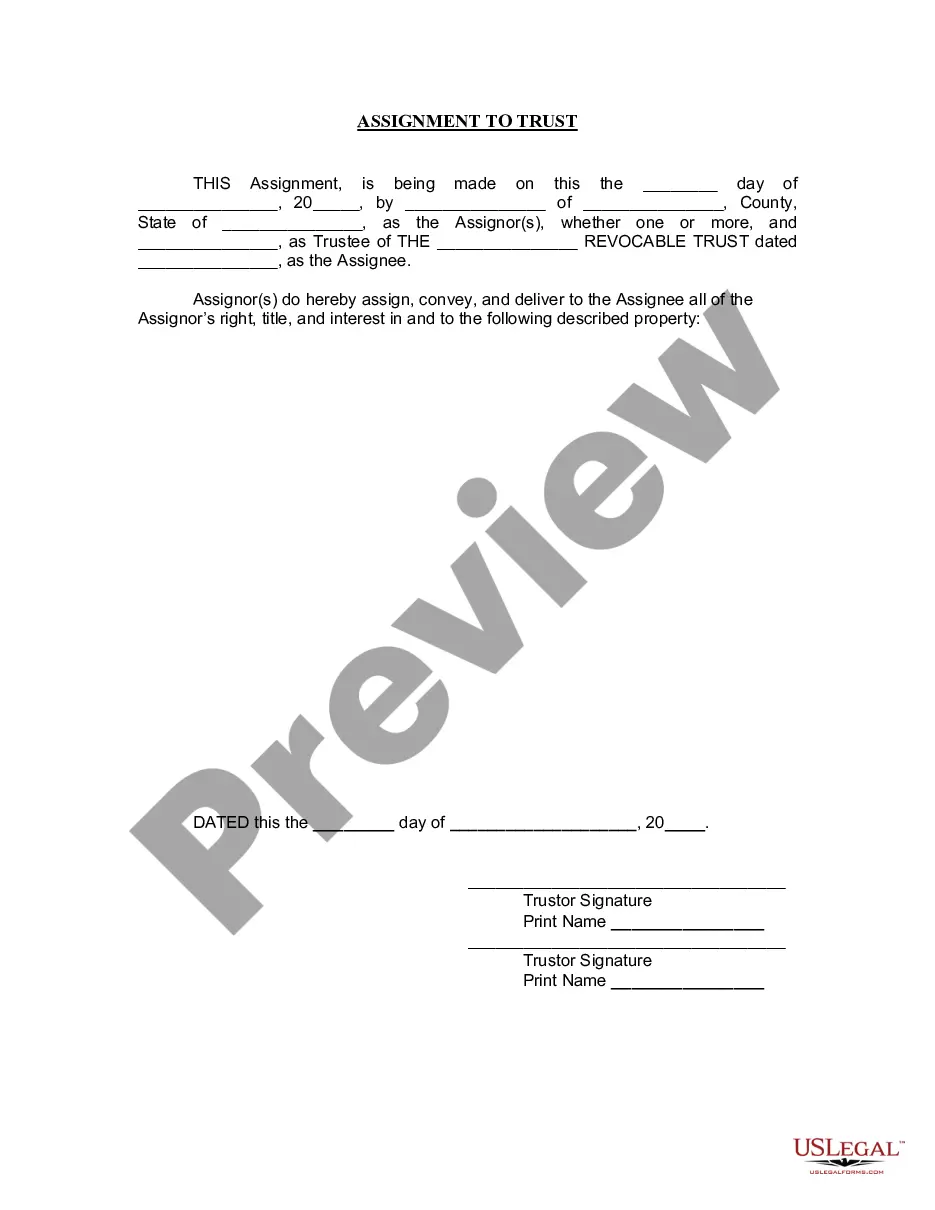

Mississippi Assignment to Living Trust

Description

How to fill out Mississippi Assignment To Living Trust?

Get a printable Mississippi Assignment to Living Trust within just several mouse clicks from the most complete library of legal e-forms. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the #1 provider of affordable legal and tax forms for US citizens and residents on-line starting from 1997.

Users who have a subscription, need to log in straight into their US Legal Forms account, download the Mississippi Assignment to Living Trust see it stored in the My Forms tab. Users who do not have a subscription are required to follow the steps listed below:

- Make certain your template meets your state’s requirements.

- If available, read the form’s description to find out more.

- If available, review the shape to view more content.

- When you’re sure the template meets your requirements, simply click Buy Now.

- Create a personal account.

- Pick a plan.

- Pay through PayPal or credit card.

