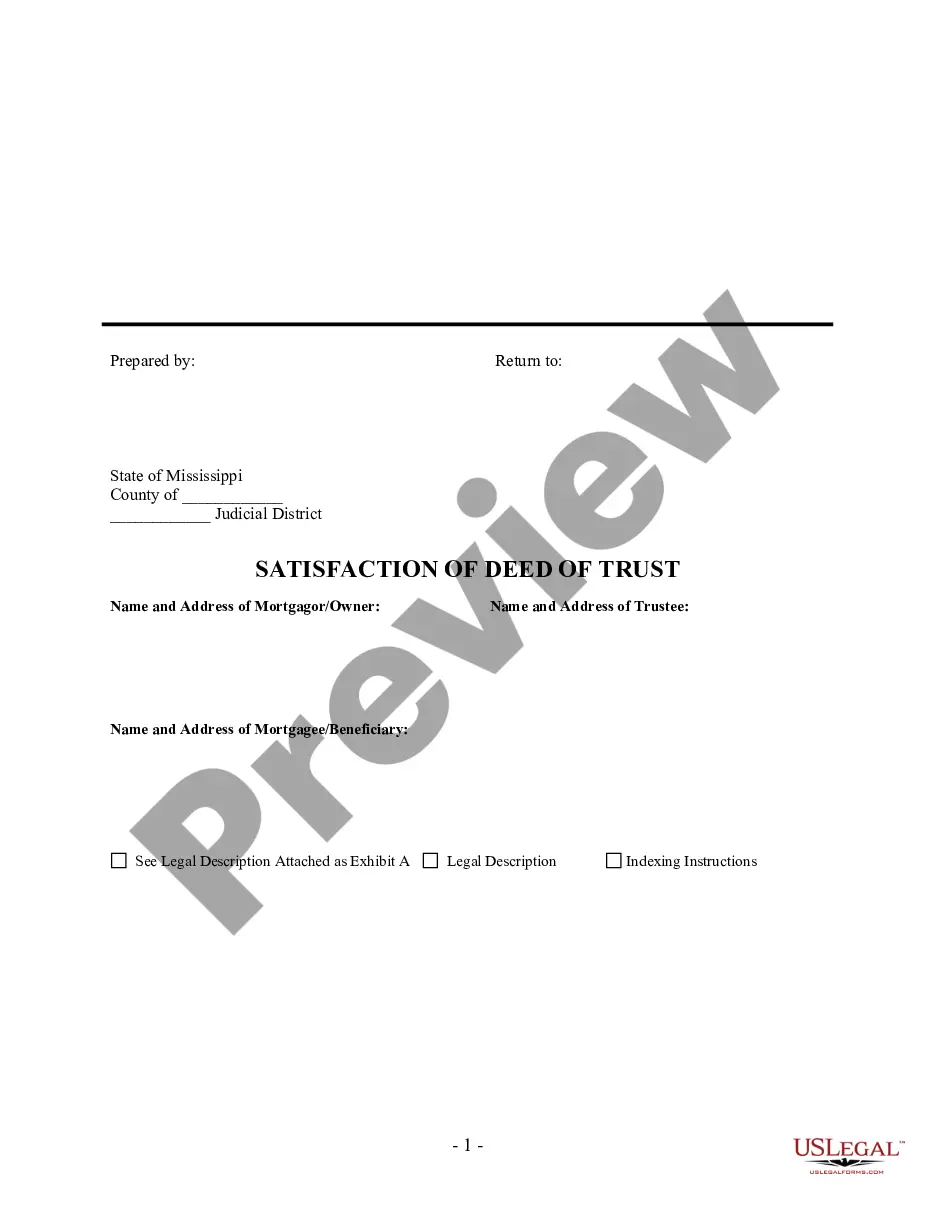

Deed Of Trust Release

Description Mortgagor Released Satisfied

How to fill out Ms Deed Purchase?

- Begin by logging into your US Legal Forms account. If you're a new user, create an account first to access the forms.

- Review the form descriptions and sample previews to ensure the chosen Mississippi Satisfaction, Release or Cancellation of Deed of Trust is suitable for your needs.

- If the desired form isn't meeting your requirements, use the search function to find additional templates that fit.

- Once you've selected the correct form, click on the Buy Now option, and choose your preferred subscription plan.

- Complete your payment by entering your credit card information or through PayPal for a hassle-free transaction.

- After purchasing, download your document directly to your device. You can also access it anytime via the My Forms section.

In conclusion, US Legal Forms provides a user-friendly method for acquiring legal documents like the Mississippi Satisfaction, Release or Cancellation of Deed of Trust. With a vast collection of over 85,000 editable forms, users can be assured they’ll find what they need while receiving expert support.

Start your journey with US Legal Forms today and discover how easy handling legal documents can be!

