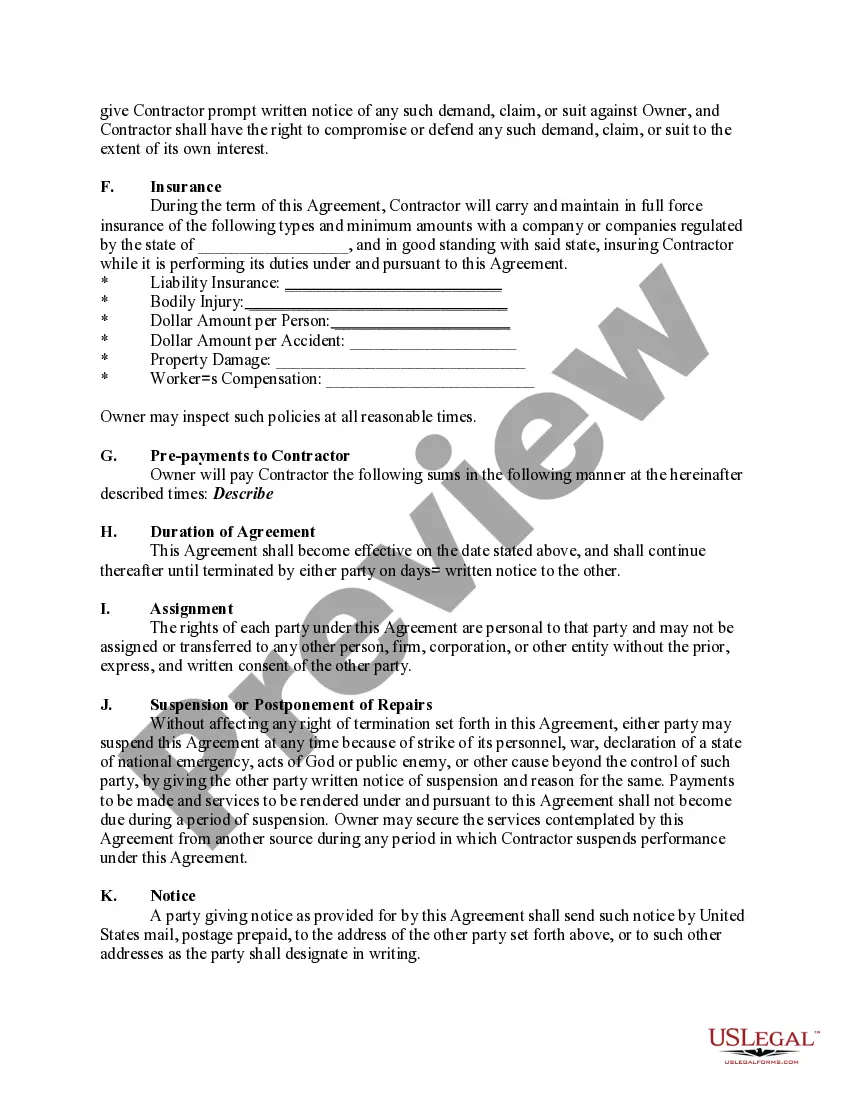

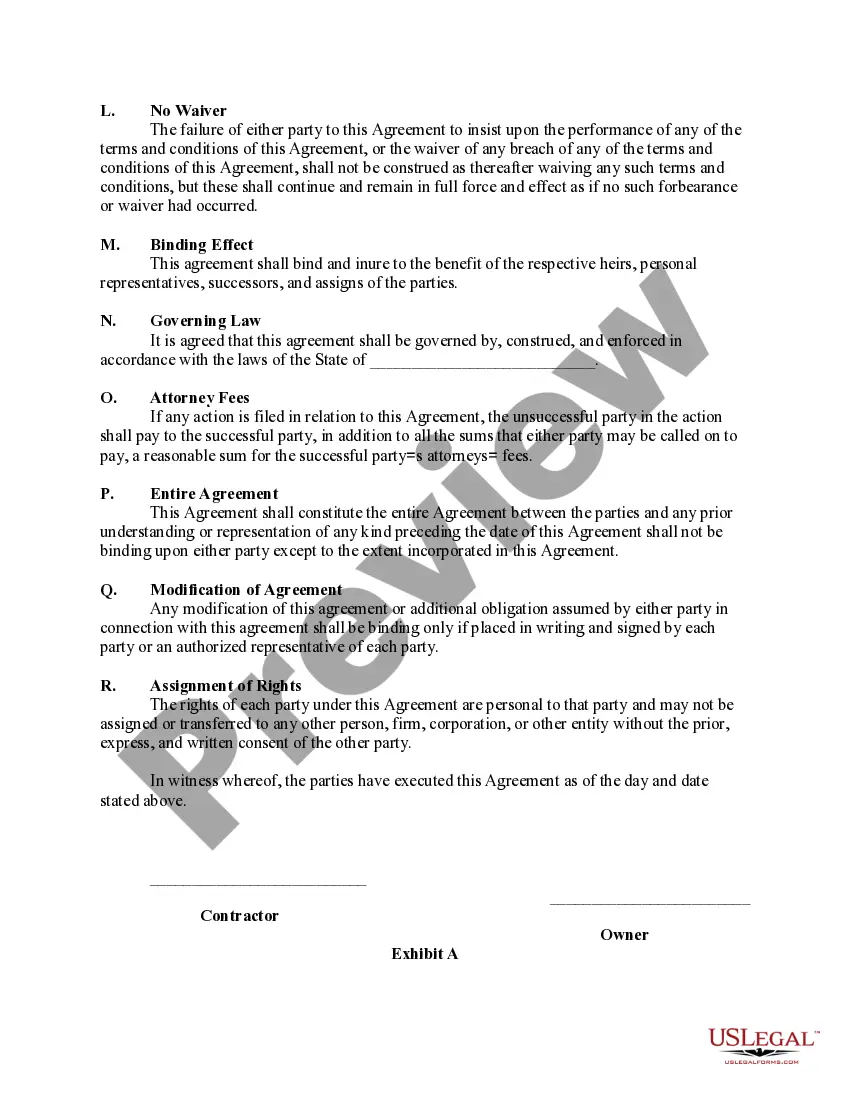

The Mississippi Agreement for Prepaid Repair Services for Residential Property is a legal document that outlines the terms and conditions for prepaid repair services in residential properties in the state of Mississippi. This agreement is specifically designed for residential properties and aims to protect both the service provider and the property owner/consumer by establishing clear guidelines and expectations. The agreement covers a wide range of repair services that may be required in residential properties, including but not limited to plumbing, electrical, HVAC (heating, ventilation, and air conditioning), carpentry, roofing, and general maintenance. This Agreement ensures that the service provider will perform the necessary repairs and maintenance in a timely, efficient, and professional manner. The property owner/consumer agrees to pay a prepaid fee for these services and expects the service provider to fulfill their obligations as outlined in the agreement. Some key components of the Mississippi Agreement for Prepaid Repair Services for Residential Property include: 1. Scope of Services: This section outlines the types of repair services covered under the agreement, specifying the areas of the residential property that will be serviced. 2. Term: This section specifies the duration of the agreement, whether it is a one-time service or an ongoing contract. 3. Fees and Payments: This section explains the prepaid fee structure, payment options, and any additional costs that may be incurred during the provision of services. 4. Repairs and Maintenance: This section details the obligations of the service provider to perform repairs and maintenance as required, including any warranties or guarantees provided. 5. Service Request and Scheduling: This section outlines the procedure for requesting repair services, the timeframes for response and completion, and the service provider's availability. 6. Limitations and Exclusions: This section describes any repairs or situations that are not covered under the agreement, such as damage caused by negligence or intentional acts. 7. Termination: This section explains the circumstances under which either party can terminate the agreement, as well as the procedures and potential penalties associated with termination. Different types of Mississippi Agreement for Prepaid Repair Services for Residential Property may exist depending on the specific service provider or organization offering the agreement. As such, these agreements may differ in certain terms and conditions or bundle different repair services. In conclusion, the Mississippi Agreement for Prepaid Repair Services for Residential Property is a crucial legal document that safeguards both service providers and property owners/consumers. It establishes clear expectations, ensures quality repairs and maintenance, and protects the interests of all parties involved.

