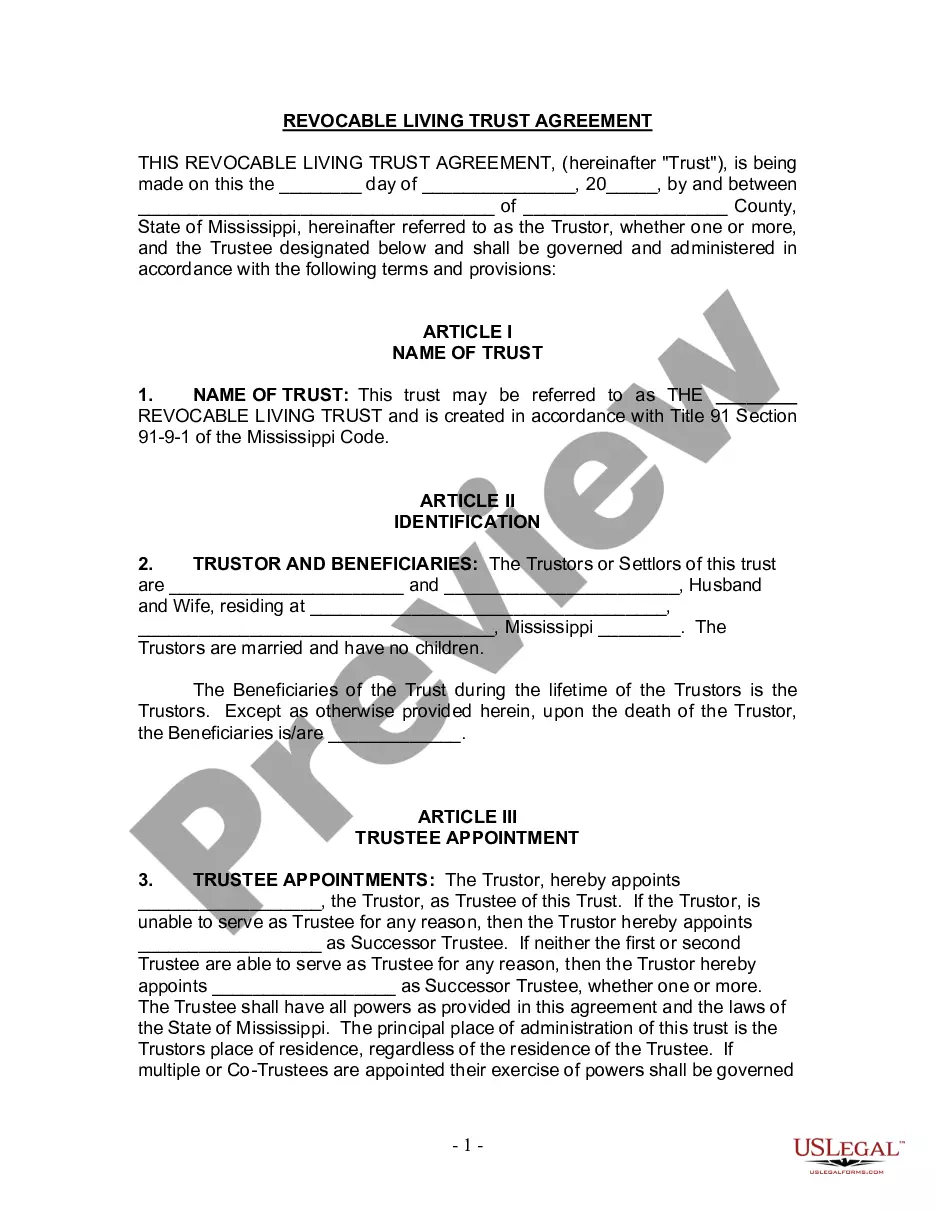

Mississippi Living Trust for Husband and Wife with No Children

Description

How to fill out Mississippi Living Trust For Husband And Wife With No Children?

Get a printable Mississippi Living Trust for Husband and Wife with No Children in just several mouse clicks in the most extensive library of legal e-forms. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the #1 provider of affordable legal and tax templates for US citizens and residents on-line since 1997.

Customers who already have a subscription, need to log in directly into their US Legal Forms account, download the Mississippi Living Trust for Husband and Wife with No Children and find it stored in the My Forms tab. Customers who never have a subscription must follow the tips below:

- Ensure your template meets your state’s requirements.

- If provided, look through form’s description to learn more.

- If offered, review the form to find out more content.

- When you are confident the template suits you, click on Buy Now.

- Create a personal account.

- Select a plan.

- Pay out through PayPal or bank card.

- Download the form in Word or PDF format.

When you’ve downloaded your Mississippi Living Trust for Husband and Wife with No Children, you may fill it out in any web-based editor or print it out and complete it manually. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

In Mississippi, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

If you die without a will in Mississippi, your children will receive an intestate share of your property.For children to inherit from you under the laws of intestacy, the state of Mississippi must consider them your children, legally.

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

Most married couples own most of their assets jointly. Assets owned jointly between husband and wife pass automatically to the survivor.This requires the will to be probated and an executor to be appointed in order to secure the assets. There are exceptions to the probate requirement for estates of $50,000 or less.

California is a community property state, which means that following the death of a spouse, the surviving spouse will have entitlement to one-half of the community property (i.e., property that was acquired over the course of the marriage, regardless of which spouse acquired it).

The Spouse Is the Automatic Beneficiary for Married People A federal law, the Employee Retirement Income Security Act (ERISA), governs most pensions and retirement accounts.

This law states that no matter what your will says, your spouse has a right to inherit one-third or one-half (depending on the state and sometimes depending on the length of the marriage) of your total estate. To exercise this right, your spouse has to petition the probate court to enforce the law.

California is a community property state, which means that following the death of a spouse, the surviving spouse will have entitlement to one-half of the community property (i.e., property that was acquired over the course of the marriage, regardless of which spouse acquired it).