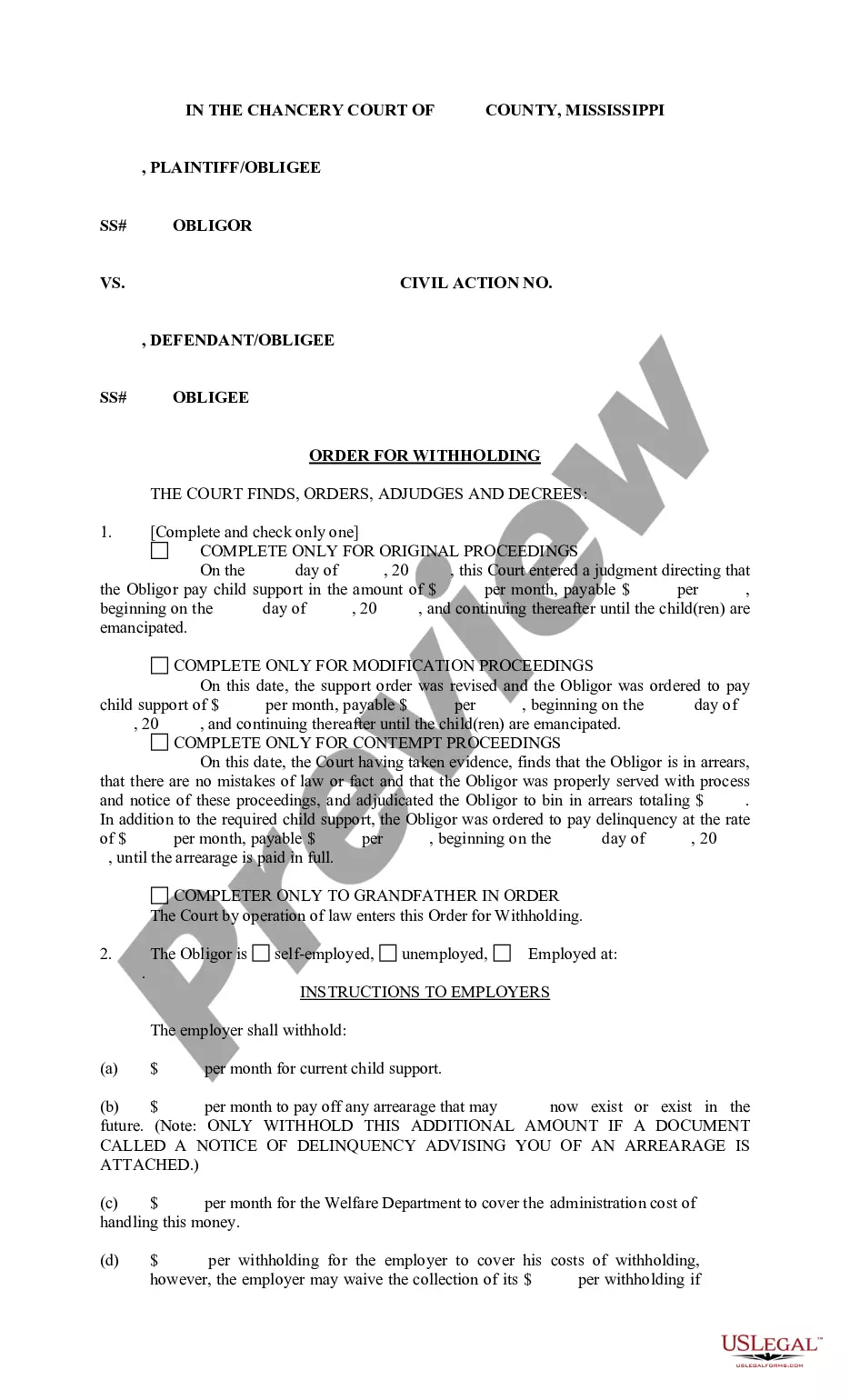

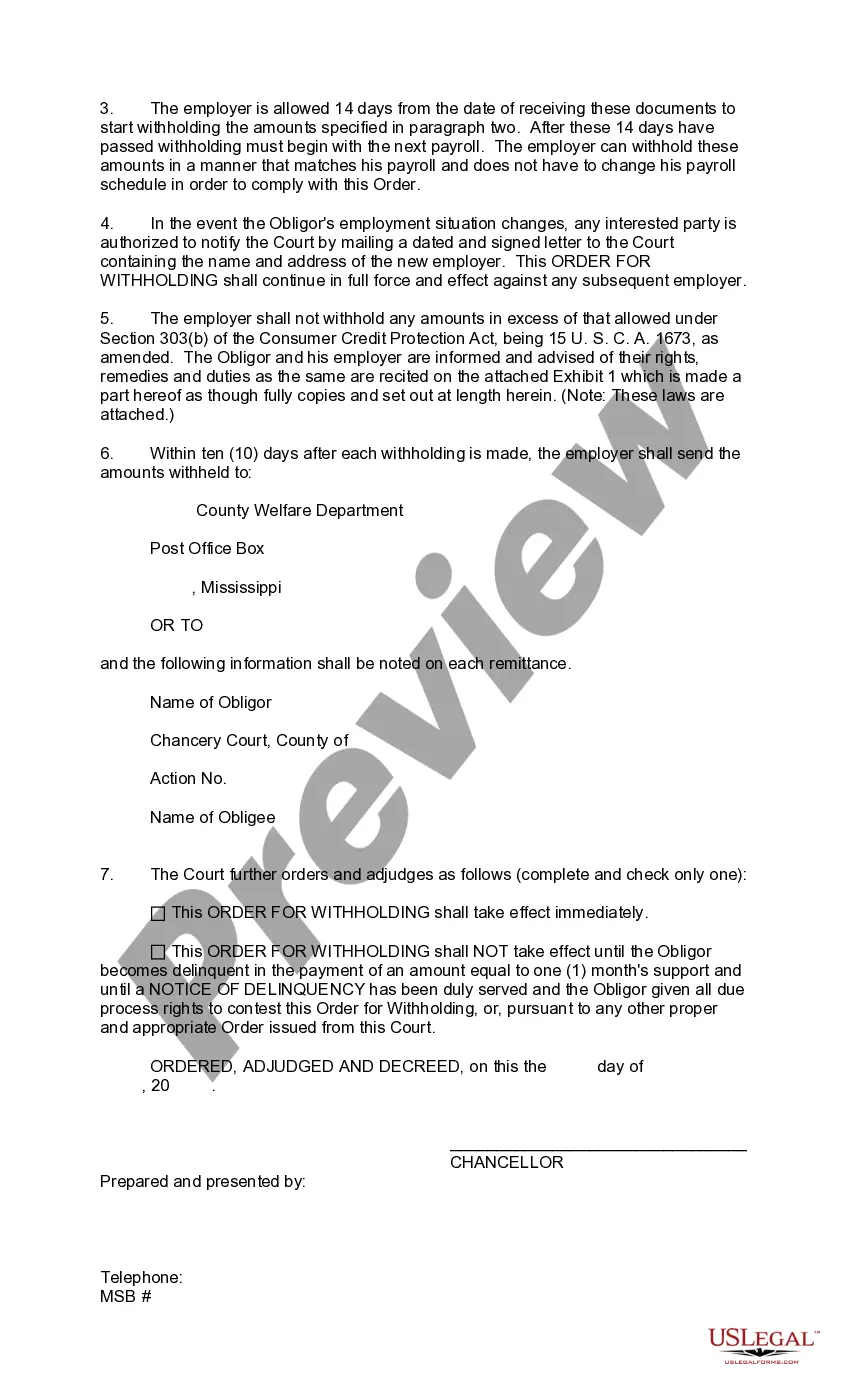

Mississippi Order for Withholding

Description Mississippi Withholding

How to fill out Mississippi Order For Withholding?

