Satisfaction, Release or Cancellation of Deed of Trust by Corporation

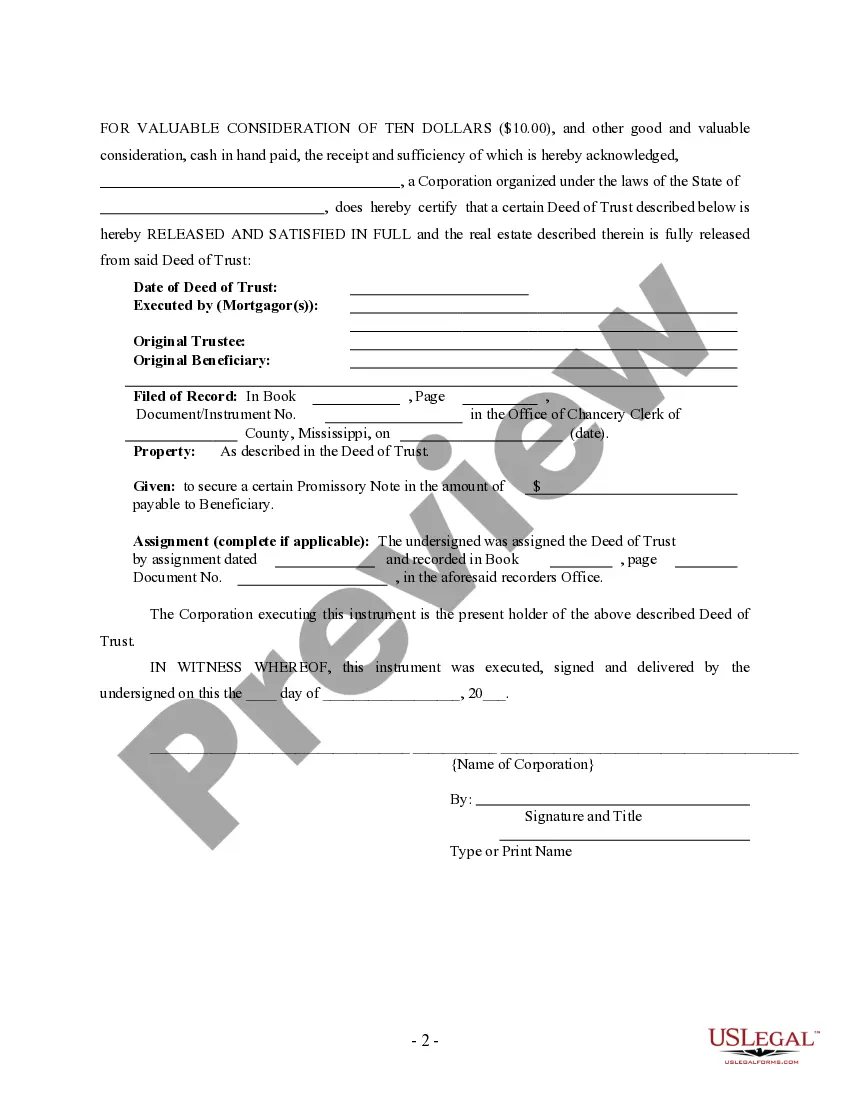

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Mississippi Law

Assignment: Assignments in whole or in part of any indebtedness secured by mortgage, deed of trust, or other lien of record, shall be entered on the margin of the record of the lien or said assignment shall be acknowledged and filed for record.

Demand to Satisfy: Upon full payoff, borrower may make written demand upon the lender to satisfy the deed of trust, whereupon lender has one month to do so or face liability.

Recording Satisfaction: Any mortgagee or cestui que trust, having received full payment of money due, shall enter satisfaction upon the margin of the record of the mortgage or deed of trust, which entry shall be attested by the clerk of the chancery court and discharge and release the same.

Marginal Satisfaction: Having received full payment of the money due by the deed of trust, lender shall enter satisfaction upon the margin of the record of the deed of trust, which entry shall be attested by the clerk of the chancery court and discharge and release the same.

Penalty: If not satisfied of record within 1 month of written request, penalty of $200 and liability for other damages.

