Mississippi Mutual Release of Claims based on Real Estate Purchase Contract is a legal document that allows the parties involved in a real estate transaction to release each other from any potential claims or disputes arising from the contract. This agreement serves as a final resolution of any issues that may have arisen during the purchase or sale of a property in Mississippi, and it ensures that both parties can move forward without any legal obligations or liabilities. Mississippi Mutual Release of Claims is commonly used in real estate deals to protect the interests of both the buyer and the seller. It is crucial to have this document in place, as it provides assurance and peace of mind to all parties involved that any claims, grievances, or disputes related to the real estate purchase contract have been resolved and released. There are several types of Mississippi Mutual Release of Claims based on Real Estate Purchase Contract, depending on the specific circumstances of the transaction. Some of these types include: 1. General Release of Claims: This type of mutual release covers any claims or disputes related to the real estate purchase contract, including issues with the property's condition, title, or disclosure. 2. Warranty Release: In cases where the seller provided warranties about the property's condition or any specific aspects, a separate warranty release may be included. This release frees the seller from any future claims related to these warranties. 3. Deposit Release: If any earnest money or deposits were made as part of the purchase contract, a deposit release may be executed along with the mutual release of claims. This ensures that the buyer's deposit is released back to them if the contract is terminated or the release is agreed upon. 4. Specific Performance Release: In situations where the buyer or seller fails to fulfill their obligations under the purchase contract, a specific performance release may be employed. This releases both parties from any claims related to performing specific actions or obligations agreed upon in the contract. It is important to note that these are just a few examples of the types of Mississippi Mutual Release of Claims based on Real Estate Purchase Contract. The specific terms and conditions of the release may vary depending on the particular transaction and the interests of the parties involved. As such, it is recommended to seek legal advice or consult a qualified real estate attorney when drafting or executing a Mississippi Mutual Release of Claims.

