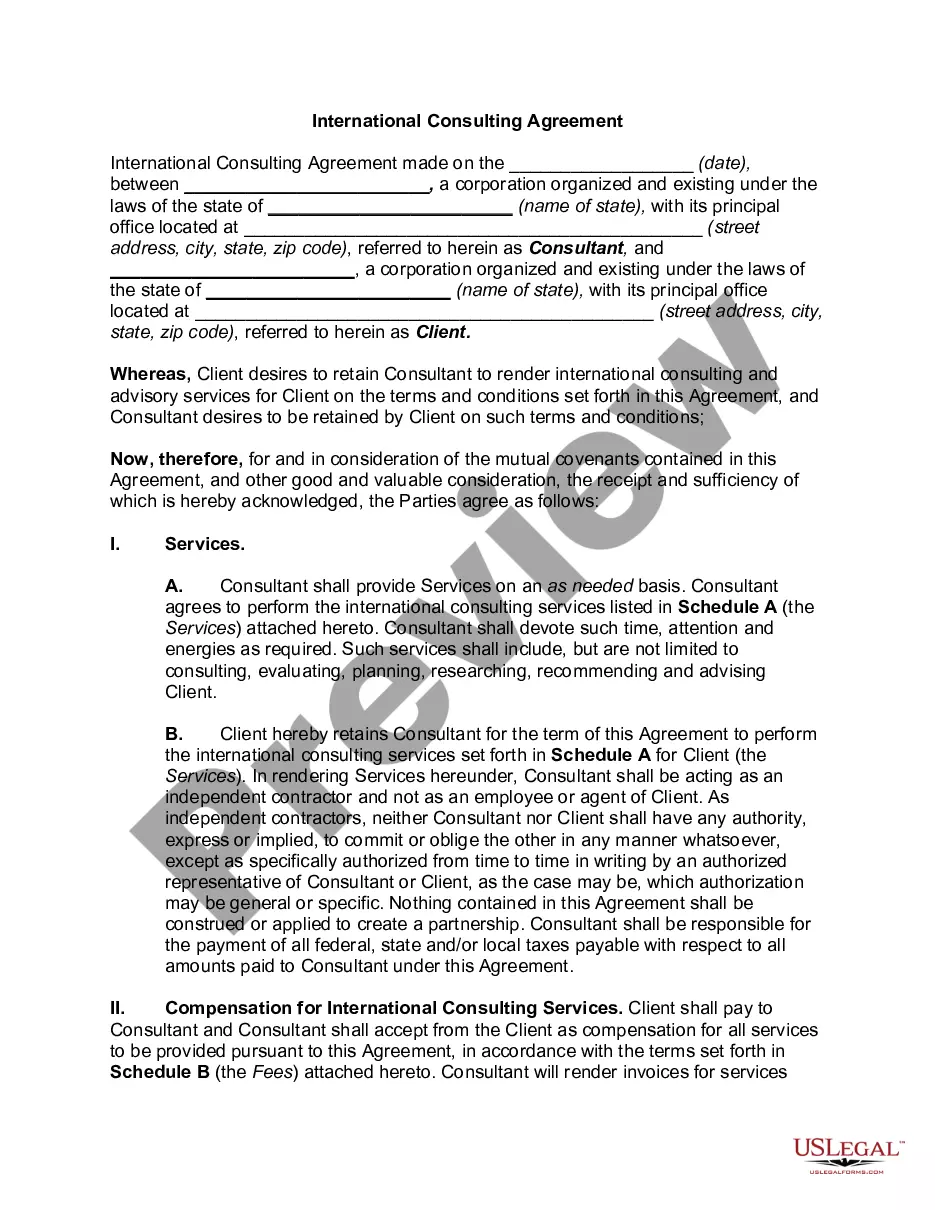

Mississippi International Independent Contractor Agreement

Description

How to fill out International Independent Contractor Agreement?

If you desire to access, acquire, or print permitted document formats, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the site’s straightforward and efficient search function to locate the documents you need.

Various templates for corporate and personal purposes are organized by categories and jurisdictions, or keywords.

Step 3. If you are dissatisfied with the document, utilize the Search bar at the top of the screen to find alternative versions of the legal document template.

Step 4. Once you have located the form you require, select the Purchase now button. Choose the pricing plan you prefer and provide your details to register for an account.

- Utilize US Legal Forms to find the Mississippi International Independent Contractor Agreement with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to access the Mississippi International Independent Contractor Agreement.

- You can also access forms you have previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you have selected the form relevant to your city/state.

- Step 2. Use the Review option to check the form’s details. Remember to read the information carefully.

Form popularity

FAQ

Yes, you can be paid in USD and yes, the payment can be deposited in your US bank account.

Generally, no Form 1099 is required for payments to foreign contractors or services performed outside the US and no withholding is required (as long as the foreign contractor is not a US person and the services are wholly performed outside the U.S).

How to approach paying foreign contractors. There is no requirement for U.S. companies to file an IRS 1099 Form to pay a foreign contractor. But as noted above, the company should require the contractor file IRS Form W-8BEN, which formally certifies the worker's foreign status.

If you wish to engage a contractor to provide your business services, it is recommended that you enter into a Contractor Agreement. This is especially important when it comes to hiring a foreign contractor as language barriers and cultural differences can lead to miscommunication.

How to approach paying foreign contractors. There is no requirement for U.S. companies to file an IRS 1099 Form to pay a foreign contractor. But as noted above, the company should require the contractor file IRS Form W-8BEN, which formally certifies the worker's foreign status.

US company hiring a US citizen living abroad US citizens are subject to the same tax rules regardless of their location. The IRS will still consider an independent contractor as a US citizen if they perform the service abroad, even if the contractor is technically a tax resident of another country.

U.S. employers cannot just assume they can pay an individual living in another country to perform work for them in that country without establishing an employment relationship. Even where self-employment is found to be the accurate classification, taxes and fees may still be due in other countries.

US companies can hire Canadians as either contractors or employees. For employers wanting to hire Canadian employees, you have two options: create a Canadian entity or engage a PEO. With a PEO, US companies can leave payroll, taxes, and compliance in the hands of experts.

US company hiring a foreign independent contractor living abroad. The US company doesn't need to report the payments they made to the foreign independent contractor to the IRS if they are not US-sourced income. The company also doesn't need to withhold any tax.