This agreement allows one lien holder to subordinate its deed of trust to the lien of another lien holder. For valuable consideration, a particular deed of trust will at all times be prior and superior to the subordinate lien.

Mississippi Subordination Agreement of Deed of Trust

Description

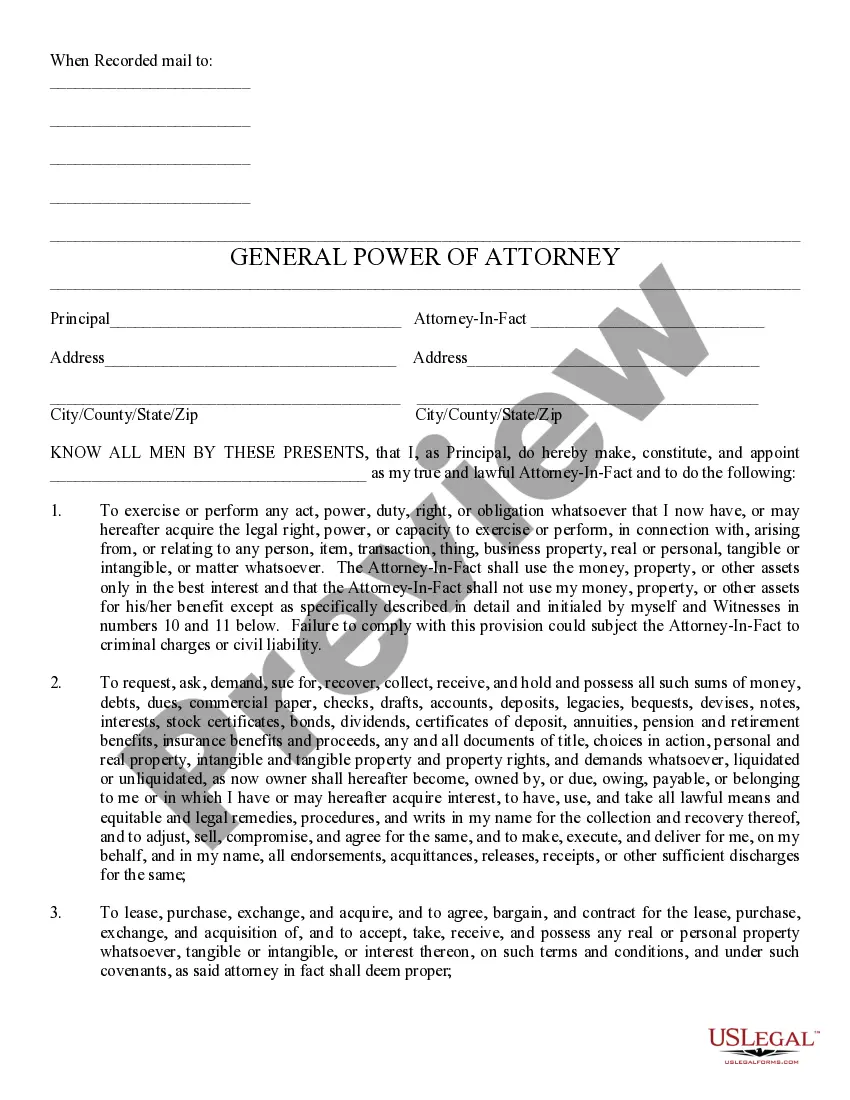

How to fill out Subordination Agreement Of Deed Of Trust?

If you need to complete, download, or print authorized file layouts, use US Legal Forms, the greatest collection of authorized forms, that can be found online. Use the site`s simple and easy handy research to obtain the files you need. Various layouts for organization and person reasons are categorized by types and suggests, or search phrases. Use US Legal Forms to obtain the Mississippi Subordination Agreement of Deed of Trust within a handful of click throughs.

Should you be presently a US Legal Forms client, log in in your account and click on the Obtain key to find the Mississippi Subordination Agreement of Deed of Trust. You can even entry forms you in the past saved in the My Forms tab of your respective account.

If you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the shape for the correct metropolis/land.

- Step 2. Use the Review option to examine the form`s content material. Don`t forget about to read through the information.

- Step 3. Should you be unsatisfied with the develop, utilize the Look for industry on top of the monitor to discover other versions in the authorized develop design.

- Step 4. Upon having discovered the shape you need, select the Purchase now key. Opt for the costs strategy you prefer and include your qualifications to sign up for the account.

- Step 5. Approach the deal. You can use your Мisa or Ьastercard or PayPal account to complete the deal.

- Step 6. Choose the file format in the authorized develop and download it in your gadget.

- Step 7. Total, edit and print or signal the Mississippi Subordination Agreement of Deed of Trust.

Each authorized file design you acquire is the one you have forever. You have acces to each develop you saved with your acccount. Click the My Forms area and select a develop to print or download yet again.

Remain competitive and download, and print the Mississippi Subordination Agreement of Deed of Trust with US Legal Forms. There are millions of professional and express-particular forms you can utilize for the organization or person demands.

Form popularity

FAQ

The new lender prepares the subordination agreement in conjunction with the subordinating lienholder. Then the parties typically sign the agreement. But in some cases, just the subordinating lender will need to sign the paperwork.

An example is a trust document that includes a subordinate clause. This requires it to state that once the primary lien becomes active, a secondary lien becomes automatically subordinate. For instance, if a trust pays education funding as a first priority, the first lien is tuition.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

Subordination is a way of changing the priority of claims against a debtor so that one creditor or group of creditors (the junior creditor(s)) agree that their debt will not be paid until debts owed to another creditor or group of creditors (the senior creditor(s)) have been paid.

Subordinate Deed of Trust means the deeds of trust granted by Borrower to secure the obligation of Borrower to repay the Subordinate Loan.

A Subordination Agreement focuses on creditor priorities and security claims, providing legal certainty to creditors when assessing repayment risk. If a credit event (or default) occurs, a subordination agreement provides a senior lender superior repayment rights than the subordinated lender.

Subordination agreements are used to legally establish the order in which debts are to be repaid in the event of a foreclosure or bankruptcy. In return for the agreement, the lender with the subordinated debt will be compensated in some manner for the additional risk.

Lenders can execute what are referred to as executory subordination agreements. Executory subordination agreements are essentially a promise to enter into a subordination agreement in the future if another loan enters the picture, like a construction loan.