What Is A Mutual Release Form In Real Estate

Description

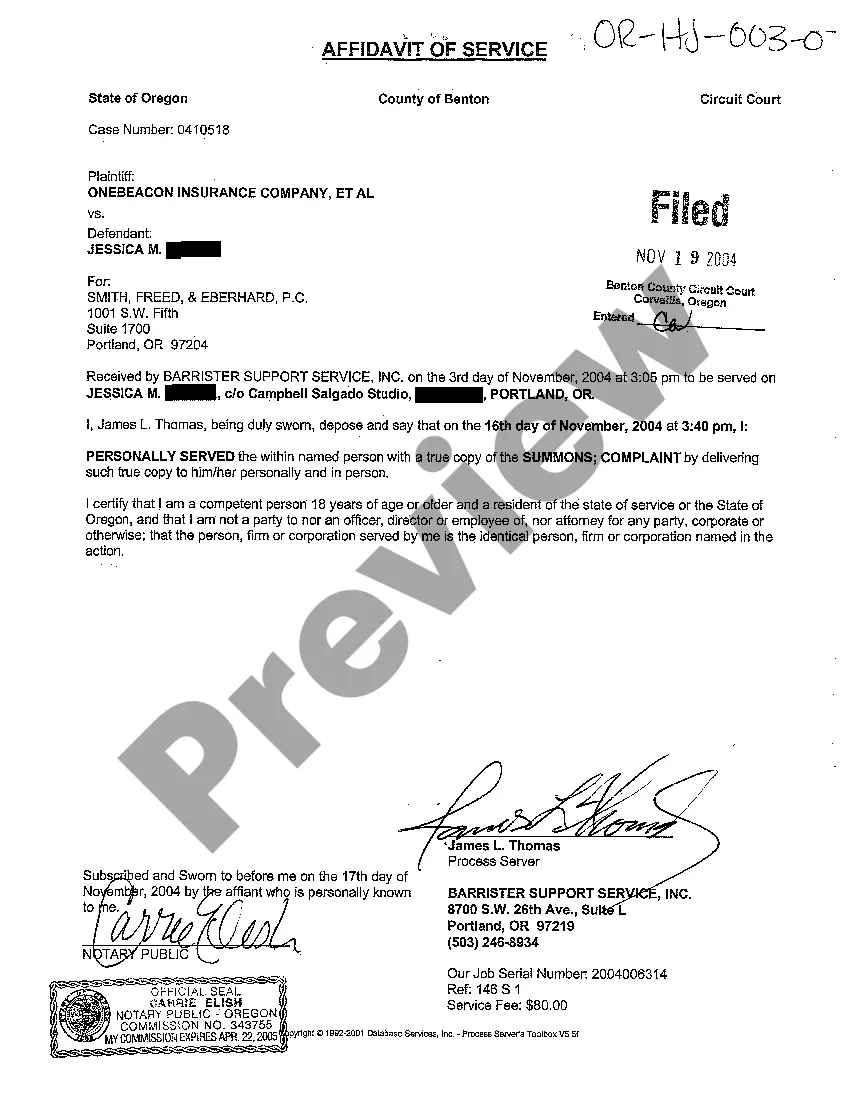

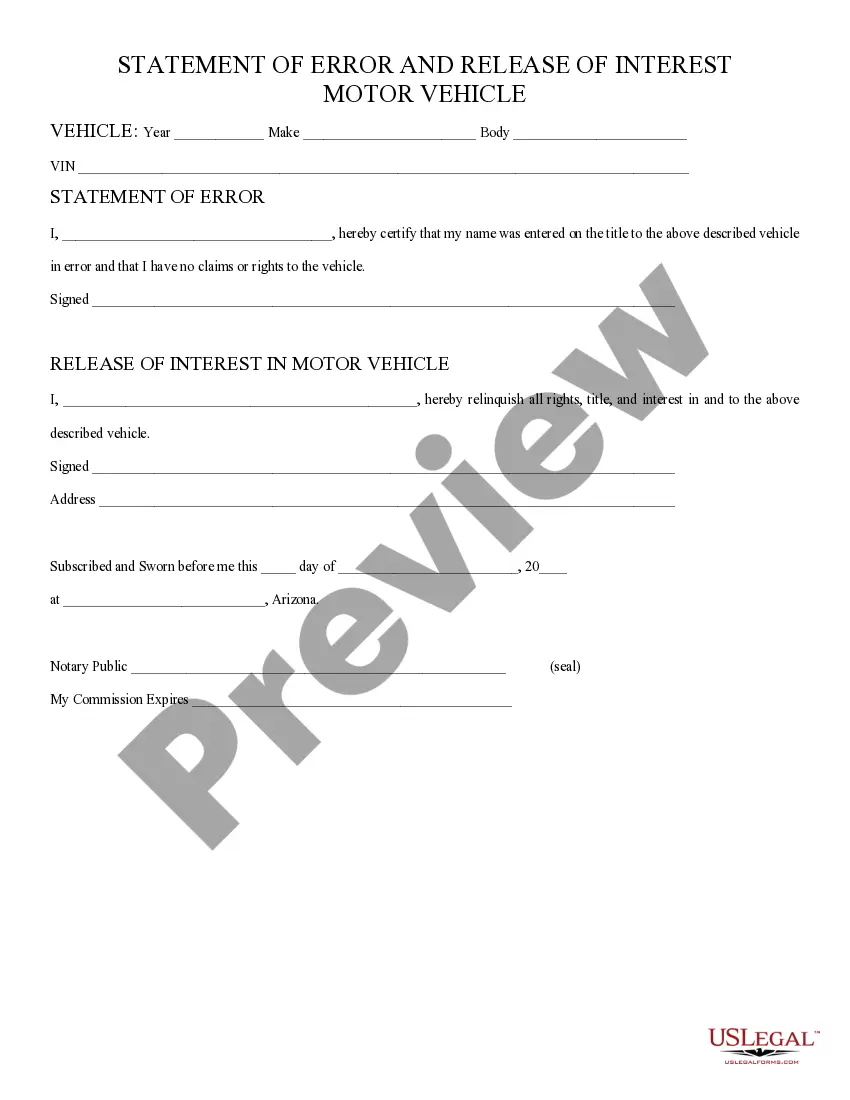

How to fill out Mississippi Mutual Release Of Claims Based On Real Estate Purchase Contract?

