A Mississippi Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction is a legal document that outlines the sale and transfer of personal assets from one party to another in the state of Mississippi. It serves as proof of the transaction and ensures that all parties involved are aware of the details and terms of the sale. In Mississippi, there are different types of Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transactions that may occur, each with its own specific purpose and conditions. Some common types include: 1. Equipment Purchase Transaction: This type of transaction involves the sale and transfer of equipment and machinery used in a business, such as vehicles, computers, furniture, and other tangible assets. 2. Inventory Purchase Transaction: Here, the focus is on the transfer of a business's inventory or stock, including raw materials, finished goods, and work-in-progress items. This type of transaction is commonly seen in retail or manufacturing industries. 3. Intellectual Property Purchase Transaction: This type of transaction involves the sale and transfer of intellectual property rights, including patents, trademarks, copyrights, and trade secrets. It enables the buyer to take control of valuable intangible assets that can contribute to the success of a business. 4. Real Estate Purchase Transaction: In some cases, a Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction can involve the transfer of real estate properties, such as land, buildings, or office spaces. This type of transaction often occurs when a business is being sold as a whole, including both tangible and intangible assets. The Mississippi Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction must include important details, such as the names and contact information of the buyer and seller, a detailed list of the assets being sold, the purchase price or compensation amount, and any terms or conditions associated with the sale. It is crucial for all parties involved to carefully review and understand the document before signing to ensure a smooth and legally binding transaction. In conclusion, a Mississippi Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction is a vital legal document that facilitates the transfer of personal assets between parties in Mississippi. Understanding the different types of transactions and their specific purposes can help individuals and businesses engage in these transactions with clarity and confidence.

