Mississippi Reaffirmation Agreement

Description

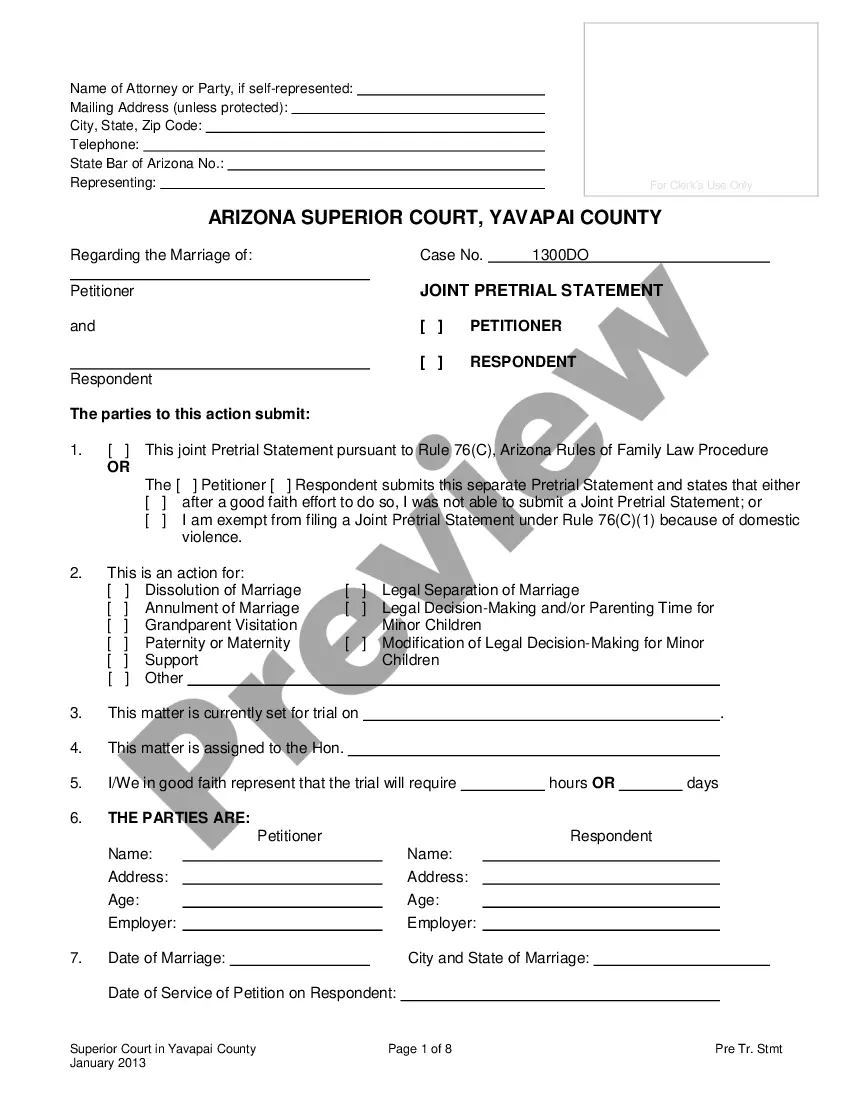

How to fill out Mississippi Reaffirmation Agreement?