Ms Deed Print Form popularity

Trust Deed Described Other Form Names

Ms Deed Buy FAQ

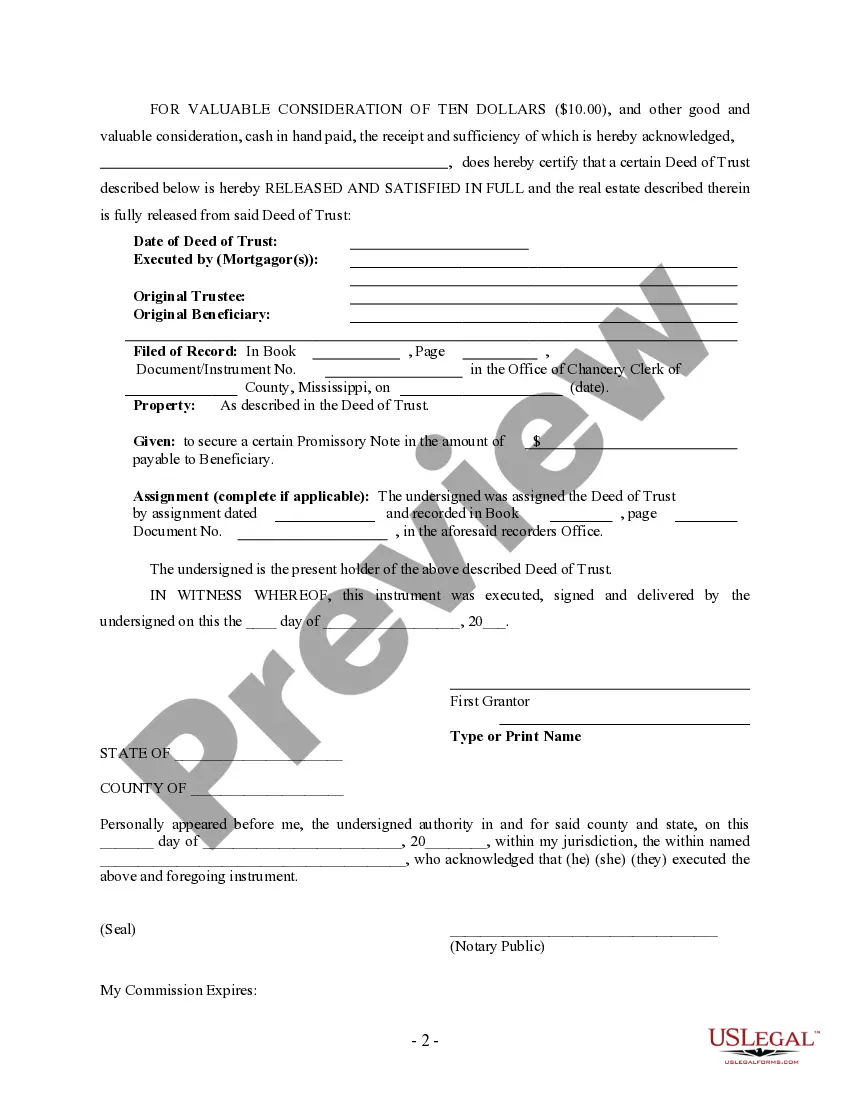

While a mortgage involves two parties, a deed of trust involves three: the trustor (the borrower) the lender (sometimes called a "beneficiary"), and. the trustee.

A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes. As security for the promissory notes, the borrower transfers a real property interest to a third-party trustee.

A deed of release or release deed is a legal document that removes the claim of a person from an immovable property and transfers his/her share to the co-owner. The release deed procedure is executed in the sub-registrars office and both the parties are required to be present for signing it.

A deed of release literally releases the parties to a deal from previous obligations, such as payments under the term of a mortgage because the loan has been paid off. The lender holds the title to real property until the mortgage's terms have been satisfied when a deed of release is commonly entered into.

A deed of trust is a legal document that is the security for a real estate loan. The document itself is recorded with the county recorder or registrar of titles in the county where the real estate is located.

The deed can be re-written to reflect changes, but it needs the consent of both parties. If you want to make substantial changes to the deed, it's typically best to get a new one written. If changes are only minor, you can enter a deed of variation.

A Deed of Trust is a three party document prepared, signed and recorded to secure repayment of a loan. The Borrower (property owner) is named as Trustor, the Lender is called the Beneficiary, and a third party is called a Trustee.

Giving the wrong legal address for the property or the wrong amount of the debt can render the deed unenforceable. In some cases, the error is easy to fix, and the court will rule the deed is enforceable.

In a deed of trust, the borrower is called the trustor and the lender is the beneficiary. The trustee holds title to the property until the trustor has fully repaid the loan to the beneficiary, at which time the lender notifies the trustee, who then transfers full title of the property to the trustor.