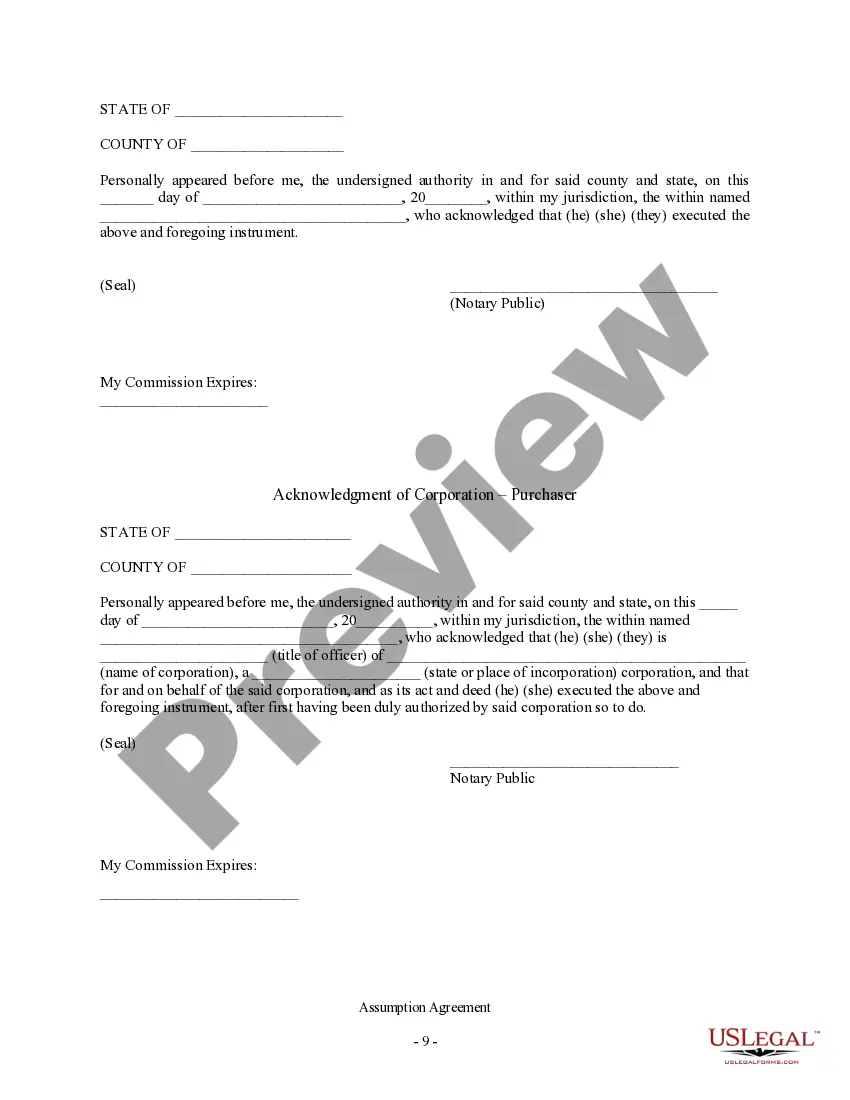

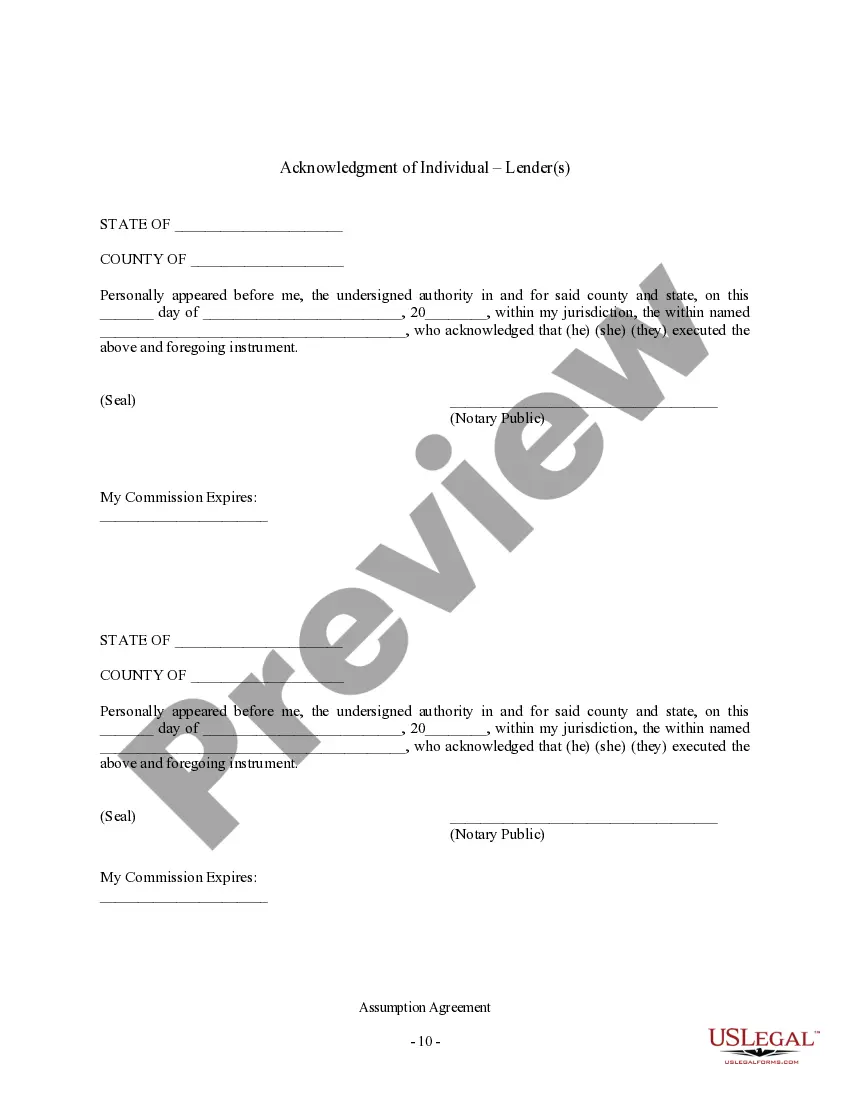

Mississippi Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description Ms Deed Trust Form

How to fill out Mississippi Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

Obtain a printable Mississippi Assumption Agreement of Deed of Trust and Release of Original Mortgagors in just several mouse clicks in the most comprehensive library of legal e-documents. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the Top supplier of reasonably priced legal and tax forms for US citizens and residents online since 1997.

Users who already have a subscription, must log in straight into their US Legal Forms account, down load the Mississippi Assumption Agreement of Deed of Trust and Release of Original Mortgagors and find it stored in the My Forms tab. Customers who do not have a subscription are required to follow the tips listed below:

- Ensure your template meets your state’s requirements.

- If provided, look through form’s description to find out more.

- If offered, review the form to view more content.

- When you’re sure the template suits you, click Buy Now.

- Create a personal account.

- Pick a plan.

- via PayPal or credit card.

- Download the template in Word or PDF format.

Once you have downloaded your Mississippi Assumption Agreement of Deed of Trust and Release of Original Mortgagors, it is possible to fill it out in any online editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific forms.

Form popularity

FAQ

The following states use Deed of Trusts: Alaska, Arizona, California, District of Columbia, Georgia, Mississippi, Missouri, Nevada, North Carolina, and Virginia.