Mississippi Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction

Description

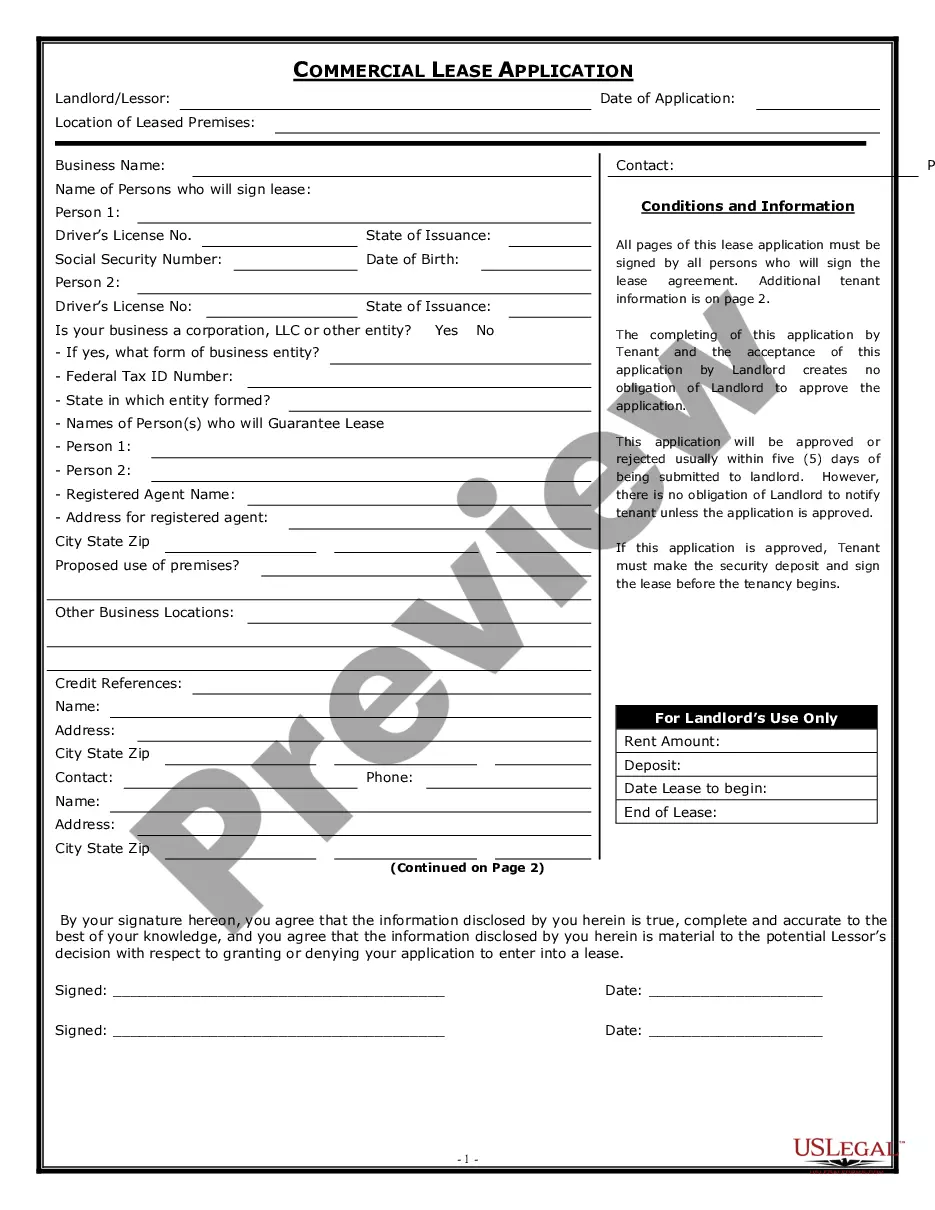

How to fill out Sale Of Business - Bill Of Sale For Personal Assets - Asset Purchase Transaction?

Are you currently in the location where you require documentation for possible business or personal purposes almost every working day.

There are numerous legal document templates accessible on the web, but finding ones you can rely on is quite challenging.

US Legal Forms provides thousands of form templates, such as the Mississippi Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction, which are designed to comply with federal and state regulations.

Once you find the correct form, click on Get now.

Select the pricing plan you want, enter the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Mississippi Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it is for the correct city/county.

- Utilize the Preview button to view the document.

- Check the outline to confirm you have selected the correct form.

- In case the form is not what you are searching for, use the Lookup field to find the form that fits your requirements.

Form popularity

FAQ

Yes, you can sell a house as is in Mississippi, but you must disclose any known defects to potential buyers. Selling as is means you will not make repairs or improvements, which can benefit sellers looking for a quick transaction. In the context of a Mississippi Sale of Business - Bill of Sale for Personal Assets, providing clear terms in the sale agreement helps avoid misunderstandings regarding property condition.

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

A business asset purchase agreement (APA) is a standard merger & acquisition contract that contains the terms for transferring an asset between parties. The terms in an APA provide key logistics about the deal (e.g., purchase price, closing date, payment, etc.) along with the rights and obligations of the parties.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

The bill of sale is typically delivered as an ancillary document in an asset purchase to transfer title to tangible personal property. It does not cover intangible property (such as intellectual property rights or contract rights) or real property.

The key difference is that a purchase order is sent by buyers to vendors with the intention to track and control the purchasing process. On the other hand, an invoice is an official payment request sent by vendors to buyers once their order is fulfilled.

A business usually has many assets. When sold, these assets must be classified as capital assets, depreciable property used in the business, real property used in the business, or property held for sale to customers, such as inventory or stock in trade. The gain or loss on each asset is figured separately.

A sales agreement is a contract between a buyer and a seller that details the terms of an exchange. It is also known as a sales agreement contract, sale of goods agreement, sales agreement form, purchase agreement, or sales contract.

An asset sale involves the purchase of some or all of the assets owned by a company. Examples of common assets which are sold include; plant and equipment, land, buildings, machinery, stock, goodwill, contracts, records and intellectual property (including domain names and trademarks).

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

Interesting Questions

More info

Automotive parts/vehicles cannot be considered personal property and thus can't be used as consideration for a business sale. In order to determine whether a vehicle is an asset and thus can qualify as personal property and be considered for a business sale, the following rules are necessary: The vehicle must be owned as a business asset, or for this purpose, the car must be used for its original purpose The vehicle must have been legally acquired There are no restrictions on the type of vehicle that is eligible as a “business asset” or personal property. No other consideration or compensation is given to the owner (e.g.