Mississippi Charitable Remainder Inter Vivos Annuity Trust

Description

How to fill out Charitable Remainder Inter Vivos Annuity Trust?

Are you presently in a scenario where you need documentation for business or particular activities often.

There are numerous authentic form templates accessible online, but locating trustworthy ones is not easy.

US Legal Forms offers thousands of form templates, such as the Mississippi Charitable Remainder Inter Vivos Annuity Trust, that are designed to meet federal and state requirements.

Once you find the appropriate form, click on Buy now.

Select the pricing plan you prefer, fill out the necessary information to create your account, and purchase your order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Mississippi Charitable Remainder Inter Vivos Annuity Trust template.

- If you do not have an account and wish to use US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it is for the correct city/county.

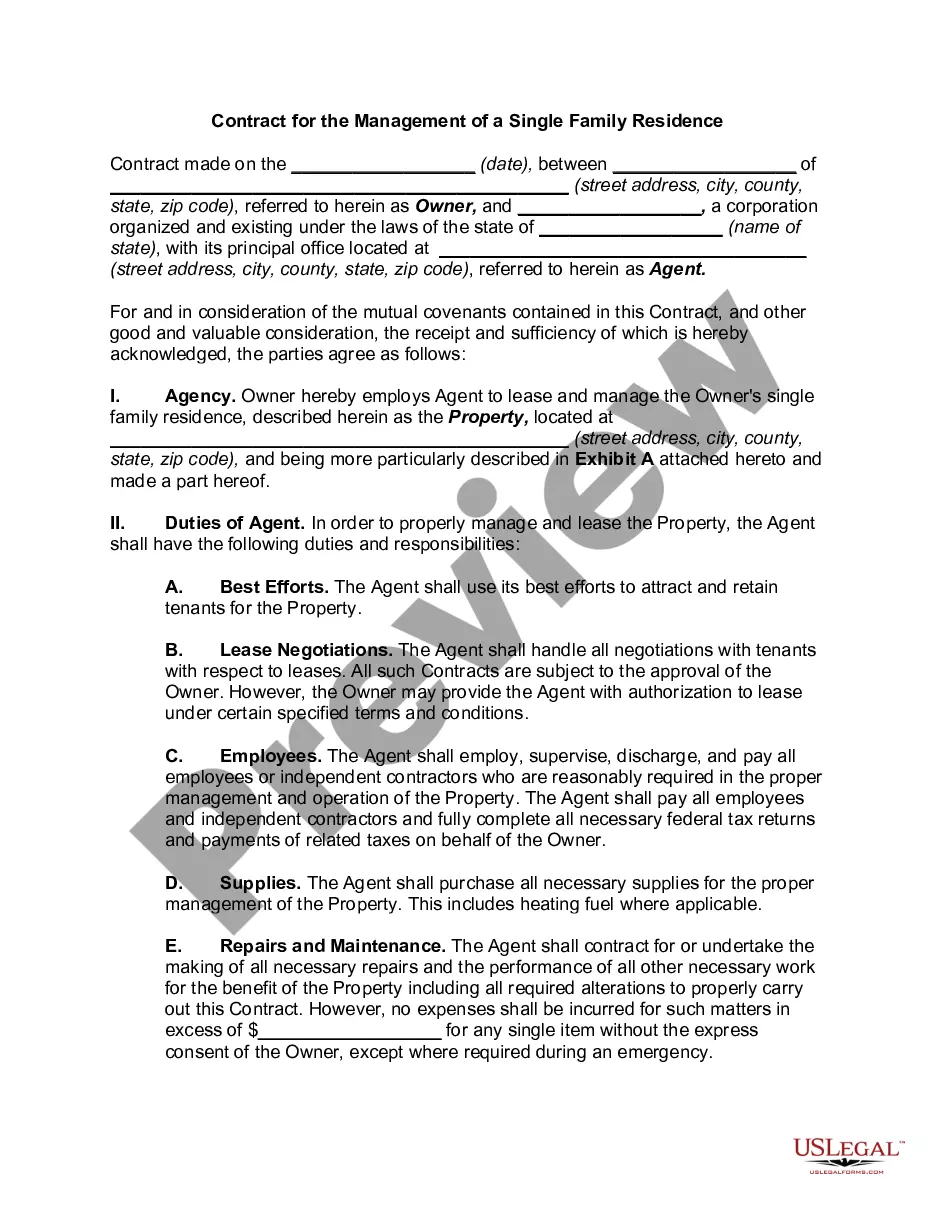

- Use the Review option to examine the form.

