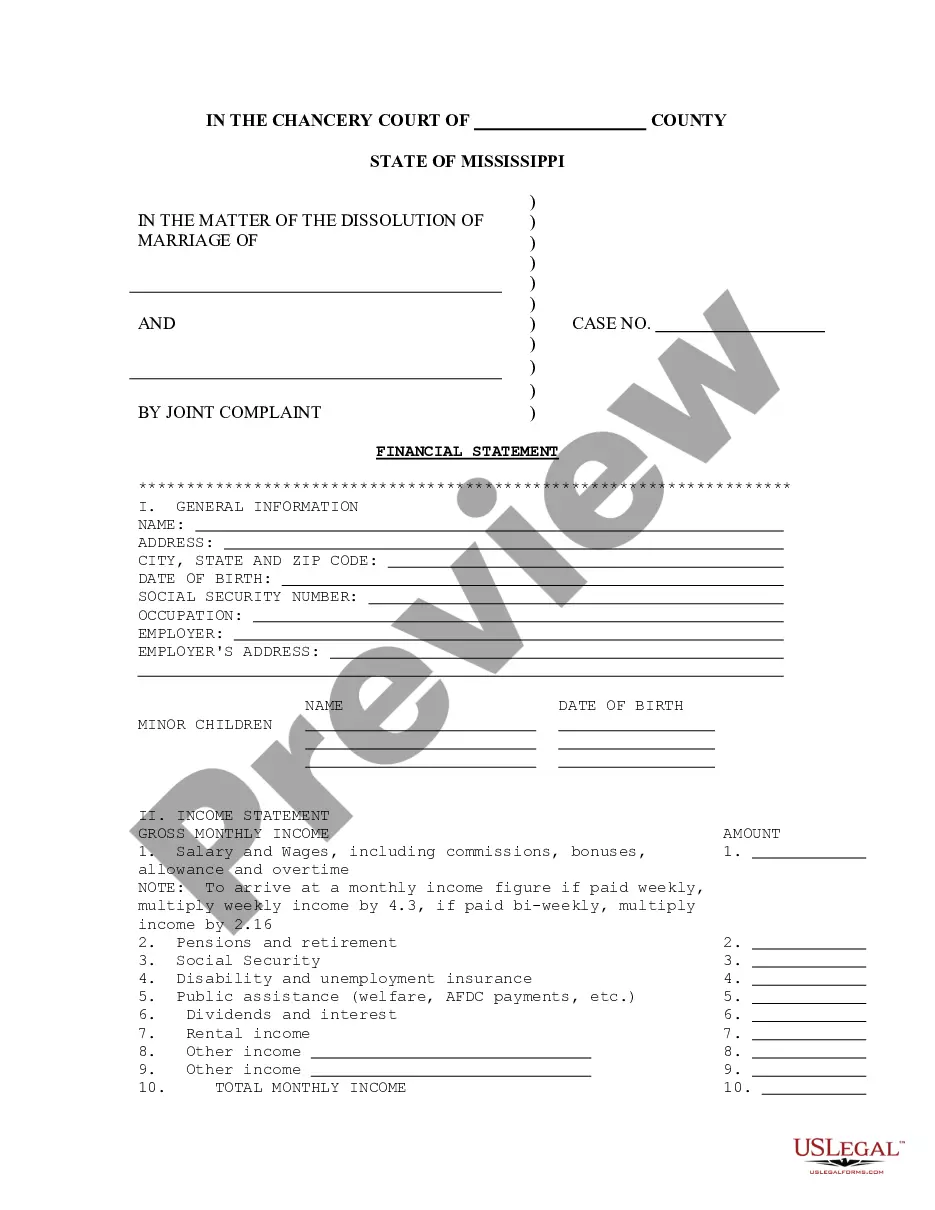

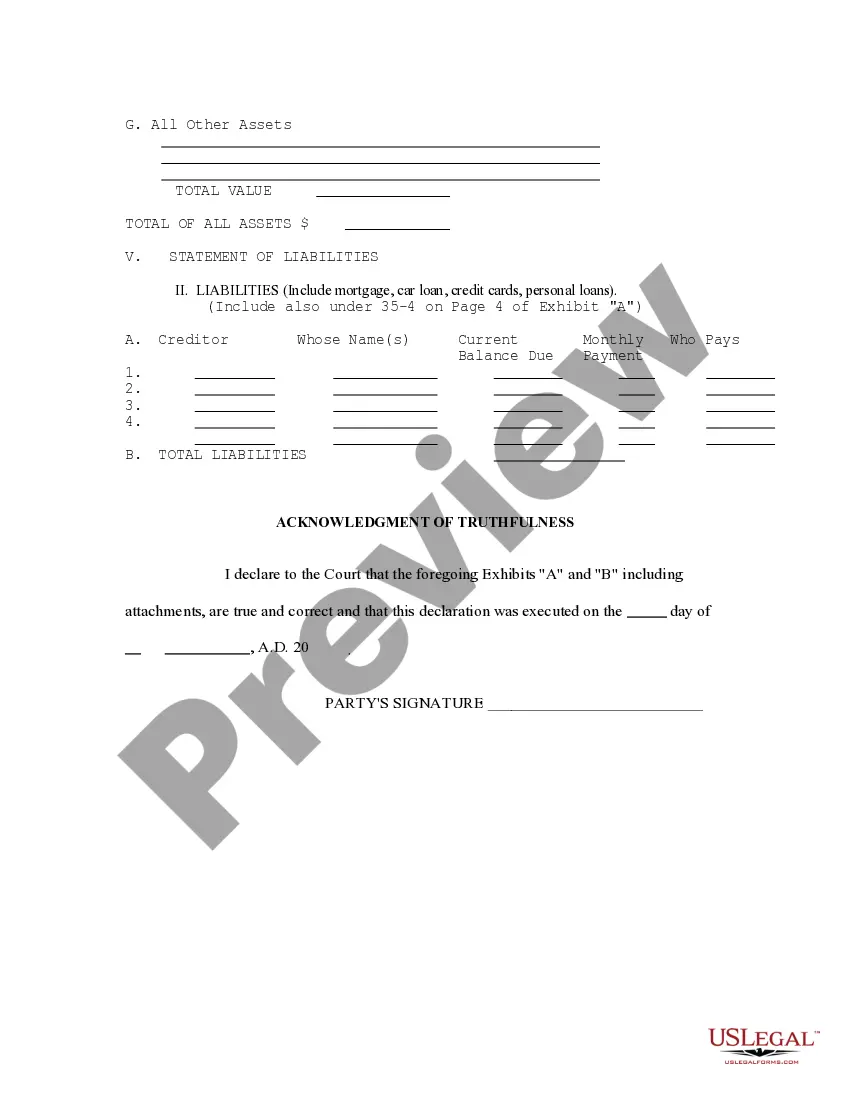

Mississippi Financial Statement

Description 805 Financial Statement Mississippi

How to fill out Financial Form Download?

Among lots of paid and free samples which you find online, you can't be sure about their reliability. For example, who created them or if they are skilled enough to take care of the thing you need these to. Always keep calm and make use of US Legal Forms! Get Mississippi Financial Statement templates made by professional attorneys and get away from the expensive and time-consuming procedure of looking for an lawyer or attorney and then having to pay them to write a papers for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button next to the form you’re seeking. You'll also be able to access all your earlier downloaded templates in the My Forms menu.

If you’re utilizing our service the first time, follow the tips listed below to get your Mississippi Financial Statement easily:

- Ensure that the file you discover is valid where you live.

- Review the file by reading the description for using the Preview function.

- Click Buy Now to begin the ordering procedure or look for another sample utilizing the Search field in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

When you have signed up and bought your subscription, you may use your Mississippi Financial Statement as many times as you need or for as long as it remains active where you live. Revise it in your favored editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Divorce Balance Sheet Template Form popularity

