Mississippi Authorization To Release Wage and Employment Information

Description Authorization Wage Information

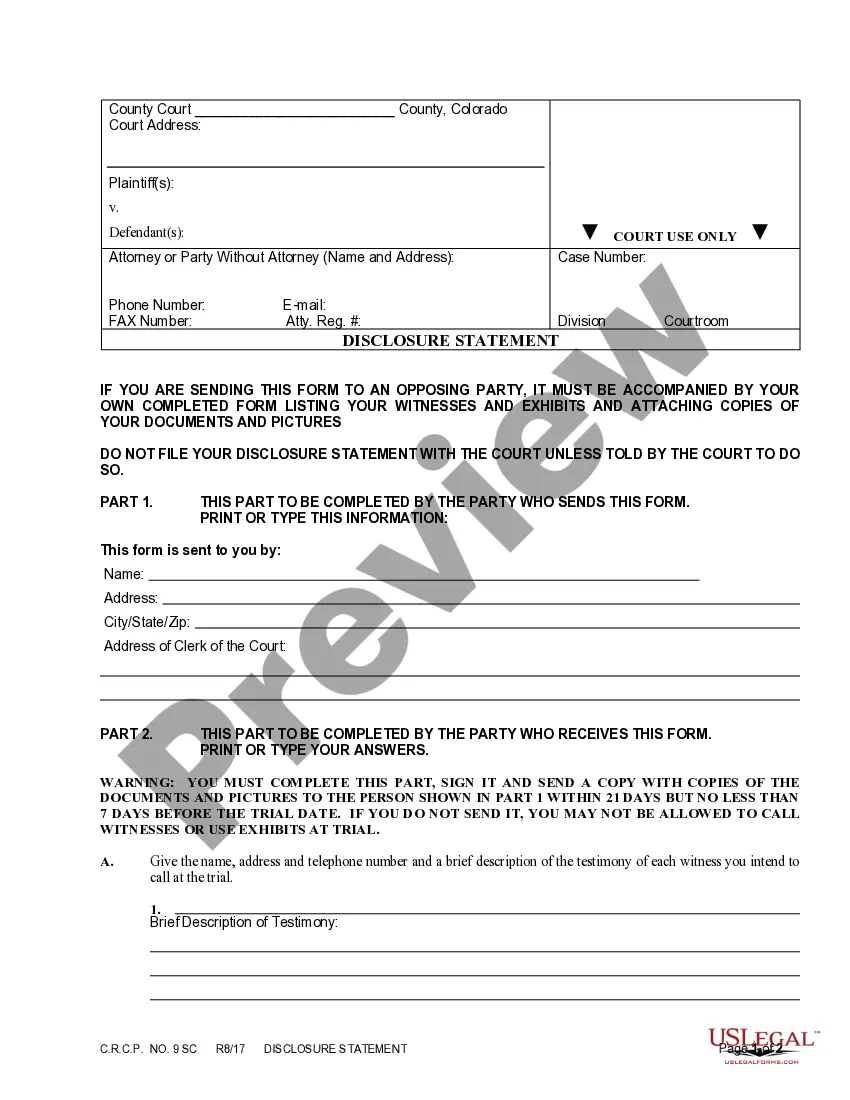

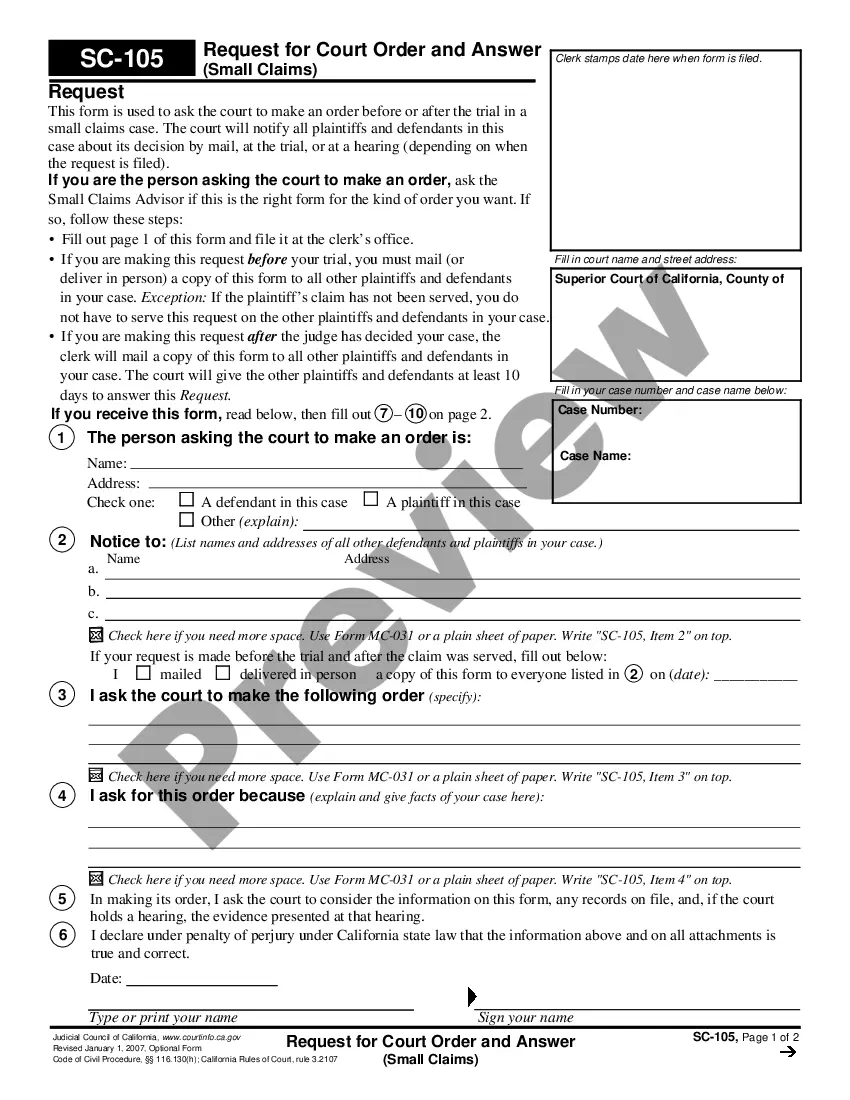

How to fill out Authorization To Release Employment Information?

