Mississippi Promissory Note - Balloon Note

Description

How to fill out Promissory Note - Balloon Note?

It is feasible to spend hours online trying to locate the legal document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal templates that are reviewed by experts.

You can easily download or print the Mississippi Promissory Note - Balloon Note from my services.

If available, use the Preview button to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can complete, alter, print, or sign the Mississippi Promissory Note - Balloon Note.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of a purchased form, visit the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure you have selected the correct document template for the area/city of your choice.

- Review the form details to confirm you have chosen the appropriate template.

Form popularity

FAQ

To get your Mississippi Promissory Note - Balloon Note, check the original lender or individual from whom you received it. You may also request a copy from your attorney or financial institution if they managed the documentation. Using USLegalForms, you can access templates to create or request copies legally and efficiently.

Claiming a Mississippi Promissory Note - Balloon Note involves ensuring that you have all necessary documentation. You must establish ownership and show any relevant transaction records. USLegalForms offers tools and templates that can simplify this process, helping you to claim your promissory note effectively.

To report a Mississippi Promissory Note - Balloon Note on your taxes, you need to include any interest income as part of your taxable income. You report this on Schedule B of your Form 1040. Additionally, if you provided the note to someone, remember to keep a record of any payments you receive, as this information is crucial for accurate reporting.

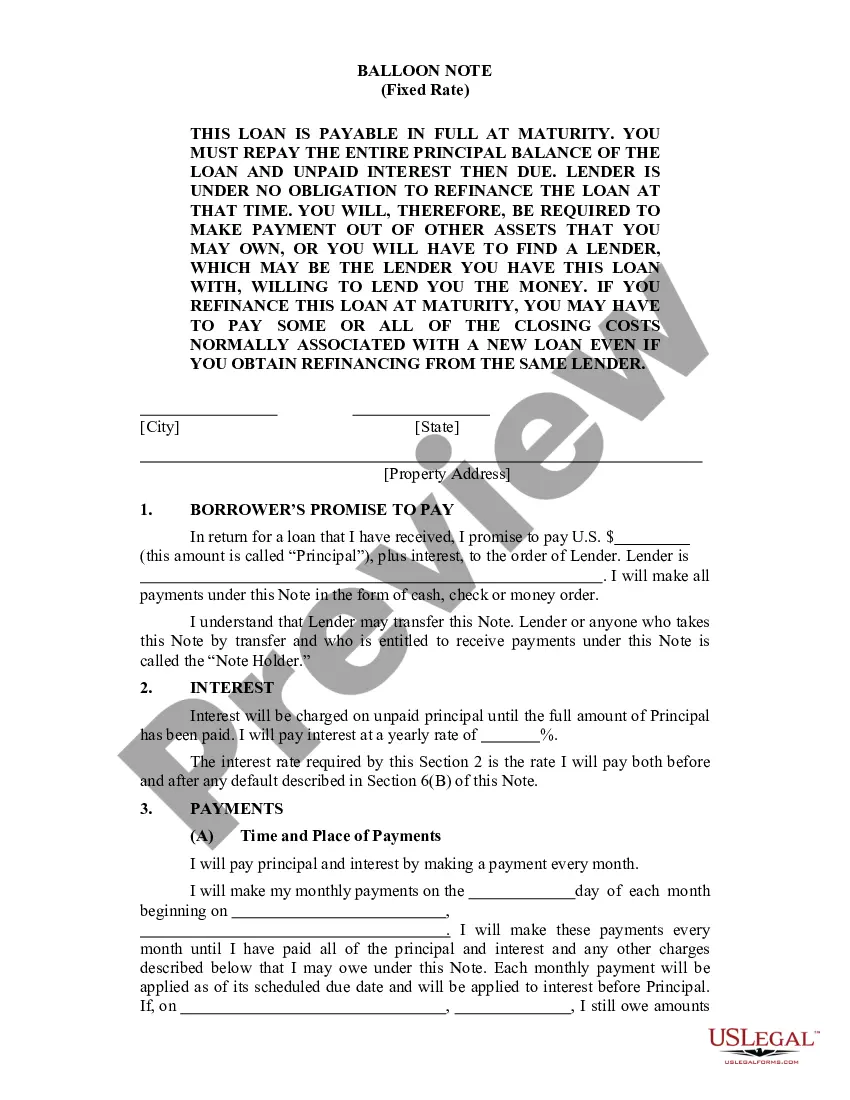

Examples of Mississippi Promissory Notes - Balloon Note include personal loans for home purchases, business loans, or loans between family members. Each note outlines the amount borrowed, the repayment schedule, and any applicable interest rates. These examples highlight the versatility of promissory notes in various financial contexts, ensuring clarity in repayment expectations.

Writing a simple Mississippi Promissory Note - Balloon Note involves drafting a straightforward document that outlines the agreement between the borrower and the lender. Start with the principal amount, specify the interest rate, and clearly state the repayment terms, including the balloon payment. Keeping the language simple helps ensure that both parties fully understand their commitments.

