Mississippi Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions

Description

How to fill out Borrow Money On Promissory Note - Resolution Form - Corporate Resolutions?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the most recent versions of forms like the Mississippi Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions in just a few minutes.

If you already have an account, Log In to download the Mississippi Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions from the US Legal Forms collection. The Download option will be available on each form you view.

Then, select the payment plan you prefer and provide your information to register for an account.

Complete the payment process. Use a credit card or PayPal account to finalize the transaction. Choose the format and download the form onto your device. Edit, complete, print, and sign the downloaded Mississippi Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions.

Every template added to your account has no expiration date and belongs to you forever. So, if you want to download or print another copy, just visit the My documents section and click on the form you need.

Access the Mississippi Borrow Money on Promissory Note - Resolution Form - Corporate Resolutions with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs.

- You can access all previously downloaded forms from the My documents section of your profile.

- If you are using US Legal Forms for the first time, here are some basic instructions to get started.

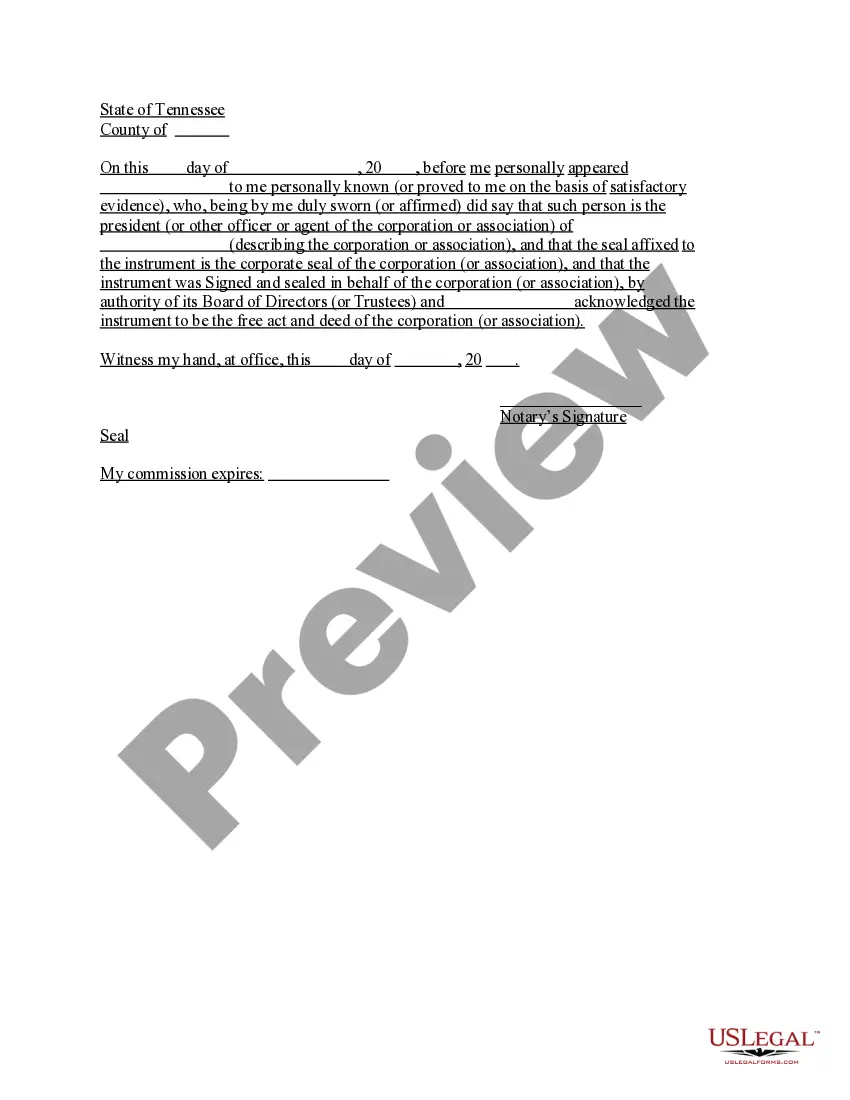

- Ensure you have selected the correct form for your area/state. Click on the Preview button to review the form’s content.

- Read the form description to make sure you have chosen the correct one.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Purchase now button.

Form popularity

FAQ

To create a resolution for a change in an authorized signatory at a bank, draft a formal document that states the change clearly. Include essential details such as the former signatory's name, the new signatory's name, and the reason for this change. It's crucial to ensure this resolution is compliant and includes necessary approvals for the bank. You can find helpful resources and templates on US Legal Forms to facilitate this process effectively.

A corporate resolution form is used by a board of directors. Its purpose is to provide written documentation that a business is authorized to take specific action. This form is most often used by limited liability companies, s-corps, c-corps, and limited liability partnerships.

A resolution can be made by a corporation's board of directors, shareholders on behalf of a corporation, a non-profit board of directors, or a government entity.

It is a legal document adopted by a corporation's board of directors containing information about the parties who may sign checks and borrow money from financial institutions. Borrowing resolutions are more commonly known as corporate resolutions.

A board resolution template is a manner of documenting decisions made by the company's Shareholders or Board of Directors. The decision can cover anything relevant to the affairs of the organization like a decision extending loans to other companies or when voting for a new member to join the board.

When you create a resolution to authorize borrowing on a line of credit, you need to include the following information:The legal name of the corporation.The name of the bank where the corporation is authorized to borrow from.Maximum loan amount that may be borrowed from the bank.Interest rate (numerical)More items...

Types of Corporate Resolutions A resolution might outline the officers that are authorized to act (trade, assign, transfer or hedge securities and other assets) on behalf of the corporation. The resolution would outline who is authorized to open a bank account, withdraw money, and write checks.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

A corporate resolution that authorizes borrowing on a line of credit is often referred to a borrowing resolution. This resolution indicates that the members (LLC) or Board of Directors (Corporation) have held a meeting and conducted a vote allowing the company to borrow a specific loan amount.

All Resolved clauses within a resolution should use the objective form of the verb (for example, Resolved, that the American Library Association (ALA), on behalf of its members: (1) supports...; (2) provides...; and last resolved urges....") rather than the subjunctive form of the verb (for example, Resolved,