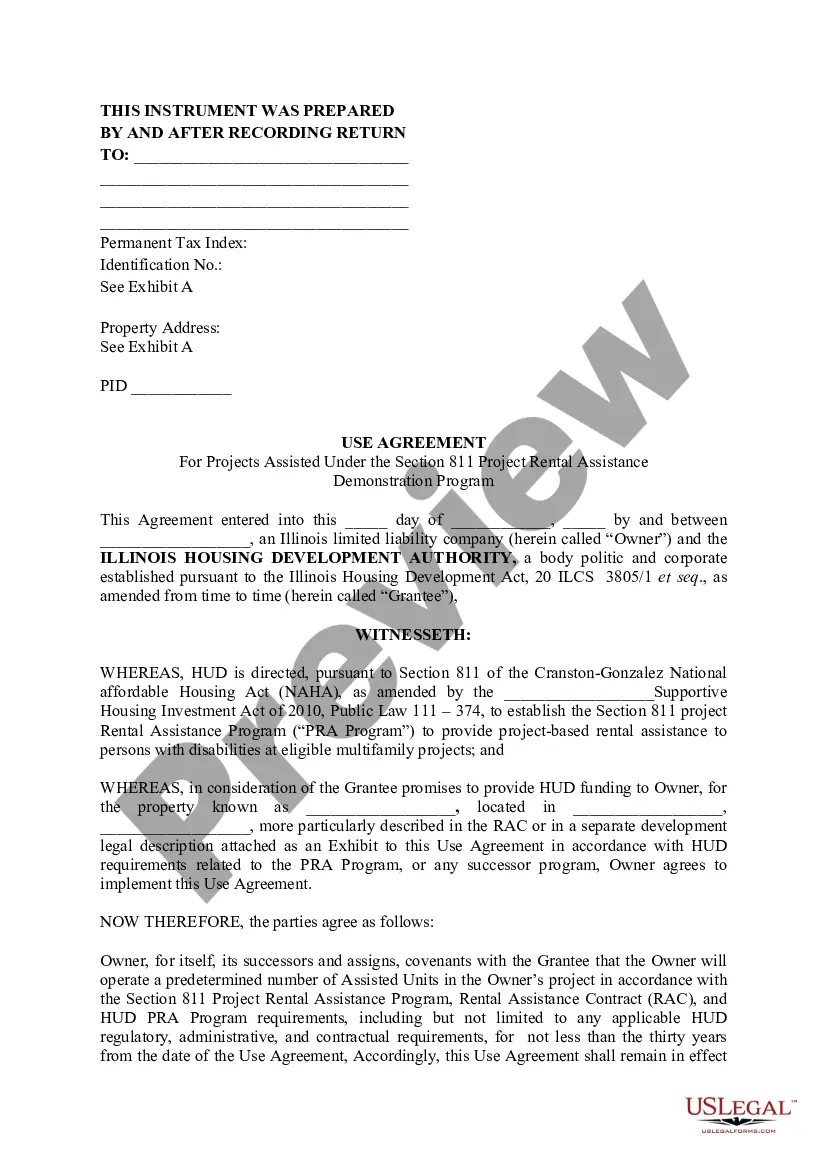

Get a printable Mississippi Authorization To Release Wage and Employment Information within several mouse clicks in the most comprehensive library of legal e-files. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the #1 provider of affordable legal and tax forms for US citizens and residents on-line starting from 1997.

Users who have already a subscription, must log in straight into their US Legal Forms account, get the Mississippi Authorization To Release Wage and Employment Information and find it stored in the My Forms tab. Users who never have a subscription must follow the tips listed below:

- Make sure your template meets your state’s requirements.

- If available, read the form’s description to find out more.

- If available, review the shape to view more content.

- As soon as you’re sure the template suits you, simply click Buy Now.

- Create a personal account.

- Select a plan.

- Pay out via PayPal or visa or mastercard.

- Download the form in Word or PDF format.

As soon as you’ve downloaded your Mississippi Authorization To Release Wage and Employment Information, you can fill it out in any online editor or print it out and complete it manually. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific documents.

Employment Information Requested Form popularity

Authorization Wage Employment Other Form Names

Employment Release Been FAQ

Currently, your claim is under review to determine if you are eligible to be paid benefits. Payment options will be through secured free Debit Card or Direct Deposit. A Debit Card will be mailed to you unless you have previously been issued an MDES Debit Card.

Eleven statesColorado, Florida, Idaho, Indiana, Michigan, Missouri, Nebraska, Oklahoma, Texas, Virginia and West Virginiarequire E-Verify for most public employers. Minnesota and Pennsylvania require E-Verify for some public contractors and subcontractors.

Click the green Verify with ID.me button. Follow the prompts to either log in to your existing ID.me account, or create a new one. Confirm your email address. Select and set up the multi-factor authentication option of your choice.

Is E-Verify mandatory? For most employers, E-Verify is voluntary and the overwhelming majority of the nation's 18 million employers do not participate in the E-Verify program. By law, E-Verify is mandatory for the federal government, as well as federal contractors and subcontractors.