805 Form Other Form Names

Financial Form Ms FAQ

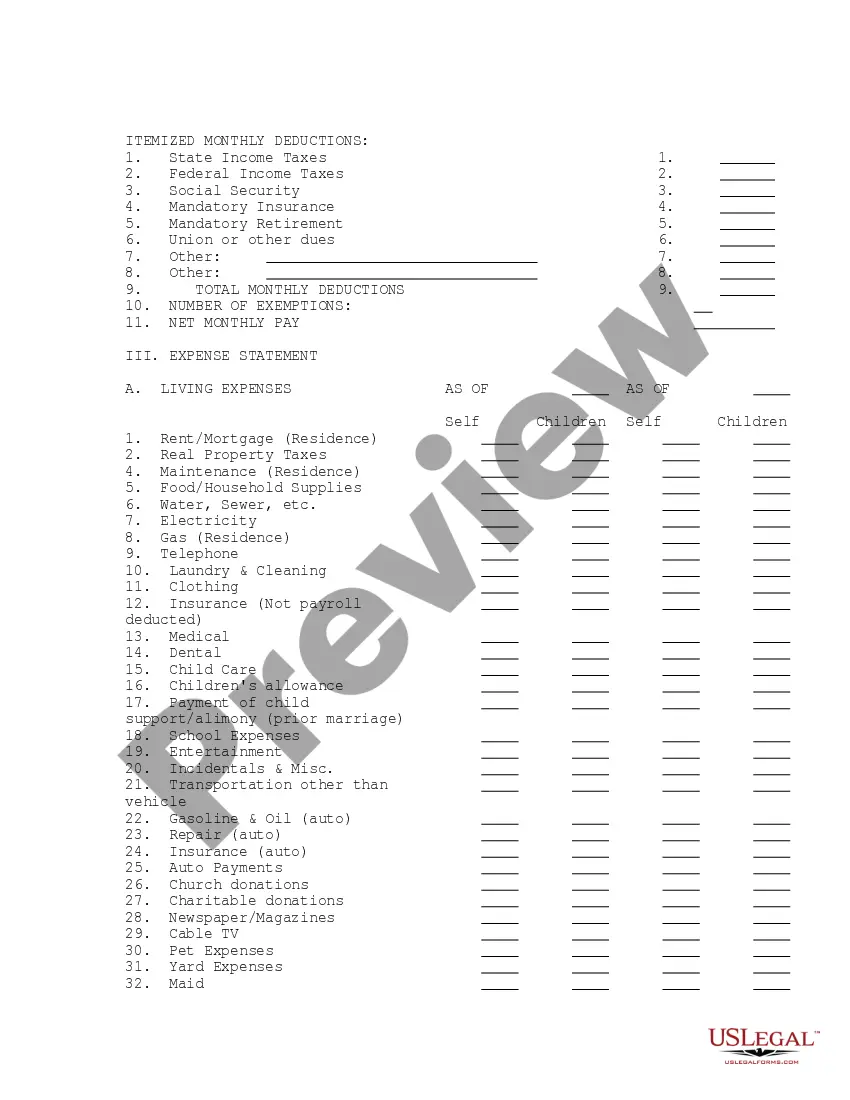

Balance Sheet. Income Sheet. Statement of Cash Flow. Step 1: Make A Sales Forecast. Step 2: Create A Budget for Your Expenses. Step 3: Develop Cash Flow Statement. Step 4: Project Net Profit. Step 5: Deal with Your Assets and Liabilities.

