Title: Protecting the Legacy: Mississippi Checklist for Remedying Identity Theft of Deceased Persons Introduction: Identity theft of deceased individuals is a significant concern that requires immediate attention to safeguard the legacy and assets of the departed. This article aims to provide a detailed description of the Mississippi Checklist for Remedying Identity Theft of Deceased Persons. Addressing various aspects of identity theft prevention and remediation, this checklist ensures the protection of the deceased person's personal information and assets. Types of Mississippi Checklist for Remedying Identity Theft of Deceased Persons: 1. Prevention Measures: The Mississippi Checklist for Preventing Identity Theft of Deceased Persons offers proactive steps to safeguard the personal information of the deceased. Key measures include: — Securely storing death certificates and other vital records. — Monitoring and securing the deceased person's physical and digital assets. — Informing relevant agencies and institutions about the death to prevent fraudulent activities. 2. Reporting Identity Theft: Mississippi Checklist for Reporting Identity Theft assists families and legal representatives in promptly reporting incidents of identity theft to the appropriate authorities. This involves: — Gathering relevant documentation, such as death certificates and ID theft evidence. — Filing a police report and alerting local law enforcement agencies. — Contacting credit reporting agencies, financial institutions, and relevant government agencies to freeze accounts and secure personal information. 3. Resolution and Recovery: The Mississippi Checklist for Resolution and Recovery guides individuals through the process of resolving identity theft issues and recovering the deceased person's assets. This involves: — Working with credit bureaus to remove fraudulent accounts and personal information. — Reviewing bank and credit card statements for suspicious activities. — Seeking legal assistance if necessary to protect the deceased person's estate. Key Elements of the Mississippi Checklist: 1. Documentation and Communication: — Gather certified copies of the death certificate for official use. — Inform vital agencies such as Social Security Administration, Department of Motor Vehicles, and Voter Registration Office about the death. — Notify financial institutions, insurance companies, and credit bureaus to prevent unauthorized access. 2. Freezing Accounts and Credit Monitoring: — Freeze the deceased person's bank accounts, credit cards, and investment accounts to halt any unauthorized transactions. — Request credit monitoring services to detect any suspicious activities related to the deceased person's identity. 3. Reviewing and Disputing Credit Reports: — Obtain a credit report of the deceased person to identify unauthorized accounts or discrepancies. — Dispute any inaccuracies or fraudulent accounts through credit reporting agencies. 4. Legal Measures: — Consult an attorney to assess the need for probate or estate administration. — Consider obtaining a court order to revoke the deceased person's social security number to prevent further misuse. Conclusion: The Mississippi Checklist for Remedying Identity Theft of Deceased Persons encompasses crucial steps for preventing, reporting, and resolving identity theft cases. By prioritizing the protection of personal information and diligently following the checklist, families and legal representatives can ensure the deceased person's legacy remains intact while minimizing the financial and emotional burdens associated with identity theft.