Property cannot be conveyed to a grantee who does not exist. Thus, a deed to a grantee who is dead at the time of delivery is void. For example, a deed recorded by the grantor is presumed to have been delivered.For example, a deed is voidable if it was obtained by fraud in the inducement.

They serve different purposes and are signed by different parties. The warranty deed transfers the property's ownership from the current owner to the new buyer, while the deed of trust ensures the lender has interest in the property in the event a buyer defaults on the loan.

Whether you have a deed of trust or a mortgage, they both serve to assure that a loan is repaid, either to a lender or an individual person. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.

This may be referred to as the "power of sale" clause. This is the language that legally authorizes the trustee to sell the property outside of court if the buyer does not meet his or her obligations under the deed of trust and promissory note.

A Deed of Trust is a three party document prepared, signed and recorded to secure repayment of a loan. The Borrower (property owner) is named as Trustor, the Lender is called the Beneficiary, and a third party is called a Trustee.

Giving the wrong legal address for the property or the wrong amount of the debt can render the deed unenforceable. In some cases, the error is easy to fix, and the court will rule the deed is enforceable.

Deed: This is the document that proves ownership of a property. It transfers ownership of the property to the grantee, also known as the buyer.Mortgage: This is the document that gives the lender a security interest in the property until the Note is paid in full.

Whether you have a deed of trust or a mortgage, they both serve to assure that a loan is repaid, either to a lender or an individual person. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.