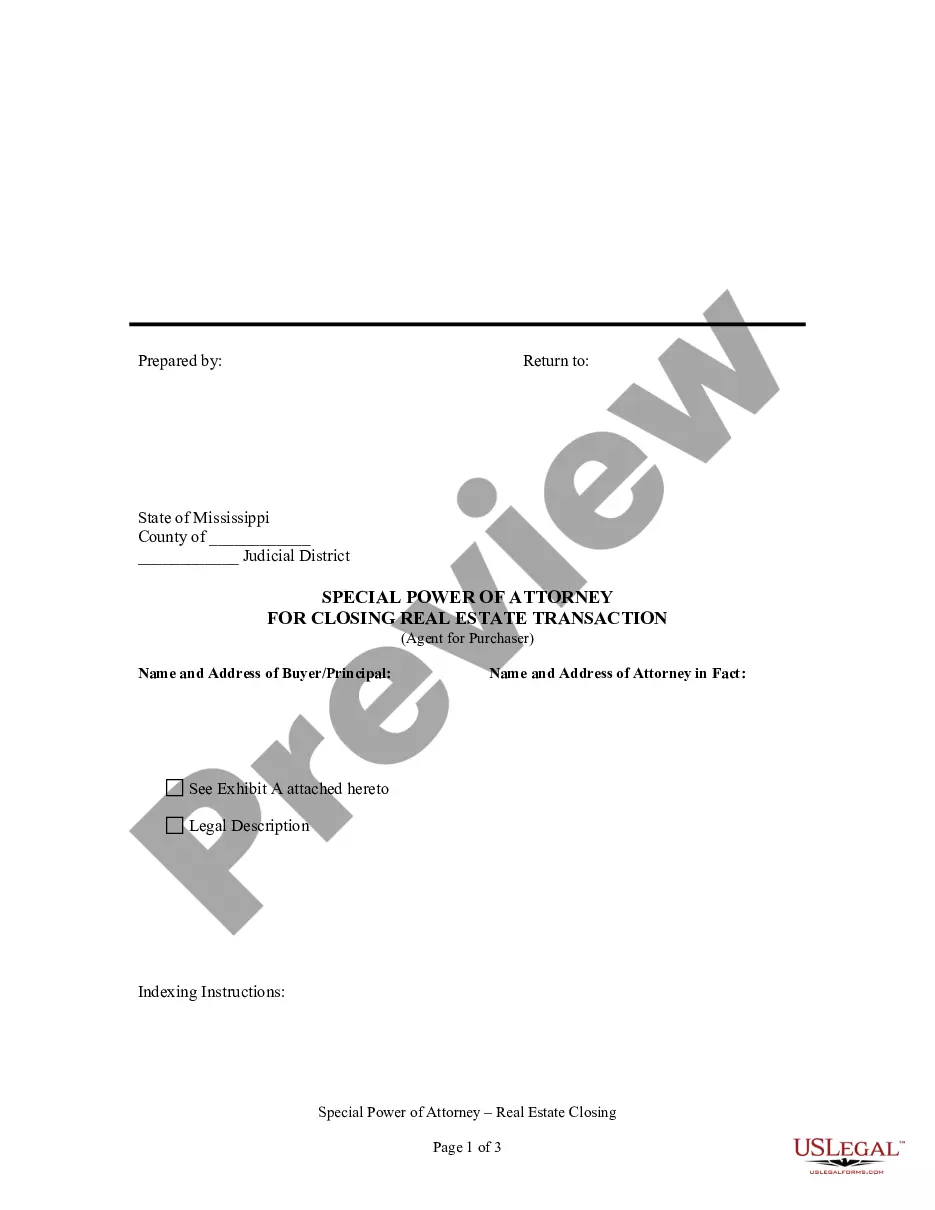

Mississippi Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser

Description Special Power Of Attorney For Deed Of Sale

How to fill out Mississippi Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

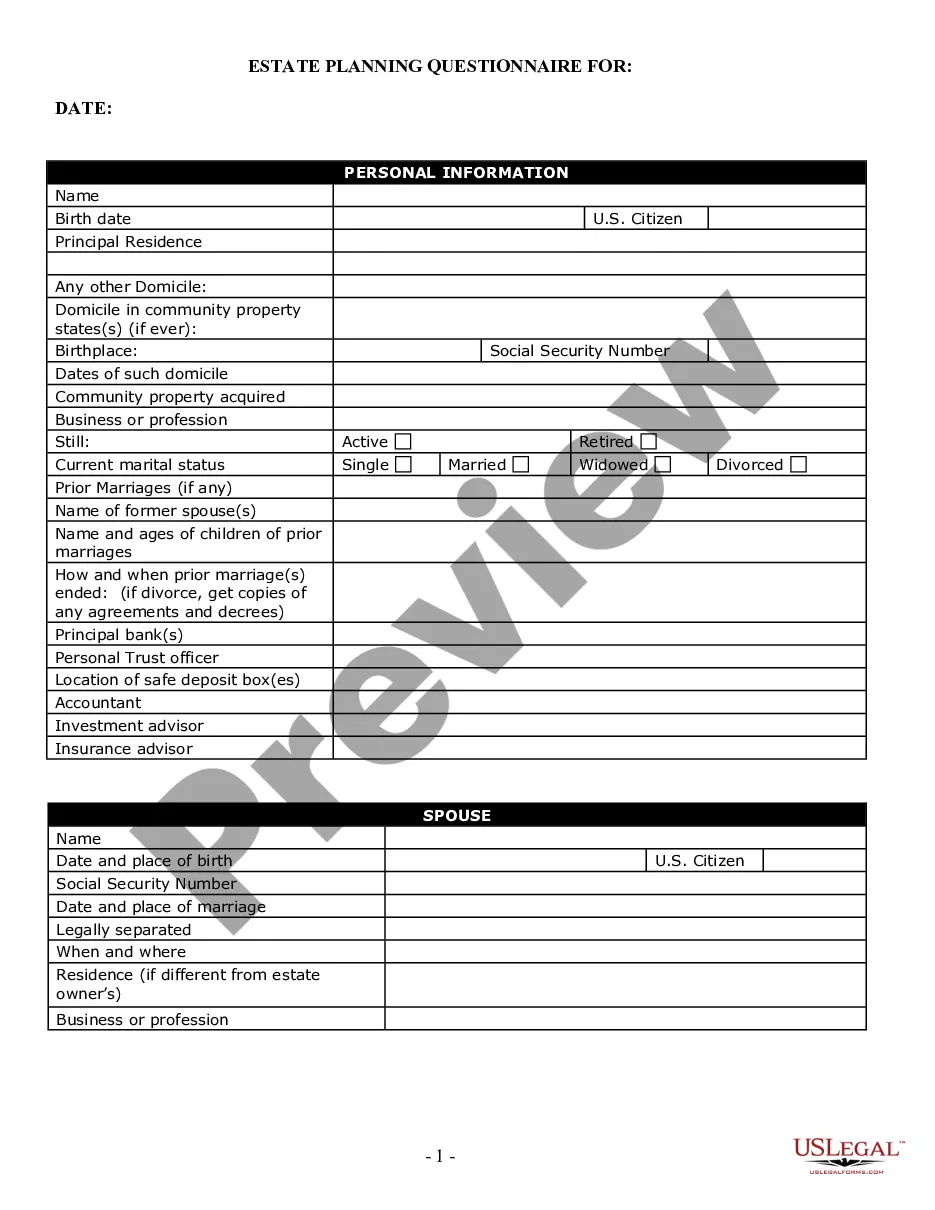

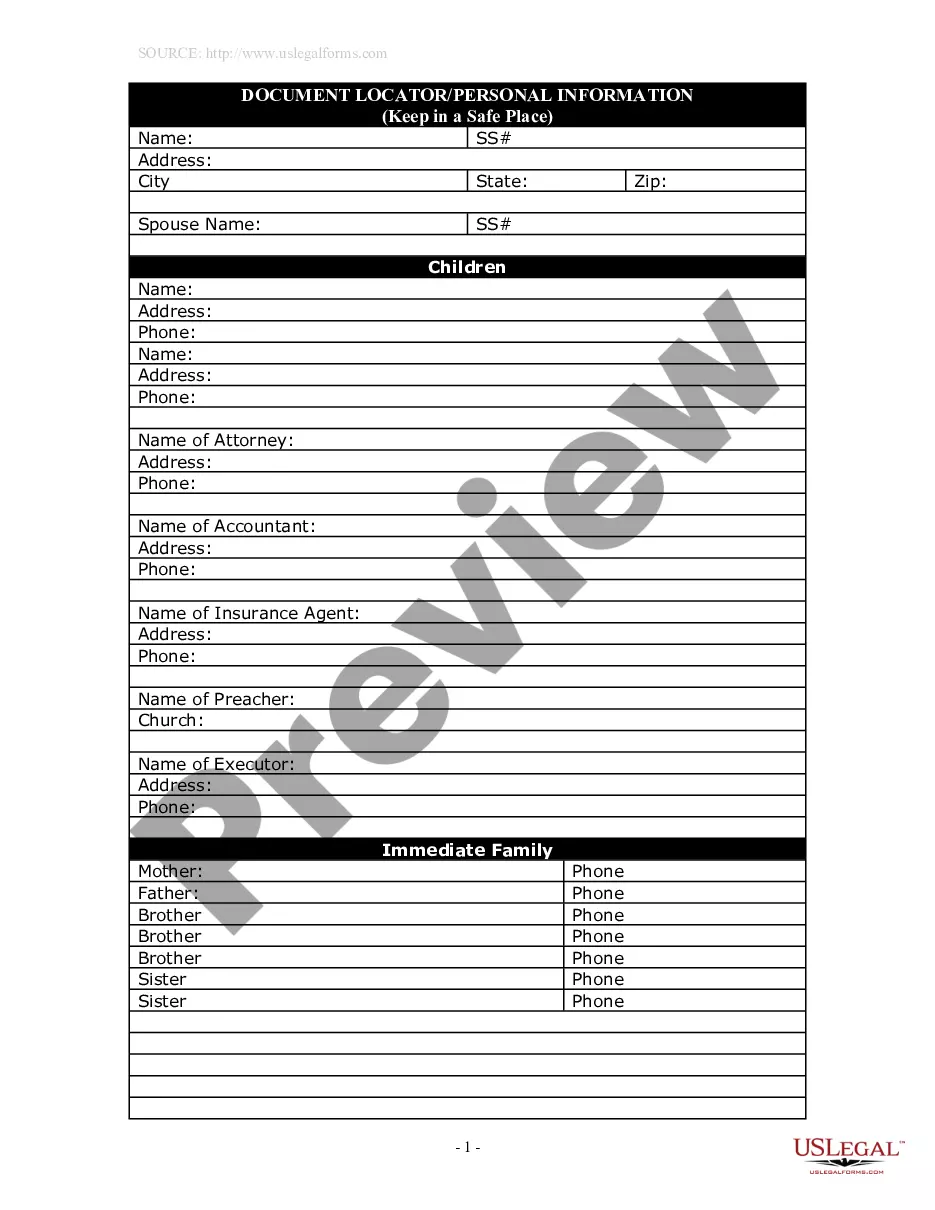

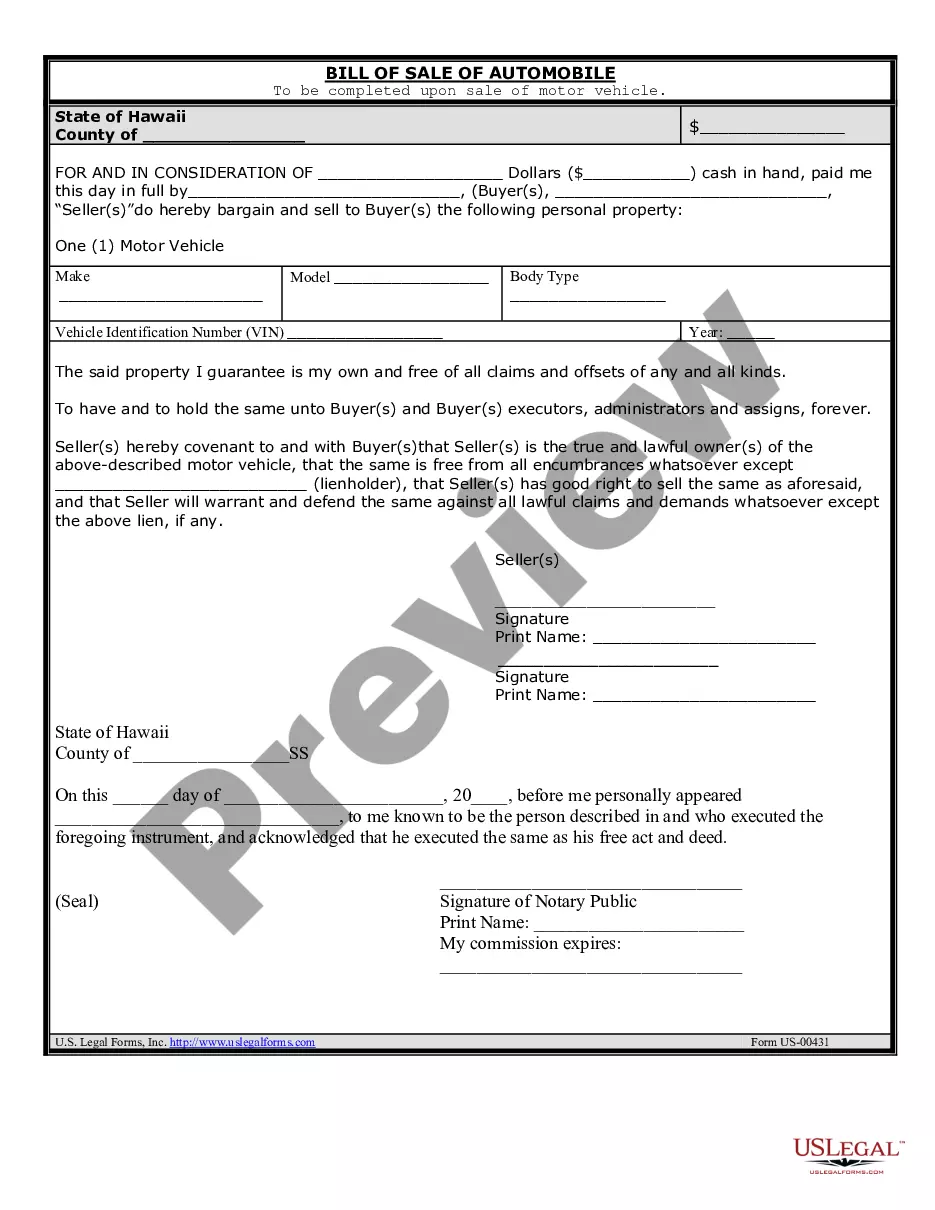

Obtain a printable Mississippi Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser in just several clicks in the most extensive library of legal e-forms. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the #1 supplier of affordable legal and tax templates for US citizens and residents on-line starting from 1997.

Users who already have a subscription, must log in directly into their US Legal Forms account, get the Mississippi Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser see it saved in the My Forms tab. Customers who do not have a subscription are required to follow the steps below:

- Ensure your form meets your state’s requirements.

- If available, read the form’s description to find out more.

- If accessible, review the shape to see more content.

- When you’re sure the form meets your requirements, click on Buy Now.

- Create a personal account.

- Select a plan.

- via PayPal or visa or mastercard.

- Download the template in Word or PDF format.

As soon as you have downloaded your Mississippi Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser, it is possible to fill it out in any online editor or print it out and complete it by hand. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific forms.

