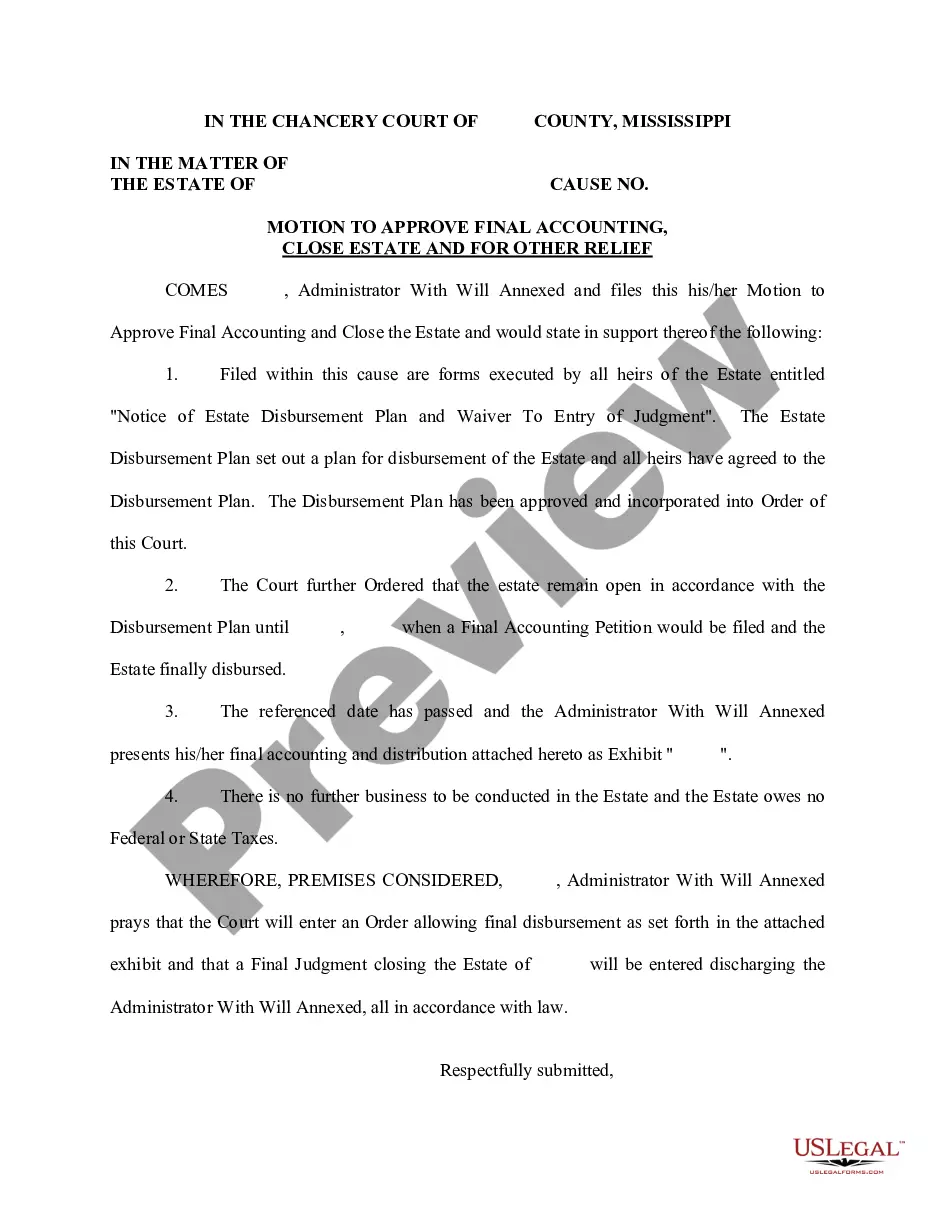

Mississippi Motion to Approve Final Accounting, Close Estate and for Other Relief (after finalization of disbursement plan)

Description Other Chancery Form

How to fill out Approve Disbursement Chancery?

