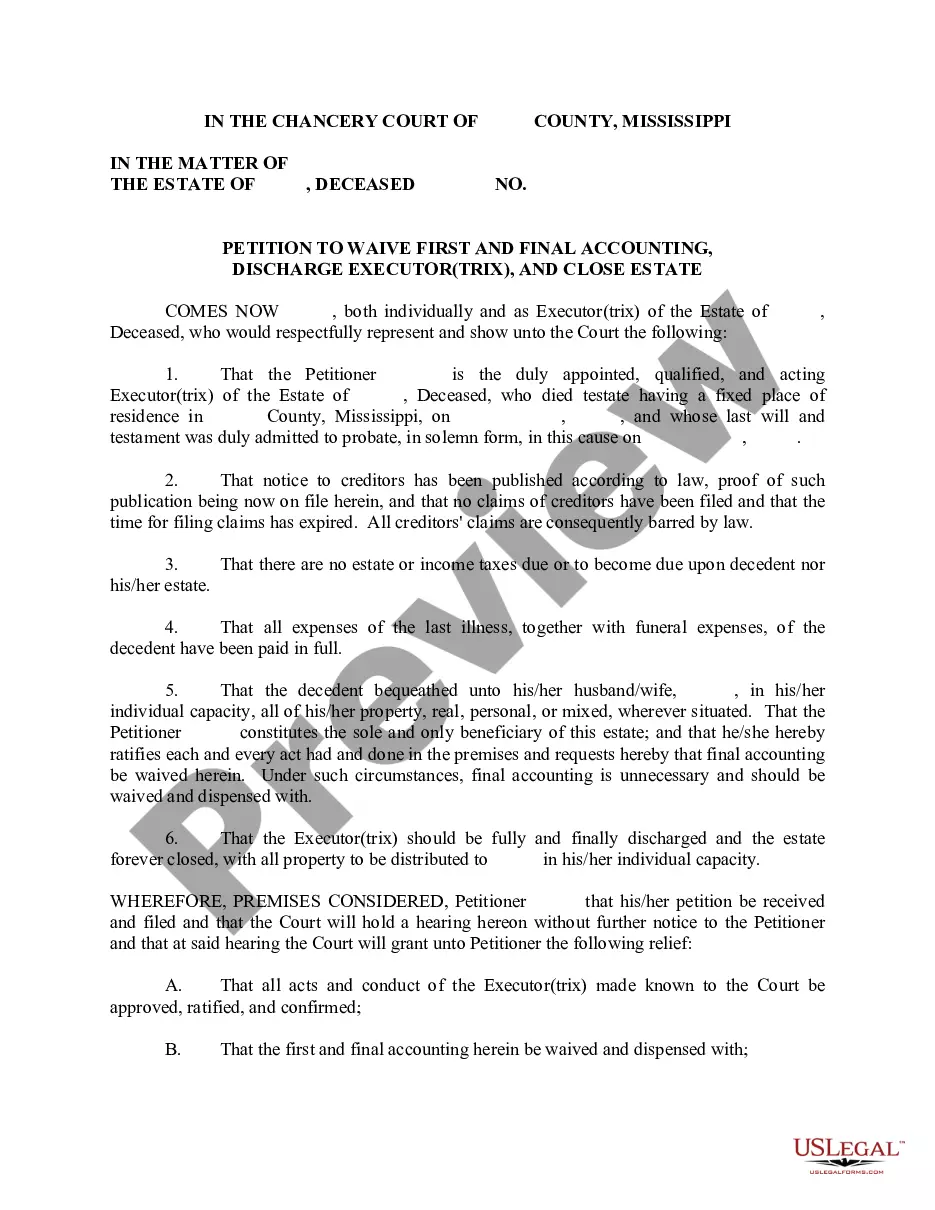

Mississippi Petition to Waive First and Final Accounting, Discharge Executrix and Close Estate

Description Estate Accounting Example

How to fill out Sample Of Final Accounting For Estate North Carolina?

