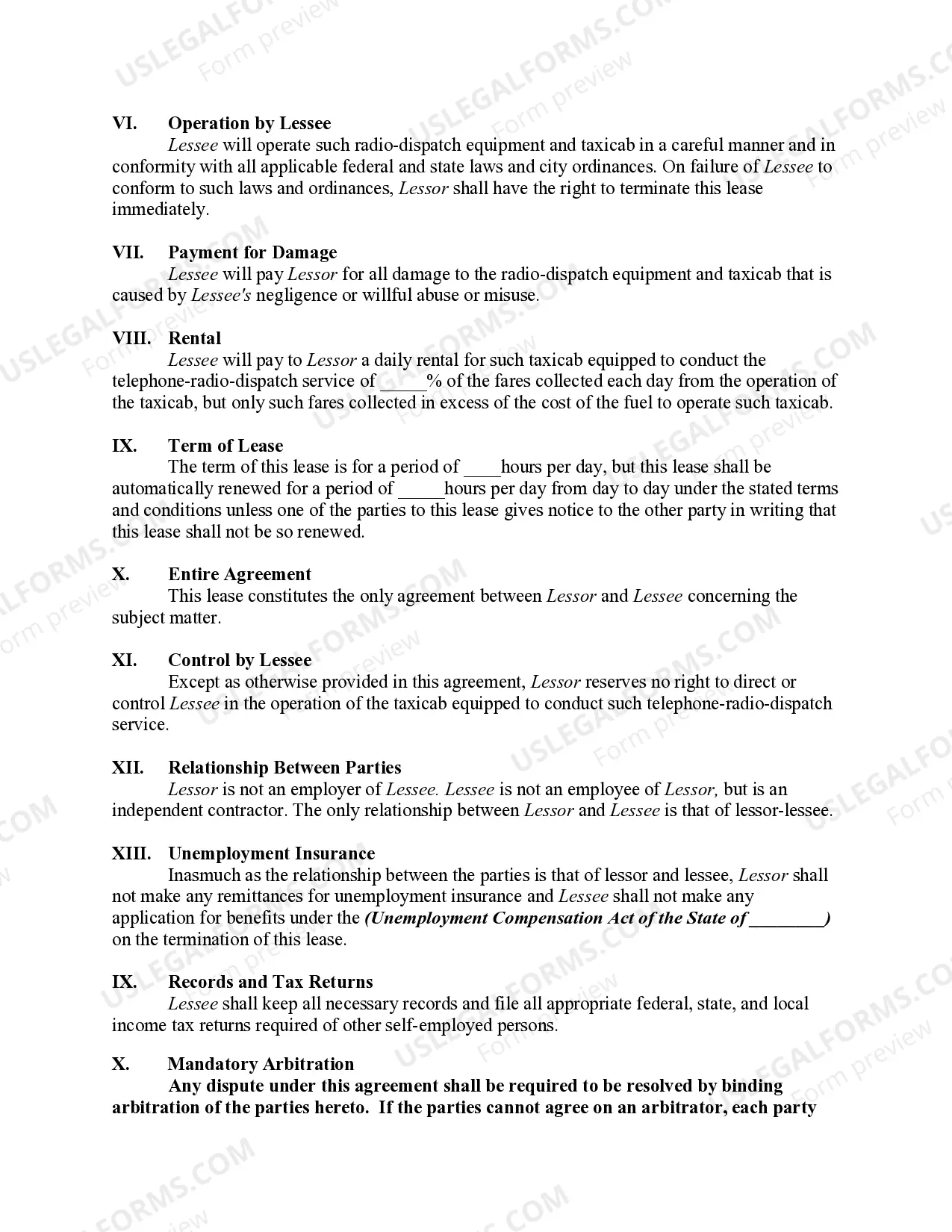

Mississippi Lease of Taxicab

Description

How to fill out Lease Of Taxicab?

US Legal Forms - one of the largest collections of legal documents in the United States - offers numerous legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of documents such as the Mississippi Lease of Taxicab in just a few minutes.

Click the Review button to examine the content of the form. Read the form description to confirm that you have selected the right document.

If the form does not meet your requirements, use the Search field at the top of the page to find one that does.

- If you have a subscription, Log In and download the Mississippi Lease of Taxicab from the US Legal Forms repository.

- The Download button will be visible on every form you encounter.

- You can access all previously downloaded forms from the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your city/state.

Form popularity

FAQ

Yes, rental income is generally taxable in Mississippi. If you earn income through the Mississippi Lease of Taxicab, this income falls under state tax regulations. Properly reporting this income ensures that you comply with state laws and can help you accurately assess your tax liabilities.

Anyone who earns above the established income thresholds is required to file a Mississippi tax return. This includes individuals who are self-employed or operate businesses, such as those managing a Mississippi Lease of Taxicab. Filing a return is essential for staying compliant and avoiding potential fines, so it's important to understand your requirements.

In Mississippi, the income threshold for filing taxes depends on your age and filing status. Typically, single filers must earn above a defined amount, while married couples have a separate threshold. Understanding these limits can help those involved with the Mississippi Lease of Taxicab ensure they meet their tax obligations without overpaying.

Certain types of income are exempt from Mississippi state income tax, including Social Security benefits and certain retirement benefits. For those running a business related to the Mississippi Lease of Taxicab, it’s essential to identify any exemptions that may apply to your income. This knowledge can help you maximize your deductions and minimize tax liabilities.

Recently, Mississippi enacted new tax laws aimed at reducing the overall tax burden for residents. These changes can affect how the Mississippi Lease of Taxicab is taxed, particularly in relation to business expenses and deductions. Staying informed on these updates ensures you can take advantage of potential savings and streamline your tax obligations.

In Mississippi, the filing threshold varies based on your filing status and income level. Generally, if you earn a certain amount, you must file a tax return. It's important to consider the specifics of the Mississippi Lease of Taxicab when calculating your gross income. By knowing these thresholds, you can ensure compliance and avoid penalties.

How much is sales tax on a used car in Mississippi? The Mississippi car sales tax is the statewide rate of 5% plus any applicable local or county tax (up to 1%). This is true for both new and used vehicle purchases.

Complete an application for the duplicate certificate of title, which is available online at your state's Department of Motor Vehicles' website or at your local DMV office.

Complete an Application for Mississippi Title and License (Form 78-002). This form can be obtained from your local MS tax collector's office. Visit your local MS DOR office. Pay the appropriate vehicle title transfer and registration fees, as well as all applicable taxes.

There are only nine title-holding states: Kentucky, Maryland, Michigan, Minnesota, Missouri, Montana, New York, Oklahoma, Wisconsin. In the other 41 states, titles are issued to the lien holder of your vehicle until the loan is fully paid off.