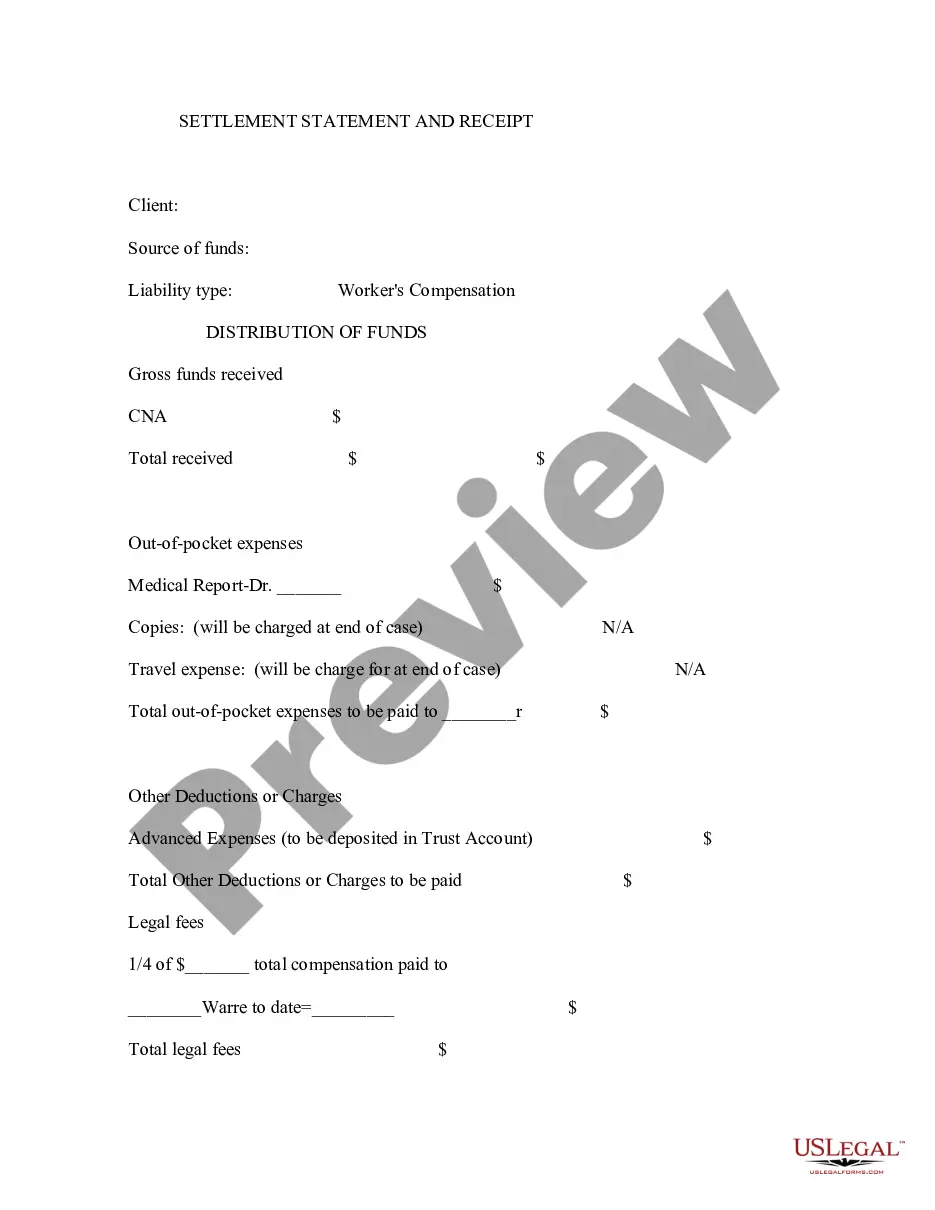

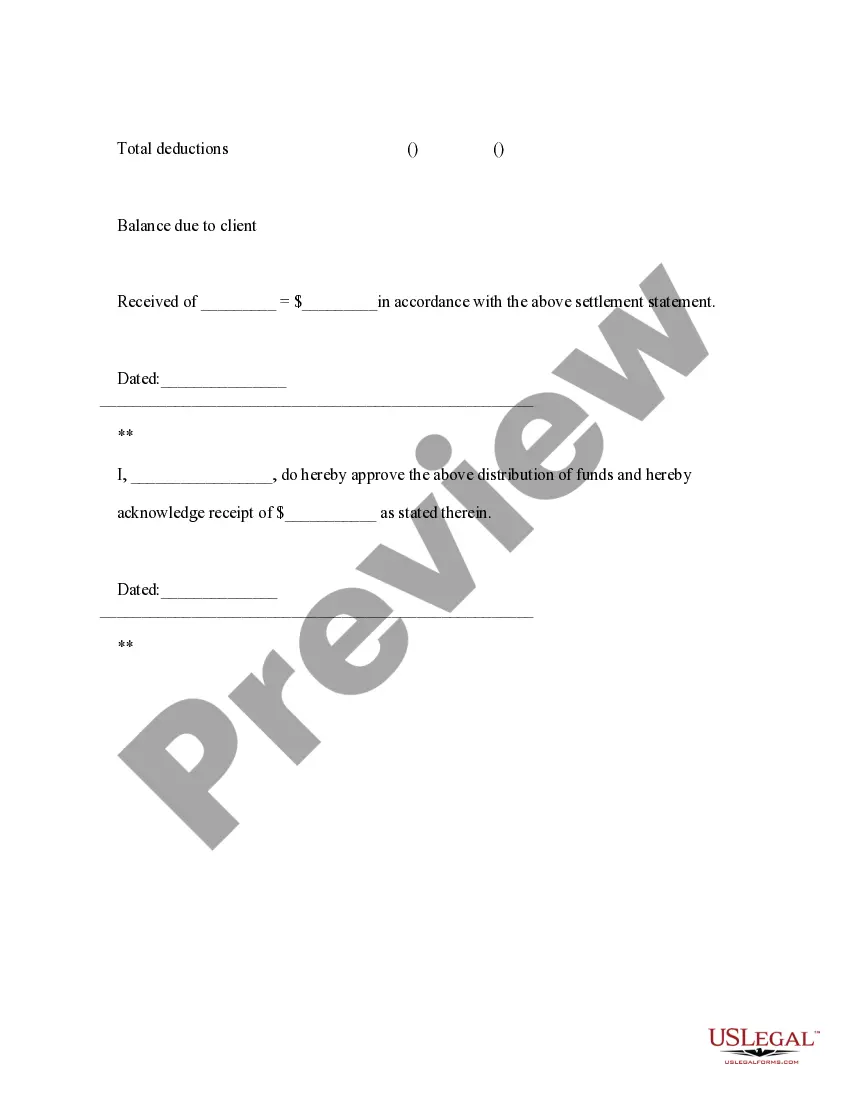

Mississippi Settlement Statement and Receipt

Description

How to fill out Mississippi Settlement Statement And Receipt?

Obtain a printable Mississippi Settlement Statement and Receipt in only several mouse clicks in the most comprehensive catalogue of legal e-files. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the Top supplier of affordable legal and tax templates for US citizens and residents online since 1997.

Customers who have already a subscription, must log in directly into their US Legal Forms account, download the Mississippi Settlement Statement and Receipt and find it stored in the My Forms tab. Customers who don’t have a subscription must follow the steps below:

- Make sure your template meets your state’s requirements.

- If provided, read the form’s description to find out more.

- If readily available, review the form to find out more content.

- Once you are sure the form is right for you, click on Buy Now.

- Create a personal account.

- Choose a plan.

- via PayPal or bank card.

- Download the form in Word or PDF format.

Once you have downloaded your Mississippi Settlement Statement and Receipt, you may fill it out in any online editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific forms.

Form popularity

FAQ

As of October 3, 2015, the Closing Disclosure form replaced the HUD-1 form for most real estate transactions. However, if you applied for a mortgage on or before October 3, 2015, you received a HUD-1.

