A Mississippi Tax Allocation and Indemnity Agreement (MTA IA) is an agreement between two or more parties in which each party agrees to bear a portion of the taxes imposed on the other party or parties. This agreement is typically used when a company is expanding its operations into Mississippi and needs to allocate its tax liability among its shareholders, partners, or other entities. The agreement specifies the allocation of the tax burden among the parties, as well as the conditions and procedures for indemnifying each party for any taxes owed. There are two types of Stairs: the stand-alone agreement and the integrated tax agreement. A stand-alone agreement is used when the parties are not related, while an integrated tax agreement is used when the parties are related.

Mississippi Tax Allocation and Indemnity Agreement

Description

How to fill out Mississippi Tax Allocation And Indemnity Agreement?

How much time and resources do you normally spend on composing formal documentation? There’s a greater way to get such forms than hiring legal experts or wasting hours browsing the web for a proper blank. US Legal Forms is the premier online library that offers professionally drafted and verified state-specific legal documents for any purpose, like the Mississippi Tax Allocation and Indemnity Agreement.

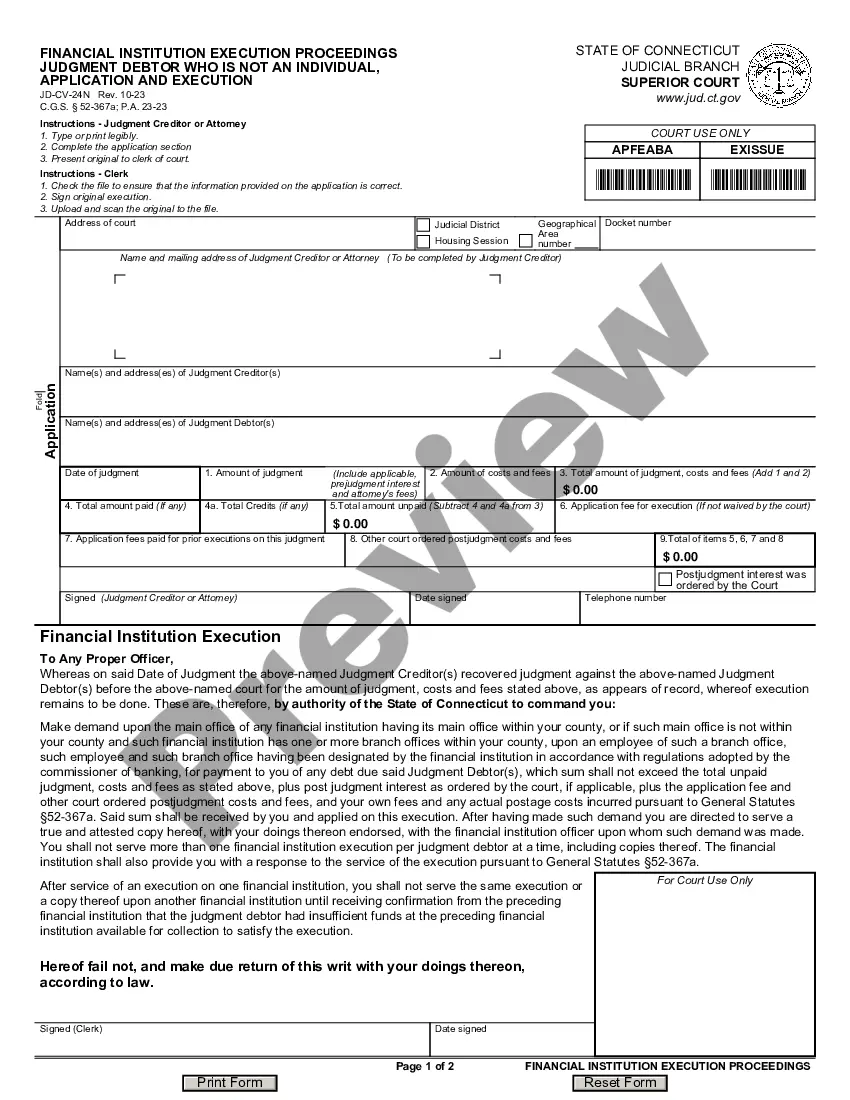

To obtain and prepare a suitable Mississippi Tax Allocation and Indemnity Agreement blank, follow these easy steps:

- Look through the form content to make sure it complies with your state laws. To do so, read the form description or utilize the Preview option.

- If your legal template doesn’t satisfy your needs, locate a different one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the Mississippi Tax Allocation and Indemnity Agreement. If not, proceed to the next steps.

- Click Buy now once you find the right document. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Register for an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is totally reliable for that.

- Download your Mississippi Tax Allocation and Indemnity Agreement on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously purchased documents that you securely keep in your profile in the My Forms tab. Obtain them anytime and re-complete your paperwork as frequently as you need.

Save time and effort completing legal paperwork with US Legal Forms, one of the most trusted web solutions. Sign up for us today!

Form popularity

FAQ

(The rate is 7% for boats and 3% for airplanes.) The use tax may be paid at your county Tax Collector's office or at one of the Mississippi Department of Revenue District offices.

There are generally two ways reciprocal agreements work: Income not taxed at source: both states tax the income, but the state of residence offers the credit. Reverse credit states: both states tax the income, but the nonresident state offers the credit.

If you are a resident of Mississippi who earns income in another state and are required to pay an income tax to that other state, you are allowed to take a credit against your Mississippi income tax due in the same year for the total income tax due to the other state (subject to certain limitations).

How do I report Gambling Winnings? Gambling winnings reported on a W-2G, 1099, or other informational return from Mississippi s are subject to a three percent (3%) non-refundable income tax. The s withhold the tax at the time of payout. The amount withheld is non-refundable to the taxpayer.

What are transferable credits? Many states offer credits that can be transferred or sold to other taxpayers. These credits can then be used by the purchasing taxpayer ("transferee") to offset its current or future tax liability.

Usually, if you are required to file taxes in multiple states, you might be eligible for a credit for taxes paid to another state. Various state laws provide these credits so that you don't pay taxes to multiple states on the same income.

You can deduct any estimated taxes paid to state or local governments and any prior year's state or local income tax as long as they were paid during the tax year. Generally, you can take either a deduction or a tax credit for foreign income taxes, but not for taxes paid on income that is excluded from U.S. tax.

"This session I hope that's not the case.? Mississippi's Republican-controlled legislature passed legislation in 2022 that will eliminate the state's 4% income tax bracket starting in 2023. In the following three years, the 5% bracket will be reduced to 4%.