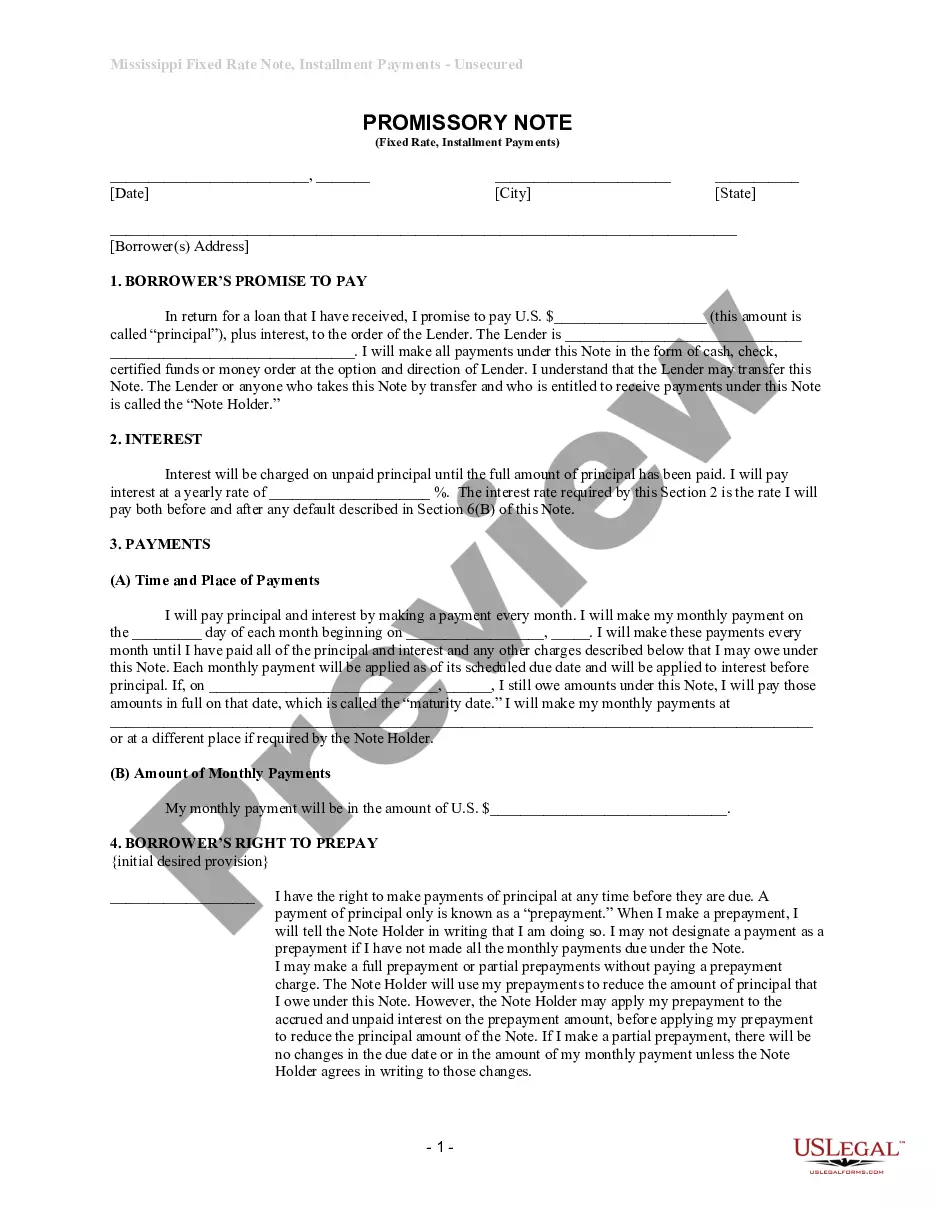

Mississippi Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Mississippi Unsecured Installment Payment Promissory Note For Fixed Rate?

Get a printable Mississippi Unsecured Installment Payment Promissory Note for Fixed Rate within just several clicks in the most complete library of legal e-forms. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the #1 supplier of reasonably priced legal and tax forms for US citizens and residents on-line starting from 1997.

Users who have a subscription, need to log in into their US Legal Forms account, down load the Mississippi Unsecured Installment Payment Promissory Note for Fixed Rate see it stored in the My Forms tab. Users who never have a subscription are required to follow the tips listed below:

- Ensure your form meets your state’s requirements.

- If provided, read the form’s description to find out more.

- If readily available, preview the shape to see more content.

- Once you’re sure the template meets your requirements, just click Buy Now.

- Create a personal account.

- Pick a plan.

- Pay through PayPal or visa or mastercard.

- Download the form in Word or PDF format.

As soon as you have downloaded your Mississippi Unsecured Installment Payment Promissory Note for Fixed Rate, you may fill it out in any online editor or print it out and complete it by hand. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific files.

