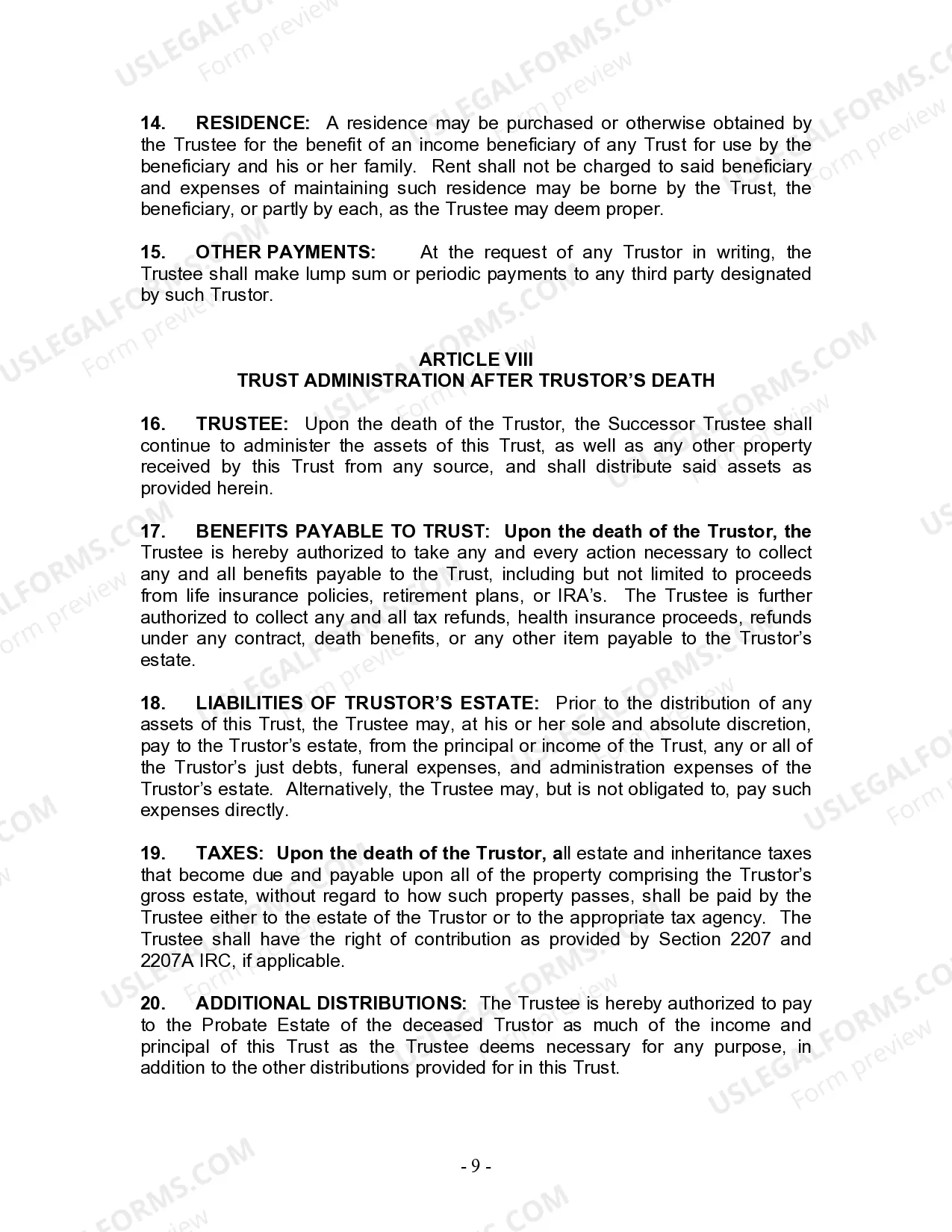

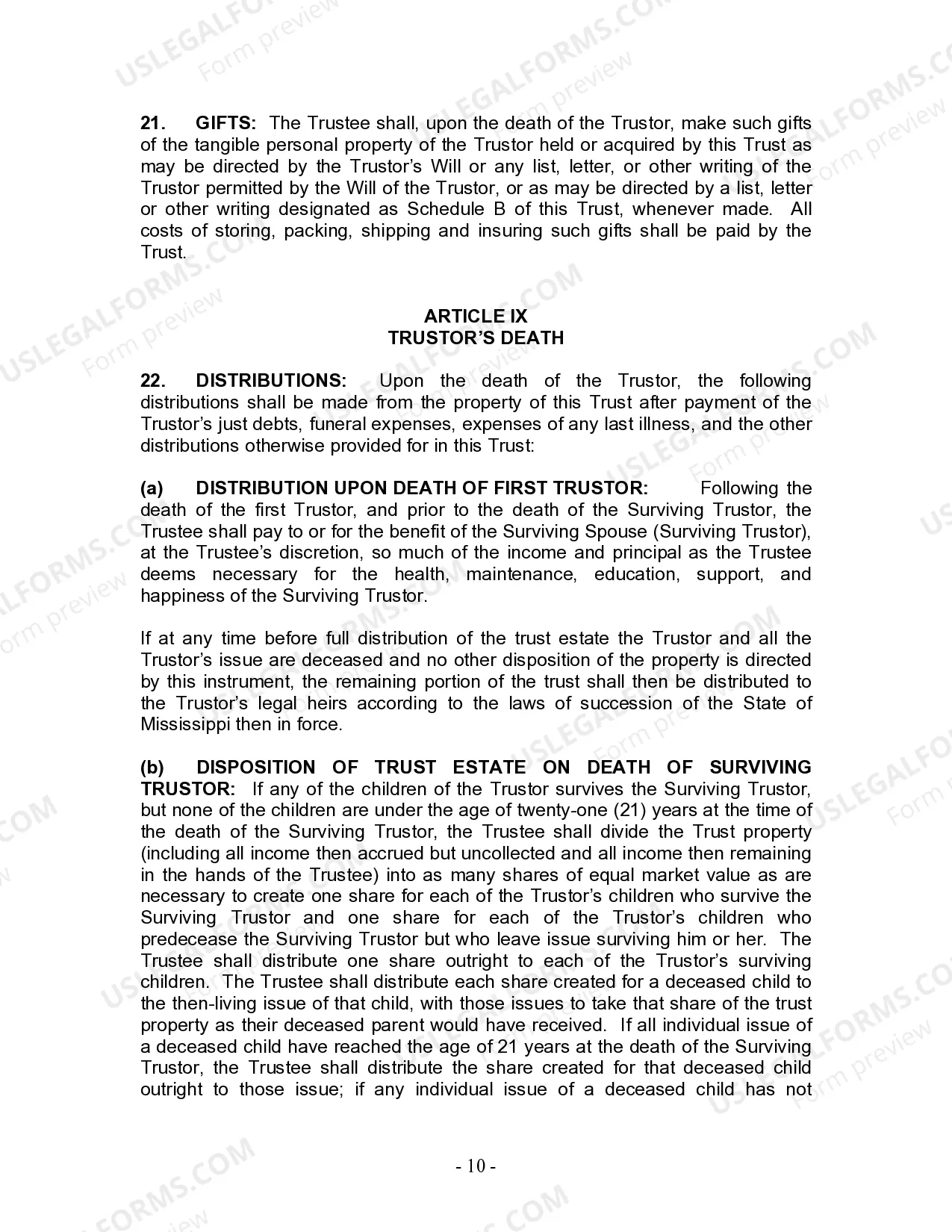

Mississippi Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out Mississippi Living Trust For Husband And Wife With Minor And Or Adult Children?

Get a printable Mississippi Living Trust for Husband and Wife with Minor and or Adult Children within just several mouse clicks in the most extensive catalogue of legal e-files. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the Top supplier of reasonably priced legal and tax templates for US citizens and residents online starting from 1997.

Users who already have a subscription, need to log in in to their US Legal Forms account, download the Mississippi Living Trust for Husband and Wife with Minor and or Adult Children and find it saved in the My Forms tab. Customers who never have a subscription must follow the steps listed below:

- Ensure your form meets your state’s requirements.

- If available, read the form’s description to learn more.

- If readily available, preview the form to find out more content.

- As soon as you’re confident the template is right for you, click Buy Now.

- Create a personal account.

- Select a plan.

- Pay out through PayPal or bank card.

- Download the form in Word or PDF format.

As soon as you have downloaded your Mississippi Living Trust for Husband and Wife with Minor and or Adult Children, you can fill it out in any online editor or print it out and complete it by hand. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

You don't need to include all your accounts in a revocable trust for your heirs to bypass the probate process, notably retirement accounts with designated beneficiaries and investment accounts that have transfer-on-death provisions.

Cash Accounts. Rafe Swan / Getty Images. Non-Retirement Investment and Brokerage Accounts. Non-qualified Annuities. Stocks and Bonds Held in Certificate Form. Tangible Personal Property. Business Interests. Life Insurance. Monies Owed to You.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

Yes you can set up a trust independent of your husband. You could fund the trust with your personal property now and/or designate any community property that is yours at the time of your death to pour over into the trust.

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

Property you put in a living trust doesn't have to go through probate, which means that the assets won't get tied up in court for months and maybe years. However, you don't have to put bank accounts in a living trust, and sometimes it's not a good idea.

One type of trust that will protect your assets from your creditors is called an irrevocable trust. Once you establish an irrevocable trust, you no longer legally own the assets you used to fund it and can no longer control how those assets are distributed.

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

You can put your real estate into your living trust even if owe money on it. A loan on the property -- like a mortgage or deed of trust -- will follow the property into the trust, and it will also follow the property to the beneficiary.