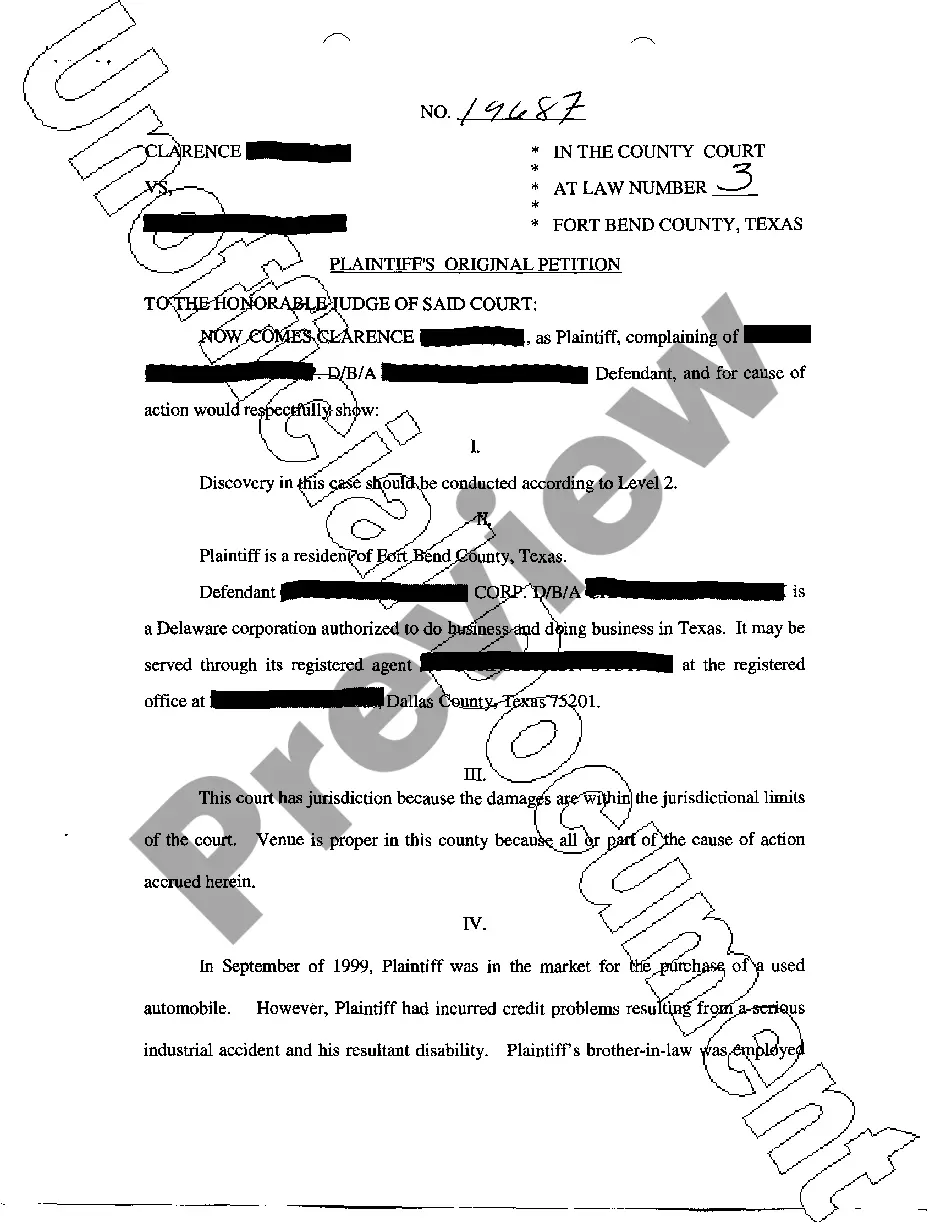

If you were discharged from your job, your employer must prove misconduct (see below). If your employer can prove your actions amounted to misconduct, the judge will deny you benefits. Because the employer has the burden of proving their case, they will go first in presenting their witnesses and documents.

Mississippi Requires Employers To Check Employees' Employment Authorization With E-Verify. The Mississippi Employment Protection Act (SB2988), signed on March 18, 2008, requires all employers in the State to use E-Verify to determine whether employees are authorized to work.

When a former employee files a claim for unemployment benefits, you receive a notice. The state sends this Notice of Unemployment Insurance Claim Filed to the employee's most recent employer.The more unemployment claims the state approves, the more you contribute for unemployment taxes.

Misconduct generally exists only when an employee's work behavior shows a willful and substantial disregard for the employer's interests or expected standards of behavior.

As of November 30, 2012, a total of 20 states require the use of E-Verify for at least some public and/or private employers: Alabama, Arizona, Colorado, Florida, Georgia, Idaho, Indiana, Louisiana, Michigan, Mississippi, Missouri, Nebraska, North Carolina, Oklahoma, Pennsylvania, South Carolina, Tennessee, Utah,