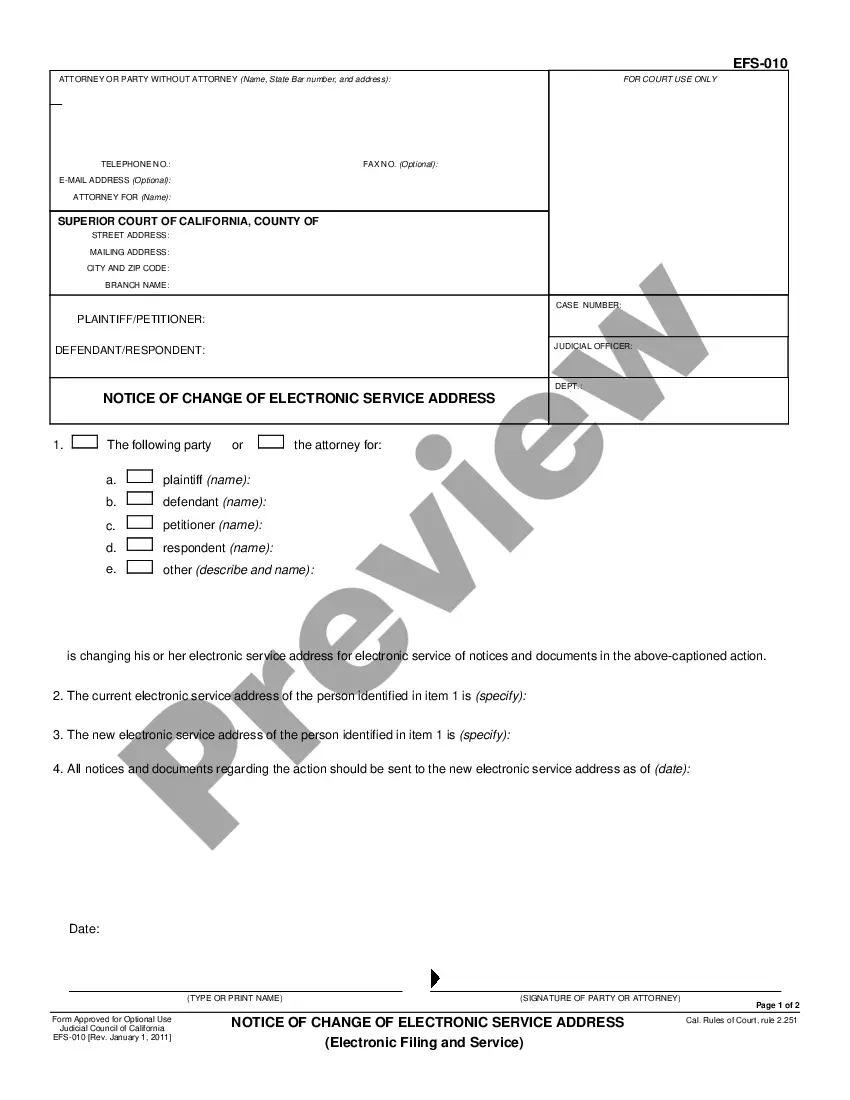

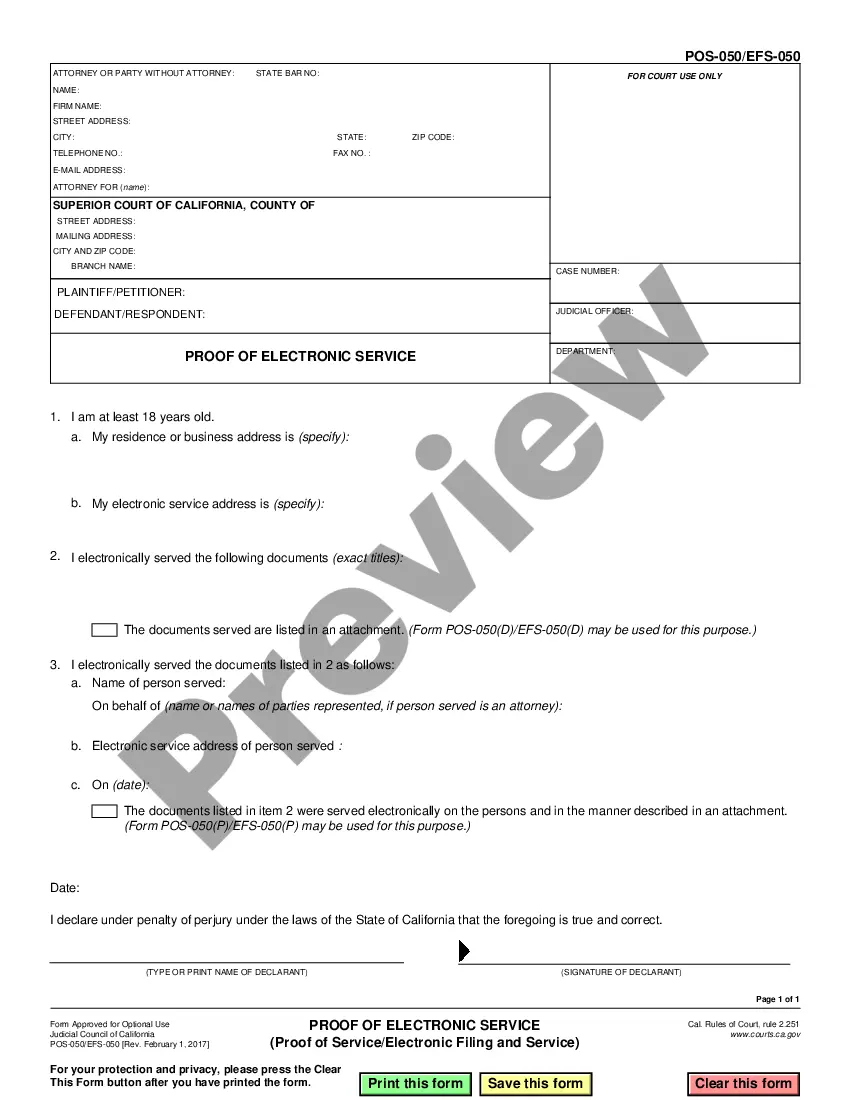

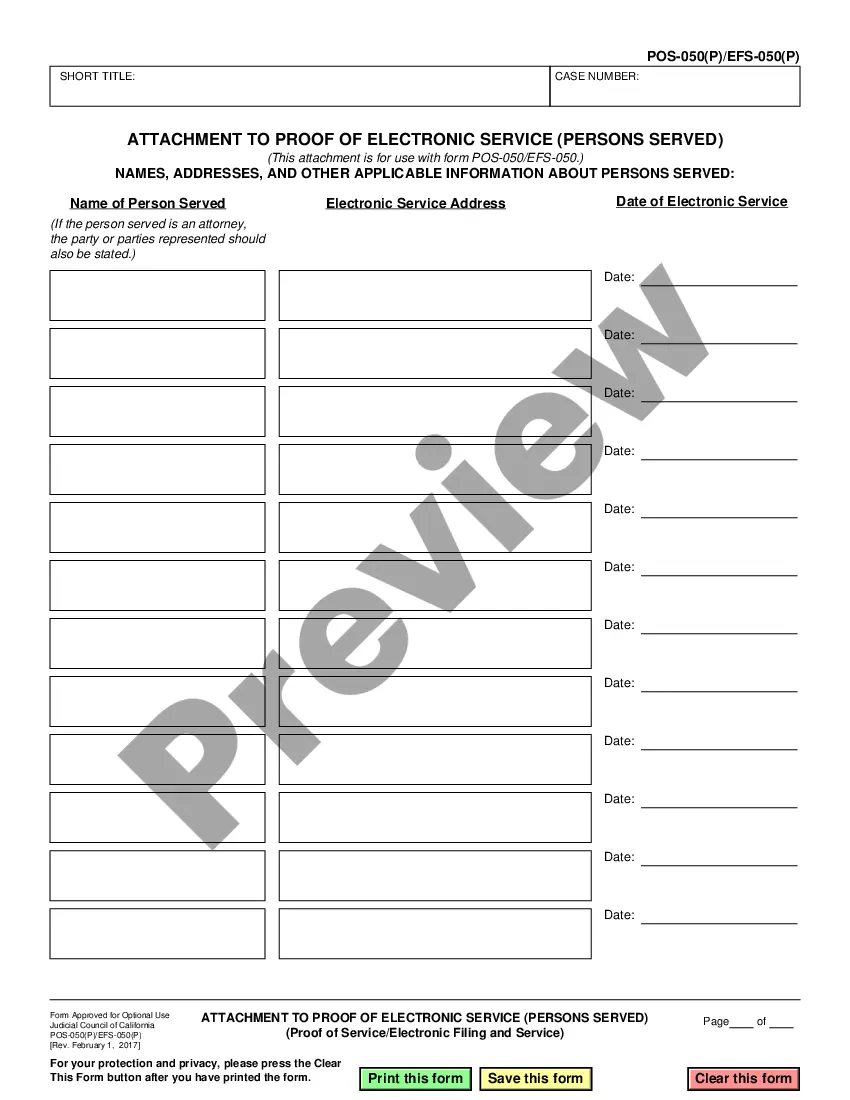

Get a printable Mississippi Motion to Approve Final Accounting, Close Estate and for Other Relief (after finalization of disbursement plan) within several mouse clicks from the most comprehensive library of legal e-files. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the #1 provider of affordable legal and tax forms for US citizens and residents on-line since 1997.

Customers who have already a subscription, need to log in directly into their US Legal Forms account, download the Mississippi Motion to Approve Final Accounting, Close Estate and for Other Relief (after finalization of disbursement plan) and find it stored in the My Forms tab. Users who never have a subscription must follow the steps below:

- Make certain your form meets your state’s requirements.

- If provided, read the form’s description to learn more.

- If readily available, review the shape to discover more content.

- Once you’re confident the form fits your needs, just click Buy Now.

- Create a personal account.

- Pick a plan.

- Pay out via PayPal or visa or mastercard.