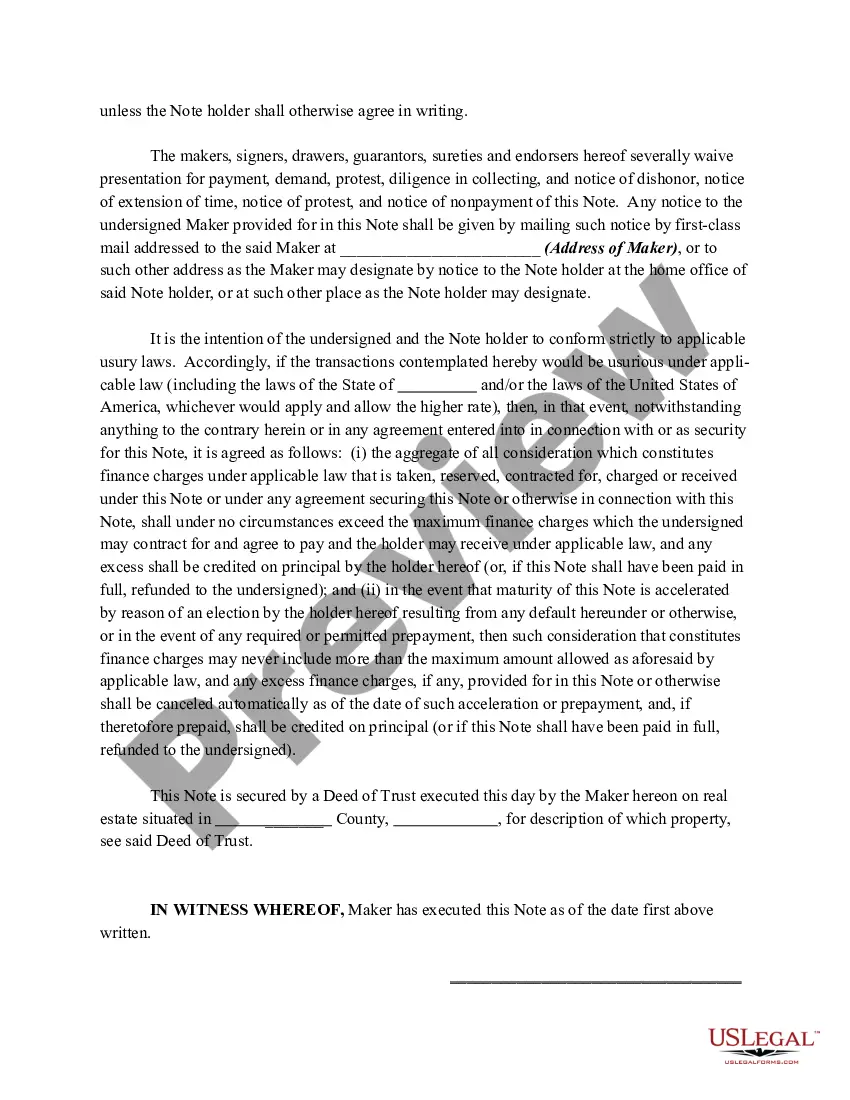

A Mississippi Promissory Note - Balloon Note typically follows a standard format that includes essential information such as the names of the borrower and lender, the principal amount, interest rate, repayment schedule, and the balloon payment due date. This format ensures that all parties understand the agreement clearly. Additionally, it is important to have the note signed and dated by both parties to make it legally binding.

A promissory note can become unenforceable for several reasons, including lack of essential details, missing signatures, or vague language. If either party did not agree to the terms, the document may not hold up during litigation. Additionally, if the terms violate state statutes or public policy, the note may be deemed unenforceable. To avoid these pitfalls, it’s advisable to use accurate templates from platforms like USLegalForms.

Yes, balloon notes are legal in Mississippi, including the Mississippi Promissory Note - Balloon Note format. These notes involve small periodic payments followed by a larger final payment at maturity. However, it's essential to ensure that all terms are clearly outlined and comply with state laws. If you are considering a balloon note, using a reliable template from USLegalForms can help you structure your agreement correctly.

In Mississippi, the validity of a promissory note can vary depending on the terms established in the document. Generally, promissory notes are valid for six years after the due date unless stated otherwise. However, balloon notes typically involve a larger payment at the end of the term, which may affect their validity. To ensure clarity on terms, you might want to consult USLegalForms for guidance.

To claim a promissory note, you must present the original signed document to the debtor. Make sure you understand the terms outlined in the Mississippi Promissory Note - Balloon Note before initiating the claim. In case of disputes, verifying the details of the note and any prior agreements will be beneficial. Consider using US Legal Forms, which provides templates and support for effectively managing claims and disputes related to promissory notes.