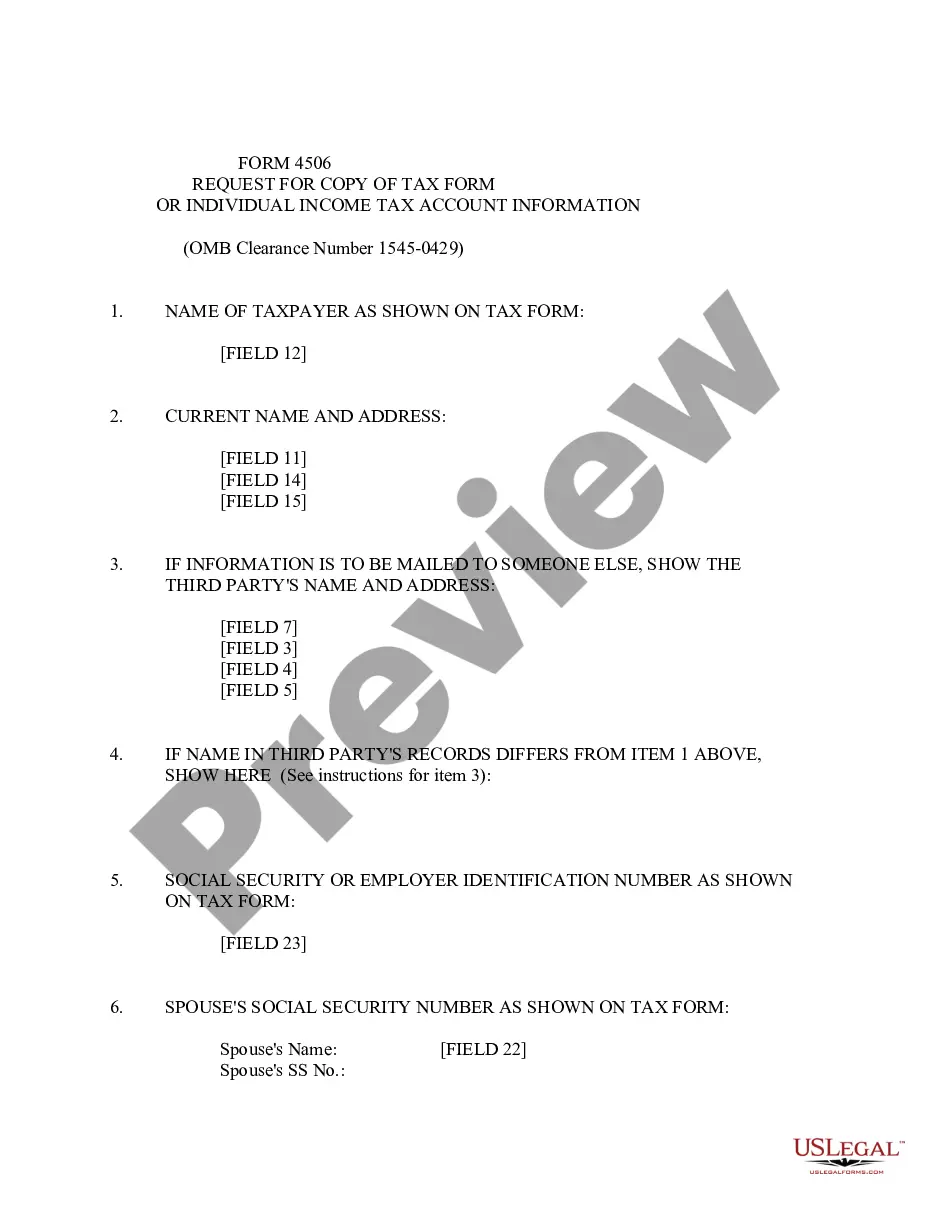

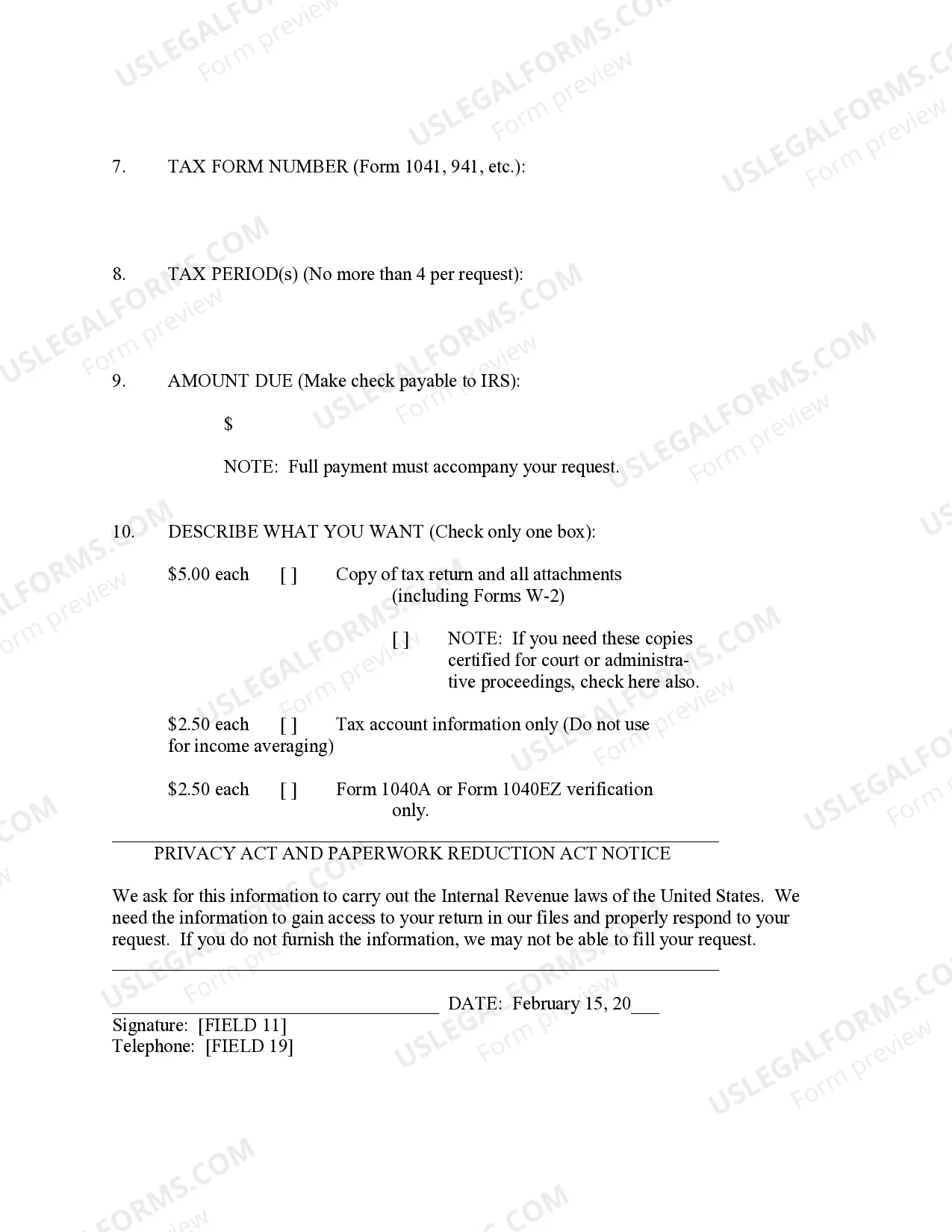

Mississippi Request for Copy of Tax Form or Individual Income Tax Account Information

Description

How to fill out Mississippi Request For Copy Of Tax Form Or Individual Income Tax Account Information?

Obtain a printable Mississippi Request for Copy of Tax Form or Individual Income Tax Account Information within several mouse clicks from the most extensive catalogue of legal e-files. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the Top provider of affordable legal and tax templates for US citizens and residents on-line starting from 1997.

Users who already have a subscription, need to log in directly into their US Legal Forms account, download the Mississippi Request for Copy of Tax Form or Individual Income Tax Account Information see it saved in the My Forms tab. Users who do not have a subscription must follow the tips listed below:

- Make certain your template meets your state’s requirements.

- If provided, look through form’s description to find out more.

- If readily available, review the form to find out more content.

- Once you’re sure the form meets your requirements, simply click Buy Now.

- Create a personal account.

- Pick a plan.

- Pay via PayPal or visa or mastercard.

- Download the form in Word or PDF format.

Once you have downloaded your Mississippi Request for Copy of Tax Form or Individual Income Tax Account Information, you can fill it out in any web-based editor or print it out and complete it by hand. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

If you missed the e-file deadline, print and paper file your corrected tax return.Additionally, if you forgot to include documentation, such as a W-2 with a paper filed return, the IRS will request the documentation. How to File an Amended Return. If you need to file an amended return, you should use Form 1040X.