- Download the form in Word or PDF format.

As soon as you have downloaded your Mississippi Assignment to Living Trust, you can fill it out in any web-based editor or print it out and complete it by hand. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific forms.

Form popularity

FAQ

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

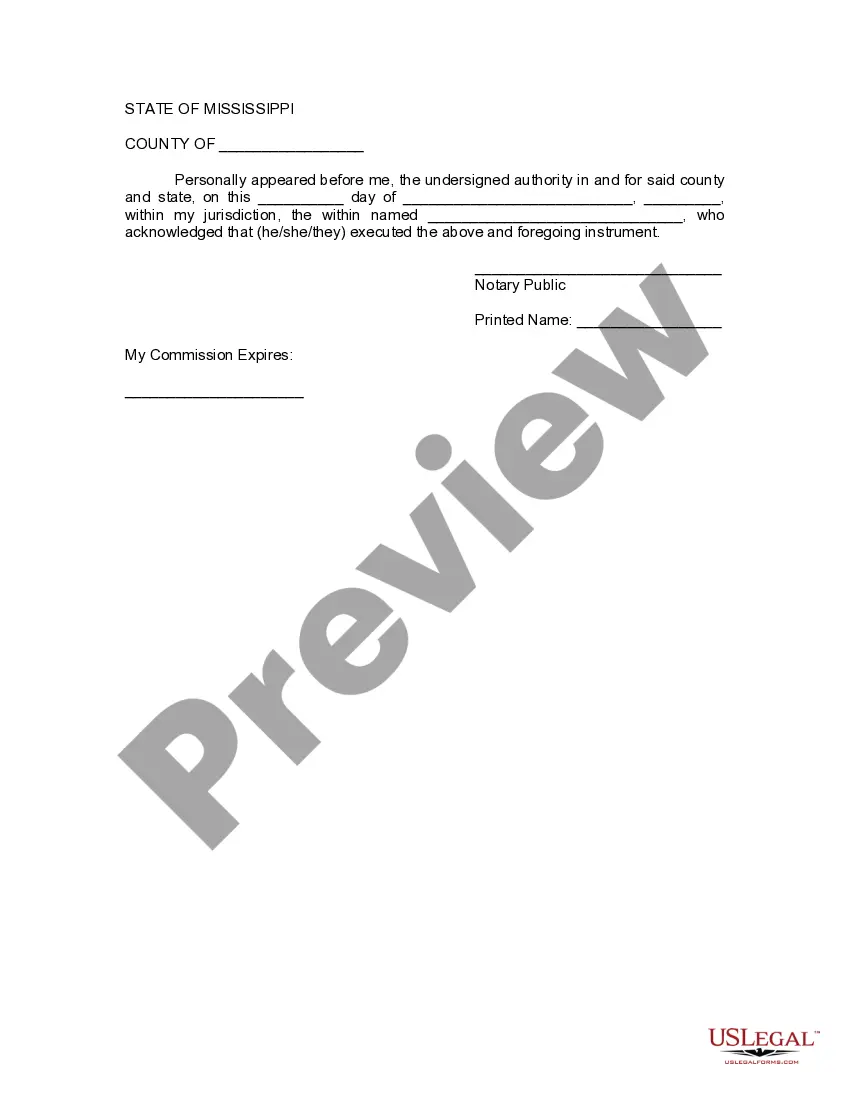

You can change your living trust, usually without incurring lawyer bills.Because you and your spouse made the trust together, you should both sign the amendment, and when you sign it, get your signatures notarized, just like the original. Another way to go is to create a "restatement" of your trust.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

You don't need a lawyer to complete most of your tasks during the first few months of a trust administration.If you'll be distributing all the trust property to beneficiaries quickly, you'll probably get most of your work done in about six months.

The average cost for an attorney to create your trust ranges from $1,000 to $1,500 for an individual and $1,200 to $1,500 for a couple. Legal fees vary by location, so your costs could be much higher or slightly lower.

Locate the original trust. The grantor must locate the original trust documents and identify the specific provisions that require amendment. Prepare an amendment form. Get the amendment form notarized. Attach amendment form to original trust.

Trusts Are Not Public Record. Most states require a last will and testament to be filed with the appropriate state court when the person dies. When this happens, the will becomes a public record for anyone to read. However, trusts aren't recorded.

Assuming you decide you want a revocable living trust, how much should you expect to pay? If you are willing to do it yourself, it will cost you about $30 for a book, or $70 for living trust software. If you hire a lawyer to do the job for you, get ready to pay between $1,200 and $2,000.