Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Mississippi Sample Letter for Change of Venue and Request for Homestead Exemption

Description

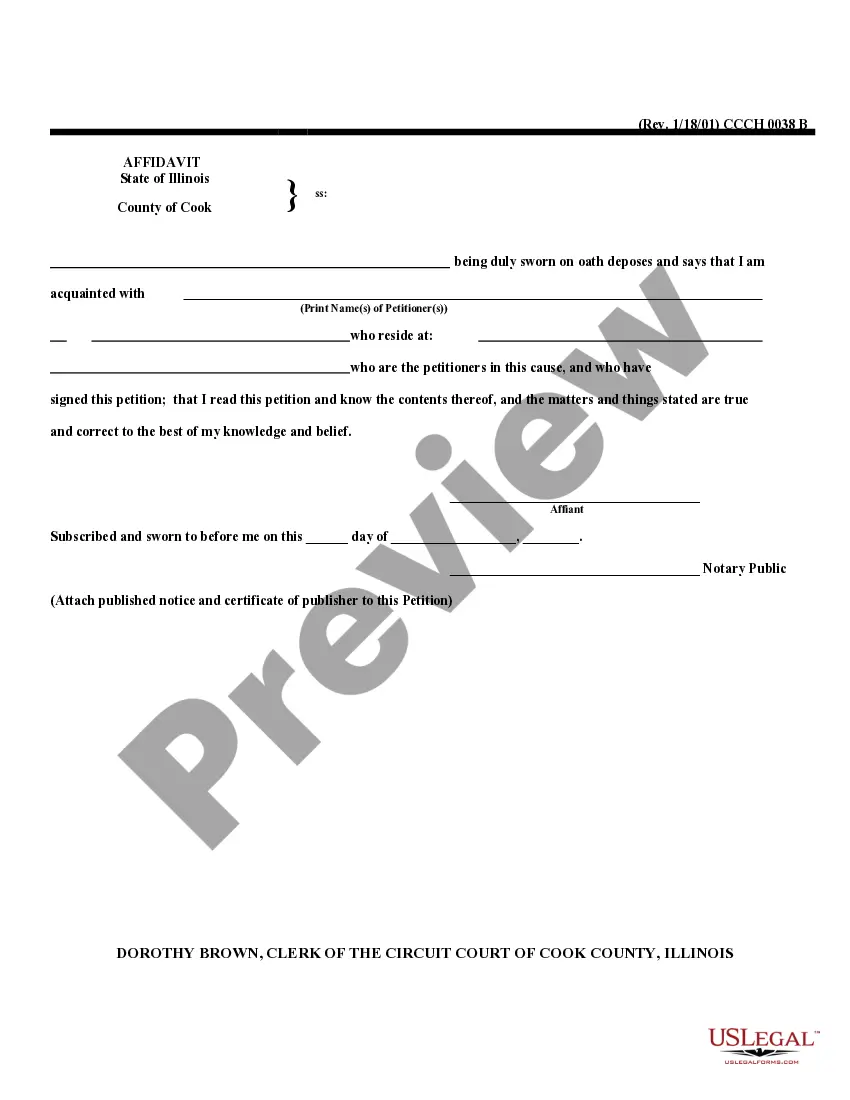

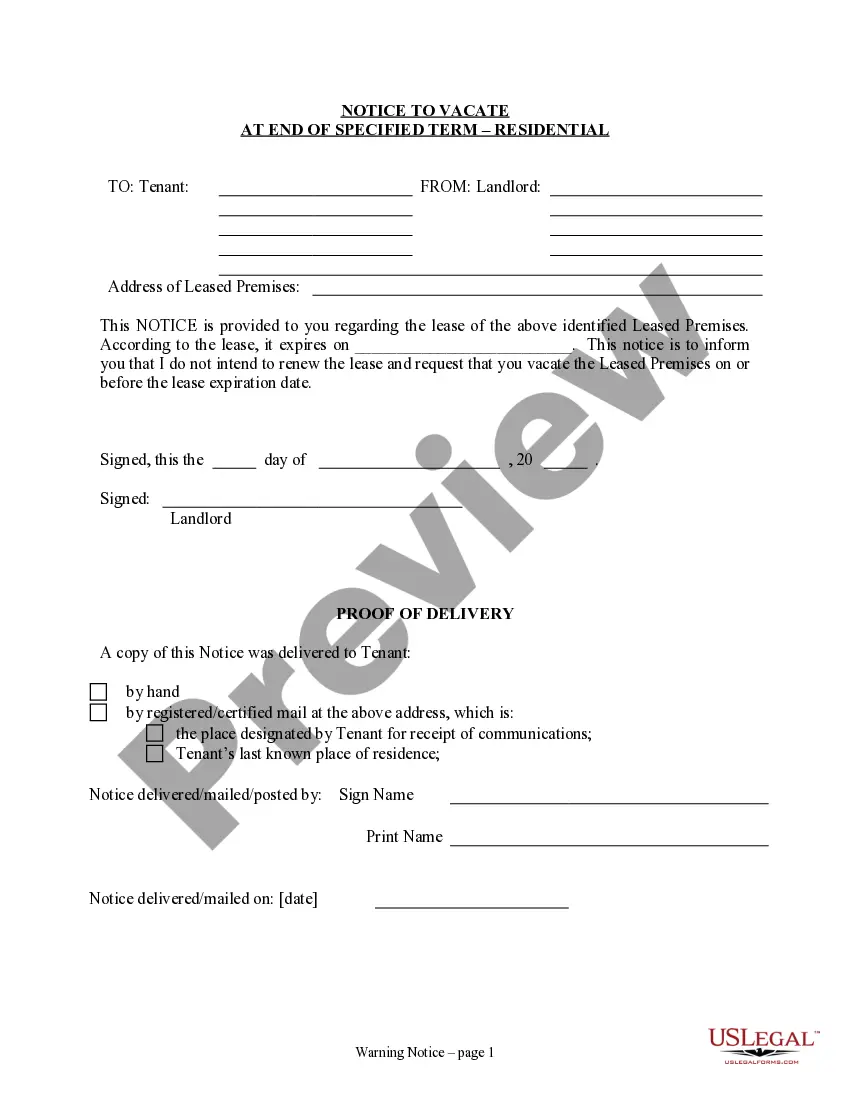

How to fill out Sample Letter For Change Of Venue And Request For Homestead Exemption?

You can spend time on-line attempting to find the legitimate record design that meets the federal and state needs you want. US Legal Forms gives a huge number of legitimate forms which can be analyzed by professionals. It is possible to acquire or produce the Mississippi Sample Letter for Change of Venue and Request for Homestead Exemption from your services.

If you already have a US Legal Forms account, you may log in and click the Obtain button. Afterward, you may comprehensive, edit, produce, or sign the Mississippi Sample Letter for Change of Venue and Request for Homestead Exemption. Every single legitimate record design you purchase is your own property permanently. To acquire another duplicate associated with a obtained kind, proceed to the My Forms tab and click the corresponding button.

If you work with the US Legal Forms site for the first time, follow the easy directions below:

- First, ensure that you have selected the correct record design for the state/town that you pick. Read the kind information to ensure you have chosen the appropriate kind. If offered, make use of the Review button to appear throughout the record design at the same time.

- In order to find another edition in the kind, make use of the Search area to obtain the design that meets your needs and needs.

- After you have discovered the design you desire, simply click Buy now to move forward.

- Pick the pricing prepare you desire, enter your credentials, and sign up for a merchant account on US Legal Forms.

- Comprehensive the deal. You can utilize your charge card or PayPal account to pay for the legitimate kind.

- Pick the structure in the record and acquire it for your product.

- Make modifications for your record if needed. You can comprehensive, edit and sign and produce Mississippi Sample Letter for Change of Venue and Request for Homestead Exemption.