There are a number of excellent sources available for taxpayers to obtain tax forms, instructions, and publications. They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center.

Yes. You can file them separately. Although state returns can be e-filed with your federal return (or after your federal return has already been accepted), it's no longer possible to e-file state returns before the federal. They are taking this measure to add an extra layer of security to all e-filed state returns.

Log in to Benefit Programs Online and select UI Online. Select Form 1099G. Select View next to the desired year. This link will only appear if you received benefits from the EDD for that year. Select Print to print your Form 1099G information. Select Request Duplicate to request an official paper copy.

Introduction. In addition to federal income taxes, U.S. citizens are liable for various state taxes as well. While some states do not levy a state income tax, all states assess some form of tax, such as sales or use taxes. And some of these taxes will require you to submit a separate state tax form each year.

No, they aren't exactly the same. Most state tax laws are similar to federal tax law, but each state usually differs from the federal rules in some way.In addition, states often apply different rules than the Internal Revenue Service (IRS) for other types of income and have differing tax rates.

Download them from IRS.gov. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

The W-4 is a federal document, and several states but not all accept the federal W-4. Below is a chart of states and what they accept. If the state has their own withholding form, then the federal W-4 is not allowed for state calculation of withholdings.

TurboTax Online includes federal and state e-filing. About 75% of our customers choose this version.