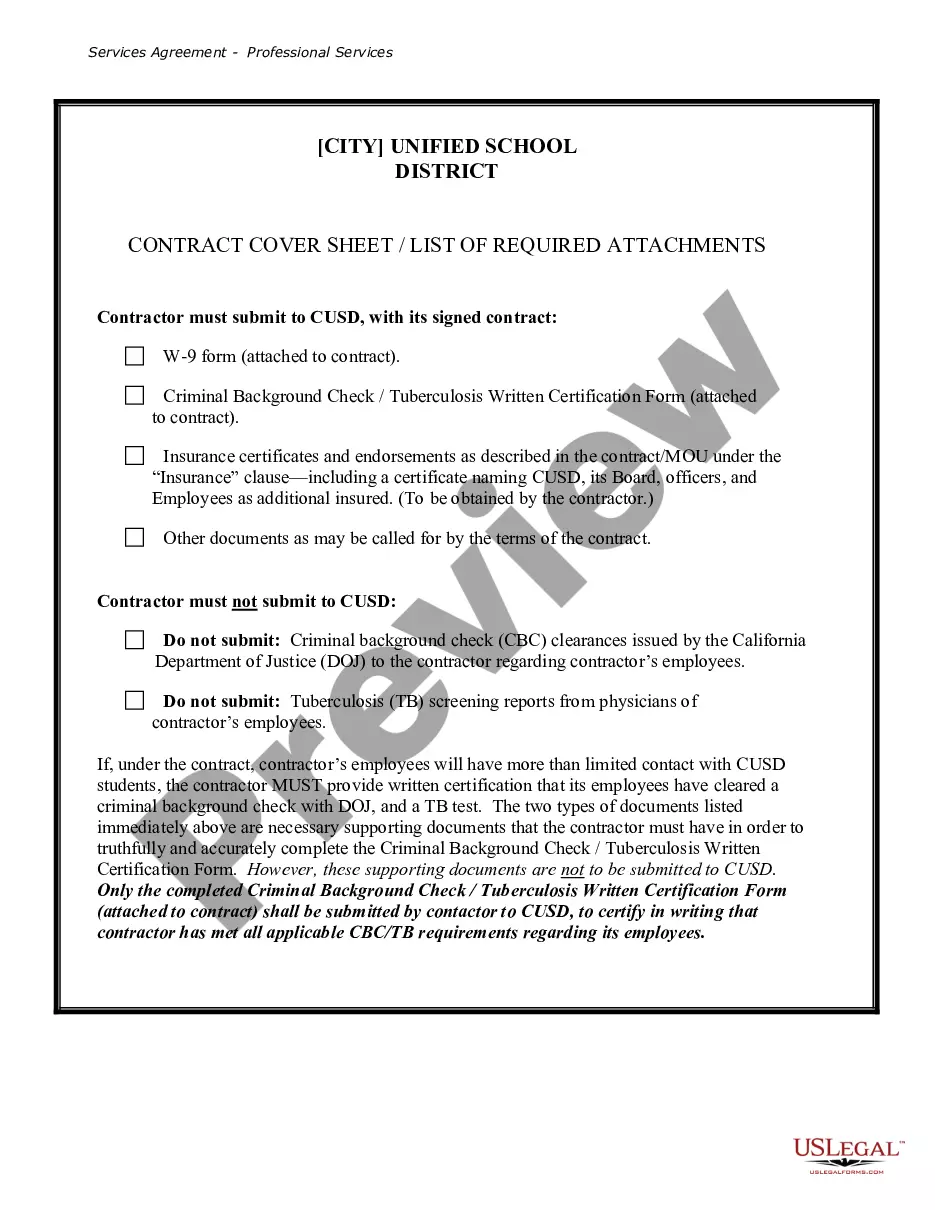

Get a printable Mississippi Petition to Waive First and Final Accounting, Discharge Executrix and Close Estate in only several mouse clicks in the most extensive library of legal e-files. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the #1 provider of affordable legal and tax templates for US citizens and residents on-line starting from 1997.

Customers who have already a subscription, must log in into their US Legal Forms account, get the Mississippi Petition to Waive First and Final Accounting, Discharge Executrix and Close Estate see it stored in the My Forms tab. Customers who never have a subscription must follow the tips listed below:

- Make sure your form meets your state’s requirements.

- If available, read the form’s description to learn more.

- If readily available, preview the shape to view more content.

- As soon as you are confident the template meets your requirements, simply click Buy Now.

- Create a personal account.

- Pick a plan.

- through PayPal or visa or mastercard.

- Download the template in Word or PDF format.

When you have downloaded your Mississippi Petition to Waive First and Final Accounting, Discharge Executrix and Close Estate, you may fill it out in any online editor or print it out and complete it by hand. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific files.

