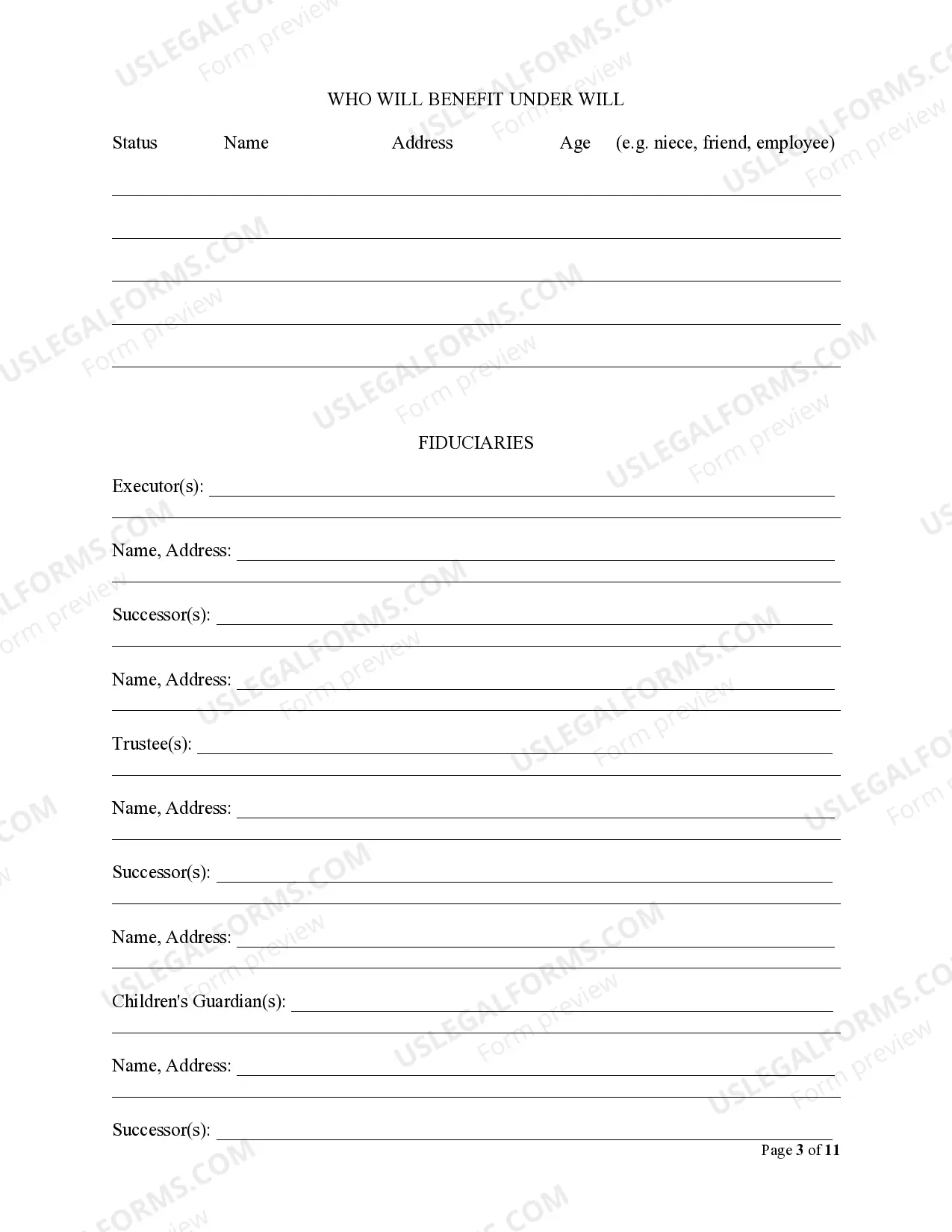

There are four main elements of an estate plan; these include a will, a living will and healthcare power of attorney, a financial power of attorney, and a trust.

What Property Can Go in a Living Trust? Who Should Be My Trustee? Does a Living Trust Avoid Estate and Probate Taxes? What Are the Benefits of a Living Trust? What Are the Drawbacks of a Living Trust? Do I Still Need a Power of Attorney?

What will happen during an initial meeting with your office and how much will it cost? Are all of your fees flat fees? Does my planning fee include a regular review of my legal documents? Do you make sure my assets are titled in the right way and my business stays in compliance?

A highly skilled trust attorney will be able to establish trusts for loved ones, minimize estate taxes, avoid probate, create wills, plan for disability, and much more.Or, if you have extensive real estate holdings, the ideal trust planning attorney will have a wealth of knowledge about real property law.

Creating an estate plan is a lot like getting into better shape. Step 1: Sign a will. Step 2: Name beneficiaries. Step 3: Dodge estate taxes. Step 4: Leave a letter. Step 5: Draw up a durable power of attorney. Step 6: Create an advance health care directive.

Bank accounts. Brokerage or investment accounts. Retirement accounts and pension plans. A life insurance policy.

You can make your own will in Mississippi, using Nolo's do-it-yourself will software or online will programs. However, you may want to consult a lawyer in some situations. For example, if you think that your will might be contested or if you want to disinherit your spouse, you should talk with an attorney.