Mississippi Report of Disbursement of Estate Assets

Description

How to fill out Mississippi Report Of Disbursement Of Estate Assets?

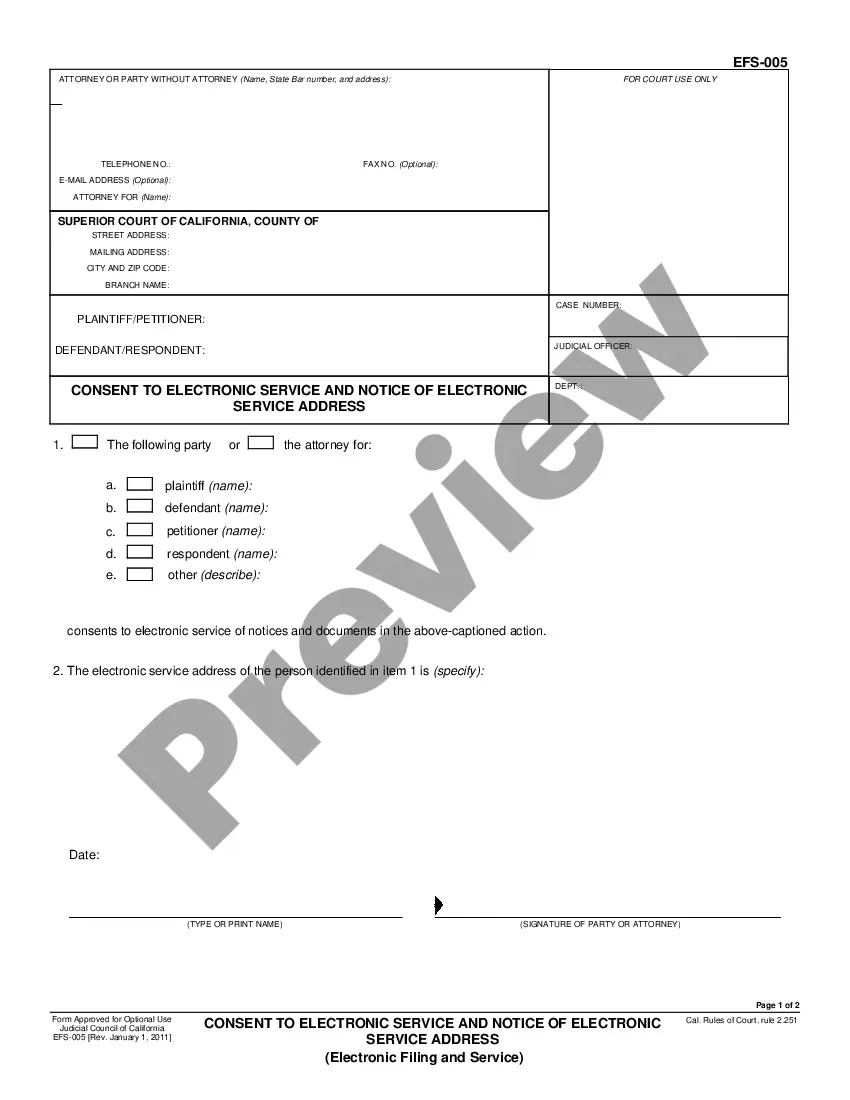

Obtain a printable Mississippi Report of Disbursement of Estate Assets in only several mouse clicks in the most complete catalogue of legal e-forms. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the Top provider of reasonably priced legal and tax templates for US citizens and residents online since 1997.

Users who already have a subscription, need to log in in to their US Legal Forms account, get the Mississippi Report of Disbursement of Estate Assets see it saved in the My Forms tab. Users who don’t have a subscription are required to follow the tips below:

- Ensure your template meets your state’s requirements.

- If provided, look through form’s description to learn more.

- If accessible, preview the shape to discover more content.

- As soon as you’re sure the template suits you, simply click Buy Now.

- Create a personal account.

- Choose a plan.

- Pay out through PayPal or credit card.

- Download the form in Word or PDF format.

Once you’ve downloaded your Mississippi Report of Disbursement of Estate Assets, you are able to fill it out in any online editor or print it out and complete it by hand. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific files.

Form popularity

FAQ

If new assets are found during Probate or after the process has completed, this can impact on the Estate's tax liability. It can also mean that some of the Probate steps that have already been taken will need to be repeated.

Probate is the court-supervised process of authenticating a last will and testament if the deceased made one. It includes locating and determining the value of the person's assets, paying their final bills and taxes, and distributing the remainder of the estate to their rightful beneficiaries.

How Are Assets Distributed With a Will?With probate proceedings, an executor is named in the will to pay all debts, taxes, and claims against the estate. Once these are paid the executor will distribute the remaining assets to the beneficiaries named in the will.

If your beneficiary dies before you or at the same time as you, the proceeds will have to go through probate so they can be distributed with your other assets. If your beneficiary is incapacitated, the probate court will probably take control of the funds through a guardianship/conservatorship.

Retirement accountsIRAs or 401(k)s, for examplefor which a beneficiary was named. Life insurance proceeds (unless the estate is named as beneficiary, which is rare) Property held in a living trust. Funds in a payable-on-death (POD) bank account.

In a probate case, an executor (if there is a will) or an administrator (if there is no will) is appointed by the court as personal representative to collect the assets, pay the debts and expenses, and then distribute the remainder of the estate to the beneficiaries (those who have the legal right to inherit), all

Common Assets That Go Through Probate owned solely in the name of the deceased personfor example, real estate or a car titled in that person's name alone, or. a share of property owned as tenants in commonfor example, the deceased person's interest in a warehouse owned with his brother as an investment.

In California, you can hold most any asset you own in a living trust to avoid probate. Real estate, bank accounts, and vehicles can be held in a living trust created through a trust document that names yourself as trustee and someone else a successor trustee who will take over as trustee after you die.