Estate Final Accounting Template Form popularity

Final Accounting Probate Other Form Names

What Is A Final Accounting In Probate FAQ

Summary of the terms of the Will/Rules of Intestacy. balance sheetcapital statementincome statement. securities (investments) schedule. distribution statement.

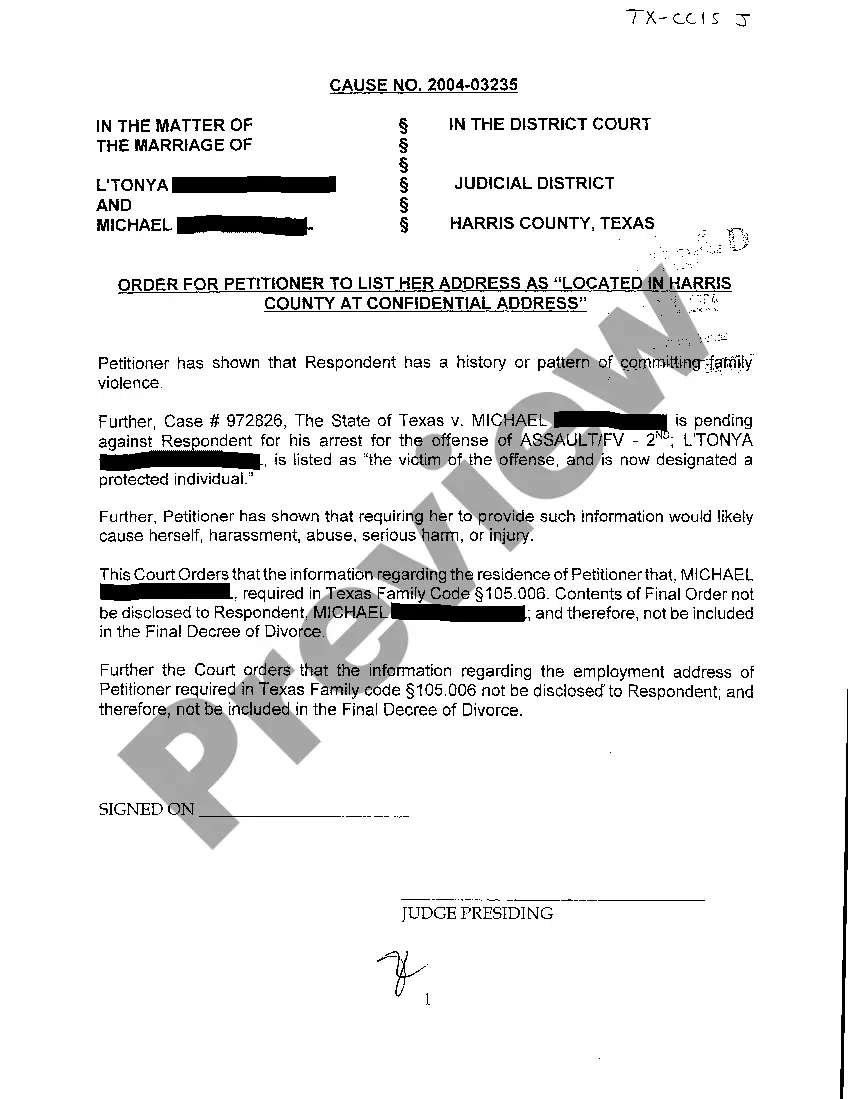

Beneficiaries often must sign off on the inheritance they receive to acknowledge receipt of the distribution. For example, if you inherit a portion of real estate from the decedent, you must sign a deed accepting that real estate.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

Where a person is a Residuary Beneficiary, they are entitled to receive a full account of the Estate assets and how they have been distributed in order to see how their share has been calculated. The Estate Accounts do not have to be provided until the Estate administration has been finalised.

Beneficiaries are entitled to receive a financial accounting of the trust, including bank statements, regularly. When statements are not received as requested, a beneficiary must submit a written demand to the trustee.The court will review the trust account for any discrepancies or irregular activity.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

Each beneficiary is entitled to a trustee's accounting, at least annually, at termination of the trust, and on upon a change of trustee. (California Probate Code 16062). Unfortunately, not all beneficiaries are entitled to automatic accounting, nevertheless, the court may force the trustee to provide an accounting.

Find the will, if any. File the will with the local probate court. Notify agencies and business of the death. Inventory assets and get appraisals. Decide whether probate is necessary. Coordinate with the successor trustee. Communicate with beneficiaries. Take good care of estate assets.