- Download the form in Word or PDF format.

Once you have downloaded your Mississippi Motion to Approve Final Accounting, Close Estate and for Other Relief (after finalization of disbursement plan), you can fill it out in any web-based editor or print it out and complete it by hand. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific files.

Ms Motion Final Form popularity

Owes Referenced Comes Other Form Names

Final Accounting Other FAQ

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

Most expenses that a fiduciary incurs in the administration of the estate or trust are properly payable from the decedent's assets. These include funeral expenses, appraisal fees, attorney's and accountant's fees, and insurance premiums.

Keeping estate accounts as an executor of a will Finally, to demonstrate they have administered the estate properly the executor should keep full records and prepare a final set of accounts for the estate. These accounts should be shown to beneficiaries and their approval of the accounts sought.

Estate accounting is accounting which pertains to the settling of an estate. When someone dies, his or her property is handled by someone appointed as an executor and the executor must keep accurate accounting records as the estate is wrapped up and distributed in keeping with the wishes expressed in the will.

Summary of the terms of the Will/Rules of Intestacy. balance sheetcapital statementincome statement. securities (investments) schedule. distribution statement.

An Estate account is a different kind of account it is a new account opened after someone has passed away, into which the Executor deposits the deceased person's money, from which the Executor pays the deceased person's debts and bills, and from which the Executor ultimately distributes funds to the beneficiaries of

Go to the county courthouse where the probate petition was filed and the estate was formally discharged. File a request for documents, specifically the reconciliation of assets and accounting.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

When the Estate Closes An executor cannot simply gather assets, pay bills and expenses and then distribute the remaining assets to the beneficiaries. She needs court approval for closing the estate, and in most states, this involves giving a full accounting of everything on which she spent money.