Mississippi Agreement for Prepaid Repair Services for Residential Property

Description

How to fill out Mississippi Agreement For Prepaid Repair Services For Residential Property?

US Legal Forms - one of the finest collections of legal documents in the United States - offers a vast selection of legal templates that you can download or print.

By using the site, you can access thousands of forms for commercial and personal purposes, categorized by type, state, or keywords.

You can find the latest versions of documents like the Mississippi Agreement for Prepaid Repair Services for Residential Property in moments.

If the document does not meet your needs, utilize the Search field at the top of the page to find an alternative.

Once you are satisfied with the form, confirm your choice by clicking the Download now button. Then, choose your preferred payment plan and enter your details to create an account.

- If you have an account, Log In to download the Mississippi Agreement for Prepaid Repair Services for Residential Property from the US Legal Forms library.

- The Download button will appear on every document you view.

- You can access all previously downloaded documents from the My documents section of your account.

- If you are new to US Legal Forms, here are simple steps to get started.

- Ensure you select the right form for your city/state. Click on the Preview button to review the document's content.

- Read the form details to confirm you've selected the correct form.

Form popularity

FAQ

Does Mississippi impose a sales tax? Yes, Mississippi imposes a tax on the sale of tangible personal property and various services.

In the state of Mississippi, services are not generally considered to be taxable.

The Sales Tax Law levies a 3.5% contractor's tax on all non-residential construction activities when the total contract price or compensation received exceeds $10,000.00. Prior to beginning work, the prime contractor(s) is required to apply for a MPC for the contract . You may apply for a MPC on TAP.

3.5% contractor's tax on contract price for non-residential construction. No sales or use tax on purchases of component materials and services. No sales tax on gross income for residential construction. 7% sales or use tax on purchases of materials and services.

Services in Mississippi are generally not taxable.

When it comes to sales tax, the general rule of thumb has always been products are taxable, while services are non-taxable. Under that scenario, if your business sells coffee mugs, you should charge sales tax for those products.

Goods that are subject to sales tax in Mississippi include physical property, like furniture, home appliances, and motor vehicles. Prescription medicine and gasoline are both tax-exempt.

Interesting Questions

More info

ITES.