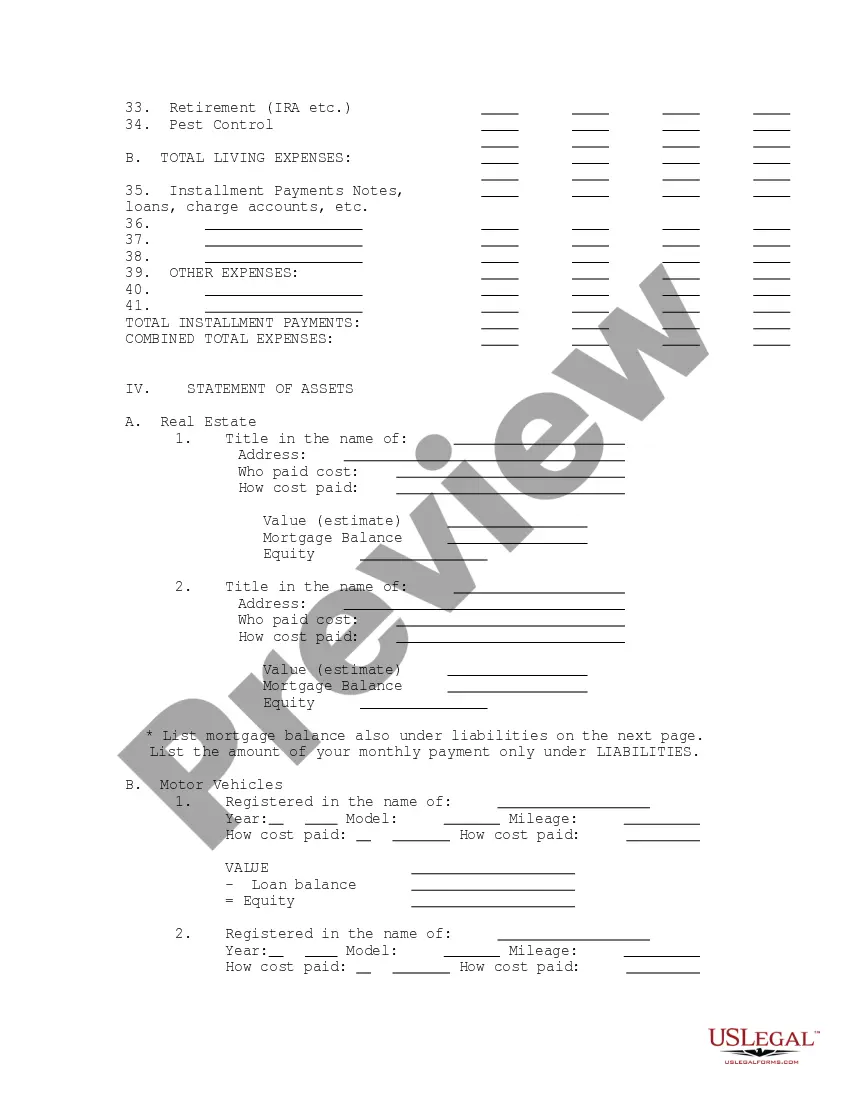

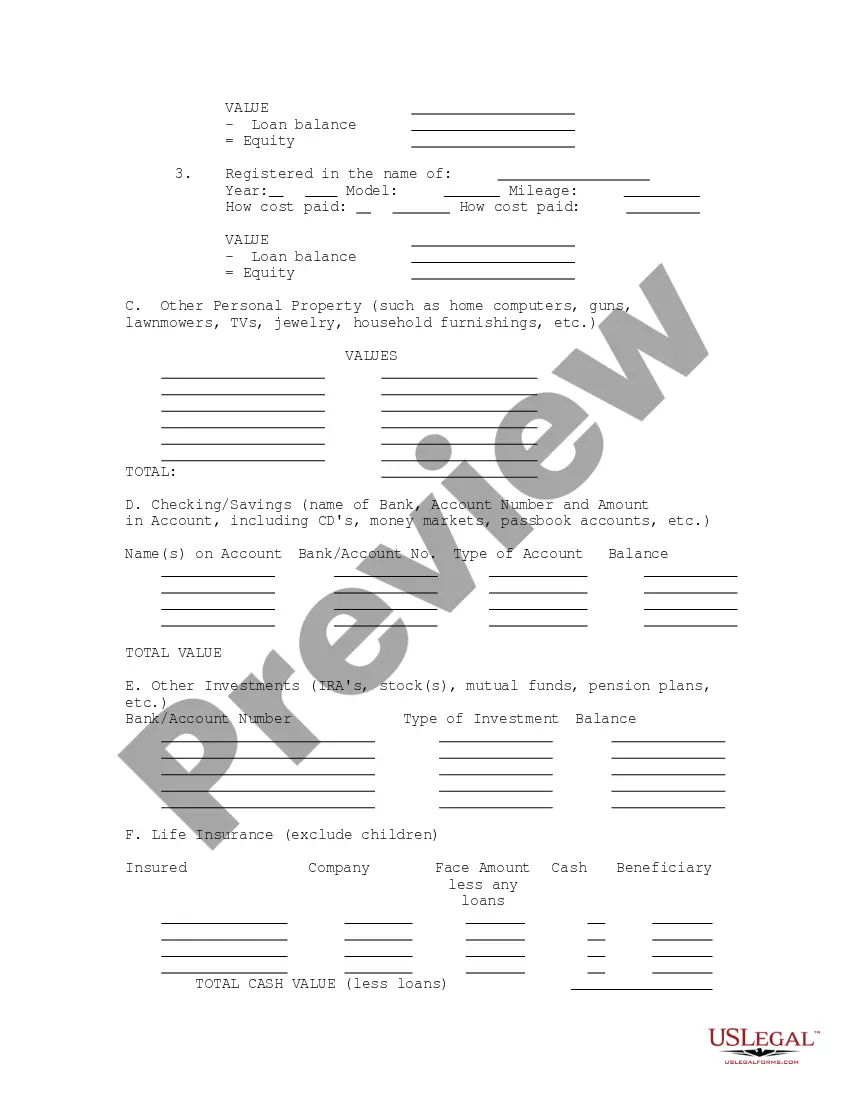

List your assets (what you own), estimate the value of each, and add up the total. Include items such as: List your liabilities (what you owe) and add up the outstanding balances. Subtract your liabilities from your assets to determine your personal net worth.

A complete set of financial statements is made up of five components: an Income Statement, a Statement of Changes in Equity, a Balance Sheet, a Statement of Cash Flows, and Notes to Financial Statements. This chapter of the Accounting 101: The Basics course presents the components of a financial statements package.

There are four main financial statements. They are: (1) balance sheets; (2) income statements; (3) cash flow statements; and (4) statements of shareholders' equity. Balance sheets show what a company owns and what it owes at a fixed point in time.

The statement of financial position is formatted like the accounting equation (assets = liabilities + owner's equity). Thus, the assets are always listed first.

The basic format for an income statement states revenues first, followed by expenses. The expenses are subtracted from the revenue to calculate the net income of the business.

For example, if you have a house and a car with a value of $100,000, and you have a mortgage and car loan for $75,000, your net worth is $25,000. Net worth for an individual is similar to owner's equity for a business. Therefore, a personal financial statement is similar to a business's balance sheet.

Statement of Cash Flows. A cash flow statement is one of the most important planning tools you have available. Income Statement. Like a cash flow statement, an income statement is one of the most important and valuable financial statements at your disposal. Balance Sheet. Statement of Changes in Equity.

Calculate your income carefully. Be sure to include all income. Be sure to also include all expenses. Do not double dip. Only include your income. Only include your expenses. Gather all appropriate documentation. Don't forget to designate separate property.