Form popularity

FAQ

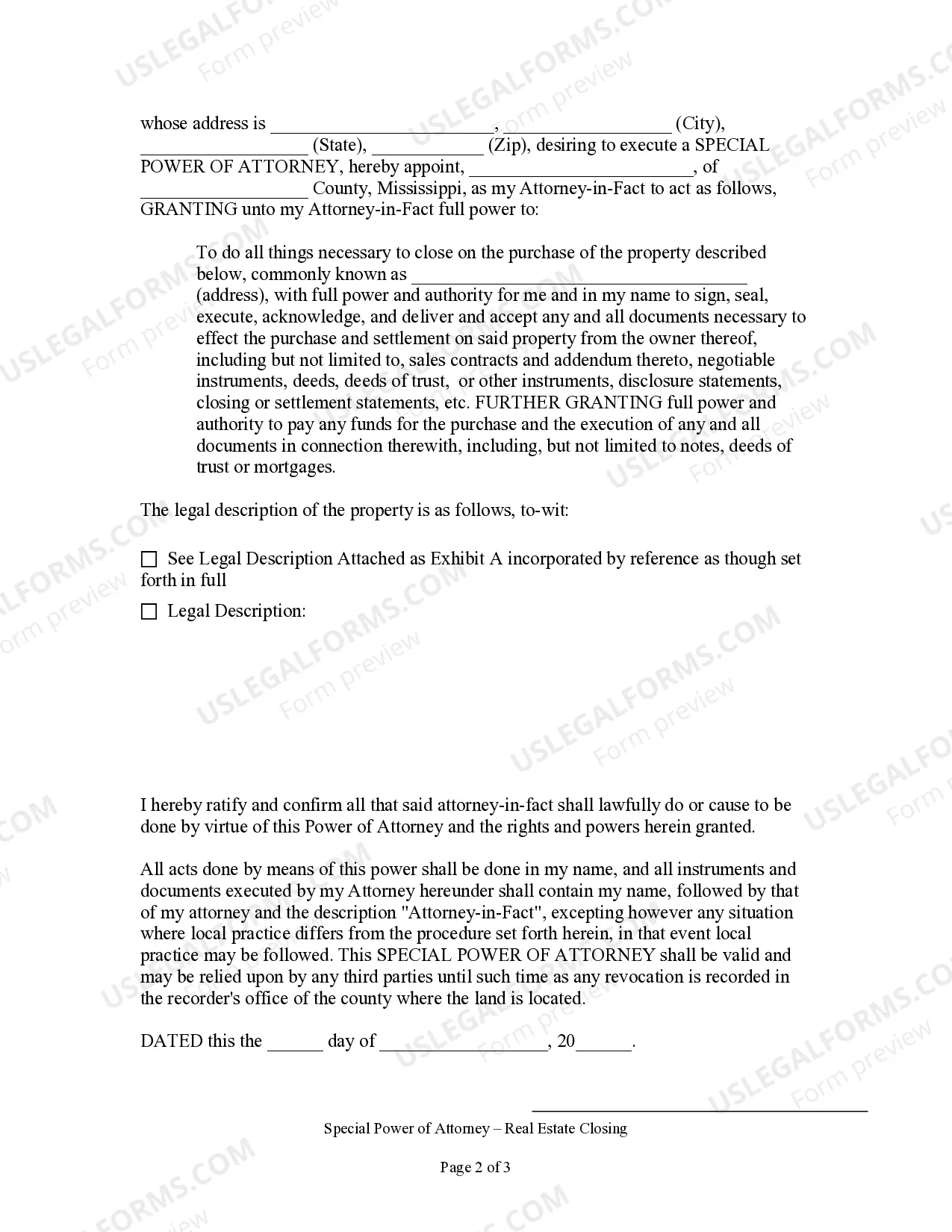

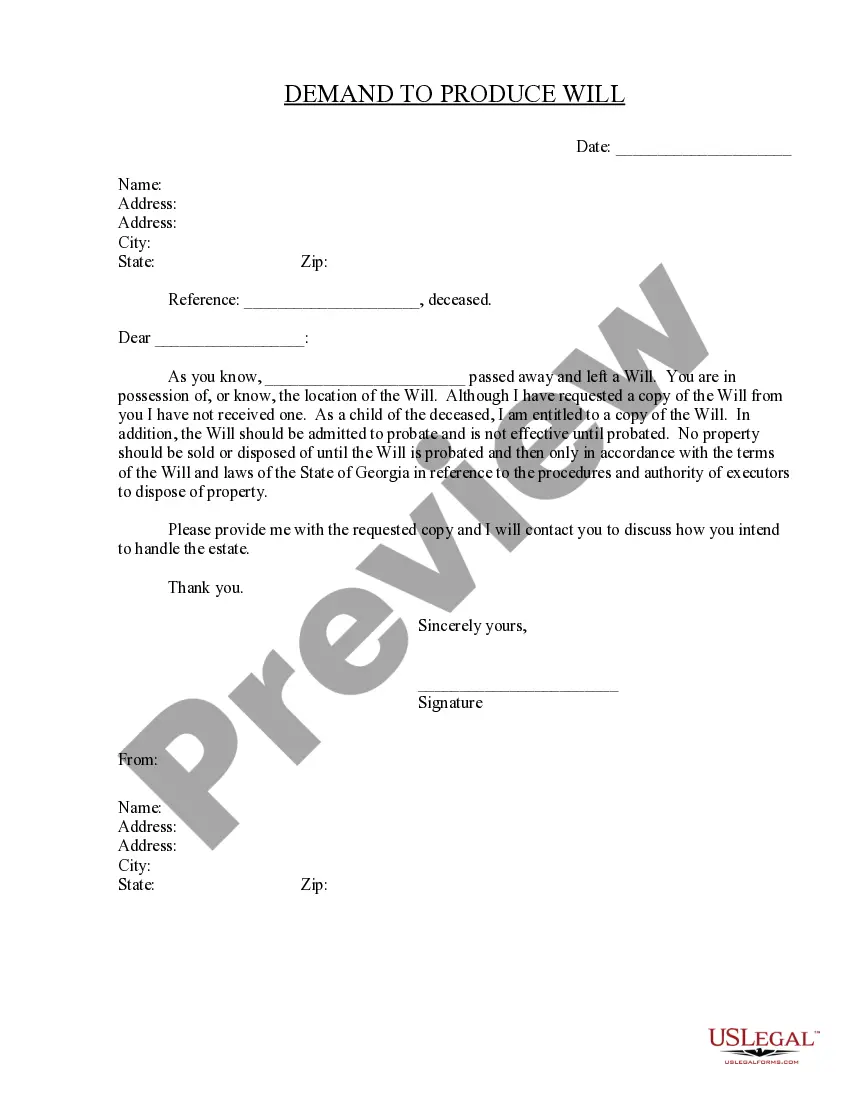

Choose the limited power of attorney made for your state. Input personal information about both the principal and the agent or attorney-in-fact. Explain the powers of the agent. Include the date the limited power of attorney expires or will be revoked.

Choose the limited power of attorney made for your state. Input personal information about both the principal and the agent or attorney-in-fact. Explain the powers of the agent. Include the date the limited power of attorney expires or will be revoked.

What's the difference between durable and general power of attorney? A general power of attorney ends the moment you become incapacitated.A durable power of attorney stays effective until the principle dies or until they act to revoke the power they've granted to their agent.

Draft a list of special powers. Decide what powers are springing. Pick an agent and a successor agent. Note the expiration date. Compile the information into one document. Execute the power of attorney letter.

You can draft a durable power of attorney by writing out or typing the document, which should include the date, your full name, and speech that clearly identifies the document as a durable power of attorney that applies even in the case of your incapacitation.

A limited PoA, amongst other things, grants the PoA holder access and permission to execute trades/orders on your trading account, on your behalf. However, it does not allow the PoA holder to perform withdrawals requests or transfer of funds. All withdrawals must be requested by the authorized signatory of the account.

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner.Before signing an LPOA, the client should be aware of the specific functions they have delegated to the portfolio manager, as the client remains liable for the decisions.

The non-durable power of attorney is used only for a set period of time and usually for a particular transaction in which you grant your agent authority to act on your behalf. Once the transaction is completed, or should the principal become incapacitated during this time, the non-durable power of attorney ceases.

The durable power of attorney is almost always required. This instrument gives another person specific powers to sign for an individual in a real estate transaction where the exact name and description of the property is stated in the document.