Obtain and produce a huge number of record themes using the US Legal Forms Internet site, which offers the greatest variety of legitimate forms. Use professional and status-particular themes to take on your small business or personal requirements.

Form popularity

FAQ

A person requesting homestead exemption must make a written application, must be a natural person, the head of a family, have ownership and eligible property, occupy the dwelling as a home, and be a Mississippi resident. Each of these requirements are discussed in detail.

Homeowners may also be eligible for the Mississippi homestead exemption. This exempts the first $7,500 in assessed value from taxation, up to a maximum of $300 off your tax bill. Seniors who are 65 or older receive a full exemption on the first $7,500 of their property's assessed value.

Persons who are 65 years of age and older or who are disabled, upon application and proof of eligibility, are exempt from all ad valorem taxes up to $7,500.00 of assessed value.

Application Requirements A copy of your recorded Warranty Deed. Your Mississippi car and/or truck tag numbers. Social Security Numbers for You and Your Spouse if You Are Married. Birth dates for you and your spouse or all parties applying for homestead. Your closing or settlement statement.

To qualify for a homestead exemption the residence must be owner occupied. All applications must be filed between the dates of January 2 and April 1 of each year.

A person requesting homestead exemption must make a written application, must be a natural person, the head of a family, have ownership and eligible property, occupy the dwelling as a home, and be a Mississippi resident.

Persons who are 65 years of age and older or who are disabled, upon application and proof of eligibility, are exempt from all ad valorem taxes up to $7,500.00 of assessed value.

Application for homestead exemption benefits must be filed between January 1 and April 1. The applicant must come in person to the Tax Assessor's office the first time to file for homestead exemption benefits.