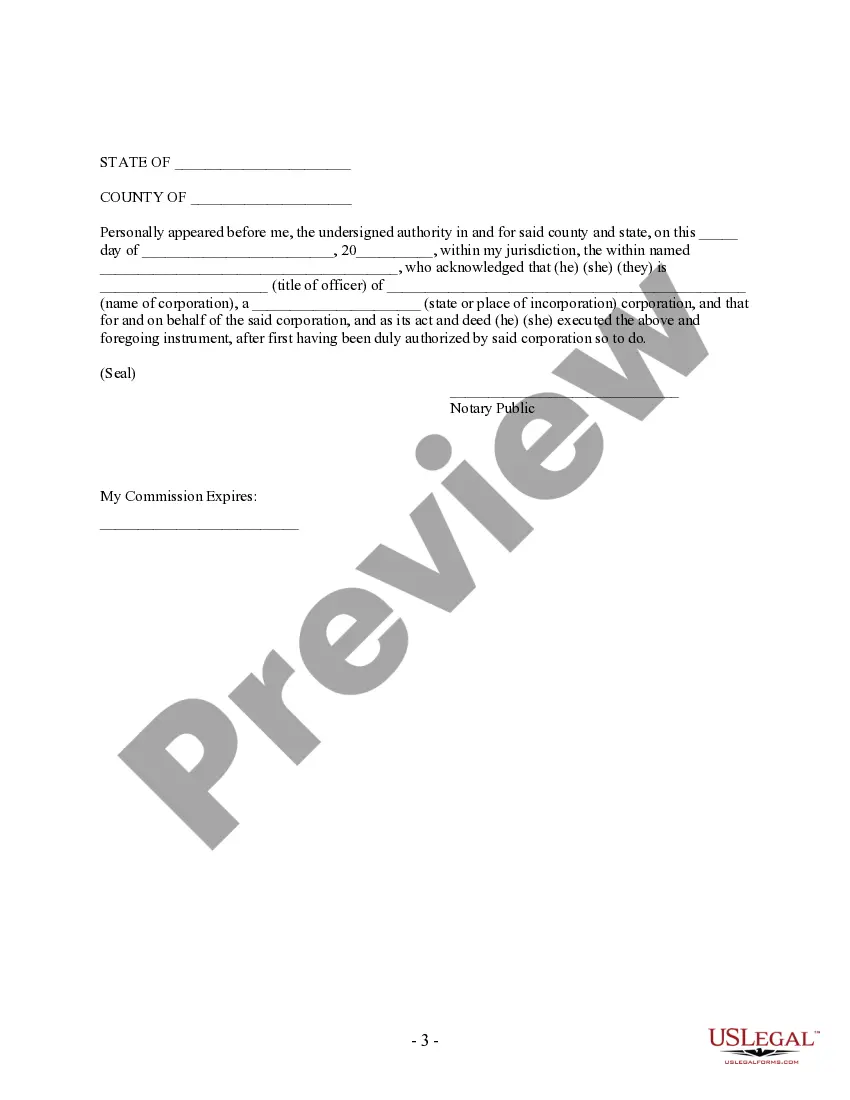

Acknowledgment: An assignment or satisfaction must contain a proper Mississippi acknowledgment, or other acknowledgment approved by Statute.

Mississippi Statutes

§ 89-5-17. Assignments of indebtedness to be marked on record

Except as provided in Section 89-5-37, all assignments in whole or in part of any indebtedness secured by mortgage, deed of trust, or other lien of record, shall be entered on the margin of the record of the lien or said assignment shall be acknowledged and filed for record, and if the assignor or assignee of said indebtedness fail to comply with the provisions of this section the debtor shall be fully protected in transactions with the holder of record in the absence of actual notice of the assignment.

§ 89-5-21. Entry of satisfaction upon record of mortgage or deed of trust

(1) Except as otherwise provided in subsections (3), (4) and (5), any mortgagee or cestui que trust, or assignee of any mortgagee or cestui que trust, of real or personal estate, having received full payment of the money due by the mortgage or deed of trust, shall enter satisfaction upon the margin of the record of the mortgage or deed of trust, which entry shall be attested by the clerk of the chancery court and discharge and release the same, and shall bar all actions or suits brought thereon, and the title shall thereby revest in the grantor.

(2) Any such mortgagee or cestui que trust, or such assignee, by himself or his attorney, who does not, after payment of all sums owed, within one (1) month after written request, cancel on the record the mortgage or deed of trust shall forfeit the sum of Two Hundred Dollars ($ 200.00), which can be recovered by suit on part of the party aggrieved, and if after request, he fails or refuses to make such acknowledgment of satisfaction, the person so neglecting or refusing shall forfeit and pay to the party aggrieved any sum not exceeding the mortgage money, to be recovered by action; but such entry of satisfaction may be made by anyone authorized to do it by the written authorization of the mortgagee or beneficiary, duly acknowledged and recorded, and shall have the same effect as if done by the mortgagee or beneficiary.

(3) With respect to a mortgage or deed of trust which states on its face that it secures a line of credit, satisfaction of record shall be accomplished and extinguishment shall occur as provided in subsection (5).

(4) As used in this section, the term "line of credit" means any loan, extension of credit or financing arrangement where the lender has agreed to make additional or future advances.

(5) Any mortgagee or cestui que trust, or the assignee of a mortgagee or cestui que trust, under a mortgage or deed of trust securing a line of credit shall, upon (a) the termination or maturity of the line of credit and the payment of all sums owing in connection with the line of credit, or (b) the payment of all sums owing in connection with the line of credit and a written request by the debtor to cancel the line of credit and the mortgage or deed of trust securing the line of credit, enter satisfaction upon the margin of the record of the mortgage or deed of trust, which entry shall be attested by the clerk of the chancery court and discharge and release the same, and shall bar all actions or suits brought thereon, and the title shall thereby revest in the grantor. For the purpose of this subsection (5), the requirement of a written request by the debtor may be satisfied by a prospective creditor's delivery of a document, signed by the debtor, requesting cancellation of the line of credit and the mortgage or deed of trust securing the line of credit.

§ 89-5-29. Mortgages and deeds of trust on land; how recorded

Except as hereinafter provided, all mortgages and deeds of trust upon land given to secure the payment of money, and all instruments of writing whereby a trustee is substituted under any such deed of trust, and all instruments of writing canceling or satisfaction of any such mortgage or deed of trust, shall be recorded separately from other instruments relating to land or records, and such records shall be called “records of mortgages and deeds of trust on land.”