- Read the summary to confirm you have chosen the correct form.

- If the form is not what you are looking for, utilize the Lookup field to find the form that suits your needs.

Form popularity

FAQ

Some potential pitfalls of a charitable remainder trust include the risk of mismanagement and the possibility of unexpected taxes. It’s crucial to properly administer the Mississippi Charitable Remainder Inter Vivos Annuity Trust to avoid these issues, as they can diminish the intended benefits. Consulting with a professional can help you navigate these concerns and ensure that your charitable and financial goals align.

The primary purpose of an inter vivos trust is to manage and distribute assets while the grantor is still living. This type of trust addresses various needs, such as tax planning or asset protection, and offers flexibility in wealth management. Establishing a Mississippi Charitable Remainder Inter Vivos Annuity Trust enables you to create a lasting legacy while enjoying the benefits throughout your lifetime.

An inter vivos charitable remainder trust is a type of trust established during the grantor's lifetime, allowing them to make charitable donations while receiving income from the trust. This approach can be particularly advantageous if you wish to support a cause while still enjoying financial benefits. By opting for a Mississippi Charitable Remainder Inter Vivos Annuity Trust, you can leverage both income and philanthropy during your lifetime.

Yes, you can include an annuity in a charitable remainder trust. This setup is beneficial in the Mississippi Charitable Remainder Inter Vivos Annuity Trust because it allows you to receive fixed annual payments for a specified period. By doing so, you can enjoy steady income while ensuring your charitable goals are met upon the trust’s conclusion.

An alternative to a charitable remainder trust is the charitable lead trust, which provides income to a charity for a certain period before transferring the remaining assets to heirs. While both setups have charitable intentions, they serve different financial strategies. If you’re considering options, the Mississippi Charitable Remainder Inter Vivos Annuity Trust offers a unique blend of income and tax benefits while supporting your favorite charity.

Charitable remainder trusts, including the Mississippi Charitable Remainder Inter Vivos Annuity Trust, come with some disadvantages. These may include complex administrative requirements and potential loss of control over your assets once the trust is established. Additionally, if not managed properly, the trust could incur substantial taxation on any income it generates.

One aspect that isn't a benefit of a charitable remainder trust is the immediate access to all trust assets. While you can receive annuity payments, the principal amount is designated for charity once the trust ends. By looking into the Mississippi Charitable Remainder Inter Vivos Annuity Trust, you can effectively plan your charitable giving while still benefiting financially during your lifetime.

In Mississippi, a trust acts as a legal entity that holds assets for the benefit of another party. The person who creates the trust is called the grantor, while the individual benefiting from it is the beneficiary. When you establish a Mississippi Charitable Remainder Inter Vivos Annuity Trust, you can receive income from the trust assets during your lifetime, and the remaining assets will go to charity upon your passing.

A prime example of a charitable remainder trust is a charitable remainder annuity trust (CRAT), where a fixed annuity amount is distributed to the beneficiaries annually. This type of trust guarantees consistent income, making it a reliable option for retirement income while helping you achieve charitable aims. Establishing a Mississippi Charitable Remainder Inter Vivos Annuity Trust can also offer significant tax advantages while securing your legacy and supporting your chosen causes.

One popular example of a charitable trust is a charitable lead trust (CLT), which provides income to a charity for a specified period before transferring assets to non-charitable beneficiaries. For individuals who wish to support charities while retaining eventual control of their assets, combining strategies like a CLT with a Mississippi Charitable Remainder Inter Vivos Annuity Trust can be beneficial. This approach enables donors to maximize the impact of their charitable contributions.