In mortgage lending, there are two main types of settlement statements a borrower may encounter: closing disclosures and HUD-1 settlement statements. A mortgage closing disclosure is a type of standard settlement statement that is formulated and regulated for the mortgage lending market.

In your case, you should start by contacting the settlement agent for the purchase of the home. Depending on how long they retain their records, they should be able to supply you with a copy of your settlement documents.

Completing Part B of HUD-1Fill in the property location and the name and address for the borrower, seller and lender. The settlement agent, date and location also are needed. Fill in the appropriate lines in sections J and K, which are summaries of the borrower's and seller's transactions, respectively.

A HUD-1 or HUD-1A Settlement Statement is prepared by a creditor or, more typically, by the settlement agent who conducts the closing on the creditor's behalf.

The HUD-1 form is used in purchase transactions, and it includes lines for both borrower charges/fees and seller charges/fees.The HUD-1A is an option, instead of using the HUD-1, for loan transactions that do not include a seller (refinance). The HUD-1 is three pages, while the HUD-1A is only two pages.

Federal regulations require that unless its use is specifically exempted, either the HUD-1 or the HUD-1A, as appropriate, must be used for all mortgage transactions that are subject to the Real Estate Settlement Procedures Act.

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction. The statement is no longer used, with one exceptionreverse mortgages.