If you have to comprehensive, obtain, or print legitimate record themes, use US Legal Forms, the largest collection of legitimate types, which can be found on the web. Use the site`s simple and easy practical look for to obtain the papers you want. Various themes for organization and specific reasons are sorted by categories and suggests, or search phrases. Use US Legal Forms to obtain the Mississippi Participating or Participation Loan Agreement in Connection with Secured Loan Agreement with a few clicks.

If you are currently a US Legal Forms buyer, log in in your bank account and click the Acquire button to get the Mississippi Participating or Participation Loan Agreement in Connection with Secured Loan Agreement. You may also gain access to types you in the past delivered electronically from the My Forms tab of your bank account.

If you work with US Legal Forms for the first time, follow the instructions beneath:

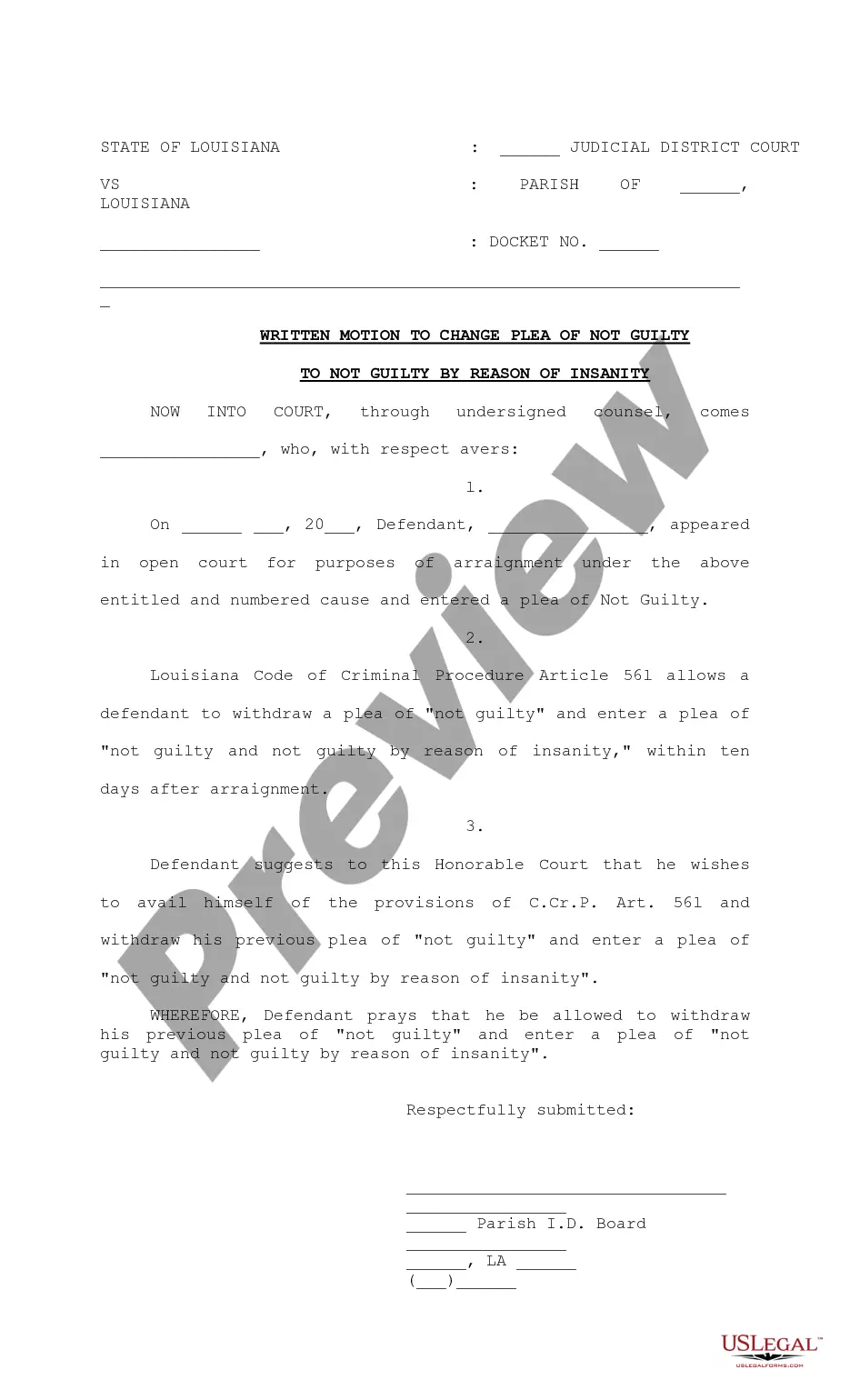

- Step 1. Be sure you have selected the form for that correct metropolis/nation.

- Step 2. Make use of the Review method to look over the form`s information. Do not forget about to read through the description.

- Step 3. If you are unhappy with the kind, make use of the Look for area near the top of the monitor to locate other versions of your legitimate kind template.

- Step 4. Once you have found the form you want, select the Purchase now button. Select the pricing prepare you favor and add your qualifications to sign up on an bank account.

- Step 5. Approach the transaction. You may use your Мisa or Ьastercard or PayPal bank account to perform the transaction.

- Step 6. Select the formatting of your legitimate kind and obtain it on your own product.

- Step 7. Complete, change and print or signal the Mississippi Participating or Participation Loan Agreement in Connection with Secured Loan Agreement.

Every single legitimate record template you get is the one you have forever. You have acces to every kind you delivered electronically within your acccount. Click on the My Forms section and pick a kind to print or obtain once again.

Compete and obtain, and print the Mississippi Participating or Participation Loan Agreement in Connection with Secured Loan Agreement with US Legal Forms. There are millions of professional and express-particular types you can use for the organization or specific needs.