Mississippi Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children

Description

How to fill out Mississippi Living Trust For Individual Who Is Single, Divorced Or Widow (or Widower) With Children?

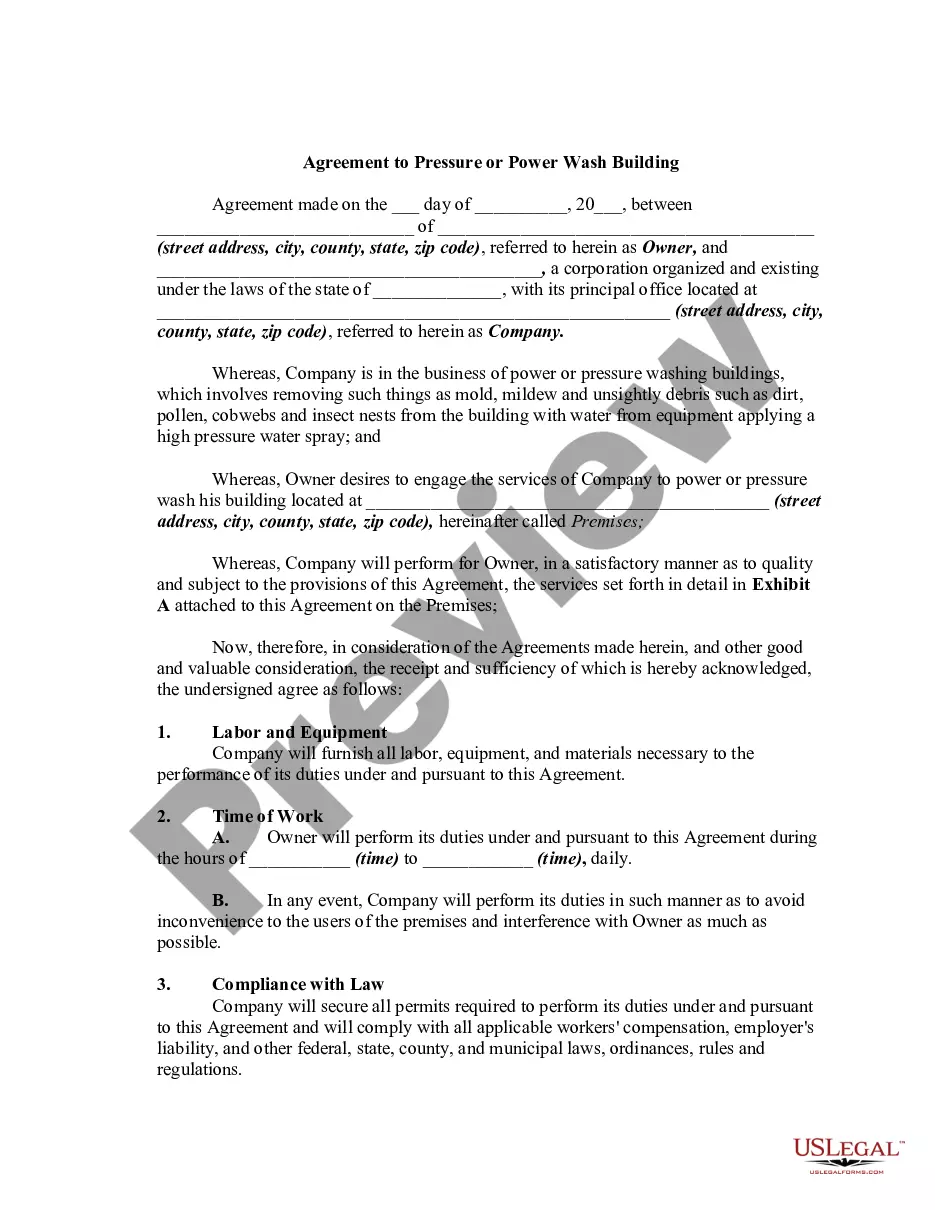

Obtain a printable Mississippi Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children in only several mouse clicks from the most extensive library of legal e-files. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the Top provider of affordable legal and tax templates for US citizens and residents on-line starting from 1997.

Users who have already a subscription, need to log in into their US Legal Forms account, download the Mississippi Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children see it stored in the My Forms tab. Users who don’t have a subscription are required to follow the tips below:

- Make certain your template meets your state’s requirements.

- If available, look through form’s description to find out more.

- If offered, review the shape to see more content.

- When you’re confident the form meets your requirements, click Buy Now.

- Create a personal account.

- Pick a plan.

- Pay out via PayPal or visa or mastercard.

- Download the form in Word or PDF format.

Once you have downloaded your Mississippi Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children, you can fill it out in any web-based editor or print it out and complete it by hand. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific forms.

Form popularity

FAQ

Using a revocable living trust instead of a will means assets owned by your trust will bypass probate and flow to your heirs as you've outlined in the trust documents. A trust lets investors have control over their assets long after they pass away.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

The average cost for an attorney to create your trust ranges from $1,000 to $1,500 for an individual and $1,200 to $1,500 for a couple. Legal fees vary by location, so your costs could be much higher or slightly lower.

When it comes to protecting your loved ones, having both a will and a trust is essential. The difference between a will and a trust is when they kick into action. A will lays out your wishes for after you die. A living revocable trust becomes effective immediately.

Legally your Trust now owns all of your assets, but you manage all of the assets as the Trustee. This is the essential step that allows you to avoid Probate Court because there is nothing for the courts to control when you die or become incapacitated.

Anyone who is single and has assets titled in their sole name should consider a Revocable Living Trust. The two main reasons are to keep you and your assets out of a court-supervised guardianship and to allow your beneficiaries to avoid the costs and hassles of probate.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

In this article: A living trust is a type of estate planning tool that allows you to transfer ownership of your assets to a separate fund while you're still alive.In some circumstances, you can use a living trust to protect money you owe to creditors.

Funding a Trust Is Expensive... This is the major drawback to using a revocable living trust for many people, but it's not worth the time, money, and effort to create one if the trust isn't fully funded.