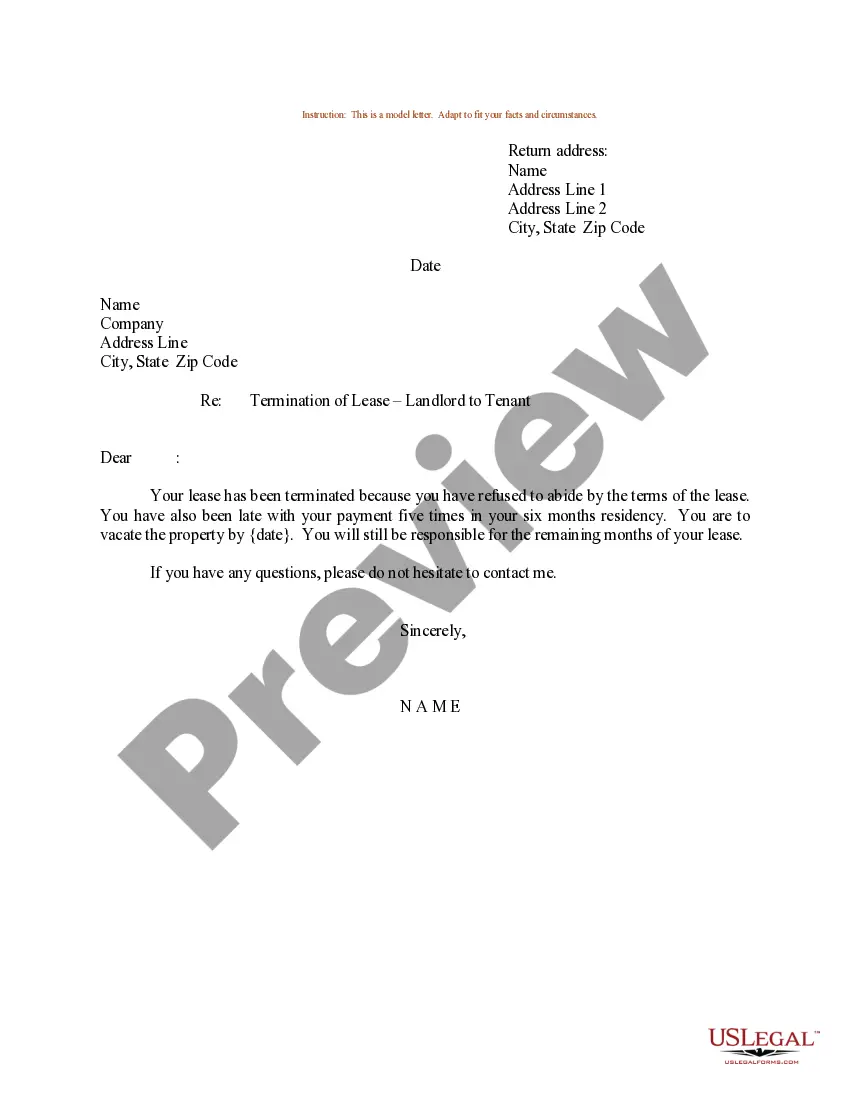

Get a printable Mississippi Order for Withholding within just several clicks in the most extensive library of legal e-forms. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the #1 supplier of reasonably priced legal and tax templates for US citizens and residents online starting from 1997.

Customers who have a subscription, must log in straight into their US Legal Forms account, download the Mississippi Order for Withholding see it saved in the My Forms tab. Customers who don’t have a subscription must follow the tips listed below:

- Make certain your template meets your state’s requirements.

- If provided, read the form’s description to find out more.

- If accessible, preview the shape to see more content.

- Once you’re confident the template meets your requirements, click on Buy Now.

- Create a personal account.

- Select a plan.

- Pay out through PayPal or visa or mastercard.

- Download the template in Word or PDF format.

As soon as you’ve downloaded your Mississippi Order for Withholding, you can fill it out in any online editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific documents.

Mississippi Tax Withholding Form Form popularity

Mississippi State Withholding Form Other Form Names

FAQ

An income withholding order (IWO) is a document sent to employers to tell them to withhold child support from an employee's wages. The IWO can come from a state, tribal, or territorial agency; a court; an attorney; or an individual.

Once you receive an IWO, you should withhold child support as soon as possible. Most states require that you start withholding no later than the pay period beginning 14 days after the agency mailed the IWO. If you don't withhold child support after receiving an income withholding order, you will face penalties.

Garnishment of wages for payment of Florida child support or alimony is an attractive option for both payors and recipients of support because of convenience.By statute, when support is ordered in Florida, a court must enter an order of garnishment known as an income deduction order.

Mississippi requires employers to withhold income taxes from employee paychecks in addition to employer paid unemployment taxes. You can find Mississippi's tax rates here. Employees fill out Form 89-350 Mississippi Employee's Withholding Exemption Certificate, to be used when calculating withholdings.

It means that the Income Withholding Order was terminated. An Income Withholding Order is often issued by the Court to withhold income from paychecks.

By paying child support, a parent need not worry about going to jail for failure to pay. Under Mississippi state law, a parent may be ordered to spend up to two years in jail if they willfully fail to pay child support.

Alabama.Arizona.Arkansas.California.Connecticut.District of Columbia.Georgia.Hawaii.State Withholding Form H&R Block\nwww.hrblock.com > tax-center > irs > forms > state-withholding-forms

Mississippi has a graduated tax rate.The graduated income tax rate is:0% on the first $3,000 of taxable income.200b3% on the next $2,000 of taxable income.200b4% on the next $5,000 of taxable income.5% on all taxable income over $10,000.Tax Rates, Exemptions, & Deductions - Mississippi Department of\nwww.dor.ms.gov > Individual > Pages > Tax-Rates

Fill out the income withholding order, mark the appropriate boxes, mark you're terminating support, file it with the court, get the order from the judge, and then serve it on the employer by certified mail. That's the way you would terminate the support.