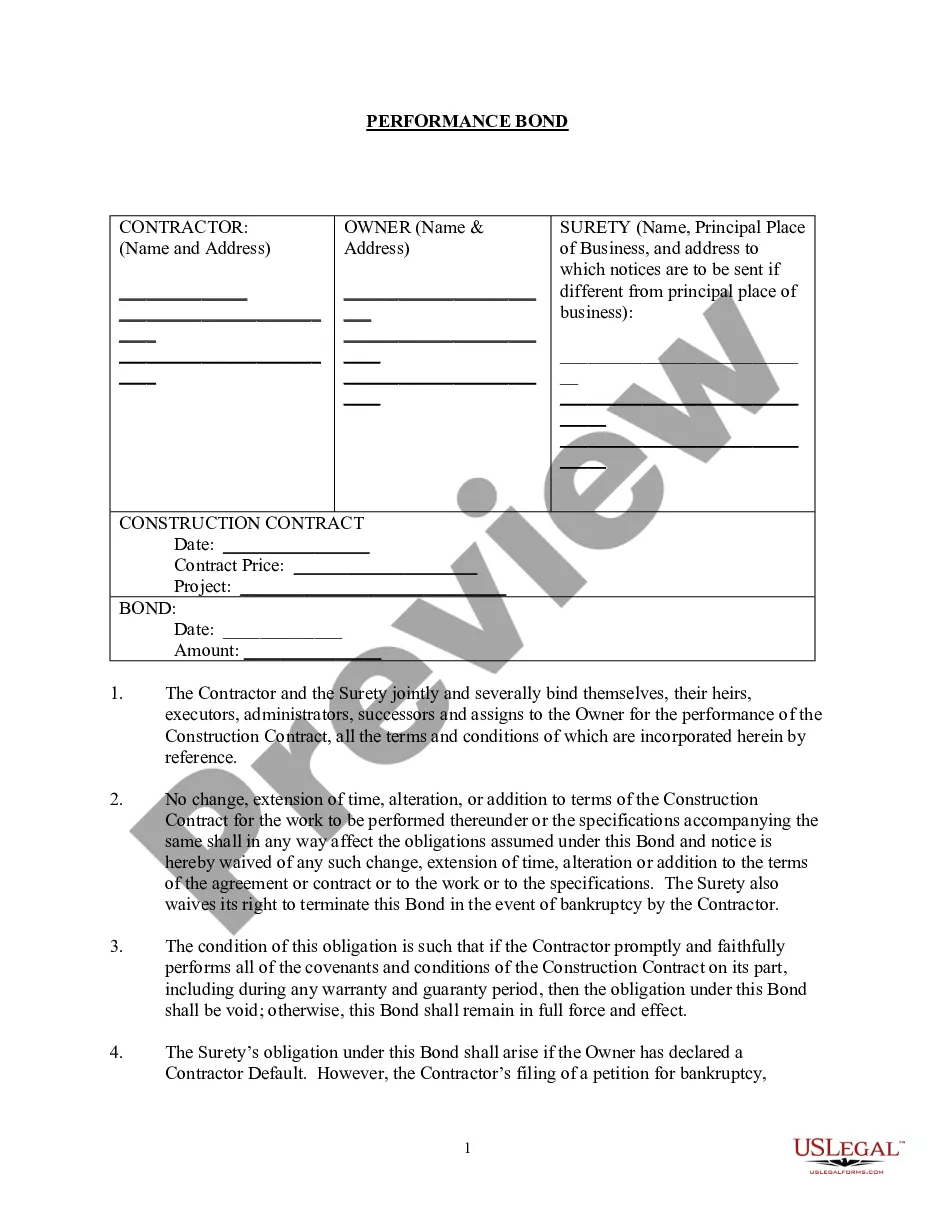

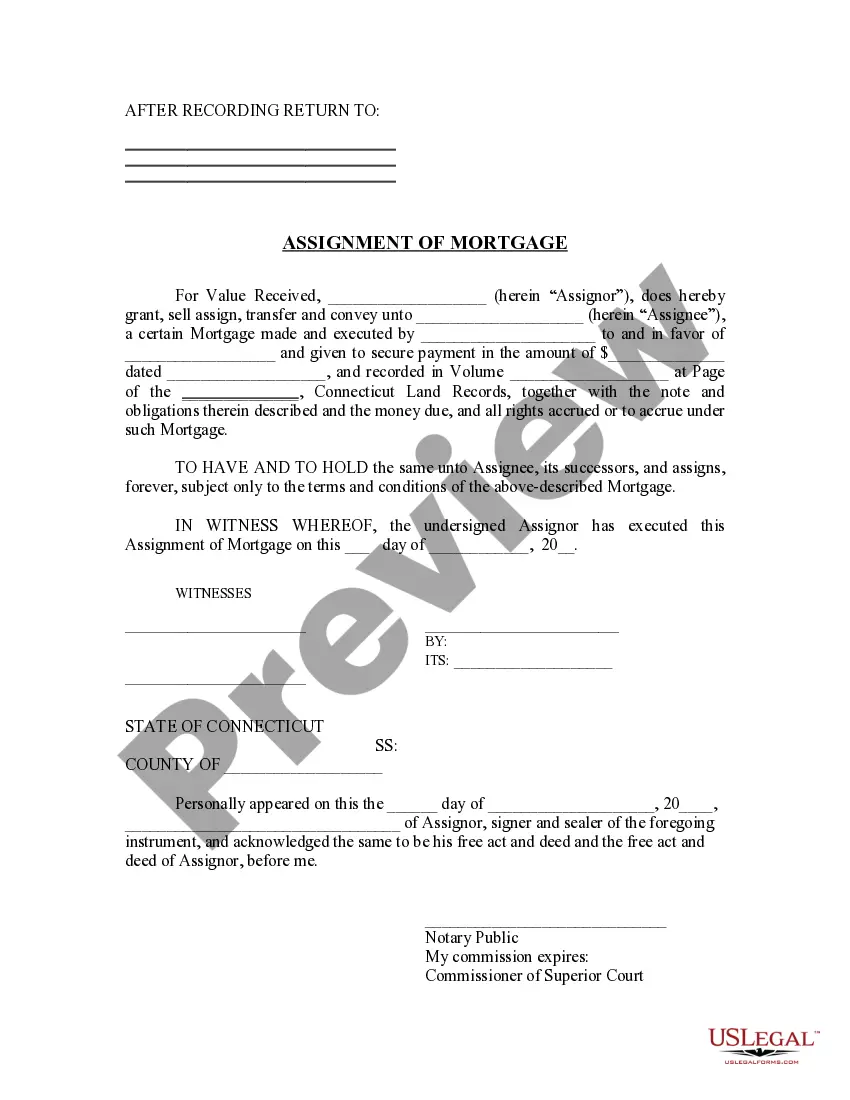

Acquire a printable Mississippi Reaffirmation Agreement in just a few clicks from the most extensive collection of legal electronic files.

Locate, download, and print professionally created and certified examples on the US Legal Forms website. US Legal Forms has been the leading provider of affordable legal and tax documents for US citizens and residents online since 1997.

Once you have downloaded your Mississippi Reaffirmation Agreement, you can complete it in any online editor or print it out and fill it in manually. Use US Legal Forms to access 85,000 professionally drafted, state-specific documents.

- Users with a subscription must Log In to their US Legal Forms account, retrieve the Mississippi Reaffirmation Agreement, and locate it saved in the My documents section.

- Users without a subscription need to follow the guidelines below.

- Ensure your template complies with your state's regulations.

- If available, review the form's description for additional information.

- If provided, preview the form to discover more content.

- Once you are confident the form meets your requirements, click Buy Now.

- Establish a personal account.

- Select a plan.

- Pay via PayPal or credit card.

- Download the form in Word or PDF format.

Form popularity

FAQ

By contrast, a reaffirmation agreement is a new contract. It's often on the same terms as the prior contract, but you can try to negotiate a new payment amount, interest rate, or some other provision.

Reaffirmation is the process wherein you agree to remain responsible for a debt so that you can keep the property securing the debt (collateral). You and the lender enter into a new contractusually on the same termsand submit it to the bankruptcy court.

