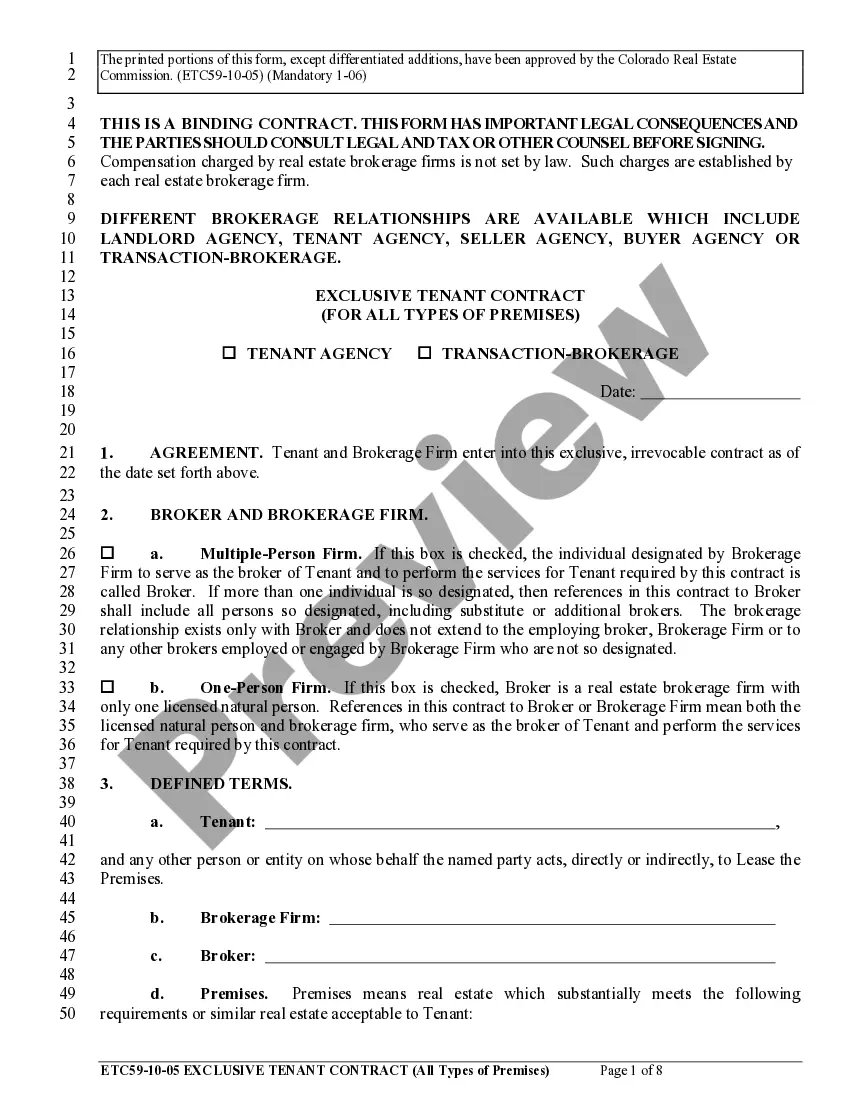

The Mississippi Pledge of Stock for Loan is a legal document that outlines the terms and conditions under which an individual or entity pledges their stock as collateral to secure a loan. This agreement is specific to the state of Mississippi and is governed by the laws and regulations set forth by the state. The purpose of the Mississippi Pledge of Stock for Loan is to protect both the borrower and the lender in the event of default or non-payment. By pledging their stock as collateral, the borrower guarantees that they will repay the loan according to the agreed-upon terms. In case of default, the lender has the right to seize the pledged stock and sell it to recover the outstanding balance. There are different types of Mississippi Pledge of Stock for Loan, which vary based on the ownership structure and kind of stock being pledged. Common types include: 1. Common Stock Pledge: This type of pledge involves the borrower pledging their common stock, which represents ownership in a corporation. The borrower still retains voting rights but pledges the stock as collateral for the loan. 2. Preferred Stock Pledge: In this type of pledge, the borrower offers their preferred stock as collateral. Preferred stockholders have certain privileges over common stockholders, such as priority in receiving dividends or assets in case of liquidation. 3. Restricted Stock Pledge: Some borrowers may possess restricted stock, which cannot be freely traded due to specific limitations or conditions. The Mississippi Pledge of Restricted Stock for Loan allows borrowers to use this stock as collateral. 4. Convertible Stock Pledge: Convertible stock gives the holder the option to convert the shares into another class of stock. This type of pledge allows borrowers to pledge their convertible stock as collateral, providing lenders with flexibility in case of default. It is essential for both parties to thoroughly understand their rights and obligations before entering into a Mississippi Pledge of Stock for Loan agreement. This document ensures transparency and serves as a legal safeguard for both the borrower and the lender.

Mississippi Pledge of Stock for Loan

Description

How to fill out Pledge Of Stock For Loan?

US Legal Forms - one of several most significant libraries of legitimate forms in the States - gives a variety of legitimate file layouts you may acquire or produce. While using internet site, you will get a large number of forms for company and individual uses, categorized by groups, states, or key phrases.You will find the most up-to-date types of forms like the Mississippi Pledge of Stock for Loan within minutes.

If you already possess a subscription, log in and acquire Mississippi Pledge of Stock for Loan from the US Legal Forms local library. The Download switch will appear on each and every type you see. You get access to all in the past downloaded forms from the My Forms tab of your own account.

In order to use US Legal Forms the first time, allow me to share easy recommendations to obtain started out:

- Be sure to have picked out the proper type for your personal city/state. Select the Preview switch to review the form`s content material. Browse the type information to ensure that you have selected the appropriate type.

- If the type doesn`t suit your demands, use the Search field towards the top of the screen to obtain the one who does.

- If you are content with the shape, validate your selection by visiting the Get now switch. Then, choose the pricing program you favor and offer your accreditations to register for an account.

- Procedure the financial transaction. Make use of bank card or PayPal account to accomplish the financial transaction.

- Pick the format and acquire the shape on your gadget.

- Make changes. Fill up, change and produce and indicator the downloaded Mississippi Pledge of Stock for Loan.

Every web template you added to your money does not have an expiration particular date and is also your own forever. So, if you wish to acquire or produce one more version, just check out the My Forms section and click on the type you will need.

Get access to the Mississippi Pledge of Stock for Loan with US Legal Forms, probably the most comprehensive local library of legitimate file layouts. Use a large number of professional and state-specific layouts that meet your organization or individual demands and demands.