Mississippi Checklist for Remedying Identity Theft of Deceased Persons

Description

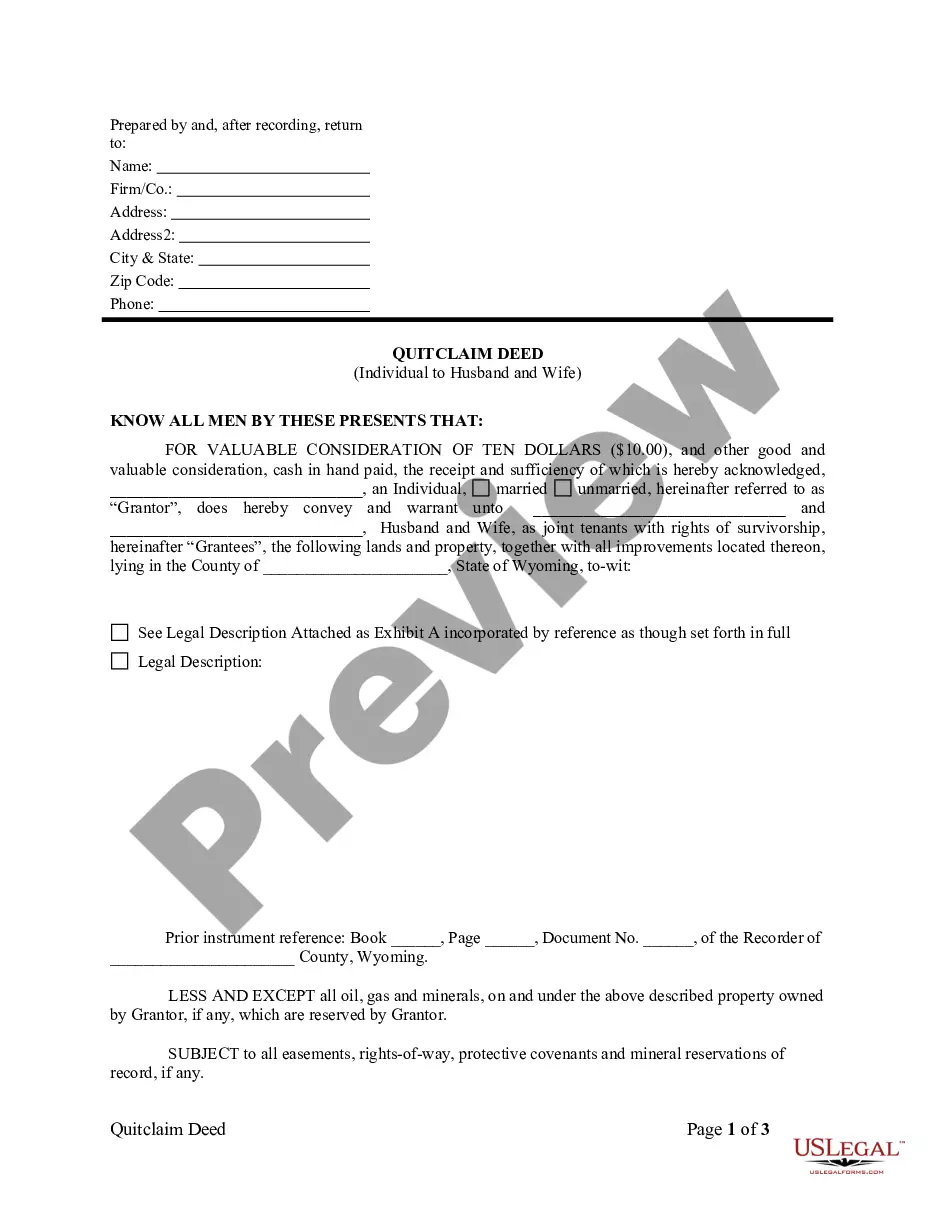

How to fill out Mississippi Checklist For Remedying Identity Theft Of Deceased Persons?

US Legal Forms - one of the greatest libraries of legitimate forms in the States - gives a wide array of legitimate document templates it is possible to download or produce. While using web site, you can get 1000s of forms for enterprise and person uses, categorized by classes, says, or keywords and phrases.You can get the most recent models of forms like the Mississippi Checklist for Remedying Identity Theft of Deceased Persons within minutes.

If you currently have a subscription, log in and download Mississippi Checklist for Remedying Identity Theft of Deceased Persons in the US Legal Forms catalogue. The Acquire key can look on every develop you perspective. You have access to all in the past acquired forms from the My Forms tab of your respective profile.

If you would like use US Legal Forms for the first time, listed below are straightforward recommendations to help you started off:

- Ensure you have selected the proper develop for the metropolis/state. Click the Review key to check the form`s information. Read the develop outline to ensure that you have selected the correct develop.

- In the event the develop does not fit your needs, utilize the Look for field at the top of the display to get the one that does.

- Should you be satisfied with the form, confirm your choice by simply clicking the Get now key. Then, choose the pricing strategy you favor and offer your credentials to sign up on an profile.

- Method the transaction. Make use of your credit card or PayPal profile to finish the transaction.

- Select the formatting and download the form on the device.

- Make modifications. Fill out, edit and produce and sign the acquired Mississippi Checklist for Remedying Identity Theft of Deceased Persons.

Each format you included in your account does not have an expiration time which is your own property for a long time. So, if you wish to download or produce yet another version, just visit the My Forms section and click about the develop you want.

Get access to the Mississippi Checklist for Remedying Identity Theft of Deceased Persons with US Legal Forms, by far the most comprehensive catalogue of legitimate document templates. Use 1000s of skilled and express-particular templates that meet your organization or person demands and needs.