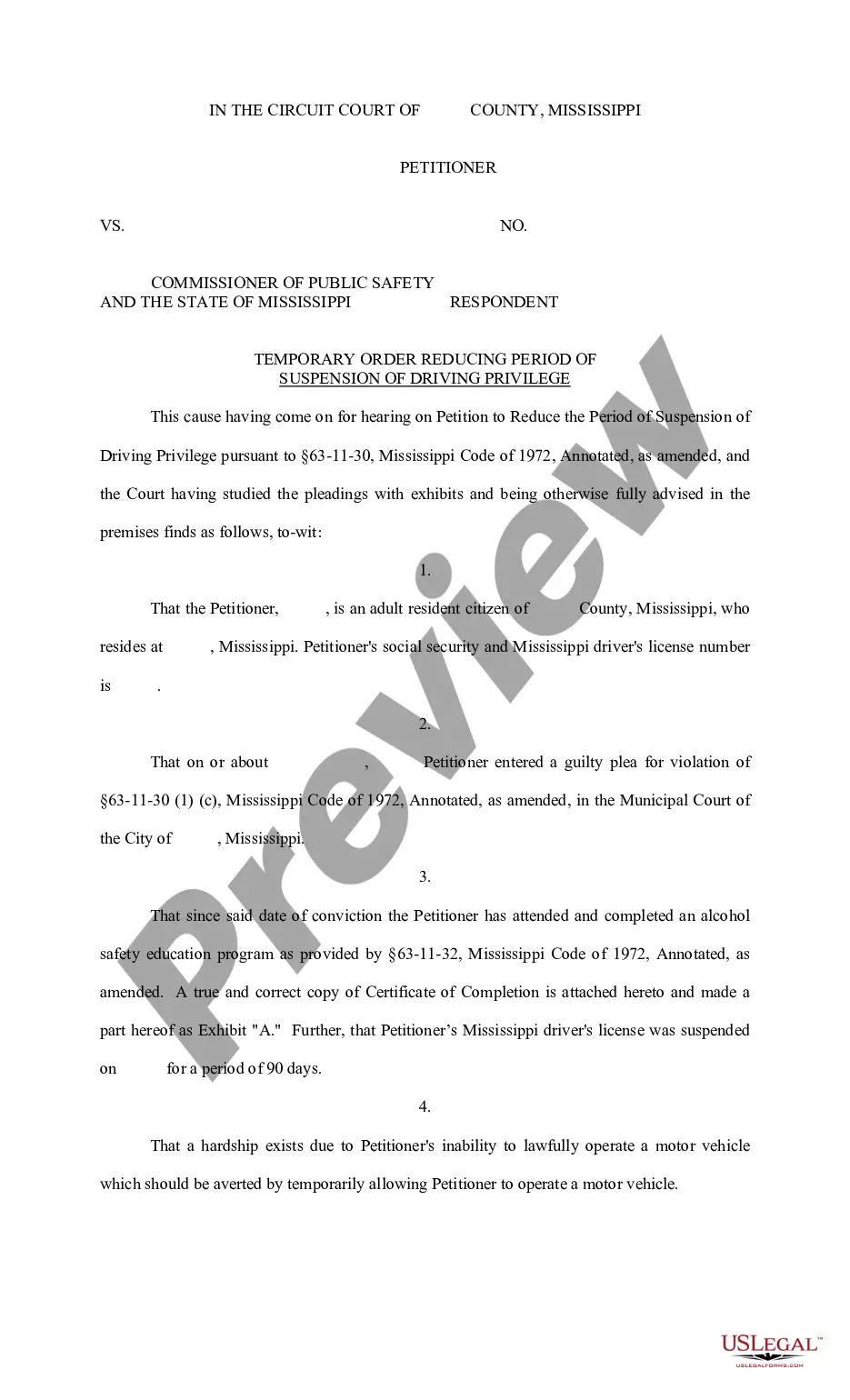

Mississippi Temporary Order Reducing Period of Suspension of Driving Privilege

Description

How to fill out Mississippi Temporary Order Reducing Period Of Suspension Of Driving Privilege?

Obtain a printable Mississippi Temporary Order Reducing Period of Suspension of Driving Privilege within just several clicks from the most comprehensive library of legal e-forms. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the #1 provider of affordable legal and tax forms for US citizens and residents online starting from 1997.

Users who have already a subscription, must log in directly into their US Legal Forms account, down load the Mississippi Temporary Order Reducing Period of Suspension of Driving Privilege and find it saved in the My Forms tab. Users who don’t have a subscription must follow the steps listed below:

- Make certain your template meets your state’s requirements.

- If available, look through form’s description to learn more.

- If offered, preview the shape to find out more content.

- When you are confident the form fits your needs, just click Buy Now.

- Create a personal account.

- Pick a plan.

- via PayPal or bank card.

- Download the form in Word or PDF format.

When you’ve downloaded your Mississippi Temporary Order Reducing Period of Suspension of Driving Privilege, you can fill it out in any online editor or print it out and complete it manually. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

Privilege taxes are imposed on businesses for the right to conduct business in a given state. Privilege taxes are usually based on the gross receipts or net worth of a business, but some are levied as a flat fee.Nexus is the technical term for when an entity is legally subject to certain taxes in a given state.

Services in Mississippi are generally not taxable.

How long is my Mississippi sales tax exemption certificate good for? These exemption certificates have no stated expiration period, so long as the keep decent records of the transactions.

Sales of property, labor or services sold to, billed directly to, and payment is made directly by the United States Government, the state of Mississippi and its departments, institutions, counties and municipalities or departments or school districts of its counties and municipalities are exempt from sales tax.

This tax is imposed on every person or company who acquires indebtedness secured by tangible personal property located in Mississippi.

It is also one the country's most tax-friendly states for retirees.Mississippi exempts all forms of retirement income from taxation, including Social Security benefits, income from an IRA, income from a 401(k) and any pension income. On top of that, the state has low property taxes and moderate sales taxes.

Mississippi has a graduated tax rate. The graduated income tax rate is: 0% on the first $3,000 of taxable income.200b 3% on the next $2,000 of taxable income.200b 4% on the next $5,000 of taxable income. 5% on all taxable income over $10,000.

Use tax is a tax on goods purchased for use, storage or other consumption in Mississippi. Use tax applies to purchases of items that are shipped or delivered into Mississippi from an out-of-state location. Use tax also applies to items purchased inside the state if sales tax was not paid at the time of purchase.