Yes, you can sell the home. The effect of no reaffirmation is that you do not have a personal obligation to pay the mortgage. You still are the titled owner and the mortgage is still a lien on the property so it must be paid in order to sell the property.

If a debtor signs a reaffirmation agreement, the debtor agrees to pay a debt that otherwise might be discharged in his or her bankruptcy case. There may be other ways to renegotiate payments with creditors without entering into a reaffirmation agreement.

Reaffirmation agreements are strictly voluntary. A debtor is not required to reaffirm any of his or her debts. If a debtor signs a reaffirmation agreement, the debtor agrees to pay a debt that otherwise might be discharged in his or her bankruptcy case.

If you don't sign a reaffirmation agreement, the lender can repossess your car after your case closes and the automatic stay lifts. Some car lenders are known to repossess the car immediately, even if you are current on payments.

If you do not reaffirm the mortgage, your personal liability for paying the debt represented by the promissory note is discharged in your bankruptcy case.The company can foreclose the mortgage and force a foreclosure sale if you stop making payments.

Reaffirmation agreements are strictly voluntary. A debtor is not required to reaffirm any of his or her debts. If a debtor signs a reaffirmation agreement, the debtor agrees to pay a debt that otherwise might be discharged in his or her bankruptcy case.

Reaffirmation is voluntary Surrender may be the best thing if the car is simply too expensive or isn't reliable. You can choose to keep the car and continue paying without reaffirming. You take your chances that the lender will repossess the car, but you also keep the benefits of the bankruptcy discharge.