If you need extensive, obtain, or printing valid document templates, utilize US Legal Forms, the most extensive selection of legal forms available online.

Take advantage of the website's efficient and user-friendly search to find the documents you need.

Various templates for business and personal purposes are organized by type and state, or by keywords. Use US Legal Forms to obtain the Mississippi Mutual Release of Claims related to Real Estate Purchase Agreement in just a few clicks.

Every legal document template you download belongs to you permanently. You have access to all forms you downloaded in your account. Go to the My documents section and select a form to print or download again.

Complete and download, and print the Mississippi Mutual Release of Claims related to Real Estate Purchase Agreement with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and click on the Download button to locate the Mississippi Mutual Release of Claims related to Real Estate Purchase Agreement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find other versions of the legal form.

- Step 4. Once you have located the form you need, click the Download now button. Select your preferred pricing plan and enter your credentials to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Mississippi Mutual Release of Claims related to Real Estate Purchase Agreement.

Form popularity

FAQ

A mutual release is a document designed to be signed by both the buyers and sellers to cancel an agreement of purchase and sale. When executed, this document cancels the agreement and releases all parties from any future liabilities or claims.

Primary tabs. Description for a contract that will not be enforced by a court even though it is valid. An unenforceable contract provision is not void, and if the parties perform as stated in the contract, the court will not object.

A mutual release agreement occurs between two parties that are involved in a legal dispute. By agreeing to mutually release, each party agrees to give up any claims against the other. This includes known claims as well as those that aren't yet known.

A situation beyond the parties' control that makes the transaction impossible or exceedingly difficult or expensive to close may be unenforceable. An example of impossibility is the sale of a home that was destroyed by a tornado while the buyer and seller were under contract.

In Mississippi, a seller can get out of a real estate contract if the buyer's contingencies are not metthese include financial, appraisal, inspection, insurance, or home sale contingencies agreed to in the contract. Sellers might have additional exit opportunities with unique situations also such as an estate sale.

What Makes a Contract Unenforceable? If a contract is deemed unenforceable, the court will not compel a party to act or compensate the other for not fulfilling the contract terms. While the elements of an enforceable contract (offer, acceptance, consideration) seem simple, there are strict standards for enforceability.

The seller of real estate must be legally entitled to sell the property. If it's found that the seller is not the rightful owner, the contract is considered unenforceable. Real estate contracts include the legal description of the property according to the locality's tax assessor.

Can seller back out? Yes, it is possible. That is, if the seller can offer compensation to the buyer or if the buyer regrets his purchase. Timing is also of essence things will be much easier before the purchase agreement is signed.

Contracts need to involve an exchange of something valuable, referred to in legal terms as consideration. In the case of a real estate contract, that consideration would be the title (from the seller) and an earnest money deposit (from the buyer). Without that consideration, the contract is unenforceable.

Can a home seller back out after a sale? Yes, a home seller can back out of a real estate contract, but only in instances in which they're willing to compensate the buyer for their trouble, or they sold to a buyer who is also experiencing buyer's remorse.

More info

Read the differences between the purchase agreements when purchasing home Learn about what can and can't be legally written when buying, selling, or trading real estate. Rocket Mortgage is the easiest and most secure way to buy and sell homes. It's the easiest way to trade with any other real estate brokerage. Why should I buy Rocket Mortgage? Read a list of reasons why a home purchase could be a good idea. You've found some homes that you'd like to sell! Read more about some reasons to sell a house Read more about selling a house Learn Home Refinance Basics Why do I need a home refinance? When buying or selling a home, it's a good idea to refinance it. When you refinance, you get to pay less interest and get a bigger cash lump sum, which you can be used to buy or to take out a loan. Read more about the benefits of refinances Read more about getting out of your mortgage Read more about home refinance rates Read more about home mortgage rates in Australia Why does one pay closing costs?