Mississippi Motion to Bar Use of Certain Aggravating Circumstances

Description

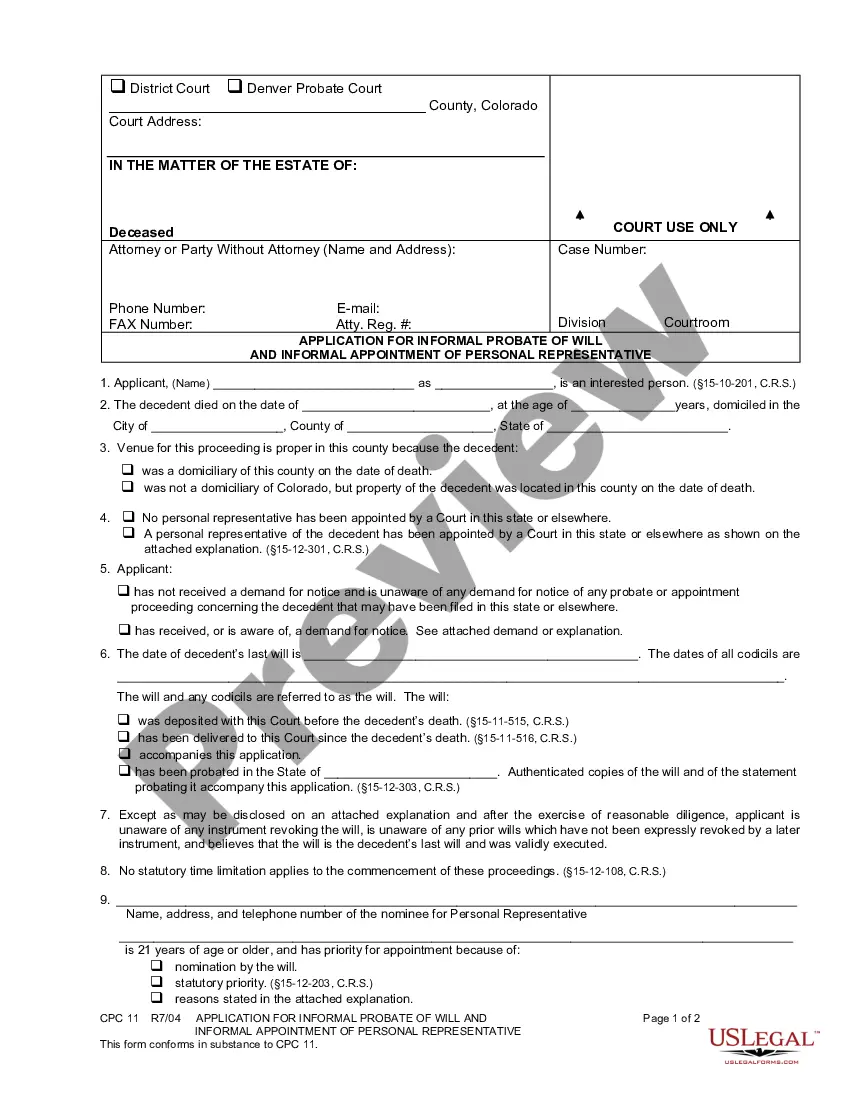

How to fill out Mississippi Motion To Bar Use Of Certain Aggravating Circumstances?

Obtain a printable Mississippi Motion to Bar Use of Certain Aggravating Circumstances in just several clicks from the most extensive catalogue of legal e-forms. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the Top provider of affordable legal and tax templates for US citizens and residents online since 1997.

Customers who have a subscription, need to log in straight into their US Legal Forms account, download the Mississippi Motion to Bar Use of Certain Aggravating Circumstances see it stored in the My Forms tab. Users who don’t have a subscription are required to follow the tips below:

- Ensure your template meets your state’s requirements.

- If provided, read the form’s description to learn more.

- If accessible, review the form to discover more content.

- When you’re confident the template suits you, click Buy Now.

- Create a personal account.

- Select a plan.

- through PayPal or bank card.

- Download the form in Word or PDF format.

As soon as you have downloaded your Mississippi Motion to Bar Use of Certain Aggravating Circumstances, it is possible to fill it out in any web-based editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific forms.

Form popularity

FAQ

Sales of property, labor or services sold to, billed directly to, and payment is made directly by the United States Government, the state of Mississippi and its departments, institutions, counties and municipalities or departments or school districts of its counties and municipalities are exempt from sales tax.

Go to www.ms.gov/dor/quickpay. There is an additional convenience fee to pay through the ms.gov portal.

File online File online at the Mississippi Department of Revenue. You can remit your payment through their online system. AutoFile - Let TaxJar file your sales tax for you. We take care of the payments, too.

The Mississippi (MS) state sales tax rate is currently 7%. Depending on local municipalities, the total tax rate can be as high as 8%. Mississippi was listed in Kiplinger's 2011 10 tax-friendly states for retirees.

Sales of grocery food are subject to sales tax in Mississippi.

All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax (7%) unless the law exempts the item or provides a reduced rate of tax for an item. The tax is based on gross proceeds of sales or gross income, depending on the type of business.

Pay your taxes online at The Mississippi Department of Revenue's Taxpayer Access Point, TAP!. You can also pay your taxes online at Official Payments Corporation. Visa, MasterCard, Discover Network, and American Express credit and debit cards, and other forms of payment, such as Bill Me Later® are accepted.

Use tax is a tax on goods purchased for use, storage or other consumption in Mississippi. Use tax applies to purchases of items that are shipped or delivered into Mississippi from an out-of-state location. Use tax also applies to items purchased inside the state if sales tax was not paid at the time of purchase.

Calculating Total Cost. Multiply the cost of an item or service by the sales tax in order to find out the total cost. The equation looks like this: Item or service cost x sales tax (in decimal form) = total sales tax. Add the total sales tax to the Item or service cost to get your total cost.