Form popularity

FAQ

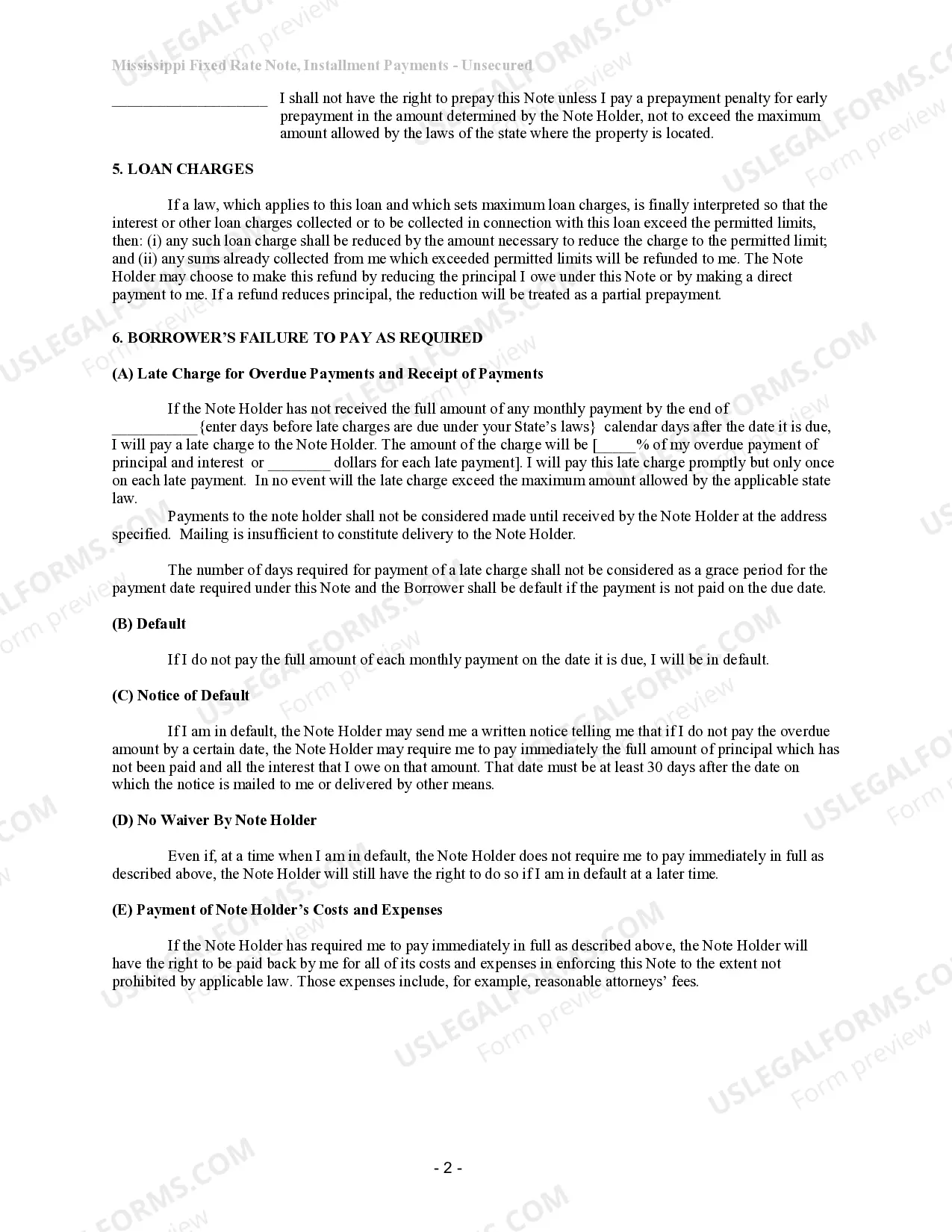

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

The owner of the promissory note can file a civil lawsuit against the signer of the note if the signer refuses to pay. The purpose of the lawsuit is to obtain a judgment against the note's signer, which will give the owner of the note the ability to pursue the signer's assets.

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

Unsecured Promissory Notes An unsecured promissory note is an obligation for payment without any property securing the payment.A short-term unsecured promissory note is the type most often used when a relatively small amount of money is borrowed from a friend or relative.

Secured or unsecured? Generally, promissory notes are unsecured which means it is more like a formal IOU. However, lenders can request some security for the loan. For personal secured promissory notes, a house or car is often used as collateral.

Step 1 Agree to Terms. Step 2 Run a Credit Report. Step 3 Security and Co-Signer(s) Step 4 Writing the Promissory Note. Step 5 Paying Back the Borrowed Money. Calculating Total Interest Owed. Calculating the Final Payment Amount. Calculating the Monthly Payment Amount.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.